Leasing & Onboarding New Renters

Everything you need to know about signing new lease agreements and onboarding new tenants.

Preparing to sign a lease agreement?

Don’t sign it lightly.

Have you collected rental applications from a large pool of candidates? Have you run credit, criminal and eviction reports on all applicants? Collected application fees or charged the screening reports to the renter, to verify they’re committed?

If you’ve done all that, and made all the phone calls to verify income, employment, housing history, etc., and you feel 100% rock solid about this tenant… now you need to make sure you have a defensive lease agreement.

Think of your lease agreement as your shield, your armor. Most state landlord-tenant laws are extremely tenant-friendly, and designed to protect the renter, not the landlord. That means you’re responsible for protecting yourself.

How do you do that? With a comprehensive, protective lease package. Read on for more details, and happy leasing!

“Required Reading” – Start Here First!

Want more? We have you covered! Here’s some further reading on lease agreements, security deposits, move-in and everything else you need to know about onboarding new renters.

Full Library of Leasing & New Tenancy Articles:

Cost Segregation Study: How to Take Accelerated Depreciation on Rental Properties

The Big Picture On A Cost Segregation Study: A cost segregation study allows real estate investors to reclassify property components into categories with shorter depreciation periods, enabling accelerated depreciation and reducing taxable income in the early years of...

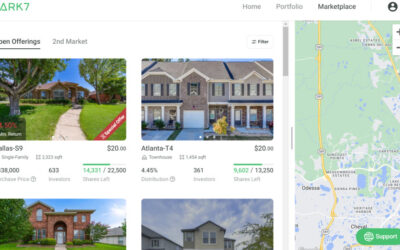

Ark7 Review: Fractional Shares of Rental Properties with Full Liquidity?

The Big Picture On This Comprehensive Ark7 Review: Ark7 is a real estate crowdfunding platform that enables investors to purchase fractional shares in rental properties, including single-family homes, multifamily units, and short-term rentals. With a minimum...

How to Handle a Bad Contractor

The Big Picture On How to Handle a Bad Contractor: Keep detailed records of all agreements, payments, communications, and any issues with the contractor's work. Photos of the work and a written record of all interactions can provide valuable evidence if you need to...

Best Cities for Real Estate Investment by GRM (Price/Rent Ratio)

The Big Picture On The Best Cities for Real Estate Investment By GRM: As of the start of Q4 2024, the national average GRM in the U.S. stands at 13.78, though this figure varies significantly across different regions, highlighting the importance of local market...

FIRE Movement: Your Path to Financial Independence and Early Retirement

The Big Picture on Financial Independence and Retiring Early: The FIRE movement is about achieving financial independence and early retirement by maximizing savings, minimizing living costs, and investing in income-generating assets like stocks and real estate. Key to...

Rent To Retirement: Building Wealth Through Rental Properties

The Big Picture On Rent To Retirement: Investing in rental properties can provide a stable income for retirement, with options like steady monthly rent, lump-sum cash from sales, and equity loans. This makes it a sustainable alternative to traditional retirement...