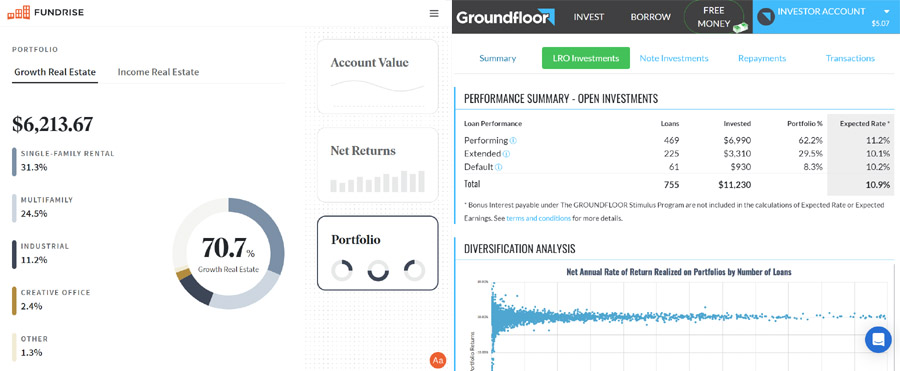

If you’ve checked out our comparisons of real estate crowdfunding investments, you know we love Fundrise and Groundfloor. Both offer simple ways to diversify your portfolio, and are great options for passively investing in real estate.

But which one reigns supreme? How should you decide which platform to invest in?

Our founder, Brian Davis, invests in both. But if you’re down to your last $10 to invest, here’s how to compare Fundrise versus Groundfloor.

In this article, you’ll learn how:

-

- Groundfloor and Fundrise are crowdfunding real estate investing platforms offering self-directed investors diversified investment options. Both platforms let you invest in real estate without requiring a ton of cash and can be great options for investors looking into investing for passive income.

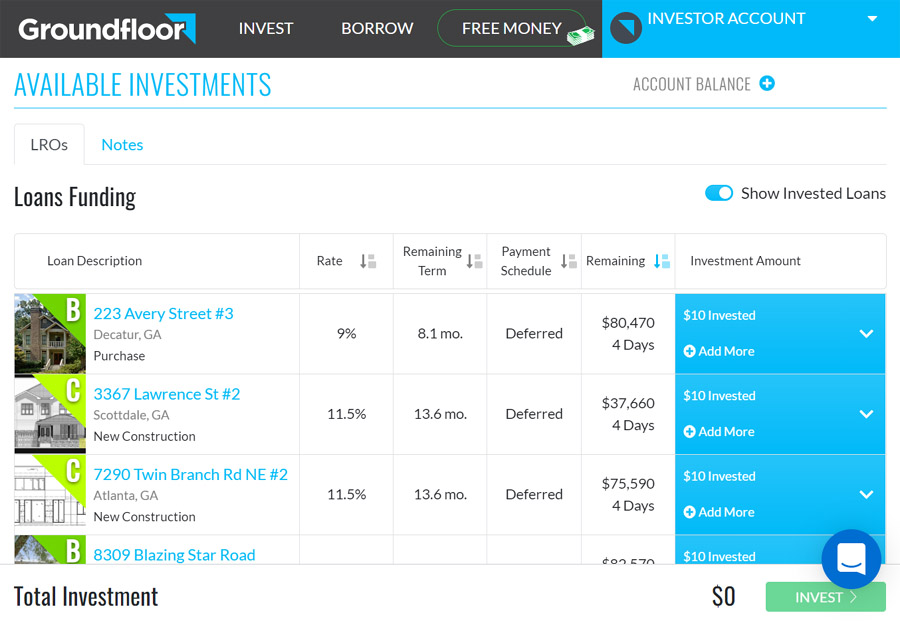

- Groundfloor allows investors to pick and choose which projects to invest in, even at minimum amounts. This is excellent for people who want to be hands-on when making an investment decision.

- Fundrise automatically diversifies investments at minimum investment and lets you pick at higher plans. Automatic diversification may be a great plus for some investors.

Groundfloor Vs. Fundrise: Differences At A Glance

| Groundfloor | Fundrise | |

| Investments: | Purchase-rehab loans & new construction loans secured by real estate | Pooled funds owning residential & commercial real estate and secured loans |

| Fees: | None | 0.15% annual advisory fee; Up to 1.85% annual management fee |

| Average Investment Returns: | ~10% | ~10% |

| Minimum investment amount: | $10 for secured loans, $100 total | $10 |

| Preferred Investment Duration: | Short-term | Long-term |

| Automated investments: | Yes | Yes |

| Diversification: | Manual; investors can pick and choose which loans to invest in (also has auto diversification option with Auto Investor account) | Automatic diversification with minimum amount (greater diversification control with Advanced and Premium plans) |

| New Features: | Fractional diversified investments through Groundfloor 3.0 Auto Investor | Private tech company investments through the Innovation Fund |

What Is Groundfloor?

