Vacancy Advertising & Tenant Screening

Want higher ROI on your rentals? Fill your vacant rental unit with the best possible renters, ASAP.

Have a vacant rental unit on your hands?

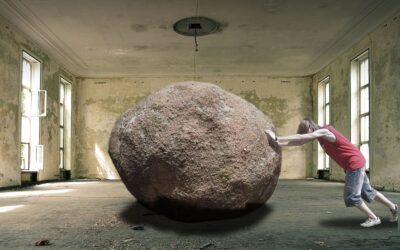

Vacancies are expensive, and they’re time-consuming to fill. Lucky you! But unless you want to be right back in this position in six months, an eviction later, get it right the first time.

Advertise on multiple rental listing websites. Give every person who expresses interest a rental application (ours is free, emailable and e-signable – hint hint).

Then run tenant screening reports on all applicants. Get a full credit report, nationwide criminal background check, and nationwide eviction report. Have the applicant pay the fee for these (our screening reports can be charged directly to the applicant).

Then it’s calls, calls calls. Supervisors. HR departments. Personal references. Current landlords. Prior landlords. If that sounds like a lot of work, it’s nothing compared to unpaid rent, serving eviction notices, filing in rent court, appearing in front of a judge, meeting the sheriff at the property, and then spending thousands of dollars to get the property back in rental shape.

Here are a few fundamental articles to get you started, and from there, you can explore our other articles in the Advertising & Tenant Screening category to make sure you get the perfect long-term tenant, every vacancy!

“Required Reading” – Start Here First!

Still hungry after eating those up? Well, we won’t let you down. There’s plenty of rental advertising and resident screening articles to sink your teeth into!

Full Library of Advertising & Tenant Screening Articles:

Apartment Application vs. House Rental Application: What Landlords Need to Know

The Big Picture On House Rentals Vs. Apartment Applications: Effective tenant screening through comprehensive rental applications is crucial for landlords to safeguard their investment and income. Recognizing variances between apartment and house rentals, such as...

Is Rental Income Active Or Passive Income? How Much Labor Landlords Should Expect

The Big Picture on Is Rental Income Passive Or Active For tax purposes rental income can be defined as passive income so long as you do not qualify as a real estate professional. In the truest sense of the word, rental income is not “passive” income, as it requires...

How to Retire at 40 With Real Estate Investments & Stocks

The Big Picture on How To Retire At 40: Retiring at 40 is not easy—but it is possible. The best way to retire at 40 is to combine many income streams, including diversified stocks and real estate investments. You can take advantage of Roth IRAs and your 401(k) but...

Non-Qualifying Mortgages: Uses & List of Non-QM Lenders

The Big Picture on Non-Qualifying or Non-QM Loans: Non-QM loans provide flexible financing options for real estate investors who do not qualify for traditional mortgages. Non-QM loans allow investors to secure financing for unique property types like fix-and-flips,...

How to Make Money in Real Estate: 18 Investing Strategies

The Big Picture on How To Make Money In Real Estate: Real estate has offered higher returns with about half the stock market's volatility over more than a century. Investors can make money by owning investment properties, like buying a multi-family home and renting...

What Is An Accessory Dwelling Unit Or ADU For Housing and Community Development?

The Big Picture on Accessory Dwelling Units An accessory dwelling unit (ADU) is a separate living space on the grounds of a single-family home, with its own entrance, kitchen, bath, and living/sleeping areas. ADUs can be used as extra living space for yourself or to...