With real estate prices soaring all over the country, are there cities where they are falling?

Join Brian and Deni as they discuss where home prices are actually declining.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Resources Mentioned in This Podcast & Video:

Deni: Hi everybody and welcome to Spark Rental Facebook Live and podcast. After a holiday, I think I’m dragging a little because of the holiday. I keep thinking today is Monday. Last week we talked about should rising crime rates deter you from investing in cities? And today we’re going to be actually talking about where real estate values are actually dropping, which is amazing considering in most places it’s going crazy. So with that, Brian, why don’t you take it off and let us know, like, why? And yeah.

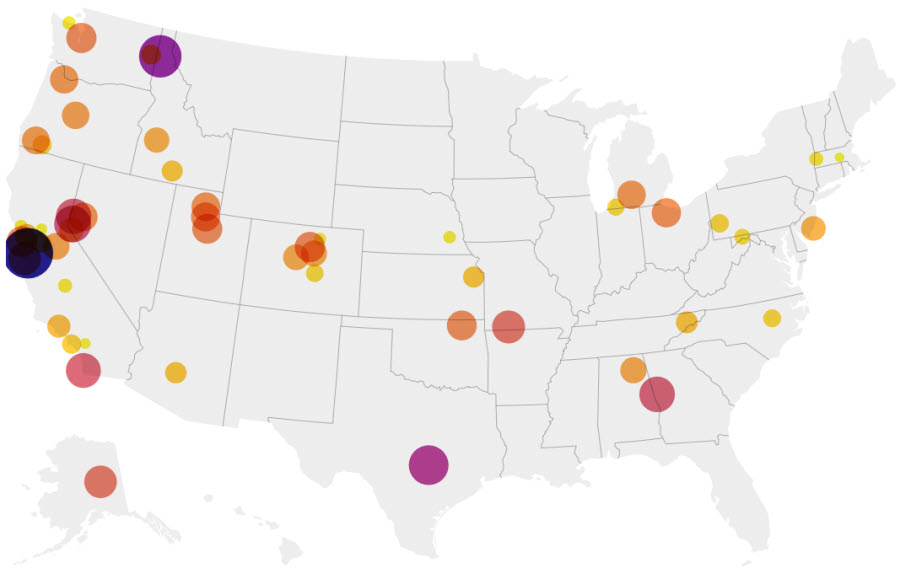

Brian: Sounds good, Deni! Well, so last month the average home price in the US sold under asking price for the first time in 18 months, and that’s based on a Redfin report that was out a couple of days ago. So we’re seeing home markets cool down across the country. And last week, late last week, we put together an interactive map of 54 cities around the country where home prices have started dropping or they’re already dropping. Now it’s a mixed bag of cities. There’s no obvious pattern to them if there is a pattern. It’s that the cities that rose the fastest and the sharpest in value during the pandemic, those are the ones that are now falling back down to earth. So a few examples of those like superstar cities during the pandemic were like Boise, Idaho, Austin, Texas, Salt Lake City, Boulder, Colorado, San Jose, Santa Cruz. You know, these cities that appreciated by just crazy percentages during the pandemic, you know, like 30, 40, 50% a year. That’s just not sustainable. Right. And end up with the disconnect between home prices and local median incomes. Now, looking at this map — We’ll send you a link to the map in the comments as well. So you can take a look at the interactive map — There are a heavy concentration of these losses in the West. Other parts of the country, like the Midwest, the Northeast, the Southeast don’t have that many cities with declining home values yet. There are a handful of them but most of these cities that are falling in value are located in the West and in particular in California. California is seeing the most declines here. Every single major city in California declined in home values last month. So LA, San Francisco, San Jose, San Diego, Sacramento, you know, and a dozen others, or maybe closer to a half dozen others. But they all declined in value. In contrast, Florida didn’t have a single city decline in value last month. Now, it doesn’t mean that more cities aren’t coming. We are seeing cooling home values across the country. But for now…

Deni: I have a question now. These are pretty large declines. I mean, seeing a cooling off because we’re starting to see it in my area a bit like it’s cooling off a little bit, but these are big drops. Do you think that it’s just a cooling off or is there something in these areas?

