Ever considered investing in rural real estate?

Most real estate investors haven’t. Which is precisely why rural properties offer so many advantages compared to their urban counterparts.

Consider the following reasons to invest in rural properties, rather than following the pack.

1. Less Competition

“A single rural property generally receives one bid on average,” explains Will Cannon, CEO of Uplead. “Often there is only one interested buyer at court auctions. An ordinary investor may spend half of what they would in a major city for a rural property.”

Tomas Satas, founder and CEO of Windy City HomeBuyer, shares similar experiences. “In all the years of investing in some rural areas, I have never had anyone bid against me to purchase a property.”

That’s pretty incredible, given how fiercely competitive urban markets are in the US.

2. Easier Networking

In small communities with few or no competitors, it’s easy to network with the local real estate community. That includes real estate agents, contractors, title companies, lenders, major landowners, and the one or two other local investors.

Investors who, if friends, find ways not to step on each other’s toes.

Satas speaks to this networking as an advantage: “If you develop relationships in a rural community, you can be very successful with less stress investing in land, rentals, and flipping homes. And you can save money by doing cash deals directly with the owner.”

Plus, if all the local residents know that you’re the only local investor, who do you think they’ll call if they need to sell their house fast?

3. Lower Prices

Cannon expands on that idea: “Rural property prices surely assist investors in realizing their aim of becoming real estate market leaders. These lower prices also allow investors to buy many homes and diversify their holdings for greater earnings.”

Mitchell G. David, founder of Beach Life Ocean City, adds “Due to a lack of competition, the prices are extremely low and affordable. In some cases, large plots are sold in an auction.” Auctions which aren’t well attended, as noted above.

That can lead to easier economies of scale in building your portfolio. “Purchasing rural properties in bulk is much easier than with city properties.”

4. Lower Property Tax Rates

Lower property values mean lower property tax bills, of course. But even the property tax rates are usually lower in rural areas compared to major cities, with their bloated local government bureaucracies and budgets.

Check out this interactive map of property tax rates by county:

5. Fewer HOAs

Homeowners associations add both monthly costs and restrictions to property owners. Not everyone wants to pay those bills, or fit the cookie-cutter mold prescribed by suburban HOAs.

“One trend I am seeing is homesteaders looking to get away from traditional neighborhoods and HOAs,” notes real estate agent Eric Hegwer. “These buyers are looking for 5-20 acres to build a home on and start a small farm or add solar and rainwater collection to become more independent and live off-grid. They can follow their dream and build their own house or buy a pre-fab home to save even more money.”

6. Higher Cap Rates

It’s not advanced calculus. Less competition, lower property prices, and fewer landlords lead to higher cap rates.

In fact, if you look at the best cities for rental properties based on GRM (rent:price ratio), you’ll see that they’re the smallest, least dense cities and towns — not the urban metropolises.

Expect higher income yields when you calculate rental cash flow on rural investment properties.

7. Higher Upside Potential

“Another big plus to rural land is the possibility for development,” says Satas. “Depending on the location relative to the nearest city, a plot of rural land may be subdivided and developed, especially if they are within an hour of a city.”

Jeff Lichtenstein, founder of EchoFineProperties.com, explains it like this: “If you look at some of the fastest growing real estate markets with the highest appreciation like Idaho, Utah, and Florida, you’ll notice that many of the hot spots were once rural. Rural areas to invest in have the best upside for return on investment.

“Take Jupiter, Florida. In 1980 the population was 9,868. Tons of land and a coastal town that was rural. Fast forward to 2020 and the population grew sevenfold to 61,107. The rental rates have shot up 50% in the last year alone.

“Zoom, ease to rent out properties, and the new infrastructure program expanding WiFi into rural areas over the next five years also make it easier to make a move to rural areas. Look for attractions like national parks, weather, and things to do, as you identify emerging rural areas that have upside for long term growth.”

8. 0%-Down USDA Loans

Hegwer concurs with Lichtenstein’s assessment, and seeing a clear and growing rural expansion. “With the increasing ability of remote working, I see many buyers looking to move to less populated areas. There are lower taxes as well as specialized mortgage programs, like USDA loans, which have 0% down payment options allowing first-time buyers to get homes.”

