The Big Picture On How Many Mortgages Can You Have As A Real Estate Investor:

-

- Real estate investors can often have more than one mortgage at a time, with some options providing up to 10 or more.

-

A variety of financing options are accessible for real estate investors, encompassing conventional mortgages, portfolio loans, and private financing solutions. Each option caters to different scenarios. However, investors must consider that multiple mortgages can negatively impact credit scores, among other things.

-

Employing innovative financing techniques, such as house hacking and seller financing, can facilitate lower costs and more manageable terms for acquiring rental properties. These strategies allow investors to reduce upfront financial requirements and can provide more favorable loan conditions.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

While homeowners don’t typically have to worry about how many mortgages they can have, real estate investors do. They don’t just want a primary residence and maybe a second home — they want to build a portfolio of as many income-producing properties as they can.

And if you’re curious about how many conventional mortgages you can have, they do have a limit.

After your first rental property or two, you’ll need to start thinking beyond conventional mortgages. Read on to find out how many mortgages you can have, and more importantly, how to finance rental properties after that limit.

Conventional Mortgages for Your First Few Rental Properties

After the 2008 economic crash, Fannie Mae technically increased the number of allowed mortgages from four to ten. But almost no conventional loan programs allow more than four mortgages to report on your credit.

That distinction bears repeating. Conventional mortgage lenders review the number of mortgages listed on your credit report. If it doesn’t appear there, they typically ignore it.

But conventional loans all report to the credit bureaus, which means most new real estate investors max out at four conventional mortgage loans.

Not that you’d want more than four mortgages on your credit report anyway. Indeed, even three or four mortgages can start damaging your credit; more could completely wreck it.

Still, for new real estate investors, conventional mortgage loans often prove to be the most affordable option, with relatively low interest rates and fees. Compare personalized interest rates and fees using online tools like Credible*.

Conventional Mortgage Requirements

-

- A good or excellent credit score

- A Loan-to-Value (LTV) ratio less than or equal to 80%

- Any and all current rental properties be performing well and generating profit

Consider house hacking your first deal by using Fannie Mae or Freddie Mac loans to buy your first property. Generally speaking, the process as well as the requirements of taking out a mortgage on these first few properties will be very similar to that of your primary residence. The process includes:

-

- Long-term, low, fixed-interest rate

- No mortgage insurance requirement (unless you put less than 20% down)

- Proof of sufficient income from statement of assets, tax returns, or W-2 documentation

- Financial statements on any current investment properties

Unless you plan to house hack a multifamily and live in the property yourself, you can’t use an FHA or VA loan. Additionally, as an investor, expect a higher interest rate and more points than homebuyers pay.

How To Get Multiple Mortgages For Investment Properties

If you want to borrow more than four conventional mortgages, you can try the Fannie May 5-10 Properties Program. As you gain more and more properties, the stricter the requirements become:

| Requirement | Detail |

|---|---|

| Minimum Number of Properties Owned | Must currently own at least four other existing properties |

| Down Payment for Single Family Home | Must make a minimum of a 25% down payment |

| Down Payment for Multi-Unit Property | Must make a minimum of a 30% down payment |

| Credit Score Requirement | Must have a credit score of at least 720 |

| Equity for Refinancing | If refinancing, 30% equity is required |

| Mortgage Payment History | Must have no late mortgage payments within the last fiscal year |

| Bankruptcy and Foreclosure History | Must have no bankruptcies or foreclosures within the last seven years |

| Tax Returns Requirement | Must provide tax returns of the last two years including the rental income of any rental properties |

| Income Requirement | Must have the income to support at least six months of PITI (Principal, Interest, Taxes, Insurance) |

| IRS Documentation | Must sign a 4506-T form to allow the lender to request a copy of your tax returns |

That said, borrowing more than a few rental property mortgages through this Fannie Mae program comes with several downsides. First, as noted above, these loans report on your credit, and that many mortgages can damage your score.

