Pay Rent with Your Credit Card or Bank Account

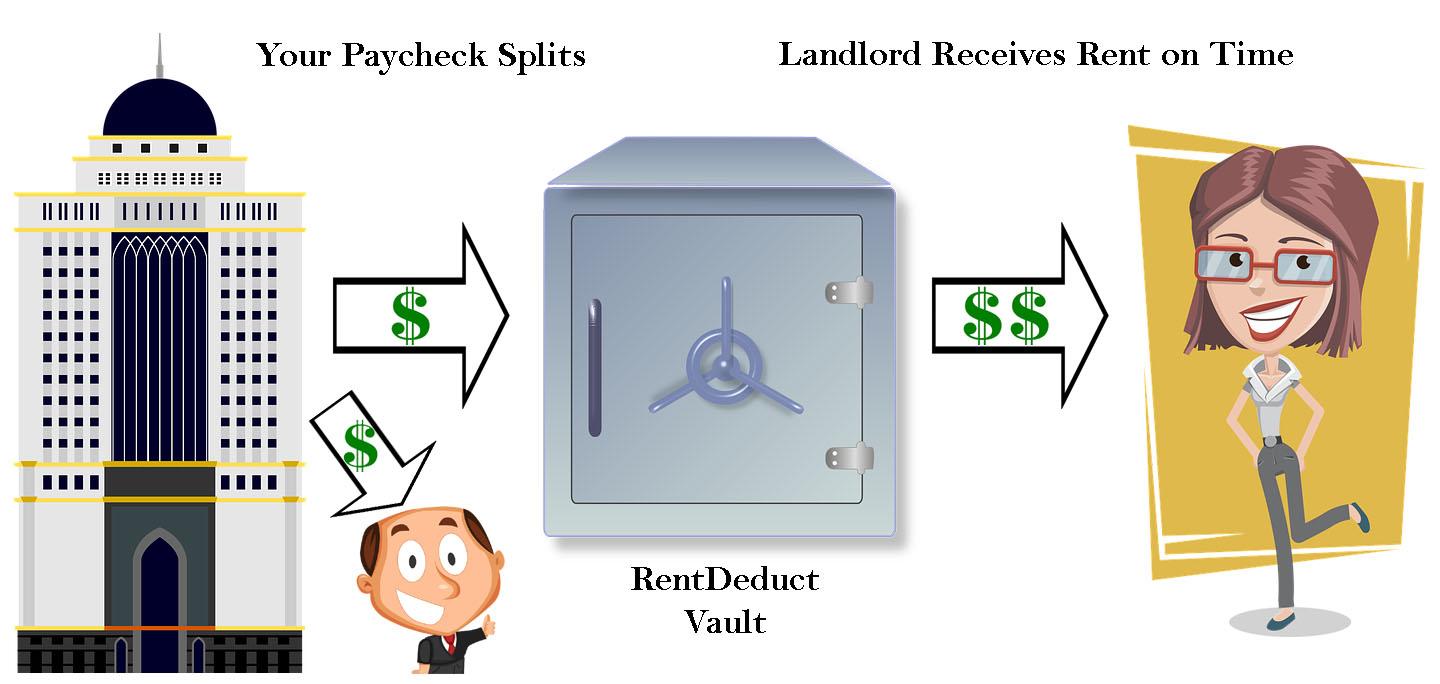

Or have the rent pulled directly from your paycheck!

RentDeduct™: Get Approved Even with Patchy Credit

Keep getting turned down for the homes you want?

We know sometimes things happen, and your credit might suffer. And it’s not always easy to be approved by landlords afterward.

But what if you could assure potential landlords that they’ll get their rent on time, every month?

With RentDeduct™, you can. We can deduct the rent directly from your paycheck, and securely send it to your landlord for you every month. They get paid on time, you get approved for the home you want.

It’s a win-win situation for everyone involved.

