When renters lose their jobs, landlords tend to lose their rental income.

Sure, most got several stimulus checks, and can go on unemployment to receive temporary assistance. But with over 10 million Americans unemployed, many renters in decimated industries like hospitality have had a rough go of it.

Not all cities and towns are getting hit evenly by COVID-19 however. Some cities, like New York, have been devastated. Many small towns haven’t seen a single case, and some larger cities have seen only minimal caseloads.

Outbreaks aside, some economies can withstand in-person business closures better than others. Diverse economies with jobs spread among insurance, tech, healthcare, education, and a dozen other industries are faring far better during the coronavirus pandemic than, say, tourist towns driven entirely by the hospitality industry.

As you consider investing in real estate during the pandemic, keep local unemployment rates in mind.

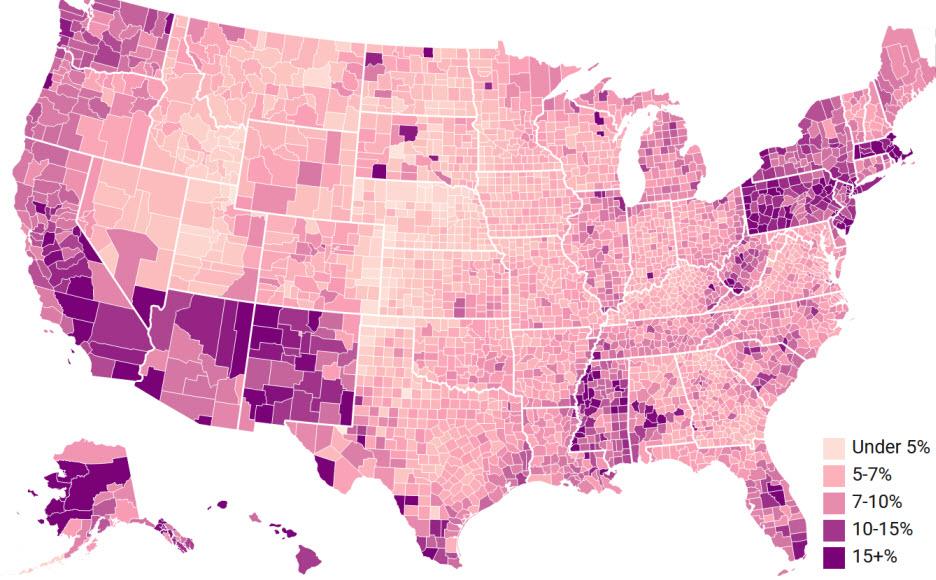

Unemployment Rates by County

Because nothing predicts rent defaults as well as unemployment, we decided to map unemployment rates in every single county in the US.

Hover your mouse over each county to see its unemployment rate. And for those tiny East Coast counties, zoom in for a closer look.

Would your readers appreciate this interactive map of unemployment rates by county? Click here for the embed code.

Share This Map on Your Site

While this represents the most recent county-level unemployment data available from the Bureau of Labor & Statistics, it still lags over a month behind. This particular data set represents December 2020, released by the BLS in February 2021. We’ll update the map in late March when the BLS releases January data.

Other Risk Factors for Local Housing Markets

We recently created another interactive map, outlining counties most vulnerable to home price drops from COVID-19.

Using data from ATTOM Data Solutions, here are the counties where home prices face the highest risk:

Would your readers enjoy this interactive map? Click here for the embed code!

Share this Map On Your Site

Keep in mind that the data only included three risk factors: local affordability, local foreclosure rates pre-coronavirus, and the local percentage of homes underwater on their mortgages. It provides some baseline for real estate risk, but it’s far from complete.

For example, it doesn’t include unemployment rates, or the underlying stability of the local economy and job market. It doesn’t include economic diversity, or reliance on highly effected industries like tourism, hospitality, retail, or other in-person services.

And, of course, there’s just no telling which counties will get hit hard by COVID-19 and which will emerge relatively unscathed.

Should Real Estate Investors Buy in Areas with High Unemployment?

The COVID-19 impact on real estate investors comes with both greater risks and greater opportunities.

Skyrocketing unemployment means greater risk of rent defaults, and a harder time filling vacant rentals during the pandemic. And widespread eviction suspensions make it impossible for some landlords to remove bad tenants (more on that shortly).

Yet there are also opportunities for distressed sales. Savvy investors can find good deals on properties, through tactics such as driving for dollars and other strategies to find off-market deals.