However, conventional mortgage loans are designed around homeowners, not investors. While this program is an exception, conventional mortgage lenders see nothing but increased risk when they look at investors with lots of properties and mortgages. So they also charge higher interest rates, and generally make life harder for the borrower.

Other Ways to Finance Rental Properties

Experienced real estate investors think in terms of building a financing toolkit, rather than simply running to the same lender every time they want to buy a new property.

As you build your own financing toolkit, keep the following options in mind.

| Financing Option | Description | Key Advantages | Ideal for Investors Who |

|---|---|---|---|

| Portfolio Lenders | Lenders that keep loans in-house and do not sell them to a nationwide loan servicing corporation. They underwrite loans based on their own experience and standards. | Greater flexibility with no property ownership limits; often offer lower rates and fees for experienced investors. | Have multiple properties and seek flexible terms without property caps. |

| Owner Financing | The property seller acts as the lender. All terms, including down payments and interest rates, are negotiable. | No traditional bank requirements; potentially lower down payments and costs. | Lack great credit or seek creative financing structures. |

| Private Notes | Money borrowed from private individuals like friends, family, or acquaintances. Terms are negotiated privately, and loans may not be secured by the property. | No limits on the number of mortgages; flexible terms negotiated directly. | Prefer private agreements and need flexible, potentially unsecured loans. |

| Business Credit Lines & Cards | Revolving lines of credit that allow investors to draw funds as needed for down payments, purchases, or repairs. | High flexibility; immediate access to funds as needed. | Require quick, flexible access to funds for various investment-related expenses. |

| Commercial Loans | Loans used for properties with five or more units, classified as commercial rather than residential. | Tailored for larger investment properties; can be combined with other financing options. | Are looking to invest in multi-unit or commercial properties. |

Portfolio Lenders

Conventional mortgage lenders don’t typically keep your loan on their books. They package and sell it to a large nationwide loan servicing corporation — which is why the loans must neatly fit precise loan program guidelines.

In contrast, portfolio lenders keep their loans in-house. They don’t have to fit an exact Fannie Mae or Freddie Mac or FHA loan program. Plus, lender underwrites your loan based on their own experience and standards, which leaves far more flexibility.

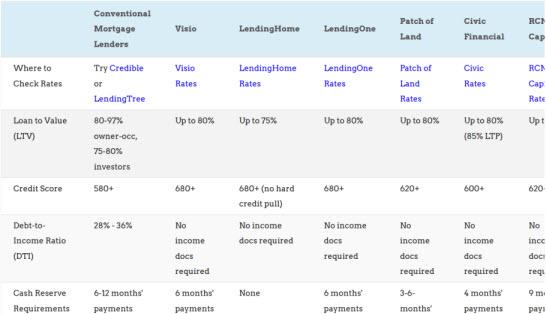

Portfolio lenders come in the form of smaller community banks, regional banks, or online lenders such as Visio and Kiavi that specialize in working with real estate investors. Moreover, they do not restrict the number of properties an investor can own.

In fact, they tend to reward more experienced investors with lower interest rates and fees. So, there’s no limit to how many mortgages you can have with portfolio lenders.

These lenders make a perfect next step for rental property loans, after you take out one or two conventional mortgages.

Owner Financing

Of course, no one says you have to go to a bank at all. Investors can often work out owner financing with the seller, rather than borrow from a bank.

The buyer signs a mortgage note with the seller of the property, and all terms are negotiable. Additionally, you can negotiate a lower down payment, lower interest rate or fees, or anything else for that matter. If you do not have great credit, the seller may still work with you in order to close the deal.

You can even get creative and propose options like wrap around mortgages to help negotiate owner financing for your next deal.

Private Notes

The seller isn’t the only private citizen you can borrow money from to finance your real estate deals.

As real estate investors build their portfolios, many start raising money privately from friends, family, and other acquaintances. They also negotiate their own terms, such as interest rates, and these notes may or may not attach to the property with a lien.

