Build Passive Income with Real Estate

Who says you need to work until you’re 65?

A Passive Income Blog for the Obsessed

Want to work forever?

Want to work forever?

We certainly don’t. Which is why we’re so obsessed with passive income. And while we love stocks, our true passion is passive real estate investing.

My name is Brian Davis, and I’m a passive real estate investor, personal finance writer, co-founder of SparkRental, and world traveler. I get to spend most of the year living abroad hiking, scuba diving, wine tasting, and breaking toes trying to learn how to surf.

Deni (my partner) and I have a simple goal: to help 5,000 people reach $5,000/month in passive real estate income. Want to be one of them? To start stacking up streams of passive income? To reach financial independence and retire early with rental properties or real estate syndications?

We created this real estate investing blog to help you stop relying so heavily on your 9-5 salary and start living more intentionally. Welcome!

The Latest from Our Real Estate Investing Blog

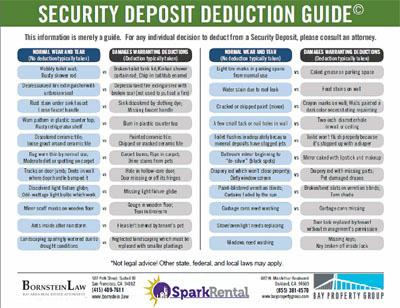

Clever Ways to Earn Extra Money from Your Rentals

The Big Picture on Earning Extra Money from Your Rentals: Leasing furnished or semi-furnished properties allows landlords to charge higher rents and justify larger security deposits. Offering services such as housekeeping, landscaping, or pool maintenance can generate...

7 Common Landlord Repairs All Property Owners Should Know How to Fix

The Big Picture On Common Landlord Repairs: Landlord repairs can save you a lot of money—if you can do them properly. Most common repairs include re-caulking, fixing leaky pipes and faucets, patching drywalls, and painting. It's important to ensure your and your...

5 Steps to Become a Millionaire from Real Estate in 5 Years

The Big Picture on Becoming a Real Estate Millionaire Within 5 Years: Decide if you want to actively manage properties or invest passively through platforms like real estate crowdfunding and syndications. Implement techniques like the BRRRR method so you can...

19 Real Estate Side Hustles to Save & Invest Money Faster

The Big Picture On Getting A Real Estate Side Hustle: Many real estate side hustles, such as bird-dogging and rental arbitrage, require minimal upfront investment, making them accessible to beginners. Engaging in these side hustles helps develop valuable skills such...

How Much to Save to Retire Quickly (Charted)

The Big Picture on How Much To Save To Retire Quickly: Your savings rate and living expenses significantly influence how much you need to save for retirement. Lowering living expenses both boosts your savings rate and decreases your required nest egg. Focus on the...

5 Fundamentals of FIRE from Real Estate

The Big Picture on FIRE from Real Estate: Setting a specific target date for achieving FIRE through real estate can help keep you focused and motivated. The rate at which you save and invest your income is critical to how quickly you can achieve financial...

What I Wish I Knew Before Investing in Rental Properties

The Big Picture on Investing in Rental Properties: New investors often underestimate non-mortgage expenses such as maintenance, property taxes, and vacancies, which can significantly impact rental cash flow. Conducting extensive research on the property's location,...

Financial Independence: 8 Steps to Make Your Job Optional

The Big Picture on 8 Steps For Financial Independence: Prioritize budgeting and minimize unnecessary spending to save more for investments. Diversify your investments in real estate, stocks, and other assets to build wealth over time. This strategy not only grows your...

How Green & Smart Homes Are Merging… and Starting to Pay Off

The Big Picture on How Green And Smart Homes Pay Off: Combining green technology with smart home systems can significantly reduce utility bills and improve efficiency. Examples include smart irrigation systems, thermostats, and security systems. Innovations like...

Appraised Value Versus Market Value: How Appraisals Work

The Big Picture on Appraised Value vs. Market Value: Appraised value, determined by professional appraisers for mortgage purposes, is based on property condition and market trends. Market value is the price a buyer is willing to pay, influenced by market conditions...

Tenant Retention: How to Maximize ROI

The Big Picture on Improving Tenant Retention and ROI: Compare your rental units to competitors in terms of pricing and amenities. Conduct market research and exit interviews to understand why tenants leave and what improvements could encourage them to stay. Keep a...

What Bills Help Build Your Credit?

The Big Picture On What Bills Help Build Your Credit: Not all bills impact your credit score; only those reported to credit bureaus do. Commonly reported bills include car payments, mortgages, student loans, and credit cards. Some providers report only late payments,...