Founded in 2013, Groundfloor is an alternative to traditional real estate investing. It’s a crowdfunded real estate platform that connects accredited and non-accredited real estate investors with entrepreneurs and builders seeking short-term, high-yield capital for new construction and rehabilitation projects. The company is, in essence, a hard money lender offering real estate debt funds.

But unlike traditional hard money lenders, they raise money for these loans from the public: investors like you and me. We invest money towards these loans, and in return, we earn interest (typically 7.5-14%).

Groundfloor makes real estate investing accessible by offering low minimums (just $10) and no fees. That might sound sketchy, so let me explain how the platform does it.

Groundfloor earns its money by charging lender fees to borrowers, not to investors. They earn money on borrower fees, and we earn money on loan interest. That keeps their interests completely aligned with ours.

Investors can also browse and select from various short-term loans, with new loans constantly available. All financing options are backed by rigorous underwriting, so investors can rest assured they’re investing in qualified investments.

Groundfloor’s investment platform also gives investors greater transparency and control. With detailed due diligence on all projects, investors can access plenty of data points regarding the risk factors involved in each loan.

Alternatively, you can lend money directly to Groundfloor through private notes. The interest rate varies depending on the length of the note and the amount you invest.

The platform also recently released Groundfloor 3.0, which allows fractional real estate investing and automatic diversification through Auto-Investor accounts for a minimum of $100 investment.

Read our full Groundfloor review to learn more.

Groundfloor’s Investment Strategy

Groundfloor offers one of the few short-term real estate investments on the market.

To help you review loans to invest in, Groundfloor uses a loan grading engine to assess the risk/reward of any individual loan or project. They evaluate the borrowers’ creditworthiness and financials as part of the underwriting process.

Groundfloor registers their investments with the U.S. Securities and Exchange Commission (SEC). The SEC qualifies each investment before ever being placed on the platform.

Plus, Groundfloor employs a host of real estate professionals and financial experts to evaluate prospective loans and create underwriting models before investing. In addition, Groundfloor has built a comprehensive technology platform to track and monitor each investment to ensure it performs as expected.

Can You Make Money With Groundfloor?

Groundfloor’s platform boasts an average of 10% yearly returns across all loans that have gone full-cycle for almost ten years of its operations.

On top of that, the platform doesn’t charge management or performance-based fees either, providing a friendly, transparent investment environment.

You can automate your investments with ongoing recurring transfers and automatic investing in new loans as they become available. You enter how much you want to invest in each new loan at different risk grade levels.

You can also automate your investments through their new Auto-Investor accounts. These come with a higher $100 minimum investment.

Sadly, Groundfloor retired its Stairs program in 2023. But you can invest in fixed-interest notes that pay between 7-10%, for terms ranging from three months to two years.

What Is Fundrise?

Fundrise is a real estate crowdfunding platform with funds for various projects and secured debt investments. When you invest, you buy into a diversified portfolio that includes residential properties, apartment complexes, commercial properties, and office buildings across the United States.

Some of their funds own loans secured by real property, which helps add to the income yield through dividends paid to investors. The amount varies, depending on your portfolio preferences.

Fundrise allows investors to research, choose, track, and manage their investments online, although you don’t get the same options at lower investment amounts.

Recently, Fundrise launched a venture capital program called the Innovation Fund that focuses on private technology companies. The program aims to capitalize on different tech companies’ potential before they go public and have stakes in Canva, Vanta, Jetty, and more.

Read our full Fundrise review for more details.

Fundrise’s Investment Strategy

Fundrise’s electronic real estate investment trusts, or eREITs, and pooled funds own different real estate assets that help diversify and minimize risk from any one sector in the market. They include:

-

- Apartment buildings

- Office buildings

- Industrial buildings

- Retail centers

- Land development

- Healthcare

- Hospitality

Fundrise has identified strategies and investments for each type to generate returns for its investors. For example, their apartment-building strategy focuses on one- to four-unit buildings in major metropolitan areas like Los Angeles, Orlando, and Atlanta.

The industrial-building strategy focuses on businesses in heavy industry, chemicals, food processing, manufacturing, and distribution/warehousing. Similarly, their retail center strategy focuses on ground-level retail space in medium to large-sized malls.

Fundrise also has a feature that allows users to access fractional ownership through its eREIT product. This feature allows investors to invest in thousands of properties without purchasing the asset.

Can You Make Money With Fundrise?

Fundrise provides a transparent track record of returns and boasts an overall historical average income returns of 4.81% from 2017-2023. The platform has over one million investors and a nearly $3 billion investment portfolio. The team aims to provide returns that beat the S&P 500 Index and public REITs.

The majority of Fundrise’s investments have provided positive returns, and some have surpassed the expected returns of their respective asset classes.

