New year, new you? Not for most people. But try this simple resolution to actually move the needle on building wealth and passive income faster. Here are 3 basic and most important steps to achieve F.IR.E or get your financial life in order in 2021. Video...

G. Brian Davis

Brian Davis is a real estate investor and personal finance writer with over two decades in the real estate and finance industries. After graduating from University of Delaware in 2003 with two useless B.A. degrees and an even more useless minor in anthropology, he fell headfirst into real estate finance by accident.

Then he promptly went on a property buying spree from 2005-2008. It was what you might call a “learning experience,” all of the lessons expensive.

Eventually, Brian tired of landlording and unloaded his own portfolio of rental properties. But he still loved real estate as an investment, and today he owns fractional shares in over 2,000 units.

The difference? Nowadays he only invests passively in real estate.

Along with his wife and daughter, Brian spends most of the year abroad living by his own rules. He loves hiking, cooking, pairing wine with said cooking, scuba diving, and occasionally surfing (badly). And writing: he writes as a real estate and personal finance expert for Inman, BiggerPockets, R.E.tipster and dozens of other publishers.

Most of all, Brian loves showing others how they too can create their ideal lives through real estate investing and lifestyle design.

Ep. 23: End-of-Year Tax Moves for Real Estate Investors

What end-of-year financial moves should you make, to minimize taxes and maximize profits? From ways to minimize your capital gains to depreciation and beyond, savvy real estate investors know all the tricks at their disposal. In this episode you will benefit from the...

Ep. 22: How is Property Depreciation Calculated?

Among the least understood tax benefits of rental properties, real estate depreciation is also one of the greatest. Want to be one of the few landlords who understand it? Deni and Brian break down how depreciation works, how to calculate it, and how it get prorated in...

Ep. 21: The Science of Gratitude and Success

On Thanksgiving week, Deni and Brian talk gratitude. Because the most successful people in this world focus on the positive, rather than dwelling on the negative. They focus on possibilities, rather than wallowing in self-pity, doubt, and cynicism. All of us have much...

Ep. 20: Which States Charge the Lowest Property Taxes?

Average property taxes across states range from as little as a few hundred dollars a year to nearly $8,000 per year. Given the impact they have on real estate cash flow — or on your personal budget as a homeowner — we decided to break down property taxes by state and...

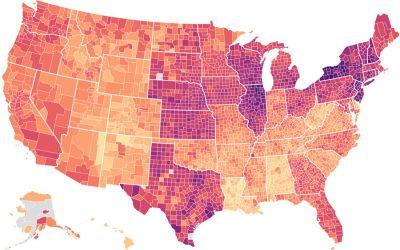

Property Taxes by State & County: Lowest Property Taxes in the US Mapped

Where are the lowest property taxes in the US? The highest property taxes? Some states offer no surprises. New Jersey, for example, charges the highest property taxes in the nation as a statewide average. But Texas also ranks among the top five highest property taxes...

Ep. 19: COVID: Legal Liability For Landlords As The Second Wave Rises?

Landlords and property managers are starting to get sued over COVID-19 infections. So how do you protect yourself and your assets from coronavirus-related lawsuits? For that matter, how do you prevent outbreaks among your tenants in the first place? Brian and Deni sit...

Is an “Eviction Tsunami” Looming in 2021?

Millions of Americans remain out of work in the coronavirus pandemic, after the economy has recovered only half of the 22 million jobs lost in the spring of 2020. Meanwhile, the stimulus checks and extended unemployment benefits are ancient history by November. This...

Ep. 18: How Do Real Estate Contingency Clauses Work?

No one wants to buy a lemon of a house. But you can't necessarily do all your real estate due diligence before making an offer on the property. The answer? Contingency clauses in your sales contract. Deni and Brian break down exactly how real estate contingencies work...

Ep. 17: Should Real Estate Investors Get Their Realtor’s License?

Do you need to get a Realtor's license as a real estate investor? The short answer: no. Should you get your real estate license anyway? Maybe. But probably not. As both a licensed real estate agent and an accomplished real estate investor and landlord, Deni breaks...