The Big Picture on How To Retire At 40:

-

- Retiring at 40 is not easy—but it is possible.

- The best way to retire at 40 is to combine many income streams, including diversified stocks and real estate investments. You can take advantage of Roth IRAs and your 401(k) but only in combination with other investments easier to access early.

- Always be mindful of your expenses. Every penny counts, whether you’re starting your retirement savings journey in your 20s or 30s.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Over a 40-year time horizon, even someone earning minimum wage can become a millionaire.

No, really!

If you invest $190 per month at an average historical stock market return of 10% return, you’d have $1,009,111 after 40 years.

I’m not suggesting that you should have started investing as a toddler. But you get the idea.

But what if you want to retire at 40 when you’re in your 20s? With insufficient time for compound interest to work its magic, you’d have to rely more heavily on savings rates, leverage, and income-oriented investments. And raw income, of course — it’d be tough to retire at 40 while earning minimum wage.

Here’s what young people need to know about reaching financial independence and retiring early (FIRE) as they consider how to retire at 40.

Start by Setting a Retirement Horizon

“Retirement horizon” refers to the timeline you want to retire. So, for example, it’s much easier to retire by 40 if you start investing for it at 22 rather than 37. If you’re 30 and looking to retire by 40, you can set your retirement horizon to 10 years. If you’re 20 and looking to retire at 40 — which is not too early, despite what other people say — you have a 20-year retirement horizon, and so forth.

In fact, no matter your current age and target retirement age, you should plan for your retirement horizon.

The more time you have to work within that retirement horizon, the more you can lean on compounding and the less you must rely on a monthly savings rate. Check out our FIRE calculator to play around with different numbers. Still, to start planning for financial independence and retirement, you need to start with two numbers: your target monthly income from investments and your retirement horizon.

From there, you can determine how much money you will need to retire at 40.

Passive Income Sources for Retiring at 40

As you plan to retire by 40, your post-FIRE income has to come from somewhere. It certainly won’t come from Social Security!

The sources of income also play a role in determining how much you will need to retire at 40.

I’ll use my plans as a rough outline to show you how it’s possible:

| Investment Type | Allocation |

| Stocks | 30% of my post-FIRE income |

| Passive Real Estate | 60% of my post-FIRE income |

| Rental Properties | 10% of my post-FIRE income |

| Active Income | Gravy. I never plan to stop working in some capacity, so I’ll keep earning money long after I no longer need to work to cover my living expenses. |

Your plans may look dramatically different, but consider the following as a sound starting point as you plan your post-FIRE income sources.

1. Stocks & Safe Withdrawal Rates

In the traditional retirement model, you gradually save up a nest egg over the course of your career and spend it down over a 20-year retirement. Your goal is not to run out of money before you shuffle off this mortal coil.

That model doesn’t work for financial independence and retiring early. You can’t spend down your nest egg with a retirement that could last half a century or longer. Instead, you want sustainable, ongoing income.

This brings us to safe withdrawal rates and the 4% Rule.

If you withdraw no more than 4% of your nest egg in the first year of retirement and only adjust upward to cover inflation each year after that, your nest egg should last at least 30 years.

But 30 years of retirement doesn’t cut it for people trying to figure out how to retire at 40. This means you must withdraw less of your nest egg each year if you want it to last longer.

What to Expect

Fortunately, you don’t have to withdraw much less. Financial planner Michael Kitces demonstrated that a 3.5% withdrawal rate would actually leave your nest egg intact and growing forever — at least based on historical stock market data. Aliens could attack tomorrow and wipe out the stock market, so the future remains uncertain. But you’d have been fine with a 3.5% withdrawal rate any time over the last century.

Everyone should have some stocks in their portfolio. Whatever percentage you choose, plan on being able to pull out 3.5% of your balance in your first year of retirement. For example, if you want $35,000 of annual income from your stock holdings, you need $1 million in stocks.

Consider investing in stocks with your IRA or 401k / employer retirement plan to receive tax benefits. As a younger investor, Roth retirement accounts, in particular, let your stocks, mutual funds, or market index funds compound tax-free.

2. Rental Properties & Leverage

You don’t have to worry about safe withdrawal rates with rental properties. They generate ongoing income, month in and month out, that you can accurately predict over the long term with a rental income calculator. The income inherently adjusts for inflation as you raise rents each year, creating a hedge against inflation.

