The Big Picture on Insights from Real Estate Attorney Mauricio Rauld: Prioritizing investment over excessive spending can accelerate wealth building, as seen in Jim Rohn’s 90% investment strategy and Grant Cardone’s 50/50 rule. Active investments, such as real estate...

G. Brian Davis

Brian Davis is a real estate investor and personal finance writer with over two decades in the real estate and finance industries. After graduating from University of Delaware in 2003 with two useless B.A. degrees and an even more useless minor in anthropology, he fell headfirst into real estate finance by accident.

Then he promptly went on a property buying spree from 2005-2008. It was what you might call a “learning experience,” all of the lessons expensive.

Eventually, Brian tired of landlording and unloaded his own portfolio of rental properties. But he still loved real estate as an investment, and today he owns fractional shares in over 2,000 units.

The difference? Nowadays he only invests passively in real estate.

Along with his wife and daughter, Brian spends most of the year abroad living by his own rules. He loves hiking, cooking, pairing wine with said cooking, scuba diving, and occasionally surfing (badly). And writing: he writes as a real estate and personal finance expert for Inman, BiggerPockets, R.E.tipster and dozens of other publishers.

Most of all, Brian loves showing others how they too can create their ideal lives through real estate investing and lifestyle design.

Debunking the High-Risk, High-Return Investment Myth: A Multi-Dimensional Approach to Smart Investing

The Big Picture on High-Risk, High-Return Investments: Investing involves multiple dimensions beyond risk and return, including liquidity, time commitment, tax implications, and regulatory constraints, all of which shape investment decisions. High returns don’t always...

High-Performance Portfolio Optimization: Why Fewer and Deeper Wins

The Big Picture on Portfolio Optimization With The “Fewer and Deeper” Strategy: While diversification protects against downturns, excessive diversification dilutes returns, increases complexity, and leads to missed opportunities. Managing too many investments is...

Why Everything You Know About Money Might Be Wrong: Insights from a Top Real Estate Attorney

The Big Picture on Mauricio Rauld's Tips For Building Wealth : Wealthy individuals prioritize a high savings rate by maintaining a modest lifestyle even as their income grows, allowing for larger investments over time. Traditional investment vehicles like 401(k)s may...

Buck$ Outside the Box: Challenging Traditional Investment Wisdom

The Big Picture on Our Buck$ Outside the Box Launch: Buck$ Outside the Box will explore unconventional investment insights beyond passive income and real estate. Moving away from interviews, the podcast will now feature twice-weekly episodes (5-10 minutes each) that...

The Truth About Index Fund Diversification: Not What You Think

The Big Picture on Truth About Index Fund Diversification: Index funds aren’t as diversified as they seem—market cap weighting makes the S&P 500 top-heavy, with the top 10 companies accounting for 37.6% of the index. True diversification requires more than just...

Is Stock or Real Estate Faster in Building Wealth?

The Big Picture On Whether Stock or Real Estate Is Faster In Building Wealth: US stocks average 10.13% returns p.a. with higher volatility. US residential real estate averages 11.6% p.a. with better stability and leverage options than stocks. Neither is universally...

Is Real Estate An ‘Alternative Investment’?

The Big Picture on Real Estate As an Alternative Investment: Real estate’s income generation, tangible value, and standardized valuations align it more with traditional investments than speculative alternatives. Real estate’s "alternative" label stems from advisory...

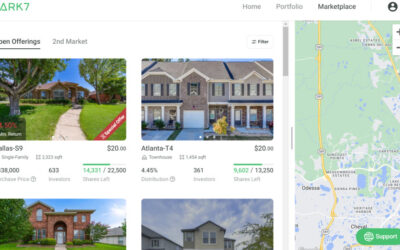

Ark7 Review: Fractional Shares of Rental Properties with Full Liquidity?

The Big Picture On This Comprehensive Ark7 Review: Ark7 is a real estate crowdfunding platform that enables investors to purchase fractional shares in rental properties, including single-family homes, multifamily units, and short-term rentals. With a minimum...

Best Cities for Real Estate Investment by GRM (Price/Rent Ratio)

The Big Picture On The Best Cities for Real Estate Investment By GRM: As of the start of Q4 2024, the national average GRM in the U.S. stands at 13.78, though this figure varies significantly across different regions, highlighting the importance of local market...