Despite the promises of fast-talking, out-of-town promoters who invite the naive to “free” Get-Rich-Quick seminars in a local hotel, building passive income through rental properties is neither simple nor guaranteed.

Real estate profits are limited by the knowledge, effort, and persistence of the individual investor. The secret to success in any endeavor depends on one’s ability to collect and analyze relevant data, make quick decisions, and act before the competition beats you to the punch. A little luck never hurts, either.

Professional real estate investors typically learn fun the fundamentals of finding good deals and forecasting real estate cash flow through experience, through searching, analyzing, and executing potential real estate transactions. As investors turned from stock and bond investments for the income and tax deductions of investment properties, competition for rental properties naturally increased. The ability to find and quickly react to a profitable opportunity became a competitive advantage, separating the real pros from the also-rans.

One of the also-rans – Peter Abualzolof, a West Coast entrepreneur with a tech background – saw an opportunity to level the playing field between the established players and those low on the learning curve in 2014. He and his partner, Moh’d Jebrini, subsequently founded Mashvisor to deliver almost-real-time market information and financial analysis of residential real estate properties across the United States.

I have always been a real estate investor who relies on shoe leather, the telephone, and an Excel spreadsheet to make investment decisions. To others like me, are Mashvisor’s tools worth paying a monthly subscription fee?

Mashvisor Review

Mashvisor’s service helps real estate investors with the acquisition process in two ways. First, it helps them locate prospective investment properties. Second, it helps them analyze those properties to determine how they’ll perform, both as a traditional long-term rental property and as a short-term vacation rental.