You can also leverage other people’s money to build your own portfolio of income-producing assets. The rental property loan covers 70-80% of the purchase price, and you still earn strong real estate cash flow each month from that leveraged property.

In fact, you can even recycle the same down payment over and over again to keep building your portfolio. The BRRRR method of rental investing lets you pull your down payment back out of the property after renovating it!

This way, you can take the same $50,000 and keep recycling it, buying three or four new properties each year.

If each property generates $250/month in cash flow, and you buy four properties per year, then you will have another $1,000/month in passive income yearly.

After ten years, you’d have $10,000/month in passive income — all from recycling the same $50,000 down payment and operating capital.

Starting to see how to retire by 40 with real estate?

3. Passive Real Estate Investments

I don’t just invest in rental properties, even among my real estate investments. To diversify and outsource the labor of finding deals and managing properties, I sometimes invest indirectly in real estate through other investors.

After all, there are many types of real estate investments. My primary way to invest passively is through real estate syndications.

I earn between 15-30%+ annually with real estate syndications.

Here’s the thing, though: one real estate income stream is not enough if you want to retire before your 60s. Or at any time, for that matter.

So, I diversify. Through our Co-Investing Club, I invest $5,000 each month in different real estate syndicates across the country. One month it might be an apartment complex in Dallas, the next a mobile home park in Nebraska, and the next a retail center in Kansas City.

Real estate investors can earn 6-14% annually on real estate crowdfunding investments.

I invested some money through Streitwise to earn from commercial real estate and office space. To gain exposure to large apartment buildings, I invested with Fundrise. For shorter-term investments in loans across the country, I lend money through GroundFloor.

In most cases, those returns are immediate income in the form of dividends or interest, although, in the case of Fundrise, they also come in the form of long-term appreciation.

I also lend money to other real estate investors I know personally through private notes. I know and trust these investors, and I’ve never been let down. These add even more streams of passive income from real estate for me.

4. Active Income

I never plan to stop working in some capacity or another, even if only part-time. So, I’ll have active and passive income long after I reach financial independence. Here are some of your choices:

- Consider freelancing or consulting in your expertise area after retirement.

- Start an online business or a blog on retiring early or your passions.

- Turn hobbies like cars or computers into content for a new website.

- Become a travel blogger for income and perks, such as free accommodations.

- Work for a non-profit in a field you’re passionate about for a modest salary.

Whatever you do, the world needs your contributions. And for those contributions, you can expect to be compensated, even if you earn less than your current high-stress day job. Think of it as supplemental income in addition to your investment portfolio income, helping you reach your financial goals faster.

Sample Numbers for How to Retire at 40

I can already hear you asking:

“That’s all well and good, but how much money do I need to retire at 40?”

That depends on how much you want to spend in retirement. For example, let’s say you’re 30 years old and looking for ways to retire by 40, so you have a ten-year retirement horizon. We’ll also say that you want $6,000/month ($72,000/year) in passive income in retirement.

You want 20% ($1,200/month) of that income to come from stocks. That $1,200/month comes to $14,400/year in income—to reach that, you’ll need $411,429 invested in the stock market if you take a 3.5% annual withdrawal rate (3.5% of $411,429 = $14,400).

You also want 50% ($3,000) of your monthly passive income from rental properties.

Let’s say you earn $250/month per rental property: you’d need 12 rental properties to generate $3,000/month.

Let’s imagine you use the BRRRR method, using $50,000 as capital for down payments and closing costs and leaving $10,000 wrapped up in each property. You’d need the initial $50,000 as working capital plus $120,000 for the $10,000/property you leave in them. But you get back the $50,000 at the end, so the total you need tied up in these investments is $120,000.

The remaining 30% ($1,800/month, or $21,600/year) you expect from indirect real estate investments. If you earn a reliable 8% cash-on-cash return on these, you would need to invest $270,000 (8% of $270,000 = $21,600). And you’d enjoy even higher returns on these as those properties appreciate and eventually sell.

Bottom Line

Here’s a quick summary of all those numbers:

| Investment Type | Required Investment | Monthly Income | Annual Income |

| Stocks | $411,429 | $1,200 | $14,400 |

| Rental Properties | $120,000 | $3,000 | $36,000 |

| Indirect Real Estate | $270,000 | $1,800 | $21,600 |

| Total | $801,429 | $6,000 | $72,000 |

So how much money do you need to retire at 40? This example comes to $801,429 invested in retirement savings to generate $6,000 monthly (or $18,000 per quarter / $72,000 a year) in passive income. A tall order, but very realistic, especially over a ten-year time horizon.

