The Shift to Self-Managed Retirement Planning

In the 20th Century, America followed a model of pensions and Social Security. Employers and Uncle Sam could afford to pay the expenses for those over 65, when life expectancy was only 63 in 1940! That model falls apart when life expectancies rise into the 80s, and increasing numbers of Americans live into their 90s and even 100s. Which says nothing of how healthcare costs have quadrupled in the last half-century, driving up retirement costs even further. Today, Americans need to look out for their own retirement planning. But most are ill-equipped to do so, with poor personal finance skills. Only 12% of Americans contribute to an IRA, and 40% of working Americans have less than $10,000 saved for retirement. Far too many Americans wake up at 54 and realize “Oh cr@p, I’m way behind on retirement savings! What am I going to do? How will I ever catch up?!” Here’s how. The following steps are based on not only my own experience building passive income, but five other personal finance experts who shared their tips for catching up on retirement savings. Enjoy!1. Planning Part I: Visualize Your Post-Retirement Life

Why do so many Americans delay in preparing for their retirement?

Because it’s so hazy in the distance of the future. It’s vague and amorphous; it has no immediacy.

If you want to accelerate your retirement savings and investments, that needs to change. Starting today.

Steve from ThinkSaveRetire.com explains: “Without a plan (or a purpose), we don’t know what we’re saving for. Do you plan to travel? Take up boating? Wood-working?

“Whatever it is, have a plan for your post-retirement life. This plan will mentally set the piece into place by giving you a purpose for your new-found saving regimen.”

It’s awfully hard to bring a blurry vision to life in the real world. You need a crystal clear plan and vision, in order to realize those goals. The following steps will (gasp!) involve some sacrifices and work; you need a clear vision to keep you grinding through the harder moments in the months and years ahead.

Why do so many Americans delay in preparing for their retirement?

Because it’s so hazy in the distance of the future. It’s vague and amorphous; it has no immediacy.

If you want to accelerate your retirement savings and investments, that needs to change. Starting today.

Steve from ThinkSaveRetire.com explains: “Without a plan (or a purpose), we don’t know what we’re saving for. Do you plan to travel? Take up boating? Wood-working?

“Whatever it is, have a plan for your post-retirement life. This plan will mentally set the piece into place by giving you a purpose for your new-found saving regimen.”

It’s awfully hard to bring a blurry vision to life in the real world. You need a crystal clear plan and vision, in order to realize those goals. The following steps will (gasp!) involve some sacrifices and work; you need a clear vision to keep you grinding through the harder moments in the months and years ahead.

2. Max Out Your Tax-Advantaged Retirement Accounts

Uncle Sam gives you a tax-free break on certain types of retirement accounts – take advantage of them! The annual contribution limit in 2018 for IRAs, Sep IRAs, Roth IRAs, and the like is $5,500 for adults aged 18-49. For adults over 50, the IRS allows an extra $1,000 in catch-up contributions tax-free. Then there are employer-managed retirement accounts, such as 401(k)s, 403(b)s, etc. These have higher limits: $18,500/year for adults 18-49, with an extra $6,000 available for adults over 50. Some employees can contribute to both, although that option phases out for higher-income earners. You earn returns multiple times over with these accounts: you earn an immediate return with tax savings, you earn the appreciation/capital gains as your investments grow in value, and you earn on any dividends or other investment income they produce. And no one says you have to invest in equities, either. You can use your retirement accounts to invest in real estate! Choncé Maddox, the founder of My Debt Epiphany, emphasizes the importance of minimizing your tax burden by maxing out these accounts. “Getting a late start on retirement means you’ll have lost out on some valuable time to grow your nest egg, but still all hope is not lost. “I’d recommend maxing out your 401(k) and/or IRA and taking advantage of the catch-up contribution rules. Practice delayed gratification and lower your expenses in order to increase contributions.”3. Slash Your Expenses

No one likes to hear this step. But it’s necessary for two reasons.

First, if you’re going to save more, that money needs to come from somewhere. It could come from extra side income (more on that momentarily), but it also usually that means spending less, so you can commit more money to your retirement savings and investments. Try house hacking as the fastest single way to supercharge your savings rate.

The second reason is slightly more nuanced. Successful retirement is about reaching financial independence, and financial independence requires that you replace your active income with passive income from investments.

The less money you spend in a given year, the easier it is to cover those expenses with income from your investments.

If that sounds like a simple concept, consider that every extra dollar you spend requires exponentially more money invested to cover it. For simplicity, we’ll use the 4% Rule to illustrate this point.

The 4% Rule states that on average, you can count on withdrawing around 4% of your nest egg each year, to pay your retirement expenses, without fear of running out of money in your lifetime. That means you need 25 times as much money saved in your retirement portfolio as your annual spending.

In other words, for every thousand dollars you spend in a given year, you need $25,000 saved and invested.

