At a Glance:

-

-

Most asset classes look “frothy” or “bubbly” right now

-

Multifamily real estate already had its bubble and has started recovering

-

The Dow closed at its 17th record high of the year yesterday. The S&P 500 is up 16.5% this year, and has logged 32 record closes in 2025.

Add in the fact that the S&P 500 has a price/earnings ratio around 31 – roughly double the long-term average of 16 – and you can see why so many analysts are biting their nails.

Tech stocks and AI look particularly bubblicious. Nvidia’s stock has skyrocketed 416% over the last two years, and the industry keeps announcing circular deals among the same few companies.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

It’s not just stocks, either. Gold prices are up 63.8% over the last year. Silver is up 75.4%.

Single-family homes keep hovering around all-time highs, despite softness in the housing market.

And crypto? Whatever I’ll just leave that alone.

It begs the question: what assets AREN’T in a bubble?

One Asset Clearly Not in a Bubble: Multifamily

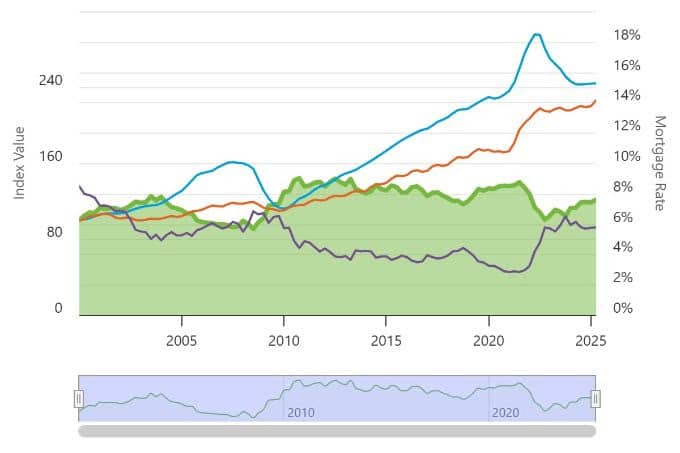

There was a bubble in multifamily: back in 2020-2022.

And it burst. The Fed’s Multi-Family Real Estate Apartment Price Index fell 25.2% from the second quarter of 2022 to the second quarter of 2024. That’s not a correction, or even a crash – it’s a bear market.

That’s roughly the same amount that single-family home prices fell during the Great Recession. Except back then, everyone panicked about it.

Almost nobody has talked about the bear market in multifamily.

The Bottom & Recovery

Multifamily values bottomed out in the second quarter of 2024. Since then, they’ve risen between 5.5% – 7.6% (depending on which data you look at).

That makes 2025 an ideal time to invest, historically speaking. Enough time has passed that we know it hit bottom and started recovering, but it’s still early enough in the market cycle that most of the growth lies ahead.

Other Tailwinds

There are plenty of distressed multifamily properties out there, and some of the operators we’ve invested with have bought them up at bargain-basement prices. That sets them up for juicy cash flow and profits on the back end.

New multifamily construction has also fallen. Redfin reports a 23% drop since the pandemic peak in apartment building permits over the last year.

Read: less supply and competition. Analysts expect that supply crash to drive up rents in 2026.

(article continues below)

Still – Don’t Time the Market

That all said, Deni and I never recommend timing the market.

We practice dollar cost averaging: investing $5K at a time, in a new real estate investment every month as participants ourselves in the Co-Investing Club.

I don’t know what the next hot city will be, or when interest rates and cap rates will drop. So I don’t play the “crystal ball” game anymore. I just keep investing every month in different cities, different asset classes, different investment timelines, and with different operators.

A few will underperform. A few will overperform. Most will sit somewhere in the middle of the bell curve.

Over time, the law of averages looks out for us. And that helps me sleep at night.

Want to chat about investments, real estate or otherwise? Hop on the open Zoom call with Deni and me today at 3:30 EST.

Hope to chat with you later on!