At a Glance:

-

-

The Fed controls the federal funds rate, not mortgage rates

-

Mortgage rates are more based on bond yields, not the federal funds rate

-

The Trump Administration can’t control bond yields – or mortgage rates

-

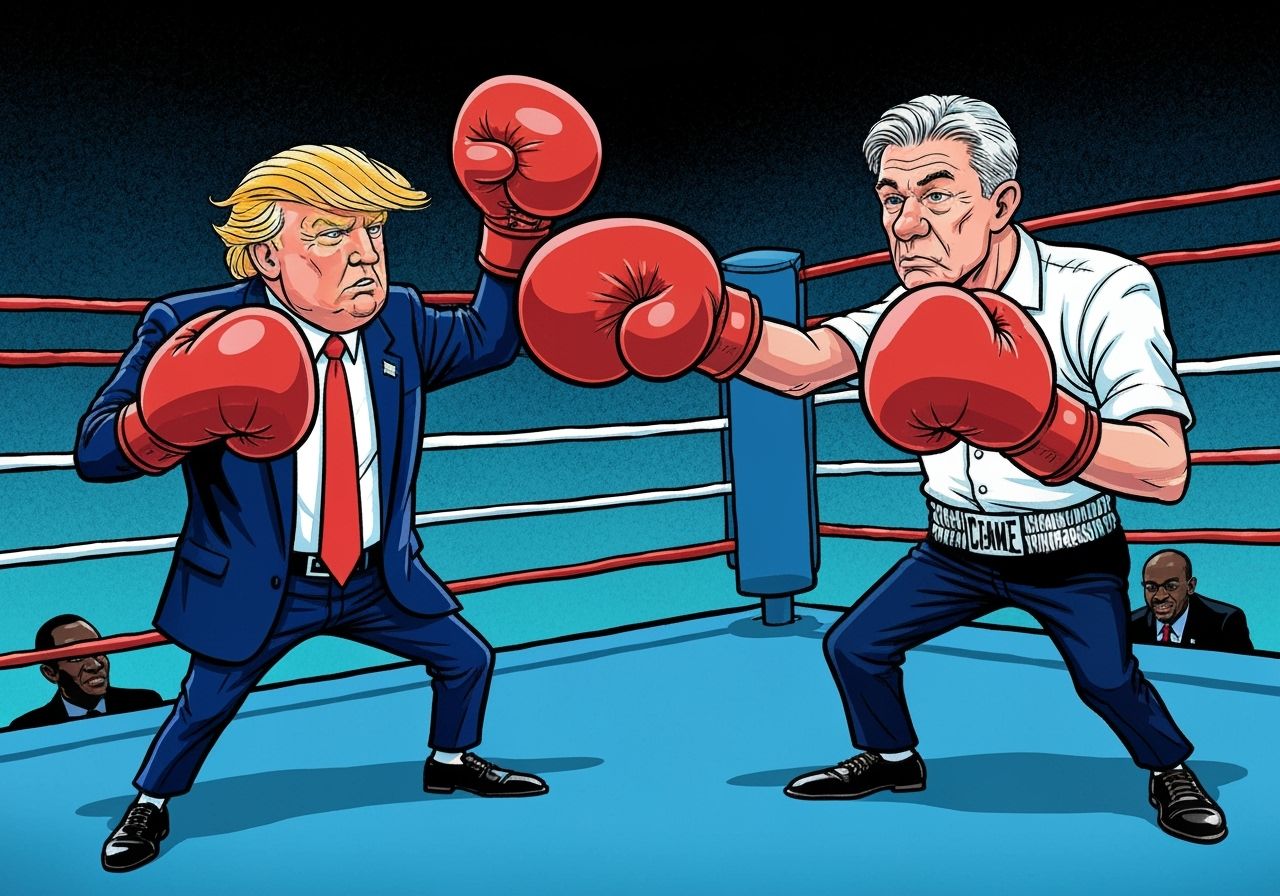

The Fight Over the Fed

President Trump has tried everything from threats to bullying to name-calling to try and force the Fed to lower interest rates since reentering the Oval Office.

Last week, he tried to fire Fed board member Lisa Cook. She’s suing, and a big legal fight will ensue, and who knows how that will turn out.

But in some ways it doesn’t matter. Sooner or later, Trump will install enough loyalists at the Fed to sway their decisions. Jay Powell’s term as Fed chair expires in May anyway.

The Fed will cut interest rates. But that may not move mortgage rates.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

The Federal Funds Rate vs. Mortgage Rates

When the Fed “cuts interest rates,” they change something called the federal funds rate. That’s the short-term interest rate range that banks use to price overnight loans to one another.

While mortgage rates do share a historical correlation with the federal funds rate, they’re not based on it.

Mortgage rates are priced based on bond yields. And bond yields are based on what bond investors are willing to pay for them.

Bond Investors Remain Wary

President Trump can bully the Fed and will eventually get his way with cuts to the federal funds rate.

But he can’t bully bond investors or control bond yields.

And bond investors aren’t thrilled with the tariffs, inflation risk, and soaring government spending. Look no further than the weak performance of recent Treasury bond auctions.

In September last year, Treasury yields dipped below 3.59%. Today, they sit around 4.25%. Again, that’s despite the Fed cutting the federal funds rate by 75 basis points over that period.

Sure enough, mortgage rates are higher today than they were a year ago.

Real Estate Markets Bending But Not Breaking

After two years of “lock-in effect,” where sellers held out for lower mortgage rates, many have decided not to wait any longer. Inventory for sale is up 20.3% over the last year, as sellers throw in the towel.

That’s caused flat price growth in some housing markets over the last year, and modest price declines in others. Consider it an overdue correction after the soaring prices during and after the pandemic.

Commercial real estate has not fared so well. Values have fallen by 20-30% for many types of commercial real estate over the last three years – comparable to the fall in residential home prices during the Housing Crisis in 2008.

That has caused enormous problems for some owners, but equally great opportunities for buyers.

We’ve seen this play out in our own investments in the Co-Investing Club. A few investments from 2022 are struggling. And we’ve seen some incredible deals on properties we invested in over the last year, with operators buying at huge discounts from distressed sellers.

That’s how investing goes. Good markets for buying make bad markets for selling, and vice versa.

Dollar Cost Averaging

You’ve probably heard the term dollar cost averaging in stock investing: buying at regular intervals, regardless of what’s going on in the market.

I do this with my own stock investments. My robo-advisor (I use Schwab’s) pulls money out of my checking account every week and invests it automatically for me.

And I do this with my real estate investments. Every month, I invest $5,000 (or more if I have it) in a passive investment vetted together with the Co-Investing Club.

I don’t time the market. But if I did, I’d say that now is a great time to buy/invest and a bad time to sell.

Curious about the kinds of group investments we vet and go in on together? Join the Co-Investing Club as a free member, to get notified of our next deal discussion. We’re hoping to meet on Monday to vet our next deal (although we’re still waiting on confirmation from the operator).

(article continues below)

What About Loan Rates?

I have no doubt the Fed will cut the federal funds rate several times over the next year.

I’m less certain that mortgage rates will drop equivalently.

Until bond investors feel more confident that tariffs and frenzied regulatory changes won’t cause a recession and/or inflation, they’ll keep demanding higher bond yields. And that will keep mortgage rates high, regardless of what the Fed does.

Want to chat about this or anything else with us? Like we do every Thursday, tomorrow at 3:30 EST we’ll host our Open Office Hours Zoom call. Looking forward to speaking with you!