by G. Brian Davis | Last updated Aug 1, 2025 | Active Real Estate Investing, Real Estate News, Spark Blog |

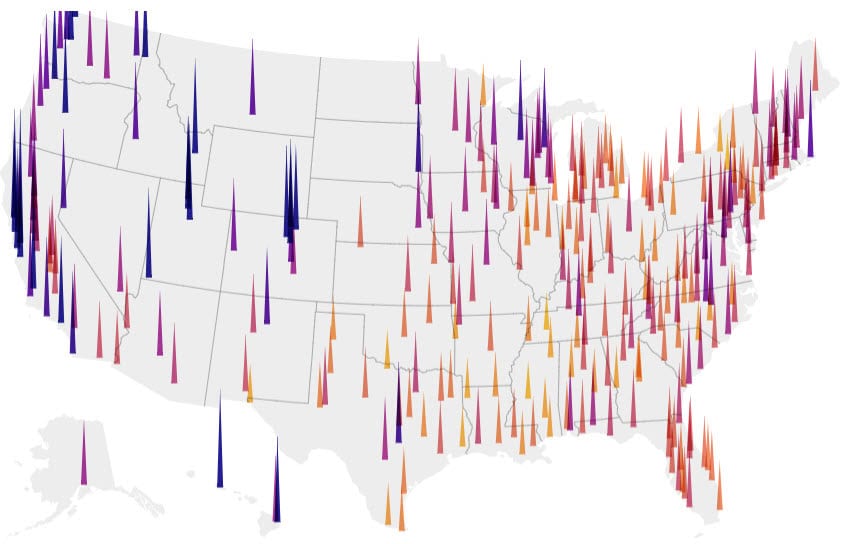

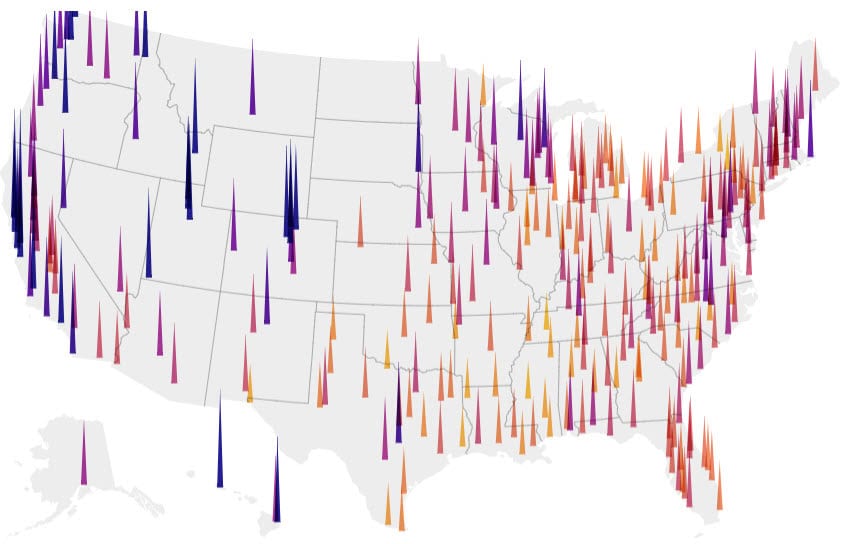

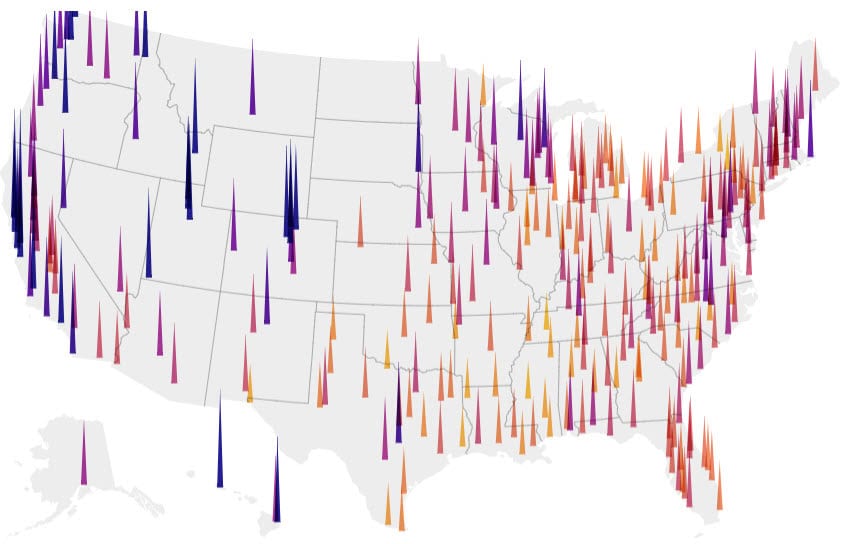

The Big Picture On The Best Cities for Real Estate Investment By GRM: As of the start of Q4 2024, the national average GRM in the U.S. stands at 13.78, though this figure varies significantly across different regions, highlighting the importance of local market...

by Guest Author | Last updated Nov 14, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture On Rent To Retirement: Investing in rental properties can provide a stable income for retirement, with options like steady monthly rent, lump-sum cash from sales, and equity loans. This makes it a sustainable alternative to traditional retirement...

by G. Brian Davis | Last updated Nov 14, 2024 | Active Real Estate Investing, Spark Blog |

The Big Picture On Blanket Mortgages: A blanket mortgage consolidates loans across multiple properties, helping real estate investors simplify their portfolio management, reduce closing costs, and potentially negotiate better loan terms. By using equity from existing...

by G. Brian Davis | Last updated Feb 20, 2026 | Active Real Estate Investing, Spark Blog |

The Big Picture On Earning Infinite Returns Through Real Estate Investment: Infinite returns mean pulling out your initial investment to reinvest elsewhere while still earning on the property. Focus on properties you can renovate and refinance to start building equity...

by G. Brian Davis | Last updated Nov 11, 2024 | Active Real Estate Investing, FIRE, Fun & Travel, Spark Blog |

The Big Picture On The Best Passive Real Estate Investments: Passive real estate investing allows you to earn returns without the hassle of managing properties—options include REITs, crowdfunding platforms, private notes, and syndications. While public REITs offer...

by G. Brian Davis | Last updated Nov 8, 2024 | Active Real Estate Investing, Property Management, Spark Blog |

The Big Picture On Fractional Ownership In Real Estate: Fractional real estate ownership allows investors to buy small shares of properties, enabling participation in rental income and capital gains without the hassle of managing properties directly. Investment...