Remember, your passive income will rise yearly as you add to these investments. You can aggressively funnel that extra income into more passive income streams to snowball your income faster.

Investing Capital: Boost Your Savings Rate

The money to start investing has to come from somewhere. Unless you inherit it or marry rich, it comes from your savings rate: the difference between what you earn and what you spend.

That gap is the source of your financial power! “Mind the gap,” as they say in nerdy FIRE circles. The less you spend, and the more you save, the faster you can build wealth and passive income and retire at 40.

How I Do It

My favorite way to save money faster involves house hacking to eliminate your housing payment. There are many ways to house hack—from housemates renting out storage space and employer-provided housing to multifamily house hacking. Find a way to get rid of your housing payment. Deni got creative with hers, bringing on a foreign exchange student whose stipend covered her mortgage. If you’re thinking about multifamily house hacking, an accessory dwelling unit, or using housemates, use our free house hacking calculator to run the numbers.

Also, look at most people’s second and third highest expenses: transportation and food. Along with housing, these expenses make up around two-thirds of the average American’s household budget, according to the BLS. That means they offer the greatest opportunity for savings.

Discretionary Expenses Can Be Trimmed

This doesn’t mean you should ignore other expenses like entertainment and clothes—but these are also ample places to trim excess fat off your budget.

For example, you might need a cable subscription, but do you really need all 1,500 channels plus on-demand rentals?

Or you could stop buying designer-brand clothes every month.

Analyze your expenses, and cut out whatever’s surplus to requirements. You don’t need them, and they’ll prevent you from retiring by 40 by dragging down your savings rate and, therefore, your investing capital.

Lastly, freeze your spending to avoid lifestyle creep. That might seem easy now, but remaining a super-saver is harder when you get a hefty raise at work. People with six-figure salaries don’t reach financial freedom sooner if they spend every raise!

Use the FIRE Lifestyle to Accelerate Your Timetable

Lowering your living expenses accelerates your retirement timetable from two directions at once.

First, it lets you invest more money, as outlined above. But just as importantly, it lets you lower your target for post-FIRE passive income. The less you spend, the less passive income you need to cover those annual expenses, and the sooner you can reach it.

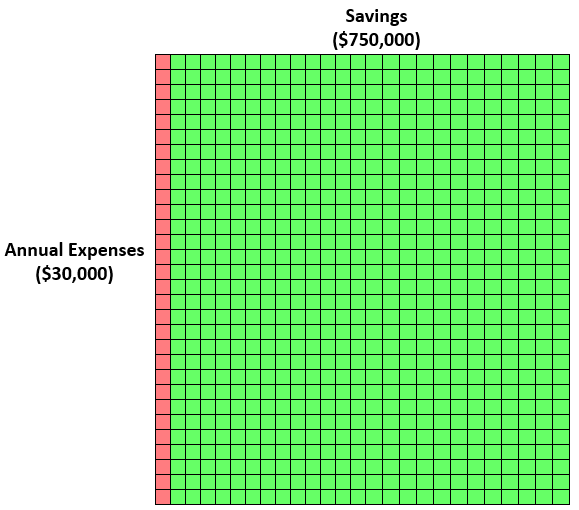

Consider this “tiny blocks” visual we covered in our Retirement Catch-Up Plan for an easy illustration. To keep the math simple, imagine you’re following the 4% Rule. That means you need 25 times as much money saved as you spend each year. In other words, for every dollar you spend in a year, you need to save $25.

In this visualization, each red block represents $1,000 of spending. Each green block represents $1,000 of savings. Here’s how it looks if you spend $30,000/year:

Not pretty, right? So, you need to cut your spending and reach FIRE exponentially faster.

That’s the “bad” news. The good news is that trimming your spending and living the FIRE lifestyle helps you save on other expenses that most people have to pay. For example, many people following the FIRE lifestyle can avoid the costs of life insurance and long-term disability insurance as they build their net worth and passive income. Their families could survive even if they were no longer earning active income.

More Benefits

Another hidden benefit of the FIRE lifestyle is that you’re less dependent on your job to pay your bills, which puts you in a far greater negotiating position. Many people pursuing FIRE leverage telework to move to a lower-cost-of-living area and take advantage of geo-arbitrage. Remember, every penny you earn in Wisconsin is not going to spend the same in, say, California.

I earn money in US dollars, but I live in Peru, where the money goes a long way.