Investors can also negotiate real estate deals more aggressively than usual. Some sellers have pulled their listings off the market, but others must sell right now for whatever reason. Many are willing to take a lower price in exchange for a quick, certain settlement.

As for local unemployment rates, areas with low unemployment rates come with lower risk of rent defaults and continued demand for housing. But they also present fewer distressed sales and less likelihood for home price dips.

Areas with high unemployment rates will prove harder to maintain your occupancy and rental revenue as a landlord. But you can potentially find motivated sellers, among both homeowners and stressed, tired landlords.

Whether that higher risk and higher reward potential appeals to you depends on your goals, type of real estate investment, and risk tolerance.

No Rent, But No Evictions Either

Many landlords nationwide can’t legally complete the eviction process right now. Even if tenants stop paying rent.

The CARES Act suspended evictions at any property secured by a federally-backed mortgage, including most conforming loans (Fannie Mae- and Freddie Mac-guaranteed loans), FHA loans, and VA loans. It also suspended evictions for Section 8 tenants, and among landlords taking the Low Income Housing Tax Credit (LIHTC). Lasting 120 days, the original eviction moratorium lifted on July 24.

But landlords face further eviction restrictions beyond the CARES Act. Some city and state governments have suspended all evictions, and even in jurisdictions without any explicit ban, many have closed civil courts.

Which means landlords can start the eviction process, but can’t complete it.

That means many real estate investors will prove reluctant to buy new rental properties. Many, like myself, have tightened my tenant screening process even more than usual. I would rather my property sit vacant than sign a lease agreement with a tenant who won’t pay rent and abuse my property.

If the terms of a legal contract like a lease agreement only apply to one party, then why would the unprotected party bother signing the contract in the first place?

(article continues below)

Landlord Loans Halted

The same logic applies to lenders. With unemployment rates soaring and rent defaults looming, many lenders who provide landlord loans have suspended all new loans. I can’t say I blame them. But it sure makes it hard for real estate investors to buy properties right now. Most of the portfolio lenders we work with have temporarily suspended new landlord loans. One, Lending Home, has restarted underwriting landlord loans, but they’ve tightened loan standards. Others still offer hard money loans for purchase-rehab, but not long-term landlord mortgages. Some lenders in the LendingTree network continue to underwrite new landlord loans. But most are conventional lenders who report to the credit bureaus, and who limit the number of mortgages that can appear on your credit (the typical limit is four). So while they can help you buy your first rental property, or even the first few properties, they don’t offer scalable financing. The most flexible source of funding still available to real estate investors comes from Fund & Grow. They help investors open a series of unsecured business credit lines and cards, which investors can draw on at any time for down payments, renovations, or even outright purchases. The average real estate investor qualifies for $150,000 – $250,000 in total credit lines. Investors can also look to creative financing tactics like seller financing or private notes, but make no mistake, you should expect a harder time finding financing during the coronavirus pandemic and its ensuing recession.Final Thoughts

With unemployment soaring nationwide, real estate investors must understand their local market. Not all economies are created equal, and many remain far more vulnerable to the coronavirus-induced recession than others. The better you know your local market, the better you can position yourself to take advantage of price dips and opportunities, while protecting yourself against risk factors like rent defaults. How do unemployment rates look in your local market? Do you plan to invest in areas with high unemployment rates? Why or why not?More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Wow the unemployment rates are worse than I thought. Great map by the way!!

Yeah not pretty Olivia. Hopefully the spike in unemployment will be short lived, or else a whole lot of people will be suffering when their unemployment benefits run out.

That’s downright terrifying. I pray the reopening of the economy goes smoothly, because if these unemployment rates continue it will take years for jobs and wages to recover.

It IS terrifying. We could be in for a tough road ahead, if we don’t get people back to work quickly.

Right now I am not planning to invest rather going to take a deep dive into my local market. Let’s see what I find!

You definitely have to know your market before investing!

Given current economic uncertainty & potential USD devaluation, I’m trying to decide if I should sell my primary residence (as planned) or hold onto it and turn it into a long term rental. I understand that it could be take time to realize appreciation, but is it a better investment right now than stocks, bonds, or cash?

Hi R., it depends on whether the property would cash flow enough to make it worth the hassle. Check out our free rental cash flow calculator to run the numbers on your property, because many people don’t realize just how many “hidden” expenses come with rental properties.

You have some excellent tips in this post. Though I think we’re still learning and evolving as far as real estate and this pandemic is concerned.