by G. Brian Davis | Last updated Sep 22, 2024 | Active Real Estate Investing, Creative Financing |

The Big Picture On The Minimum Down Payment For An Investment Property: You can borrow at a higher LTV (loan-to-value ratio) if you live in the property for at least a year, have higher credit scores, negotiate seller financing, or cross-collateralize with other...

by G. Brian Davis | Last updated Jun 7, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture On How To Avoid Capital Gains Tax on Real Estate: The IRS taxes your profits on real estate and other investments as capital gains. The tax rate on capital gains is lower than regular income — if you owned the investment for at least a year. Real...

by G. Brian Davis | Last updated Oct 10, 2024 | Active Real Estate Investing, Creative Financing, Personal Finance, Spark Blog |

The Big Picture On Clever Ways To Come Up With Down Payment For A Rental Property: Various financing options exist for rental property down payments, such as using home equity lines of credit (HELOCs), borrowing from retirement accounts like 401(k)s or IRAs, and...

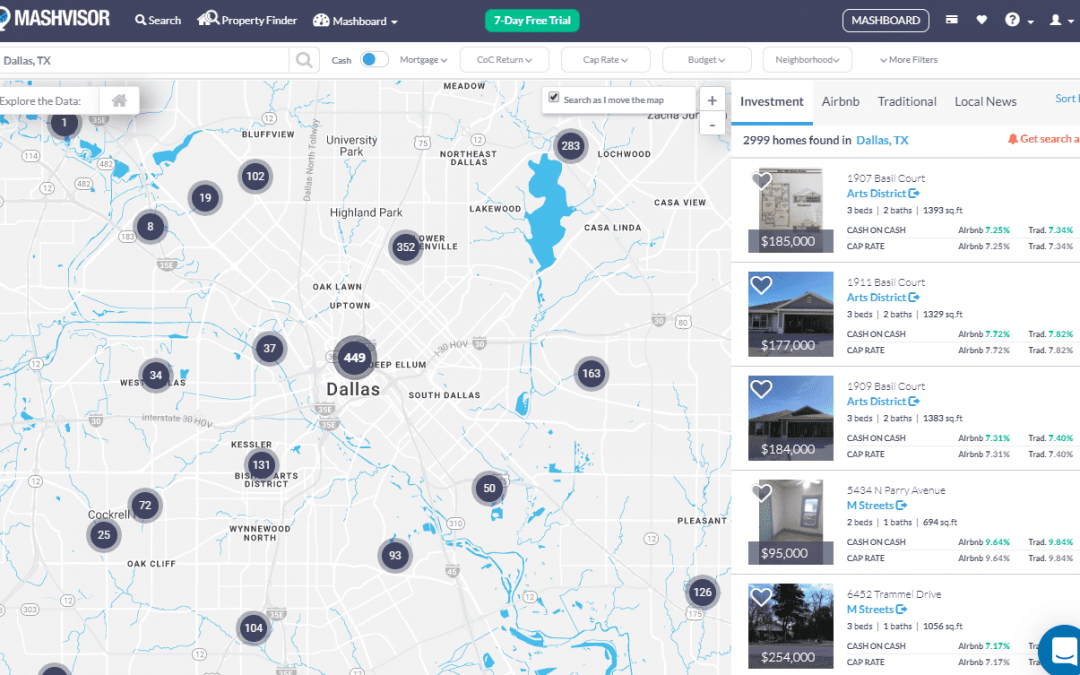

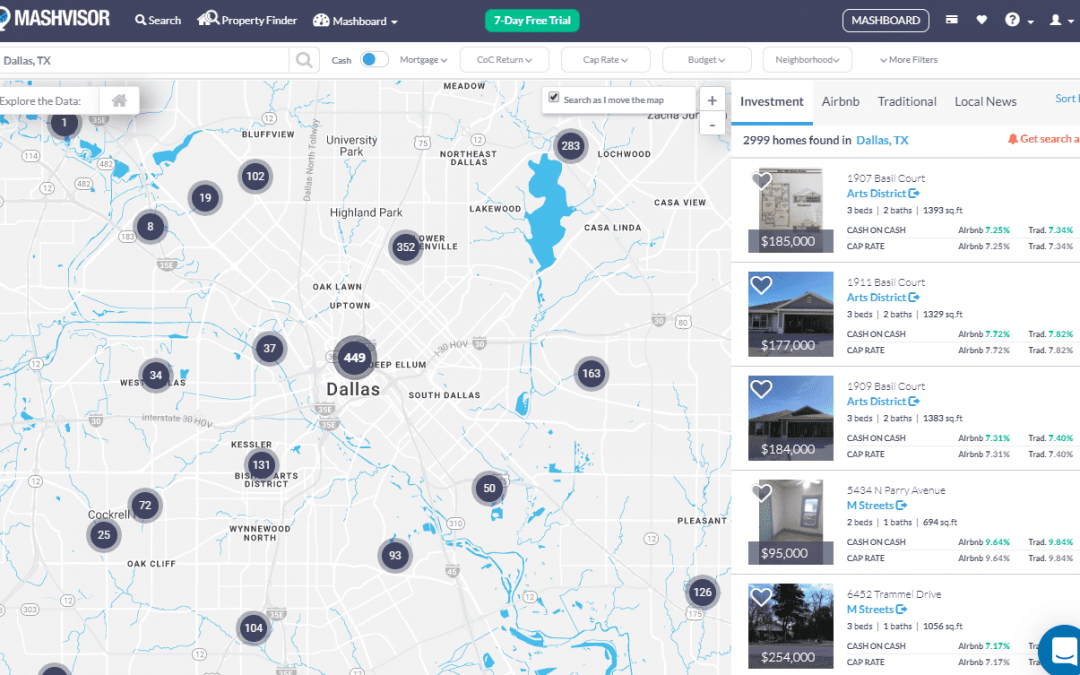

by Michael Lewis | Last updated Oct 16, 2024 | Active Real Estate Investing, Airbnb & Short-Term Rentals, Spark Blog |

The Big Picture On Our Mashvisor Review: Mashvisor offers a range of tools for property analysis, including heatmaps, Mashvisor Airbnb calculator, and other investment calculators, which help investors identify profitable rental properties. The platform is designed to...

by G. Brian Davis | Last updated Oct 24, 2024 | Active Real Estate Investing, Real Estate News, Spark Blog |

The Big Picture On The Best Real Estate Investing Podcasts: Podcasts are a convenient and free way to gain knowledge and stay updated on real estate trends, making it easy for investors to learn while multitasking. These top podcasts provide valuable education on real...

by Kim Pinelli | Last updated Sep 26, 2024 | Active Real Estate Investing, Passive Real Estate Investing, Personal Finance, Spark Blog, Tax Tips for Real Estate |

The Big Picture On Calculating Rental Property Depreciation: Rental property depreciation is calculated based on the building’s cost basis (purchase price minus land value), divided over 27.5 years. This allows property owners to deduct a portion of the...