by G. Brian Davis | Last updated Oct 20, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture On The Risks of Real Estate Investment: Real estate investments carry risks such as rising interest rates, increased expenses, market stagnation, and capital loss. Sponsors often face challenges from tightening credit markets and delays in...

by Jim Cirigliano | Last updated Oct 17, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture On Transferring A Property To An LLC: Transferring a rental property to an LLC can protect personal assets from lawsuits, simplify ownership, and offer tax benefits through pass-through taxation. However, it may incur state tax fees and complicate...

by G. Brian Davis | Last updated Oct 16, 2024 | Active Real Estate Investing, Spark Blog |

The Big Picture On How You Can Invest $1000 In Real Estate: You can invest $1,000 in real estate through fractional ownership, REITs, crowdfunding, or other low-entry options like land investing or rental arbitrage, allowing you to start building wealth without a...

by G. Brian Davis | Last updated Oct 14, 2024 | Active Real Estate Investing, Property Management, Spark Blog |

The Big Picture on Passive vs Active Real Estate Investing: Active real estate investing offers higher potential returns, but it comes with significant responsibilities such as property management, tenant issues, and market research. Investors need to be hands-on and...

by G. Brian Davis | Last updated Oct 15, 2024 | Active Real Estate Investing, Property Management, Real Estate News, Spark Blog |

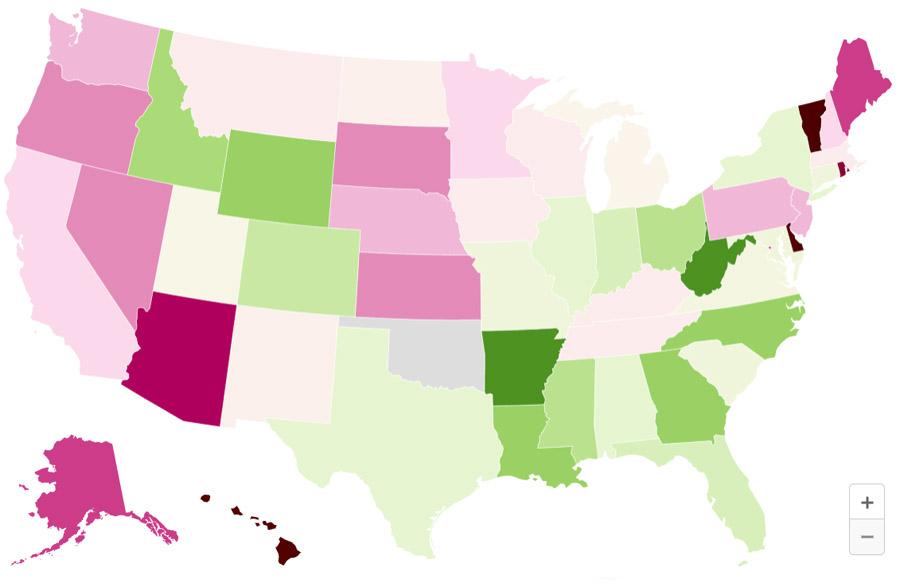

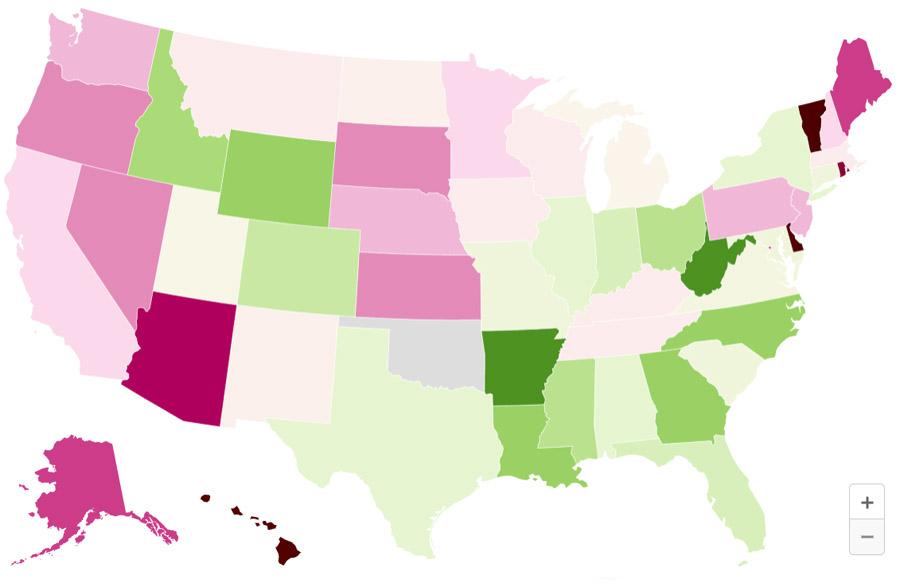

The Big Picture on The Least Landlord-Friendly Cities and States: Many cities and states have implemented strict eviction processes, making it harder and more time-consuming for landlords to remove non-paying or problematic tenants. Eviction bans, long court delays,...

by Guest Author | Last updated Oct 14, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture on Home Loans vs. Investor Loans: Investment property loans tend to have higher interest rates than home loans, typically 0.375% to 0.625% more, due to the higher risk for lenders. Investment property loans demand larger down payments, often between...