Heard the term “real estate lien” thrown around, but not sure what a lien on property is? Liens can be general or specific, voluntary or involuntary. As the name suggests, a voluntary lien (such as a mortgage lien) is one you agree to. An involuntary lien (such as a...

G. Brian Davis

Brian Davis is a real estate investor and personal finance writer with over two decades in the real estate and finance industries. After graduating from University of Delaware in 2003 with two useless B.A. degrees and an even more useless minor in anthropology, he fell headfirst into real estate finance by accident.

Then he promptly went on a property buying spree from 2005-2008. It was what you might call a “learning experience,” all of the lessons expensive.

Eventually, Brian tired of landlording and unloaded his own portfolio of rental properties. But he still loved real estate as an investment, and today he owns fractional shares in over 2,000 units.

The difference? Nowadays he only invests passively in real estate.

Along with his wife and daughter, Brian spends most of the year abroad living by his own rules. He loves hiking, cooking, pairing wine with said cooking, scuba diving, and occasionally surfing (badly). And writing: he writes as a real estate and personal finance expert for Inman, BiggerPockets, R.E.tipster and dozens of other publishers.

Most of all, Brian loves showing others how they too can create their ideal lives through real estate investing and lifestyle design.

Lower Mortgage Rates: 8 Creative Ways to Finance Properties While Rates Are High

High interest rates and a nationwide housing shortage make for a tough combination for homebuyers and investors alike. So, what creative financing options do you have while interest rates for investment properties and home loans keep soaring? Creative Financing...

Savings Rate: How Much of Your Paycheck Should You Save to Retire Early?

No matter how much you earn, you won’t build wealth if you spend every penny you bring in. A person who earns $75,000 and saves $25,000 per year will create wealth faster than someone who earns $1,000,000 and spends $995,000 of it. Flashy cars and imposing homes may...

Visualizing Real Estate Cash Flow

Real estate cash flow is not about what happens in a “normal” month. In a “normal” month, your expenses will probably be minimal. And then a not-so-normal month hits, and you get slapped with a $2,500 expense. So when rental investors forecast real estate cash flow,...

Best Real Estate Crowdfunding Investment Platforms to Diversify Your Portfolio

Real estate investments come with several huge drawbacks. Diversification poses a problem when a median home in the US costs over $400,000. Even when you leverage other people’s money and make a minimum down payment on an investment property, you still tie up tens of...

How Much Emergency Fund Should I Have as a Property Owner?

Just 39% of Americans could cover an emergency expense costing $1,000, per a 2021 study by Bankrate. The other 60% would be up the creek without a paddle. Because emergencies do happen, and not just to other people, either. Three out of ten Americans say they or an...

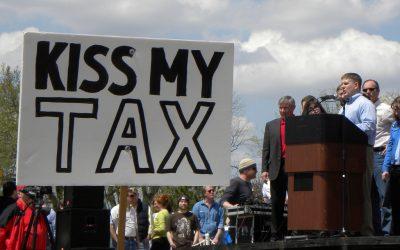

How Rental Income Is Taxed

Real estate investments can offer some huge tax breaks — if used wisely. In fact, some investors opt for real estate specifically for the tax breaks! But how is rental income taxed? What other taxes do landlords and real estate investors pay? How can you avoid the...

Free Loan Calculator With Amortization Schedule

Take one look at an amortization schedule and you discover that “simple interest amortization” is a misnomer. Still, it’s not rocket science either. An amortization table shows you how quickly you’ll pay down your loan balance over the course of your loan term. And...

How Dandan Zhu Became a Millennial Millionaire with Real Estate

Before turning 30, Dandan Zhu reached financial independence and quit her day job. She still does some recruiting work and real estate investing on her own terms — but why stop when you love what you do? Zhu scaled her real estate portfolio quickly through aggressive...

Why Rural Investment Properties Outperform Urban Real Estate

Ever considered investing in rural real estate? Most real estate investors haven’t. Which is precisely why rural properties offer so many advantages compared to their urban counterparts. Consider the following reasons to invest in rural properties, rather than...