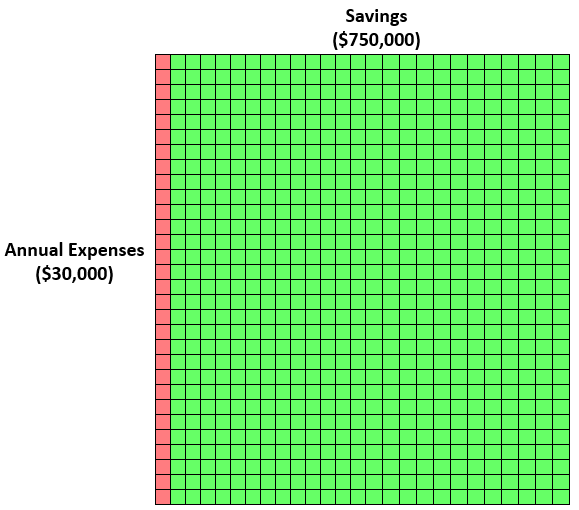

Like visuals? Zach from FourPillarFreedom illustrates this point with elegant simplicity, using tiny blocks. The red block above represents $1,000 in spending in a year. The green blocks are all the investments you’ll need to cover it.

If you want $30,000/year in passive income, that means a nest egg of $750,000. Here’s how that looks visually:

Get the idea? Every extra dollar multiplies your needed nest egg exponentially, by 25 times.

Chris Mamula of Can I Retire Yet proposes a few questions to help you get there. “Could you downsize your home or move to a lower cost of living area? Could you go from a two-car household to a one car household? Ideas such as these could free up capital tied up in homes and cars, while simultaneously lowering ongoing expenses.”

4. Earn More Money While You’re Still Healthy & Working

Your 40s and 50s are your peak earning years. Meanwhile, your kids are probably older, so you’re not in zombie mode getting up three times each night to feed them.

You have connections. You have marketable skills. In other words, you’re in a perfect position to push a little harder and earn some extra cash.

I chatted with Michelle Schroeder-Gardner from Making Sense of Cents about her thoughts on catching up on retirement investing. “My top tip for someone who is wanting to accelerate their retirement savings and investments would be to find ways to make more money.

“That could mean getting into rental real estate, finding a part-time job, starting a side business, reaching for that next promotion, and more. I always like to point out that the average person watches over 30 hours of TV a week. That time could be used towards making more money instead!”

When I asked Michelle if she had any more detailed ideas to help people get their side hustle going, she didn’t disappoint. Here’s her list of 75 Ways to Make Extra Money, to help get those creative juices flowing!

And — spoiler alert! — one of those ideas is, of course, buying rental properties.

5. Rental Properties: How to Bend the 4% Rule

According the 4% Rule, you’d need $1,000,000 in retirement savings in order to generate $40,000/year in passive income. That’s a tall order for most of us.

But the 4% Rule was conceived based on equities and bonds. Equities are unstable, bonds are low-yield… but what about residential rental properties? A recent study analyzed all investment types over the last 145 years, and found that residential rentals beat out equities to offer the best returns, especially when the economists adjusted for risk and volatility.

Rental properties are an income-focused investment, unlike most equities, which rely on appreciation in value for most of their returns. Using rental properties, investors can bend the 4% Rule, using less cash to create more income.

Rental properties are an income-focused investment, unlike most equities, which rely on appreciation in value for most of their returns. Using rental properties, investors can bend the 4% Rule, using less cash to create more income.

Why? First, investors can use far more leverage (other people’s money) to buy real estate compared to other asset classes. For a small down payment, investors can buy a high-value, high-income-producing asset.

Second, rental property returns are far more predictable than equity returns. Before purchasing, Investors can accurately forecast a rental property’s cash flow., by accounting for long-term average expenses when calculating real estate cash flow. (Use our free rental income calculator to run the numbers for any property.)

Rental properties protect against inflation, too: landlords can raise the rent every year to keep pace with (or surpass) inflation. The same can’t be said for bond or stock returns, which you have to adjust for inflation.

Finally, landlords have control over their returns. They can optimize their property management practices, by automating rent collection, conducting periodic inspections, conducting extensive tenant screening, etc. And if landlords want to charge dramatically higher rents, they can always improve their property to command higher revenue.

(article continues below)

6. Get More Aggressive, Not More Conservative

Sound counterintuitive? Traditional financial advisors tell older clients to scale back on risk, as they get closer to retirement. They explain sequence risk and tell their clients to switch to more conservative investments.

Which is good advice… if you already have an adequate nest egg.

But if you need to play catch up? All bets are off.

“Many people want to be more conservative as they get older and closer to retirement,” explains Mark Ferguson of InvestFourMore. “If you really want to take advantages of the benefits of real estate as a retirement vehicle, you may need to get more aggressive instead.

“The benefits of real estate are multiplied when you buy many properties. A lot of investors want to pay cash for their properties to be ‘safe’, however buying more properties with loans will get you where you want to be faster. If you buy three properties with a loan instead of one with cash, that have good rent-to-value ratios, you will have more cash flow, more tax advantages, more equity, more appreciation potential, and more diversification.”