Finding Properties to Buy

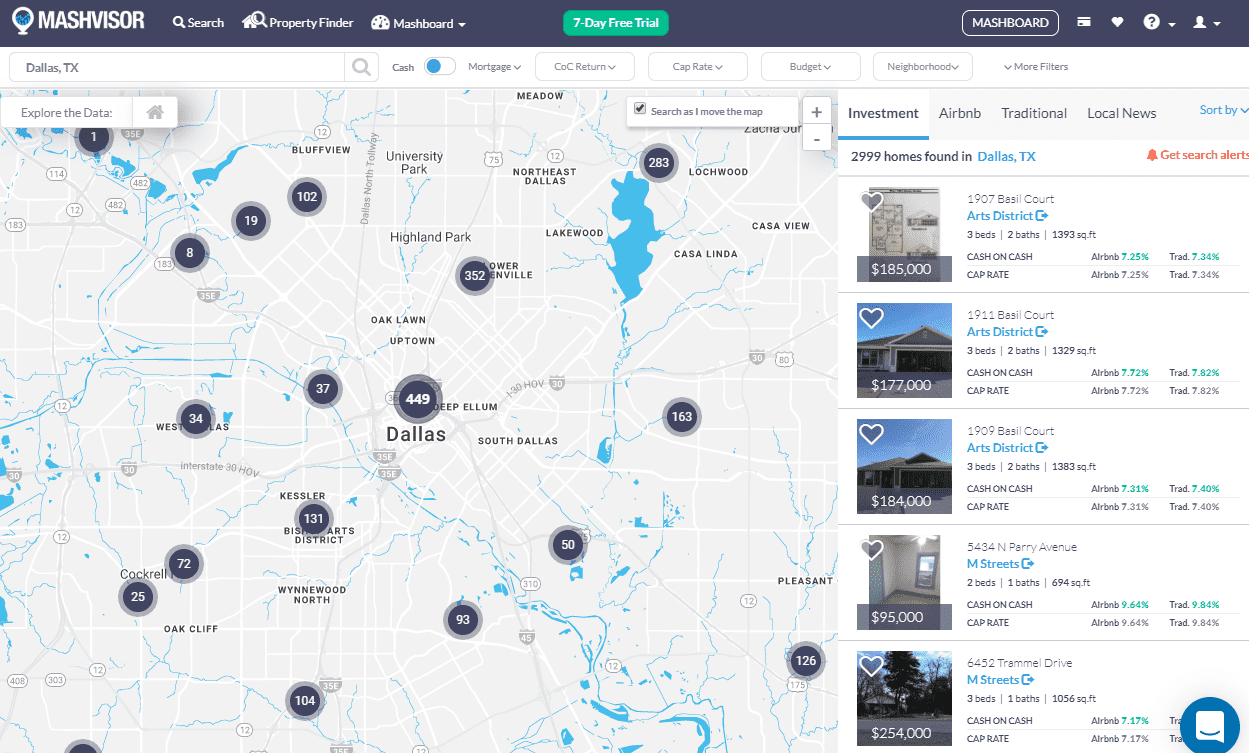

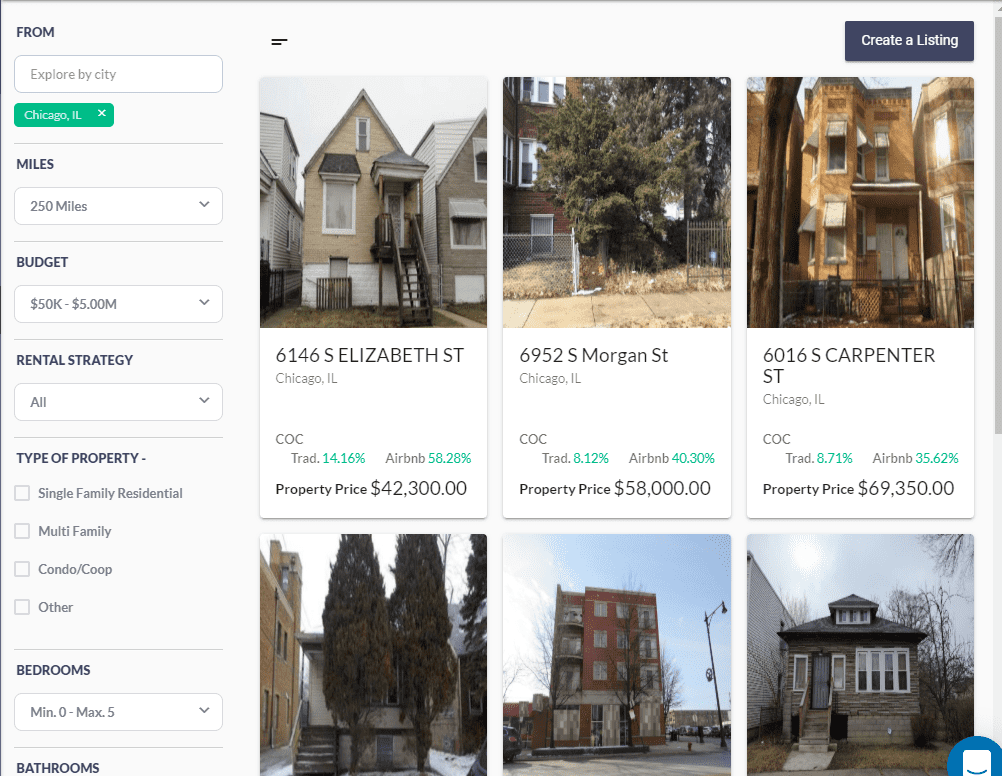

Investors who buy real estate long-distance will fall in love with the company’s Property Finder model. With the click of a mouse, users can switch from a city overview of listed properties to details of a specific property with photographs, descriptions, listing price, and other relevant information. Subscribers can easily search the database and identify properties by city, neighborhood, street address, or zip code using specific financial targets.

The results of a search: an easily understood street map, pop up with individual property uniquely identified, including physical and financial details. The software also provides side-by-side comparisons of potential acquisitions.

Data feeds from multiple sources, including the MLS, Zillow, and Realtor.com., continuously update the company database. The company also collects data from its partners:

- Airbnb is the premier on-line market for short-term rental of residential real estate.

- Roofstock specializes in the acquisition and management of single-family homes for investors that guarantees a minimum rent for properties that are vacant 45 days or more.

- Auction.com focuses on the sale of residential bank-owned and foreclosure properties available through traditional public and on-line auctions.

The Airbnb rental and occupancy data enable a potential purchaser to compare short-term and traditional long-term rental strategies for each location, an additional data point not available in most competitive real estate analytical services.

Some users of the service ask whether the inventory of properties is complete when compared to the source data. While occasional omissions might occur when handling massive amount of constantly changing data, the inventory of properties remains robust and thorough compared to competing services.

Though the property search process will not be new to experienced residential investors, the scope of the search function, details on each property, and ease of use are impressive. The most significant advantage of the service is the enormous amount of time saved in the process of finding potential properties to acquire. I suspect that the most skeptical opponents of real estate search engines will be impressed.

The color-coded “Heatmap” of the search function is especially useful. Users can sort the database for a specific variable such as listing price, cap rate, or cash on cash return with results displayed for neighborhoods in hues of “red” for low and “green” for high. A prospective buyer, for example, would theoretically look for properties that are green for cash on cash return and red for market price. A user with unique search criteria can modify the search metrics at will. For example, an investor can quickly move from a cash purchase to a mortgage (and vice versa) with unique down payments, terms, and interest rates to see the impact on rates of return.

Here’s a quick breakdown of the process works:

Property Analysis

The properties identified through the Property Finder should be further analyzed to ensure they meet an individual investor’s threshold for minimum returns. The process typically requires developing a spreadsheet of probable profits, expenses, and cash flows.

Building a unique spreadsheet or a fill-in-the-blanks model can be a daunting task for those who do not regularly work with spreadsheets. Mashvisor’s Property Analysis tool is a mathematical model designed solely for residential real estate investors. Its format identifies the major categories of revenues and expenses necessary to calculate net operating income and subsequently, rates of return and cap rates.

Errors in the calculations arise because investors typically over-estimate revenues and underestimate expenses. The model minimizes the chance of gross errors by populating revenue figures from data collected with the Property Search function and estimates costs – start-up and ongoing – based on averages for comparable properties in the database. The software allows users to override each element to create a unique worksheet based on their experience that more accurately represents future results.

Mashvisor’s analysis modeling also helps investors determine the best usage of a potential property. It compares returns for short-term Airbnb renting versus long-term leasing. In some markets, short-term rentals don’t make ideal investments!

