Whether you’re looking for a way to lower your down payment on a flip or a way to house hack for free housing, live-in flips might just be the answer. But what is a live-in flip, and how exactly does it work? How do you finance them? Here’s everything you need to know...

G. Brian Davis

Brian Davis is a real estate investor and personal finance writer with over two decades in the real estate and finance industries. After graduating from University of Delaware in 2003 with two useless B.A. degrees and an even more useless minor in anthropology, he fell headfirst into real estate finance by accident.

Then he promptly went on a property buying spree from 2005-2008. It was what you might call a “learning experience,” all of the lessons expensive.

Eventually, Brian tired of landlording and unloaded his own portfolio of rental properties. But he still loved real estate as an investment, and today he owns fractional shares in over 2,000 units.

The difference? Nowadays he only invests passively in real estate.

Along with his wife and daughter, Brian spends most of the year abroad living by his own rules. He loves hiking, cooking, pairing wine with said cooking, scuba diving, and occasionally surfing (badly). And writing: he writes as a real estate and personal finance expert for Inman, BiggerPockets, R.E.tipster and dozens of other publishers.

Most of all, Brian loves showing others how they too can create their ideal lives through real estate investing and lifestyle design.

What Are REO’s? How John Retired Early with Bank-Owned Properties

If you've ever wondered "What are REO's?" just talk to John Soforic. He reached financial independence in his 40s after learning how to buy bank-owned properties, and today owns over a hundred of them. But he certainly didn't start out that way. At 30, John Soforic...

Roth Conversion Ladders: How to Raid Your Retirement Funds Before 59

Want to tap your retirement accounts earlier than 59 ½? You can withdraw money from your tax-sheltered retirement funds earlier, tax- and penalty-free, using a strategy called a Roth conversion ladder. But as the name suggests, it takes “a bit of doing” as my father...

Tenant-Proof: 13 Rental Property Improvements to Fortify Against Damage

People are clumsy, dirty, accident-prone Tasmanian devils. That goes double for children, and says nothing of pets. Homeowners are no better, but they have so much money invested in their property that they take more care not to damage it. But renters? Fuhget about...

How Real Estate Investors Can Protect Against Future Eviction Moratoriums

In the last eviction moratorium, some U.S. landlords couldn’t evict non-paying tenants for over two years. That is all but legalized theft. It’s like someone renting a car from Hertz without a credit card, then driving off on a two-year joy ride without paying. First,...

States with Population Growth: State Net Migration & Taxes Comparison

Quick Bites: A state's total "tax burden" includes income tax, property taxes, and sales and excise taxes. There is a correlation between state tax burdens and migration patterns — but it's not a perfect one. Other factors such as real estate affordability and climate...

10 Rental Property Financing Ideas from Professional Real Estate Investors

Leverage. It’s one of the great advantages of real estate over other types of investments. You can finance 80%, 90%, even 100% of your investment. Ever tried doing that with stocks? Good luck finding a lender. The best you can do is buy stocks on margin, and that’s a...

Dollar Cost Average Calculator: How to Use It For Real Estate

The Big Picture On Using A Dollar Cost Average Calculator: Dollar Cost Averaging (DCA) involves investing a fixed amount regularly, regardless of market conditions, to mitigate the risks of market volatility. While commonly associated with stocks, DCA can also be...

Passive Income Types: The Best Sources of Passive Income

The Big Picture On Types Of Passive Income Passive income sources like rental properties, stock dividends, and royalties can provide financial stability but often require initial investment and strategic planning to ensure sustainability. Different types of passive...

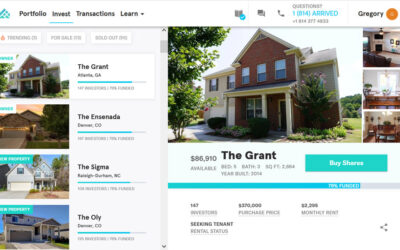

Arrived Review: Fractional Ownership in Rental Properties for $100

As someone who teaches people how to invest in rental properties, should I be worried about how easy Arrived makes it to invest without any knowledge or skill? Arrived (formerly Arrived Homes) is a real estate crowdfunding platform that lets you buy fractional shares...