SparkRental transfers the rent electronically to the landlord, so you don’t have to do a thing.

On-time rent, no late fees, no hassling with licking stamps or writing checks. After the initial setup you can forget all about making rent payments.

Our pledge to you: SparkRental will make your life easier, and help you get accepted for more homes!

Or you can pay by credit card, debit card or eCheck (ACH/electronic payments)!

Rent on Your Credit Card or Debit Card

Paper checks are so 20th Century. Pay your rent on your credit card or debit card instead!

No envelopes, no checks, no postage. Just pay your rent with your credit card, the same way you pay for anything else online!

It’s fast, secure, and you even get to rack up some credit card reward. Win, win, win.

Get Approved for Better Housing

Have a few rough patches in your credit history?

It can be hard to get approved for good housing. Every time you think you’ve found the perfect home, the leasing agent turns down your rental application. Talk about frustrating.

But now you can offer any landlord to pull the rent directly from your paycheck. Their risk suddenly drops to near zero. You get approved, they get virtually guaranteed rent payments.

Bank-Level Security

Your landlord will never see your banking information. Ever.

As for security? Our online rent payments use the Federal Reserve’s payment transfer system. It doesn’t get much more secure than that!

We take security extremely seriously. From our website’s full SSL (https) status to our complete PCI compliance, we maintain bank-level security.

Quick Setup

If you’re paying by credit card, debit card or bank transfer, there’s no setup required. As soon as you create an account, you can fire off rent payments instantly.

If you’re using RentDeduct to have the rent deducted from your paycheck, the setup is still quick. We’ll give you a form to give to your HR department, so they can start splitting the rent off from your paycheck. It’s that simple!

Coming Soon: Rent Reporting to Credit Bureaus

Want to build your credit so you can buy a home? Or get a car loan, get better credit cards, and generally live a better life?

We’ll soon be featuring rent payment reporting to credit bureaus. You can build your credit while you rent, so you can get a good mortgage and buy a home sooner rather than later.

Better credit makes everything cheaper. We’ll help you get there!

Pricing – How Much Does It Cost?

What’s Free:

Rent payments made by ACH (bank transfer/eCheck) are free! They’re also free for your landlord.

Credit Card Surcharge:

Rent payments made by credit card or debit card are subject to a 2.99% convenience fee. Visa, Mastercard, American Express and Discover all accepted… and they all charge for their services.

RentDeduct™:

Having the rent deducted from your paycheck costs 1.9% of the rent for you, and 1.9% of the rent for your landlord. With that said, your landlord may select that they will pay the entire fee, or that you will be responsible for the fee. As the old timers used to say, “Them’s the breaks.”

No hidden pricing or gimmicks. That’s our pricing. Period.

Frequently Asked Questions

Can I use SparkRental even if my landlord doesn't have an account?

You can refer your landlord to SparkRental, so they can create an account and receive your rent payments!

Click here to refer your landlord to create an account with us.

What's the setup process like?

It’s pretty easy – you can set up recurring payments, or log in to make your payments manually each month with a click of a button.

If you’re using RentDeduct, we’ll give you a form to download and take to your HR department. They’ll handle the rest!

Can I transfer money for utilities, security deposits, late fees, etc. using SparkRental?

You can transfer money to your landlord for any purpose using SparkRental. Just make sure your landlord knows what the money’s for 🙂

If I'm using RentDeduct, what happens at the end of the lease term?

After you move out and the last rent payment has gone out to the landlord, we’ll refund any remaining balance in your Vault account to you.

What's free, and what costs money?

Rent payments made by ACH are free (both for you and for your landlord).

Rent payments made by credit card are subject to a 2.99% convenience fee.

RentDeduct™ costs 1.9% of the rent for the landlord, and 1.9% of the rent for the renter. However, the landlord can choose to pay the entire fee themselves, or select that the renter will pay the entire fee.

Pretty simple and transparent, eh?