The Property Analysis model, in my opinion, successfully transforms a usually messy project into an elegant, easily understandable, and audit-able result to make the right investment decision.

Mashvisor Pricing

The company offers a range of plans and pricing; each billed annually with a free 7-day trial period:

-

- Starter Plan. Investors can focus on one or two city markets for $7.50/month (if billed annually). The fee includes most of the identification and analytic capabilities of the full program except access to Heatmaps.

- Basic Plan. For $25 monthly, a subscriber gets access to three city markets plus Heatmaps, property sales history, and property tax history.

- Professional Plan. For $49.92, investors have access to five city markets (of their choice) plus the ability to export reports and findings.

- Enterprise Plan. For $79.17 monthly, a subscriber gets access to Mashvisor’s full offerings plus telephone access for assistance.

Mashvisor Competitors

Mashvisor competes with a variety of companies in the real estate identification and analysis market. However, none offer the combination of the services provided by Mashvisor. They include

-

- BiggerPockets. The company has attracted more than 1.3 million members according to its website seeking to find partners, deal, and financing. It offers a variety of forums, educational materials, and several basic real estate investment calculators. Its offerings are not in the same league with Mashvisor. A Basic membership with limited access to the company’s services costs $19 monthly, while a premium membership with total access is $99 monthly.

- Reonomy. Designed primarily for commercial real estate investors and backed by venture capital firms such as Bain Capital Ventures, Sapphire Partners, and Soft Bank, the New York City-based technology company provides on-line, extensive research on commercial properties. An individual license is $3,600 annually.

- AirDNA. The company claims to be the world’s leading provider of short-term vacation rental data and analytics. The company offers Market Minder targeting investors in specific markets and Investment Explorer covering short-term rental properties in the United States. Market Minder subscriptions range from $19.95 and $99.95 monthly, depending on the number of active listings. Investment Adviser’s monthly price ranges from $199.00 for a single state to $499.00 for the nation.

In addition to the companies above, other real estate analytics programs vary from Rentometer at $99 annually ($29 monthly) to Alteryx ($33,800 for access to data sets in the United States and Canada). You can also research rental prices in your market and view your local market report on Wheelhouse.

Cautions and Reservations

Despite the many advantages of using a Mashvisor-type service, potential subscribers should keep in mind that:

1. Artificial intelligence and remote analysis are not a substitute for on-the-ground, visual inspections of prospective real estate properties, and their surroundings. Rental prices reflect desirability and demand; the more desired, the higher the potential rent. Neighborhoods and the people who live within them continuously change, affecting their popularity. If you are not willing to invest the time and expense to visit a potential acquisition, you should rely on real estate professionals to manage your investment.

2. Projections of future results, no matter how sophisticated or elegant, are simply tools for making decisions, not predictors of an inevitable outcome. A neat, visually pleasing document is not evidence of veracity or relevance. Incorrect or incomplete information or assumptions invariably produce a wrong future outcome or, in the words of computer guru Will Hey, “Garbage in, garbage out.” Whether using your estimates or relying on the complex logarithms of Mashvisor, check and recheck your information to be sure it is valid before relying on it to invest thousands of dollars.

3. For real estate flippers, the services of Mashvisor are probably overkill, the equivalent of wearing a tux to a beach party. The service is designed specifically for those investors who intend to buy-and-hold real estate for rental income, not to find a diamond in the rough.

My Recommendation

Mashvisor occupies a singular competitive niche serving the residential real estate investment market with its voluminous data and easy-to-use analytics, no doubt the reason for its significant growth in the last five years.

Subject to my cautions above, I cannot imagine any rental investor who would not benefit from a subscription. The price is low for the services provided, its existing customer base speaks highly of it on review sites across the web, and the potential time savings for its use are incredible.

Have you used Mashvisor’s tools? What were your experiences?

The More You Learn, the More You Earn as a Landlord:

About the Author

Thanks for the information about Mashvisor. I will definitely look into it and also let some investor clients know about it.

Mashvisor is cheap compared to it’s service.

Absolutely Emon! It’s great service. Glad you found the Mashvisor review helpful!

Thanks for taking the time to write this. Very helpful. You stated that this isn’t a good tool for flippers. Is there one that you can recommend that does?

Thank you for the highly objective review. I went to the their website and looked at the BBB reviews; some of which were very critical of the platform. It seems a good resource for real estate investors for the price. I will check it out.

Glad you found it helpful Julian!

Sadly, Mashvisor turned out to be useless for me as it doesn’t allow to filter out 55+ communities; HOAs in which Airbnb is not allowed etc.

Moreover, during my search of the investment properties in Kissimmee in many cases Mashvisor calculates HOA fees circa 85-120 and then I find out (by going to original listing page) that monthly fee for the property is much higher, it is actually $1200. That dramatically changes CoC return calculations and makes this property selected by Mashvisor a very bad investment.

I therefore asked Mashvisor to refund my money paid for professional membership. Never heard back from them

I’m very sorry to hear you had a bad experience with them Elena!

Good tool for short-term rental investing!

Agreed Crystal!