Build Passive Income with Real Estate

Who says you need to work until you’re 65?

A Passive Income Blog for the Obsessed

Want to work forever?

Want to work forever?

We certainly don’t. Which is why we’re so obsessed with passive income. And while we love stocks, our true passion is passive real estate investing.

My name is Brian Davis, and I’m a passive real estate investor, personal finance writer, co-founder of SparkRental, and world traveler. I get to spend most of the year living abroad hiking, scuba diving, wine tasting, and breaking toes trying to learn how to surf.

Deni (my partner) and I have a simple goal: to help 5,000 people reach $5,000/month in passive real estate income. Want to be one of them? To start stacking up streams of passive income? To reach financial independence and retire early with rental properties or real estate syndications?

We created this real estate investing blog to help you stop relying so heavily on your 9-5 salary and start living more intentionally. Welcome!

The Latest from Our Real Estate Investing Blog

5 Real Estate Niches Most Investors Overlook (Huge Returns)

The Short Version: The most profitable real estate opportunities often exist in corners of the market that rarely get attention. Property tax abatements, mobile home parks, raw land, niche industrial, and bedroom boost flips are all strategies that consistently...

Why You’re Wealthy on Paper But Broke in Reality

The Short Version: You bought a house, maxed out your 401(k), funded the HSA and 529. On paper, you're doing great. But when you actually need money... you can't touch any of it. Most middle-class wealth is locked in illiquid assets, retirement accounts with...

The Difference Between Saving and Investing (And Why It Matters)

The Short Version: Saving preserves capital. Investing grows it. Confusing the two can cost you decades of wealth-building potential. A savings account earning 4% while inflation runs at 3.5% means you're barely treading water — and most years, you're actually falling...

How to Start Investing in Real Estate Without Getting Crushed by Taxes

The Short Version: Depreciation is one of real estate's biggest tax advantages but the IRS wants that money back when you sell. It's called depreciation recapture, and it catches a lot of investors off guard. The depreciation recapture portion is taxed at your...

How To Vet A Real Estate Deal (Correctly)

The Short Version: The difference of approach between a seasoned investor vs a novice Why we're psychologically wired to focus on upside and ignore risk. It's why so many investors get burned by deals that looked great on paper. The 2008 crash and the 2022 syndication...

A Practical Starting Point for Passive Real Estate Investing

The Short Version: Most people don’t avoid passive real estate because of risk. They avoid it because they don’t want to feel uninformed. Confidence doesn’t come from knowing everything. It comes from understanding the key moving parts and following a clear process....

Why I Stopped Using Real Estate Crowdfunding Platforms

The Short Version: After years investing through crowdfunding platforms, I've shifted away due to high fees, limited liquidity, and better opportunities in direct real estate investments. Real estate crowdfunding promised passive income, but illiquidity, platform...

How to Build AI-Proof Income With Real Estate

The Short Version: AI is already cutting entry-level and mid-level knowledge jobs. A Harvard study found a 22% reduction in entry-level postings at companies using AI. Some careers are more exposed than others. The jobs that survive require human judgment,...

Why “Your Network = Your Net Worth” Is Actually True

The Short Version: "Your network = your net worth" sounds like a cliché. But there's real research backing it up. The people around you shape your financial beliefs, behaviors, and access to opportunities, whether you realize it or not. The best investment deals...

Best Places to Invest Your Money in 2026 (And Actually See It Grow)

The Short Version: Most people default to stocks, crypto, or savings accounts without considering the trade-offs of each. The "safe" option might actually be costing you money every year. There's a way to invest in real estate without becoming a landlord or needing...

How to Build Passive Income in Your 30s and 40s

The Short Version: Why your 30s and 40s are the highest-leverage years to build wealth. The most popular passive income strategies (with the trade-offs that rarely get mentioned.) The reason serious investors keep coming back to one asset class for building long-term...

How to Start Investing in Real Estate on a Budget

The Short Version: You don't need $100K (or even $50K) to start investing in real estate. There are legitimate paths in with $10K or less. The traditional "buy a rental property" model isn't your only option and for most busy professionals, it's not the best one...

The “Live Off Rents” Podcast

Prefer to watch or listen to your real estate investing and FIRE tips & tricks? No sweat.

Deni and Brian have been broadcasting live every week to the SparkRental-sponsored Facebook groups since 2017, and started releasing the content via podcast in 2020. Each episode is quick, 15-20 minutes, but jam-packed with actionable content.

No fluff, just advice you can put to work immediately to build passive income from real estate.

If you enjoy the episodes, share them, and please rate and review on iTunes or wherever else you listen!

Recent Episodes

Beyond Education: Group Real Estate Investment Club

Beyond Education: Group Real Estate Investment Club

Learning is wonderful, and we offer nearly endless free education content for real estate investors. But nothing beats getting in the trenches and actually investing to earn real returns.

