by G. Brian Davis | Last updated Feb 20, 2024 | Active Real Estate Investing, Creative Financing, Spark Blog |

What’s the difference between hard money and private money loans? Real estate investors sometimes use these terms interchangeably. Many hard money lenders are private lenders, and vice versa, making the discussion more confusing. Fortunately, understanding the...

by Guest Author | Last updated Feb 19, 2024 | Real Estate News, Spark Blog |

Non-fungible tokens, or NFTs, haven’t been around too long, but they definitely shook up the collectibles market. For a little while, NFTs became the hottest niche in the blockchain space, selling for anywhere from $100,000 to millions of dollars and giving...

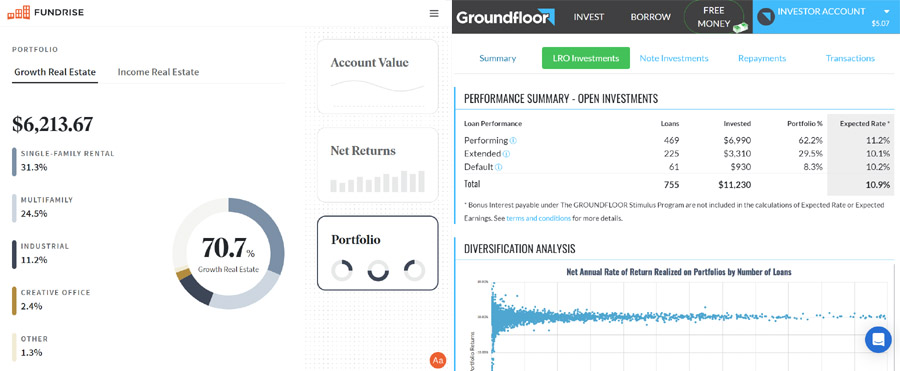

by Christopher Murray | Last updated Feb 19, 2024 | Passive Real Estate Investing, Real Estate News, Spark Blog |

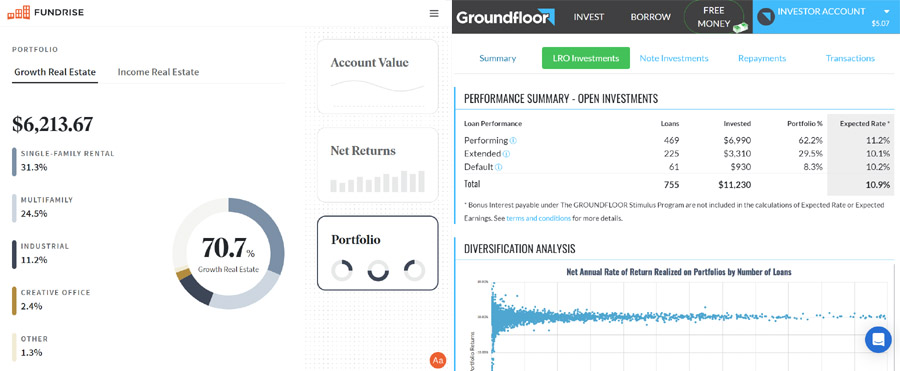

If you’ve checked out our comparisons of real estate crowdfunding investments, you know we love Fundrise and Groundfloor. Both offer simple ways to diversify your portfolio, and are great options for passively investing in real estate. But which one reigns supreme?...

by G. Brian Davis | Last updated Apr 8, 2024 | Active Real Estate Investing, Spark Blog |

When Deni and I poll new real estate investors about their greatest challenges, two answers pop up again and again: coming up with a down payment and finding good deals on real estate. So we talk about those two challenges a lot. And while “driving for dollars” has...

by Emma Dudley | Last updated Feb 19, 2024 | Active Real Estate Investing, Spark Blog |

Real estate investing requires money, and usually more than we like when buying an investment property. Fortunately, you can leverage other people’s money to buy our own assets. But navigating the world of investment property loans is stressful and oftentimes...

by Christopher Murray | Last updated Apr 1, 2024 | Active Real Estate Investing, Personal Finance, Spark Blog |

The Big Picture On How To Minimize Passive Income Tax: Passive income is taxed differently depending on the type – dividends, interest, rents, capital gains, business income, and royalties all have specific tax rules. Rental real estate income can be offset with...