The “Live Off Rents” Podcast

Prefer to watch or listen to your real estate investing and FIRE tips & tricks? No sweat.

Deni and Brian have been broadcasting live every week to the SparkRental-sponsored Facebook groups since 2017, and started releasing the content via podcast in 2020. Each episode is quick, 15-20 minutes, but jam-packed with actionable content.

No fluff, just advice you can put to work immediately to build passive income from real estate.

If you enjoy the episodes, share them, and please rate and review on iTunes or wherever else you listen!

Recent Episodes

Beyond Education: Group Real Estate Investment Club

Beyond Education: Group Real Estate Investment Club

Learning is wonderful, and we offer nearly endless free education content for real estate investors. But nothing beats getting in the trenches and actually investing to earn real returns.

At your request, we created a real estate investment club that lets you “earn while you learn” with a club of other investors. Every month, we meet on a video call to vet a new passive real estate investment. These group real estate investments range from private parnetships to private notes to real estate syndications and funds for fractional ownership in an apartment complex, self-storage facility, retail or other large property. You get all the benefits of real estate investing, from cash flow to appreciation to tax benefits, without the headaches of buying properties yourself.

Best of all, you can invest with a lot less money. Rather than the $50,000 – $100,000 needed for a typical private equity real estate investment or rental property down payment, you can invest with $5,000 per deal.

Oh, and non-accredited investors are welcome on all deals. We intentionally propose inclusive deals open to all investors.

Who Is this Real Estate Investing Blog For?

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

But while the “how-tos” and “avoid these mistakes” are important, they’re only part of the picture.

The bigger picture? How real estate investing fits into your larger strategy for building wealth and passive income.

Specifically: reaching financial independence to give you the freedom to retire early, if you so choose. Or to supplement your current lifestyle so you can live better or switch to your dream work.

So who is this “real estate investing blog” for? It’s not just for passive real estate investors or active landlords — it’s for anyone looking for creative ways to reach FIRE through real estate investing.

Real Estate Investing & Landlord Education

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

But our landlord education doesn’t end with the blog.

We offer a range of free webinars and online masterclasses for real estate investors. We offer a premium course called FIRE from Real Estate, to help you reach financial independence and retire early in years rather than decades. Our weekly newsletter keeps you abreast of rental industry trends, landlord tips, and the best of real estate investing blogs from around the web. And every week, Deni & Brian hop on live video on Facebook for a 15-minute live vlog and answer questions.

What for? Why do real estate investors and landlords need continuing education, anyway?

Because investing in rental properties is not like throwing money in an index fund.

Buying real estate investment properties takes skill (at least if you want to make money). Managing rental properties takes skill.

Your returns on rental investment properties are directly proportionate to your knowledge and skill, both as an investor and as a landlord. If you want to reach financial independence from real estate, you’re going to need to know what you’re doing.

That’s why we’re obsessed with ongoing real estate education at SparkRental. We want you to make as much passive income as possible, as fast as possible, on the fewest real estate investments possible.

More Resources for Investors

Had enough of us going on about the importance of real estate investing education?

“Cut to the goods already Brian! Gimme some free stuff!”

All right, all right. Here are some free real estate investing resources, to help you on your quest for financial independence from real estate:

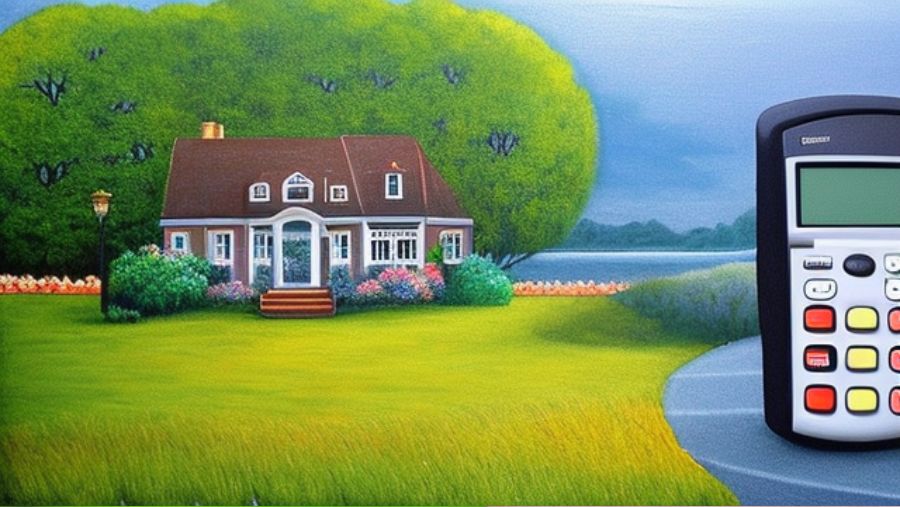

Real Estate Investing Calculators

Real estate investing involves math. But it doesn’t have to be hard math. Use our free rental income calculator, house hacking calculator, property depreciation calculator and more to get ahead in the game of life.