There’s no limit to how many mortgages you can have when you borrow private notes.

For reference, a “note” is the legal document signed by a borrower committing to repay a loan. A private note, therefore, is simply a private loan.

(article continues below)

Rotating Business Credit Lines & Cards

If financing your properties is a concern of yours, utilizing a revolving line of credit can help. A revolving line of credit gives you the freedom of drawing upon a pool of funds as frequently as you need.

You can draw on business credit lines or cards at any time, whether for a down payment, to buy a property outright, or for repair costs. You also pay interest on your current balance any given month, and repay it at your own pace. It makes for the ultimate flexible financing.

While credit cards do charge a cash advance fee to pull out cash directly, you can get around this using tools like Plastiq.

To open business credit lines as a real estate investor between $50,000-$250,000, try Fund&Grow. (If you’re not familiar with the concept, check out this webinar explaining how they raise credit for you.)

Commercial Loans

Buildings that have five or more units are classified as commercial, not residential, which means you need a commercial loan, rather than a mortgage loan.

Alternatively, you can still use options such as owner financing, private notes, and business lines of credit. Some portfolio lenders, such as RCN Capital, offer commercial loans in addition to residential loans.

FAQ

Can you have multiple mortgages on the same property?

Yes, you can have multiple mortgages on the same property. Typically, you can have up to two mortgages: a first mortgage (first-position mortgage) and a second mortgage (second-position mortgage). The first mortgage has priority in case of foreclosure, while second mortgages are often used for home equity loans or lines of credit.

How many mortgages can one individual have at the same time?

Generally, an individual can hold more than one mortgages at once. Conventional lenders may limit the number to 10, while portfolio lenders might not have a specific cap, offering more flexibility for investors.

What are the requirements to qualify for multiple mortgages?

Lenders typically seek strong credit scores, low debt-to-income ratios, and sufficient reserves, among others. Each additional mortgage might require increasingly stricter qualifications.

Are there different types of mortgages available for someone looking to hold multiple properties?

Yes, besides conventional mortgages, there are portfolio loans, commercial loans, and private financing options.

How does holding multiple mortgages affect your credit score?

Holding multiple mortgages can impact your credit score, especially if your debt-to-income ratio or late payments become too high. Lenders report these loans to credit bureaus, influencing your credit history.

Can you use the income from rental properties to qualify for additional mortgages?

Yes, rental income can be considered in your mortgage application, but lenders typically require a history of rental income, evidenced through tax returns or leases, and may apply a vacancy rate to assess stable income.

Are there benefits to using different lenders for multiple mortgages?

Diversifying lenders can help you access different types of loan products and terms, potentially minimizing risk and improving terms based on different lenders’ appetites for investment properties.

Is There a limit to how many rental properties you can own?

The United States has no hard cap on how many rental properties you can own. The real limits come down to your financial muscle and management skills. Lenders might raise an eyebrow after your first few mortgages, and you’ll need to prove you’ve got the income and credit score to back up your ambitions.

Final Thoughts

Real estate investors need as many options in their financing toolkit as possible, to maximize their odds of closing any given deal.

Conventional mortgage loans work great for your first rental property or two, but you quickly reach the cap of how many mortgages you can have. Even as a new investor, start thinking in terms of building your financing toolkit and building relationships with many portfolio lenders, rather than relying on your homeowner mortgage lender to provide financing.♦

How many mortgages do you have reporting on your credit? How have you financed rental properties as you built your portfolio, or how do you plan to do so?

More Real Estate Investing Reads:

*Credible Disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

Finally, I have cleared my doubts on how many mortgages can one have!

Having multiple options to have mortgages is always an advantage!

Very true Kanra!

I personally think you should have fewer mortgages. You would spend your life clearing them!

A valid point Selmi!

This is interesting. Investors have so many options these days. It’s good!

Many options indeed!