Brian: Well, so it depends on what you mean by a big drop. So on a monthly basis, most of these dropped by less than 1% or the actual sales prices, but that’s in a single month. So annualized, if a city sees home prices fall by 1% a month for a year, it’s 12% in a year, right? Actually, it’s more than that because each month it adjusts. But you get the idea. You’re looking at roughly a 12% annualized drop, which is a big drop in home values. So on a single monthly basis, these are huge drops. But if this were sustained for an entire year, that would be a big drop in value. And I think, again, the main thing we’re seeing right now is a correction of some of these cities that went too hot, too fast with the real estate markets. So they’re correcting back down to the fundamentals of local median incomes. But, you know, rising interest rates are going to have a cooling effect and we’re going to see that not just in markets that overshot their real estate values, but potentially in more markets as well. Even markets that didn’t overshoot what local incomes can support.

Deni: I mean, in the suburbs where I am still it’s still pretty nuts.

Brian: Still pretty hot.

Deni: Yeah, Philly has has definitely cooled a bit, but the suburbs are. Yeah.

Brian: Yeah. And, you know, so there’s a couple reports out there talking about how much of the US is overvalued. So Moody’s Analytics, for example, they have a report out that 97% of the nation’s cities are classified as overvalued compared to local incomes. And a lot of those are really overvalued. So this report that they ran looked at 392 cities across the country, and of those 392, 149 of them were overvalued by at least 25%. So that’s huge. Now, that doesn’t mean that those cities will drop in average home price by 25%. They still probably won’t. So Mark Zandi, the chief economist over at Moody’s Analytics. So he expects those most overpriced housing markets to fall up to around 10% in average home prices over the next year.

Deni: If you’re just joining us, we’re talking about where real estate prices are dropping and if you’re in an area where this is happening. Pop a comment in the chat.

Brian: We want to hear your experiences on the ground.

Deni: Yeah.

Brian: All real estate is local, right? I mean, we can talk about these nationwide trends, but really this comes down to just a hodgepodge of local markets around the country.

Deni: So what else can you tell us, Brian? I mean, as investors what should we look out for?

Brian: Yeah, a couple of things. So we mentioned briefly interest rates and interest rates rising and the effect that has on home prices. I just want to illustrate that with a really quick example. So the median home price in the US is somewhere around 440,000 at the moment. So if you were to borrow a 30 year mortgage for 400,000, which is not atypical, and if you borrowed that at 3% interest, that loan would cost you 1680 $6 a month in principal and interest. And at the beginning of this year, that’s roughly where interest rates set was around 3%. Now, over the last few months, interest rates have been hovering between five and a half and 6%. So that same loan, a 30 year, $400,000 mortgage at 6% would cost to $2,398 a month in principal and interest. So that’s over $700 a month in difference in just the monthly payment. So that goes to show just how much rising interest rates affect home affordability. There’s just no way that it can’t affect homes when you’re talking about doubling interest rates like that. Now that being said. So we’ve had people ask us for the last for all year, all of 20, 22 people have been asking us, are we in a housing market bubble? Is the bubble going to burst? Is this a second 2008? You know, our housing market is going to collapse. And the short answer to that is no. And the reason why is because in 2022, we have a housing shortage. There are not enough homes in the US to house all of the Americans who want to have their own households.