The upshot? Leverage in real estate can help you build your property portfolio faster. Mark sums it up nicely: “This may seem like a risky way to save for retirement, but sometimes it takes a little risk to get to where you want to be.”

7. Planning Part II: Explore Options for Income After “Retirement”

We started this seven-step journey with planning. Ready to come full circle and close the loop?

Once upon a time, retirement meant going from 60 to 0 in 2.4 seconds. On Angie’s last Friday, she blew out some candles on a cake with coworkers, and walked out of the office, never to return.

Just like pensions and relying on Social Security, this model of retirement is outdated. A vestige of the 20th Century.

For middle-aged adults trying to catch-up on their retirement saving, they should consider just what “post-retirement” actually means. Does it mean sitting on the couch all day, watching TV and driving your spouse loony?

For middle-aged adults trying to catch-up on their retirement saving, they should consider just what “post-retirement” actually means. Does it mean sitting on the couch all day, watching TV and driving your spouse loony?

Chris Mamula urges older adults — or anyone else hoping to retire within the next 5-10 years — to “focus on redefining retirement. There is no law that says that you cannot work at all, and not earn any money in retirement. It is far easier to find a hobby job, start a fun small business, or simply work part-time in your original career in retirement.”

To illustrate that point, he invokes the 4% Rule we touched on above. “Using the 4% Rule as a rule of thumb for retirement planning, one would have to save $250,000 to support $10,000 of retirement spending.

“This could be a major challenge to accomplish in a short time frame!

“Conversely, it would not be very hard for most people to earn an extra $10,000/year doing a minimal amount of reasonably enjoyable work in retirement.”

Reframing “Retirement”

As people live longer, healthier lives, we as a society need to reframe what “retirement” means. The 20th Century model of moving to Florida and spending the rest of your days on the golf course or fishing is not only outdated, but it prevents many older adults from seeing their options clearly.

Instead, one option to reframe retirement is shifting from that high-stress, higher-earning career to a low-stress, higher-enjoyment lifestyle. A lifestyle that still contains some “work,” but work that is more about meaning than money.

Your post-retirement income won’t look like it does today, centered around a biweekly paycheck. Start thinking instead about how to combine income from dividends, rental properties, bonds, side hustles, part-time work, and Social Security to cover your expenses.

And perhaps most important of all, slash your living expenses! The less 9-5 income your have to replace, the easier time you’ll have reaching that target.

What tactics are you using (or considering) to help you reach financial independence in the next 5-10 years? What has worked well for you so far? What has completely flopped? Share your thoughts below!

Thanks for the shout out! 🙂

Thanks for such a useful visualization, and for the excellent work at Four Pillar Freedom!

This is great! And it’s true, no one wants to hear “you need to spend less and save more” but that doesn’t make it any less of a fact. Anyone who’s serious about retiring within 5-10 years needs to spend FAR less than they earn, and invest well.

Thanks Mike! Yeah, no one wants to hear that they have to make sacrifices. I do believe that when you embrace frugality and minimalism as ends in themselves, rather than means to an end, it makes it much easier.

Best of luck with your own retirement investing!

Thanks for including me! There are some awesome tips in this article. It’s never too late and if you do feel behind, you can always catch up and adjust your plan.

Thanks for contributing your tips and thoughts Chonce! Looking forward to staying in touch!

This should be a “must read” for anyone over 30! It’s not all about retirement but achieving the financial freedom to do the things you want. It does take discipline, a plan, and 5 to 10 years to accomplish. Sorry, no instant success.

Thanks Marie! And you’re absolutely right, that so many people have an outdated or simplistic mental model of what retirement is all about. Thanks again for reading and for the comment!

Great tips Brian. Not enough people take their retirement investing seriously until they reach their late 40s or early 50s, and while it’s still entirely doable to reach financial independence in 5-10 years, you have to move aggressively (like the steps on this list).

Thanks for compiling a great list, some excellent personal finance minds quoted on here!

Thanks Chelsea, and it truly is a huge problem for many middle-aged adults. It sounds like you’re not among them though!

Thanks again for reading and the comment.

Who does not want a wealthy retirement? I guess just like me, many have got answers to their question through your article.

Informative and well explained article for for everyone over 40! Great tips, thanks for sharing these kinds of valuable retirement planning lessons.

Thanks for the comment Clavin! It’s so important to feel like you’re in the driver seat for your retirement planning, especially when you need to play catch-up on your retirement savings.

I like that you mentioned how visualizing your life after retiring can help you stay on track as you save money for retirement. My uncle is 46 years old but hasn’t come up with a retirement plan, and I would like to make sure that he can retire before his leg injury prevents him from working when he is older. I’ll let him know that imagining how his life will be when he retires will allow him to determine his priorities.

Thanks Darrien, and it’s so true: you need to know what you want if you ever hope to make it a reality!

It’s a work in progress but we’re getting there. Thanks for the tips!

Keep us posted on your retirement progress Andrew!