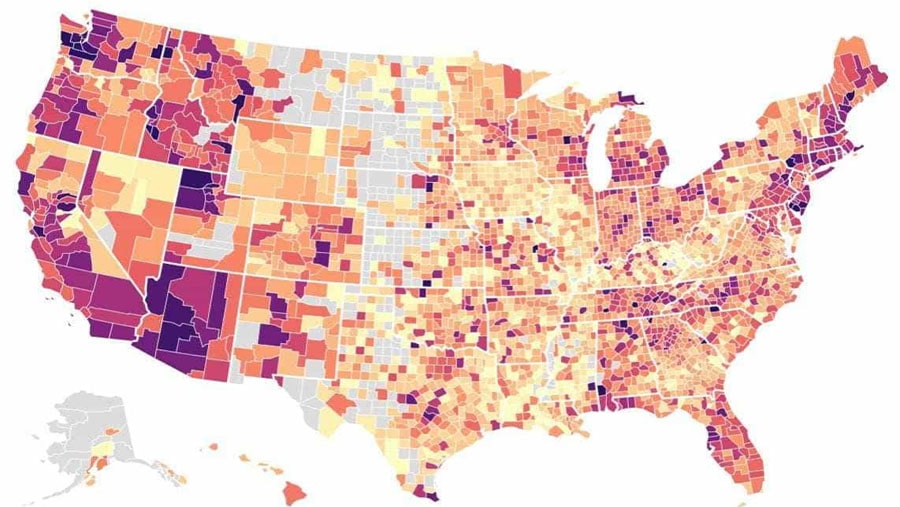

Interactive Real Estate Maps

It’s a big country, with thousands of towns you could invest in. Where should you invest? Why? Check out our interactive maps of the hottest housing markets, cooling real estate markets, best cities for real estate investing by price/rent ratio, and more.

Real Estate Crowdfunding Comparison

Wondered whether real estate crowdfunding investments are worth considering? The answer: some are, others aren’t. But which are worth it? Check out our comparison of real estate crowdfunding platforms — and which we invest in ourselves.

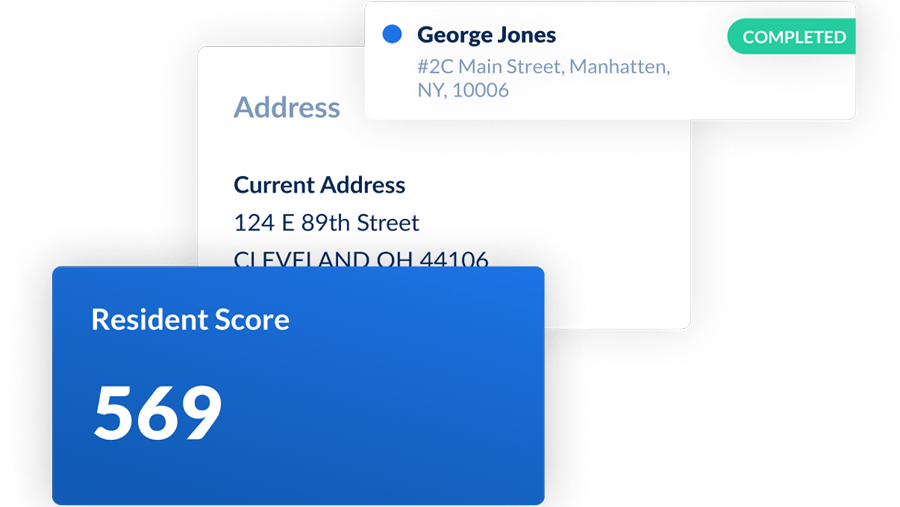

Landlord Software & Mobile App

Use our free landlord software to screen tenants, collect rent online, and automate your rental accounting. Sync your bank account, automatically label income and expenses, and use one-click Schedule E tax statements.

Want more free landlord resources? Check out our list of Free Real Estate Investing Tools.