These loans, guaranteed by the US Department of Agriculture, allow homebuyers in rural areas finance up to 100% of the purchase price. And just as you can use VA loans to buy multifamily properties, you can do the same with USDA loans — provided you move into one of the units for at least a year. It’s one more way to buy rental properties with no money down.

Plus, you get to house hack and live for free, with your neighboring renters covering your mortgage payment.

9. Changing Population Trends

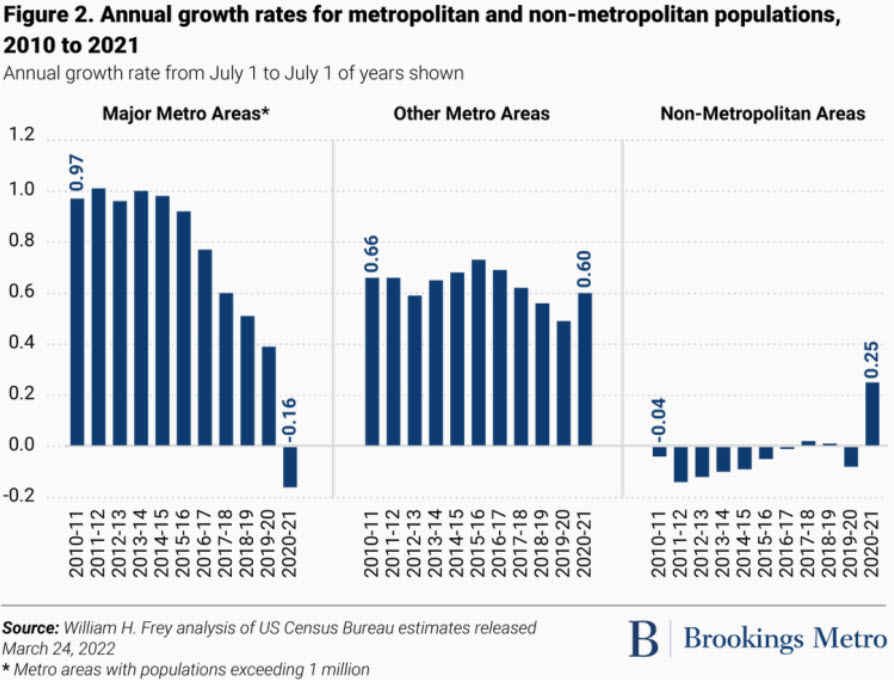

The coronavirus pandemic created a demographic shift away from the country’s largest cities and toward smaller cities and rural areas. In fact, Census Bureau data shows rural America showing a population surge for the first time in years.

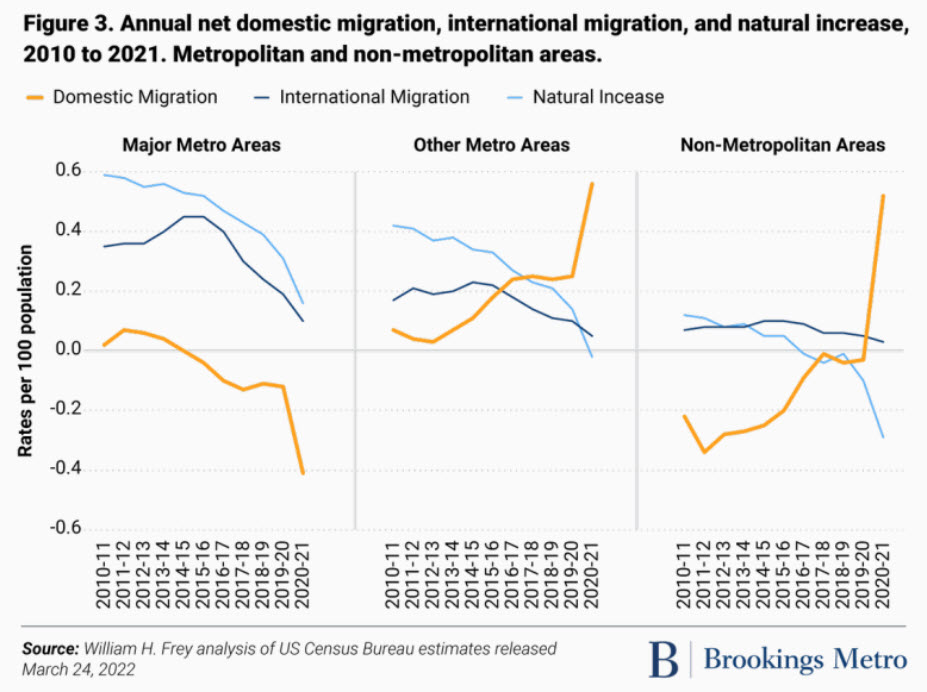

Check out these migration graphs from The Brookings Institution, showing major metropolitan areas versus non-metropolitan areas:

In fact, you can see a trend of shrinking population growth in major cities even before the pandemic — and shrinking losses in rural areas:

A study by the Economic Innovation Group found similar results, and credited the rise of remote work in making rural areas a more viable option for white-collar workers. And, of course, their attendant higher salaries.

(article continues below)

10. Less Regulation

Anti-landlord regulation has become a growing problem in tenant-friendly cities like Los Angeles, New York, Baltimore, Chicago, and Philadelphia. From rent control to months-long eviction processes, the inability to non-renew lease agreements, requirements to pay tenants interest on their security deposits, and more, I no longer invest in any cities with these sorts of regulations. (For a list and interactive map, avoid these tenant-friendly cities and states.)

David points to minimal rural rental regulation as a huge attraction. “One of the advantages of rural property is there are fewer laws governing rural real estate. Restrictions and regulations are limited and purchasing any property in this area requires less legal advice and consolations. Owners can build their businesses and not worry about complicated laws.”

11. Availability of Raw Land

Deni and I have started investing in raw land over the last year or so. It doesn’t come with the extensive regulations that apply to residential real estate, nor the maintenance or tenant headaches. And you can earn much higher returns.

Such high returns, in fact, that one new land investor reached financial independence just 18 months after he started investing. Check out his land investing strategy here, and consider taking a land investing course if you’re interested.

Cannon likes rural land, due to the higher upside potential outlined above. “Many people buy rural land as a long-term investment strategy. Cities and metropolitan regions are constantly increasing due to annual population increases. If an investor is strategic in their rural property buying location, they may acquire an investment for a low price and sell it for a much bigger profit in the long run.”

Ed Brancheau, founder of SunnyNest Land, invests both ways. “I buy houses and vacant land in rural areas and have discovered that there’s not a huge difference. When it comes to buying land, I never pay more than 40% of market value (usually 25%) because there are so many deals out there.

“When buying houses, I only have one extra rule: there must be a supercenter like Walmart within 25 miles. I’ve found that that is about as far away as 99% of people want to live.”

Final Thoughts

I’ve had countless bad experiences with urban real estate.

From high crime rates to high rent default rates, professional tenants to tenant-friendly laws, there’s a lot not to like about urban rental properties.

Rural real estate comes with its own challenges of course. Smaller populations and lower overall demand for housing can lead to longer vacancies. But less frequent turnovers helps mitigate that risk.

Follow the fundamentals of investing, find good deals on properties, calculate rental cash flow before buying, and you might find fewer headaches and higher returns among rural real estate properties.♦

Have you ever invested in rural properties real estate? What have your experiences been?

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

Rural real estate is challenging but it is more comfortable to manage than urban real estate. We moved in Benton City, WA 2 years ago and I currently have 3 doors. So far I haven’t had any bad experiences.

Glad to hear you’ve had positive experiences with rural real estate investing Alex!

Finally, highlights of rural investing! It’s always a relaxing trip when I visit my rentals 🙂

Haha, I hear you Janice!

Very interesting article! I’m intrigued . Can you share to us the best places to invest rural real estate? I will take it with a grain of salt. I just want to know where I to start.

That’s the million dollar question Arthur!

It’s the perfect time to buy land and hold. No competition at the moment which is great!

Interesting to hear you say that Aurelia. I’ve found a lot of competition over the last 2-3 years. But glad to hear you’re having good experiences with land investing!

I have partnership with experts in rural lands. Either I buy or coordinate with present land owners. It’s a win-win situation.

I haven’t consider rural real estate. That might be the missing piece on my portfolio.

Let us know how it goes Charles!