You can also automate Fundrise investments with recurring investments and a dividend reinvestment plan for its investors. This feature allows investors to grow their portfolios on autopilot without lifting a finger.

Pros and Cons of Groundfloor

Here’s a breakdown of the best (and worst) aspects of Groundfloor:

|

Pros |

Cons |

|

Low minimum investment of $10 makes real estate accessible to all investors. |

Illiquid, requiring commitment until the borrower repays. |

|

No fees for investors to invest through Groundfloor. |

Vulnerable to shifting markets and interest rates. |

|

Offers short-term real estate investments, typically repaying in under a year. |

|

|

Welcomes non-accredited investors, unlike most real estate platforms that require accreditation. |

|

|

Opportunity to diversify across various loans, including single-family units, multi-units, rehabs, and new construction. |

|

|

Stable returns observed, with around 10% across both booming and cooling real estate markets. |

Pros and Cons of Fundrise

Now, it wouldn’t be fair if we didn’t do the same for Fundrise. So, aside from its diversified real estate projects, what are the platform’s benefits? And what aspects did we take away points for?

|

Pros |

Cons |

|

Low minimum investment with the “Starter” plan at just $10. |

Long-term investments expected; funds should be held for at least five years to avoid a 1% penalty. |

|

Opportunity to earn dividends from rental income, paid quarterly. |

Limited liquidity; early redemption can take months and incurs a 1% fee. |

|

Open to non-accredited investors, making it accessible to a wider range of people. |

Management fees are charged, impacting overall returns. |

|

Automatic diversification through investment in a portfolio of different real estate projects. |

|

|

Higher potential returns, with 2021 delivering returns in the low-mid 20% range. |

Which Should You Choose Between Groundfloor And Fundrise?

As two of the biggest names in real estate crowdfunding, Groundfloor and Fundrise offer similar historical returns of around 10%. Both platforms provide simple, intuitive interfaces and automated investing, which are excellent for newbies who want to invest in real estate. Both let you invest with just $10 and allow non-accredited investors.

Groundfloor offers shorter-term investments, as most loans repay in well under a year. They also offer a savings account alternative with their Stairs app, paying up to 4% and letting you withdraw your money anytime. I also appreciate that Groundfloor doesn’t charge investors any fees.

That keeps their interests aligned with mine as an investor, and the model lends itself to 100% transparency. But to get the full benefit of diversification, you must invest in many different loans, with a minimum investment of $10 apiece.

Fundrise offers outstanding diversification with as little as $10, spreading that money across dozens of properties and hundreds of loans. The platform offers more flexibility to pick and choose investments and funds at higher amounts.

Pick The Real Estate Crowdfunding Platform That Fits You

Groundfloor and Fundrise offer two distinct investment models. But if you only have $10 to invest monthly, try Fundrise for instant diversification. If you have $100 to invest monthly, consider spreading it across ten loans on Groundfloor or get an Auto Investor account.

Ultimately, both platforms provide investors with different investment opportunities, aligning with risk tolerances and objectives. So, start investing in what platform is best for you.♦

What are your thoughts on Fundrise vs. Groundfloor? Which do you prefer and why?

Love the passive income I get from both. One thing you noted that’s worth reiterating is that the more you invest with Groundfloor, the more diversified your investment portfolio with them. That’s not true with Fundrise, where you get the same diversification no matter how much you invest (unless you start customizing your portfolio, which you can do above a certain dollar amount).

Great point Mae, and well put!

These are both reputable platforms, been around for over a decade. I have more invested in these than other, newer real estate crowdfunding platforms that offer intriguing models but aren’t as established.

Agreed Oliver!

If your objective is to invest in high-yield opportunities for the short-term, Groundfloor would be a more suitable choice. Conversely, if you aim to make a long-term, passive investment, then Fundrise would be a more appropriate option.

I hear you JJ. Although I’ve actually earned higher returns in the long term from Groundfloor than Fundrise.

I like Groundfloor because it offers a potentially high rate of return in a relatively short amount of time. A good choice for new investors reluctant to tie up capital for the long term.

Agreed Martin!

I’m a newbie investor looking to branch out and diversify my portfolio with other affordable investments of $10 or more. Love how big on diversification you guys are. I’m just now learning about real estate crowdfunding but you clearly have firsthand experience investing in a lot of these crowdfunding platforms, which I appreciate.

Anyway long way of saying thanks!

Glad we could be of service Celeste!

I invest in both, can enjoy the benefits of both types of investments while spreading out my risk. The more diverse your portfolio, the wider your safety net.

Agreed Kaida!

Me too Mae!

The comments provided to investors by Groundfloor are beyond useless. They make the most general, global and inane summary sentences. When e-mailed, they provide a few secretaries who answer inquiries the same way. I’m not a fan.

Yeah I don’t read their market commentary. Their monthly reports about portfolio performance is much more useful and telling.