Vacancy Advertising & Tenant Screening

Want higher ROI on your rentals? Fill your vacant rental unit with the best possible renters, ASAP.

Have a vacant rental unit on your hands?

Vacancies are expensive, and they’re time-consuming to fill. Lucky you! But unless you want to be right back in this position in six months, an eviction later, get it right the first time.

Advertise on multiple rental listing websites. Give every person who expresses interest a rental application (ours is free, emailable and e-signable – hint hint).

Then run tenant screening reports on all applicants. Get a full credit report, nationwide criminal background check, and nationwide eviction report. Have the applicant pay the fee for these (our screening reports can be charged directly to the applicant).

Then it’s calls, calls calls. Supervisors. HR departments. Personal references. Current landlords. Prior landlords. If that sounds like a lot of work, it’s nothing compared to unpaid rent, serving eviction notices, filing in rent court, appearing in front of a judge, meeting the sheriff at the property, and then spending thousands of dollars to get the property back in rental shape.

Here are a few fundamental articles to get you started, and from there, you can explore our other articles in the Advertising & Tenant Screening category to make sure you get the perfect long-term tenant, every vacancy!

“Required Reading” – Start Here First!

Still hungry after eating those up? Well, we won’t let you down. There’s plenty of rental advertising and resident screening articles to sink your teeth into!

Full Library of Advertising & Tenant Screening Articles:

Passive Income Types: The Best Sources of Passive Income

The Big Picture On Types Of Passive Income Passive income sources like rental properties, stock dividends, and royalties can provide financial stability but often require initial investment and strategic planning to ensure sustainability. Different types of passive...

Ep. #130: Can You 1031 Exchange a Property to a Real Estate Syndication?

This question comes up often when we discuss syndication investments. Brian and Deni how you can actually use a 1031 exchange to purchase syndication investments, and the limitations in place.Video Broadcast VersionAudio Podcast Version Also available on iTunes,...

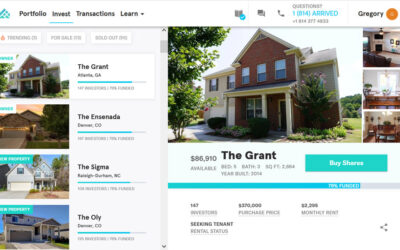

Arrived Review: Fractional Ownership in Rental Properties for $100

As someone who teaches people how to invest in rental properties, should I be worried about how easy Arrived makes it to invest without any knowledge or skill? Arrived (formerly Arrived Homes) is a real estate crowdfunding platform that lets you buy fractional shares...

Ep. #129: Boredom: The Silent Killer Risk For Smart People’s Finances

Investors get bored of dollar cost averaging, index funds, and robo-advisors — and then they start trying to beat the market by picking individual stocks or trying to time the market. Don't do that. Instead, try expanding into these options for real estate investing,...

How to 1031 Exchange into Real Estate Syndications

Real estate syndications have exploded in popularity among investors seeking passive income, diversification, and higher yields than many traditional investments offer. But if you're a landlord looking to switch to passive syndication investing, can you avoid capital...

Ep #128: Real Estate Side Hustles to Save Money Faster

Real estate investing take money. A lot of money. Fortunately, it also offers endless ways to make money. Deni breaks down some real estate side hustles to help you earn extra money while you save money to invest.Video Broadcast VersionAudio Podcast Version Also...