Vacancy Advertising & Tenant Screening

Want higher ROI on your rentals? Fill your vacant rental unit with the best possible renters, ASAP.

Have a vacant rental unit on your hands?

Vacancies are expensive, and they’re time-consuming to fill. Lucky you! But unless you want to be right back in this position in six months, an eviction later, get it right the first time.

Advertise on multiple rental listing websites. Give every person who expresses interest a rental application (ours is free, emailable and e-signable – hint hint).

Then run tenant screening reports on all applicants. Get a full credit report, nationwide criminal background check, and nationwide eviction report. Have the applicant pay the fee for these (our screening reports can be charged directly to the applicant).

Then it’s calls, calls calls. Supervisors. HR departments. Personal references. Current landlords. Prior landlords. If that sounds like a lot of work, it’s nothing compared to unpaid rent, serving eviction notices, filing in rent court, appearing in front of a judge, meeting the sheriff at the property, and then spending thousands of dollars to get the property back in rental shape.

Here are a few fundamental articles to get you started, and from there, you can explore our other articles in the Advertising & Tenant Screening category to make sure you get the perfect long-term tenant, every vacancy!

“Required Reading” – Start Here First!

Still hungry after eating those up? Well, we won’t let you down. There’s plenty of rental advertising and resident screening articles to sink your teeth into!

Full Library of Advertising & Tenant Screening Articles:

Cost Segregation Study: How to Take Accelerated Depreciation on Rental Properties

The Big Picture On A Cost Segregation Study: A cost segregation study allows real estate investors to reclassify property components into categories with shorter depreciation periods, enabling accelerated depreciation and reducing taxable income in the early years of...

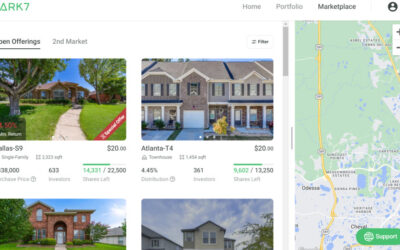

Ark7 Review: Fractional Shares of Rental Properties with Full Liquidity?

The Big Picture On This Comprehensive Ark7 Review: Ark7 is a real estate crowdfunding platform that enables investors to purchase fractional shares in rental properties, including single-family homes, multifamily units, and short-term rentals. With a minimum...

How to Handle a Bad Contractor

The Big Picture On How to Handle a Bad Contractor: Keep detailed records of all agreements, payments, communications, and any issues with the contractor's work. Photos of the work and a written record of all interactions can provide valuable evidence if you need to...

Best Cities for Real Estate Investment by GRM (Price/Rent Ratio)

The Big Picture On The Best Cities for Real Estate Investment By GRM: As of the start of Q4 2024, the national average GRM in the U.S. stands at 13.78, though this figure varies significantly across different regions, highlighting the importance of local market...

FIRE Movement: Your Path to Financial Independence and Early Retirement

The Big Picture on Financial Independence and Retiring Early: The FIRE movement is about achieving financial independence and early retirement by maximizing savings, minimizing living costs, and investing in income-generating assets like stocks and real estate. Key to...

Rent To Retirement: Building Wealth Through Rental Properties

The Big Picture On Rent To Retirement: Investing in rental properties can provide a stable income for retirement, with options like steady monthly rent, lump-sum cash from sales, and equity loans. This makes it a sustainable alternative to traditional retirement...