At your request, we created a real estate investment club that lets you “earn while you learn” with a club of other investors. Every month, we meet on a video call to vet a new passive real estate investment. These group real estate investments range from private parnetships to private notes to real estate syndications and funds for fractional ownership in an apartment complex, self-storage facility, retail or other large property. You get all the benefits of real estate investing, from cash flow to appreciation to tax benefits, without the headaches of buying properties yourself.

Best of all, you can invest with a lot less money. Rather than the $50,000 – $100,000 needed for a typical private equity real estate investment or rental property down payment, you can invest with $5,000 per deal.

Oh, and non-accredited investors are welcome on all deals. We intentionally propose inclusive deals open to all investors.

Who Is this Real Estate Investing Blog For?

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

But while the “how-tos” and “avoid these mistakes” are important, they’re only part of the picture.

The bigger picture? How real estate investing fits into your larger strategy for building wealth and passive income.

Specifically: reaching financial independence to give you the freedom to retire early, if you so choose. Or to supplement your current lifestyle so you can live better or switch to your dream work.

So who is this “real estate investing blog” for? It’s not just for passive real estate investors or active landlords — it’s for anyone looking for creative ways to reach FIRE through real estate investing.

Real Estate Investing & Landlord Education

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

But our landlord education doesn’t end with the blog.

We offer a range of free webinars and online masterclasses for real estate investors. We offer a premium course called FIRE from Real Estate, to help you reach financial independence and retire early in years rather than decades. Our weekly newsletter keeps you abreast of rental industry trends, landlord tips, and the best of real estate investing blogs from around the web. And every week, Deni & Brian hop on live video on Facebook for a 15-minute live vlog and answer questions.

What for? Why do real estate investors and landlords need continuing education, anyway?

Because investing in rental properties is not like throwing money in an index fund.

Buying real estate investment properties takes skill (at least if you want to make money). Managing rental properties takes skill.

Your returns on rental investment properties are directly proportionate to your knowledge and skill, both as an investor and as a landlord. If you want to reach financial independence from real estate, you’re going to need to know what you’re doing.

That’s why we’re obsessed with ongoing real estate education at SparkRental. We want you to make as much passive income as possible, as fast as possible, on the fewest real estate investments possible.

More Resources for Investors

Had enough of us going on about the importance of real estate investing education?

“Cut to the goods already Brian! Gimme some free stuff!”

All right, all right. Here are some free real estate investing resources, to help you on your quest for financial independence from real estate:

Real Estate Investing Calculators

Real estate investing involves math. But it doesn’t have to be hard math. Use our free rental income calculator, house hacking calculator, property depreciation calculator and more to get ahead in the game of life.

Interactive Real Estate Maps

It’s a big country, with thousands of towns you could invest in. Where should you invest? Why? Check out our interactive maps of the hottest housing markets, cooling real estate markets, best cities for real estate investing by price/rent ratio, and more.

Real Estate Crowdfunding Comparison

Wondered whether real estate crowdfunding investments are worth considering? The answer: some are, others aren’t. But which are worth it? Check out our comparison of real estate crowdfunding platforms — and which we invest in ourselves.

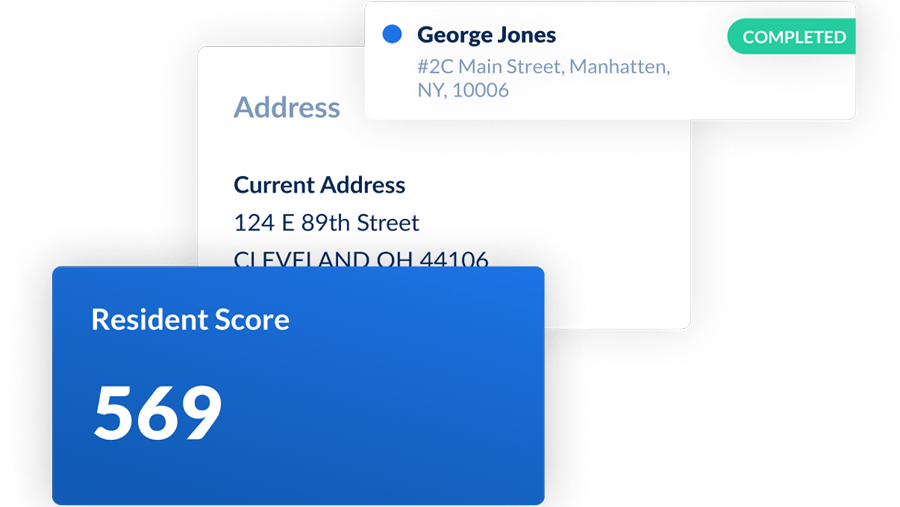

Landlord Software & Mobile App

Use our free landlord software to screen tenants, collect rent online, and automate your rental accounting. Sync your bank account, automatically label income and expenses, and use one-click Schedule E tax statements.

Want more free landlord resources? Check out our list of Free Real Estate Investing Tools.