Those are just the tip of the iceberg. Read up on the other hidden benefits of the FIRE lifestyle for more ways that savings beget more savings!

Plan for Post-FIRE

When people first discover that they don’t have to work until 65, many envision retiring by 40 as sitting on a beach sipping daiquiris for the rest of their days. That might be fun for a week, but it gets old fast. You’ll want to create a rounded, meaningful next life after you no longer need your high-octane job.

Again, it probably involves working in some capacity, albeit doing something fun, fulfilling, and possibly lower-paying. You could open a microbrewery, write novels, freelance while traveling, or become a travel blogger. You could take up your favorite cause, working at a nonprofit.

Start thinking about your ideal work now. You might just find that you can take it up within the next year or two and don’t need to reach full financial freedom to switch to it. Again, lower living expenses and a higher savings rate help you get there faster.

Location, Location, Location

Also, consider where you want to live. Ideally, you should opt for a place with a low cost of living, whether within the US or outside of it. Read up on the cheapest real estate in the US for a few ideas, and consider moving to a state with lower taxes. Or, for that matter, alternative housing ideas to save money and have more adventure!

As you plan to retire at 40, remember to plan for medical expenses. Your post-FIRE career might offer medical insurance, of course, but it might not. Fortunately, there are more options than ever for health insurance for early retirees—a few include HSAs, association health plans, healthcare-sharing ministries, and many others.

And, of course, you can move abroad! Americans believe this myth that they have the best healthcare in the world. While the US does offer plenty of world-class doctors and hospitals, it certainly doesn’t have a monopoly on them. You can find equal or better care in plenty of other countries, often at a fraction of the cost. See how one couple retired early to live on a houseboat touring Europe’s rivers, all while saving thousands of dollars each year on healthcare.

Final Thoughts

The people who scoff at the FIRE movement tend never even to consider how to retire by 40. They focus on the lower living expenses and see nothing but “sacrifice” and deferred gratification.

In doing so, they miss the point entirely. A life without new designer clothes every month and massages every other week is not a sacrifice. I enjoy living a simpler lifestyle, wearing athletic clothes to work every day, living overseas, and cooking upscale meals at home rather than eating out every other night.

And while they’re still paying off debts at 38, 45, 55, 62, I will have long been financially independent.

No, I won’t actually retire at 40. But that’s because I love what I do and live my life by design and intentionality. I never plan to work for someone else again, to set an alarm clock again, or to wear a suit to anything other than weddings and funerals, and it brings a smile to my face.♦

What are your plans for how to retire at 40? How much do you need to retire at 40? What’s preventing you from taking more steps to make it a reality?

It is cool to retire at 40, but I have no plan for retirement. I wanna work as long as I enjoyed it.

I’m with you Michael! I plan to keep working long after I reach financial independence. It’s through our week and the impact that we make on the world that we create fulfillment!

This hit hard. I always imagined myself retiring early but never actually ran any numbers on savings or investments. Bit of a reality check.

I hear you on the reality check Martha! But it gets easier, once you start adding passive income streams.

You really have the talent of explaining. I’m taking the Free Course as well, a beginner in the F.I.R.E moving and I’m loving it! Great article!

Thanks Ray, much appreciated, and keep us posted on how else we can help!

This is what I wanted to happen. I am already on my late 30’s but I am gaining my confidence on acheiving this by reading your articles. Thanks to you guys!

Best of luck Ivan, and keep us posted on your progress!

For some people savings for retirement is a struggle. I myself struggle on savings for many years because I had to give away my savings for my loved ones. I talked to them that I had to stop financial support because it’s time for savings for my retirement. I’m just starting my savings but it is never too late!

Truly a difficult situation Kelly, but I’m glad to hear you’re getting back on track with your retirement savings!

I love this, passing it along to my daughter who’s been increasingly interested in financial independence and passive income streams recently.

Very glad to hear it Manilyn!

I’m always amazed in the FIRE community how many focus only on expenses when the retirement equation has two variables – income and expenses.

Very true Eric. But where the average person messes up is spending most or all of their raises or side hustles. And I think most people already pay attention to their careers and income growth. So a lot of FIRE bloggers focus on where the average person needs to pay more attention, rather than the areas where they already know to look.

This is truly inspirational. Thanks for sharing!

Glad you got something out of it Catherine!

Didn’t realize this was a thing people actually did. Love it

Glad to hear you got a fresh perspective on retirement Lionel!