Vacancy Advertising & Tenant Screening

Want higher ROI on your rentals? Fill your vacant rental unit with the best possible renters, ASAP.

Have a vacant rental unit on your hands?

Vacancies are expensive, and they’re time-consuming to fill. Lucky you! But unless you want to be right back in this position in six months, an eviction later, get it right the first time.

Advertise on multiple rental listing websites. Give every person who expresses interest a rental application (ours is free, emailable and e-signable – hint hint).

Then run tenant screening reports on all applicants. Get a full credit report, nationwide criminal background check, and nationwide eviction report. Have the applicant pay the fee for these (our screening reports can be charged directly to the applicant).

Then it’s calls, calls calls. Supervisors. HR departments. Personal references. Current landlords. Prior landlords. If that sounds like a lot of work, it’s nothing compared to unpaid rent, serving eviction notices, filing in rent court, appearing in front of a judge, meeting the sheriff at the property, and then spending thousands of dollars to get the property back in rental shape.

Here are a few fundamental articles to get you started, and from there, you can explore our other articles in the Advertising & Tenant Screening category to make sure you get the perfect long-term tenant, every vacancy!

“Required Reading” – Start Here First!

Still hungry after eating those up? Well, we won’t let you down. There’s plenty of rental advertising and resident screening articles to sink your teeth into!

Full Library of Advertising & Tenant Screening Articles:

Ep. 21: The Science of Gratitude and Success

On Thanksgiving week, Deni and Brian talk gratitude. Because the most successful people in this world focus on the positive, rather than dwelling on the negative. They focus on possibilities, rather than wallowing in self-pity, doubt, and cynicism. All of us have much...

Ep. 20: Which States Charge the Lowest Property Taxes?

Average property taxes across states range from as little as a few hundred dollars a year to nearly $8,000 per year. Given the impact they have on real estate cash flow — or on your personal budget as a homeowner — we decided to break down property taxes by state and...

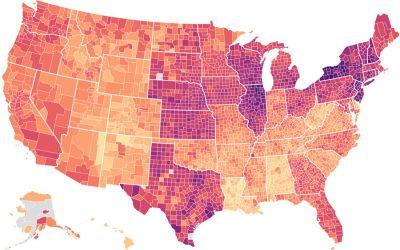

Property Taxes by State & County: Lowest Property Taxes in the US Mapped

Where are the lowest property taxes in the US? The highest property taxes? Some states offer no surprises. New Jersey, for example, charges the highest property taxes in the nation as a statewide average. But Texas also ranks among the top five highest property taxes...

Ep. 19: COVID: Legal Liability For Landlords As The Second Wave Rises?

Landlords and property managers are starting to get sued over COVID-19 infections. So how do you protect yourself and your assets from coronavirus-related lawsuits? For that matter, how do you prevent outbreaks among your tenants in the first place? Brian and Deni sit...

Is an “Eviction Tsunami” Looming in 2021?

Millions of Americans remain out of work in the coronavirus pandemic, after the economy has recovered only half of the 22 million jobs lost in the spring of 2020. Meanwhile, the stimulus checks and extended unemployment benefits are ancient history by November. This...

Ep. 18: How Do Real Estate Contingency Clauses Work?

No one wants to buy a lemon of a house. But you can't necessarily do all your real estate due diligence before making an offer on the property. The answer? Contingency clauses in your sales contract. Deni and Brian break down exactly how real estate contingencies work...