Brian: So everyone has their own estimate for just how short we are on housing supply. But here are a few numbers for you. So Moody’s Analytics, so we just talked about a minute ago, their most recent report estimates that the US is 1.6 million housing units short of what it needs to meet demand. There was another report out a month or so ago from Up for Growth nonprofit organization. They estimate that the US housing supply is 3.8 million units short of what it needs to meet demand. And there’s a home light report that shows that we have a shortfall of around 5 million units, at least based on what was constructed over the last decade. So if you look at the period from 2012 to 2021, 12.3 million households were formed in the US, but we only built 7 million new housing units. So that’s 5.3 million housing units short of the new households that were formed in the US. So no matter how you cut it, no matter which one of these numbers or reports you look at, we are millions of housing units short in the US of what we need to cover demand. So that is why this is not the same as 2008. Why we don’t have a traditional housing market bubble doesn’t mean there aren’t local bubbles. There are. That’s why we’re seeing some of these home prices fall in cities like Boulder and Santa Cruz and Boise. They did. They they shot up too fast and home prices became divorced from local economic fundamentals. That’s why they’re correcting. But is the US headed for a housing market collapse nationwide? No, it’s not.

Deni: It’s like toilet paper. Just kidding. That’s crazy, if you think about it. I mean. 5 million short.

Brian: Yeah! And that’s one of the reasons why I’m still bullish on real estate in general. I mean, that’s why you and I are still investing in real estate, right, Denny? I mean, we’re not going to see the same kind of real estate price growth that we saw in the last few years. I mean, it’s just been nutty and there’s been a disconnect from economic fundamentals. But we’re still short a bunch of housing units, millions of housing units in the US, so.

Deni: Rents as well. Always go up anyway, but they have gone up significantly.

Brian: Yeah. And that’s actually that’s a that’s a really important point. So a couple of months ago, we ran an analysis of how real estate performs during recessions because the jury’s still out on whether we’re going to have… Whether the Fed can maneuver a soft landing for the economy or whether we will end up with a recession. Home values do sometimes dip during recessions. They don’t usually dip by that much. There has only been twice in US history that home prices have fallen more than 10%. The Great Depression and the Great Recession. Sometimes they don’t fall at all. Sometimes they fall 5% or so. Rents never dip. Basically, if you look at recessions over the last 70 or 80 years, sometimes they flatten out. Rents never fall nationwide. So. Now, that’s one caveat there. Vacancy rates do go up during recessions, so it doesn’t mean you’re completely protected as a landlord. But when you run the numbers through a rental cashflow calculator, at least your market rents aren’t going to be declining even if we have a recession. Right.

Deni: Wow. It’s kind of crazy. I mean, really, you hear all the speculations and then you see data like this and. You know, I mean, some people it could cause panic. And I personally have been obviously pro real estate since I was very young. But. Definitely.

Brian: Well, you know, at least it’s a real asset, right? I mean, it’s not going to drop to a value of zero. Unlike a stock, for example, where, you know, the CEO has a sex scandal and runs off to Mexico or something. You know what I mean? Like. So the value could drop 5%, 10%. You know, in catastrophic recessions, we’ve seen it fall 25%. But it’s not going to go to zero. And it’s always going to recover because people always need a place to live. So you do have some built in protection there with real estate that you don’t have with paper assets. Deni, anything else that you want to say on this topic before we call this episode complete?

Deni: No, Brian, I think we covered it. It’s interesting to me.

Brian: If you guys haven’t checked out the map, check out the interactive map showing the cities where property values are dipping. And we’ll update that map every few months as conditions on the ground change. I expect more cities will see property prices dip a little bit. But again, we don’t expect a catastrophic collapse in home prices around the country.

Deni: Well, that’s good news.

Brian: For sellers, not for buyers.

Deni: Well, that’s true. That is true. Just to let you all know, next week we have a guest and I’m looking forward to that. I like hearing other people’s stories and anything else, Brian.

Brian: No, wait. So you mentioned next week’s broadcast. We will be speaking with a realtor next week who specializes in working with investors and she’ll be talking to us about flipping during cooling home markets. So it ties in with what we’re talking about today. Can you flip houses during a cooling housing market, which will be an interesting conversation to have.

Brian: So on that note, we’ll see you guys next week! Stay in touch. Let us know. We want to hear more about and we’ll see you on the flip side.

Deni: Bye bye, guys!