Leasing & Onboarding New Renters

Everything you need to know about signing new lease agreements and onboarding new tenants.

Preparing to sign a lease agreement?

Don’t sign it lightly.

Have you collected rental applications from a large pool of candidates? Have you run credit, criminal and eviction reports on all applicants? Collected application fees or charged the screening reports to the renter, to verify they’re committed?

If you’ve done all that, and made all the phone calls to verify income, employment, housing history, etc., and you feel 100% rock solid about this tenant… now you need to make sure you have a defensive lease agreement.

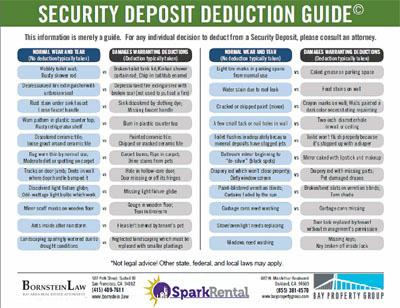

Think of your lease agreement as your shield, your armor. Most state landlord-tenant laws are extremely tenant-friendly, and designed to protect the renter, not the landlord. That means you’re responsible for protecting yourself.

How do you do that? With a comprehensive, protective lease package. Read on for more details, and happy leasing!

“Required Reading” – Start Here First!

Want more? We have you covered! Here’s some further reading on lease agreements, security deposits, move-in and everything else you need to know about onboarding new renters.

Full Library of Leasing & New Tenancy Articles:

Questions To Ask Before Buying a Rental Property

The Big Picture on Questions To Ask Before Buying Rental Property: Unlike stocks or REITs, selling real estate is time-consuming and costly, often taking several months and thousands of dollars. Successful rental property investors need to identify their competitive...

Real Estate Due Diligence: What Is It and How Do You Do It?

The Big Picture Due Diligence in Real Estate: Due diligence ensures real estate buyers thoroughly assess a property’s condition, neighborhood, financial potential, and risks, preventing costly surprises after purchase. This involves property inspections, title checks,...

Real Estate Investment Risks — And How to Protect Against Them

The Big Picture On The Risks of Real Estate Investment: Real estate investments carry risks such as rising interest rates, increased expenses, market stagnation, and capital loss. Sponsors often face challenges from tightening credit markets and delays in...

How to Transfer a Property to an LLC

The Big Picture On Transferring A Property To An LLC: Transferring a rental property to an LLC can protect personal assets from lawsuits, simplify ownership, and offer tax benefits through pass-through taxation. However, it may incur state tax fees and complicate...

How To Invest $1000 In Real Estate

The Big Picture On How You Can Invest $1000 In Real Estate: You can invest $1,000 in real estate through fractional ownership, REITs, crowdfunding, or other low-entry options like land investing or rental arbitrage, allowing you to start building wealth without a...

Passive vs. Active Investing in Real Estate: Pros & Cons of Rentals vs. Syndications

The Big Picture on Passive vs Active Real Estate Investing: Active real estate investing offers higher potential returns, but it comes with significant responsibilities such as property management, tenant issues, and market research. Investors need to be hands-on and...