Will real estate prices go down? Will interest rates continue to rise? What about rent growth? Brian and Deni break down the numbers for real estate’s performance in 2022, and where we’re likely headed in 2023.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Resources Mentioned in This Podcast & Video:

Deni: Hello everyone, and welcome to the Spark Rentals, Facebook Live, Podcast…

Brian: and YouTube Live.

Deni: And YouTube… You didn’t give me a chance! I was going to remember YouTube. Thank you for joining us. Last week we had a, I thought, a really good interview with Paul Wakeham. Who was he? I found him to be very interesting.

Brian: You pronounce his name right this time.

Deni: I know. I was so embarrassed. Today, Brian’s going to talk to us about real estate numbers to watch entering 2023 and everybody is talking about all the stuff that’s going on overall, but particularly in the real estate market as well. So if you’re an investor, this is going to be a or if you want to be an investor, it’s going to be a good show to watch. If you have any comments, questions, anything, throw them in the in the comments. We’re a very relaxed kind of, you know, shoot us what you think. Kind of show.

Brian: If you couldn’t tell by the lack of polish. Yeah. Yeah. Although, you know, I think that people appreciate the rawness sometimes. And Paul actually said that last week that, you know, he had been watching some episodes of ours and really appreciated the rawness. I feel like this. Yeah, maybe raw is a better way to put it than lack of polish. I don’t know. Tim Dooley says Greetings from Norfolk, Virginia. It’s great to see you. It’s it’s, it’s I feel like it’s been a while since. Since we’ve seen your lovely face. But it’s glad to have you with us.

Deni: Absolutely.

Brian: So real estate has obviously been much more volatile than usual in 2022. You know, usually we talk about the stock market being super volatile and real estate markets being much more stable, largely because real estate is so illiquid, know it takes so long to buy and sell real estate and it’s so expensive to buy or sell that it just doesn’t fluctuate nearly as much in value as very liquid investments like stocks do. But 2022 has been an interesting year, to say the least. Real estate markets started out the year white hot and really for the first half of the year continued that super overheated market appreciation and rent growth that we saw from 2020 and 2021 and the pandemic. And then the second half of 2022. It’s been a very different story with declining home values in a lot of markets, including as of the most recent data, it looks like nationwide, the nationwide average of home prices has dropped below zero. So we are starting to see nationwide average home price declines. So where does that leave us going into 2023? So we want to we want to talk about some numbers to keep an eye on today. And the first is no surprise at all. Mortgage interest rates, that’s been one of the prime real estate related stories, really the prime economic story in 2022, as the Federal Reserve has tried to tame inflation. They have driven up interest rates at at speeds not seen since the early eighties, since over 40 years ago. And, of course, that has had a dramatic effect on mortgage interest rates, which in turn have a huge effect on home values. So as of today, as of when I checked this morning, the average 30 year mortgage rate with 6.64%, that’s down a little bit from a couple of weeks ago when it topped 7%. It started 2022, around 3%. So that’s more than doubled. Yeah, more than doubled in less than a year. And that has a huge impact on affordability. I mean, you’re talking about hundreds, if not thousands of dollars more per month to afford the same loan, depending on the loan value.

Deni: Not to mention the house prices are going up, too. But we’ll talk about that later.

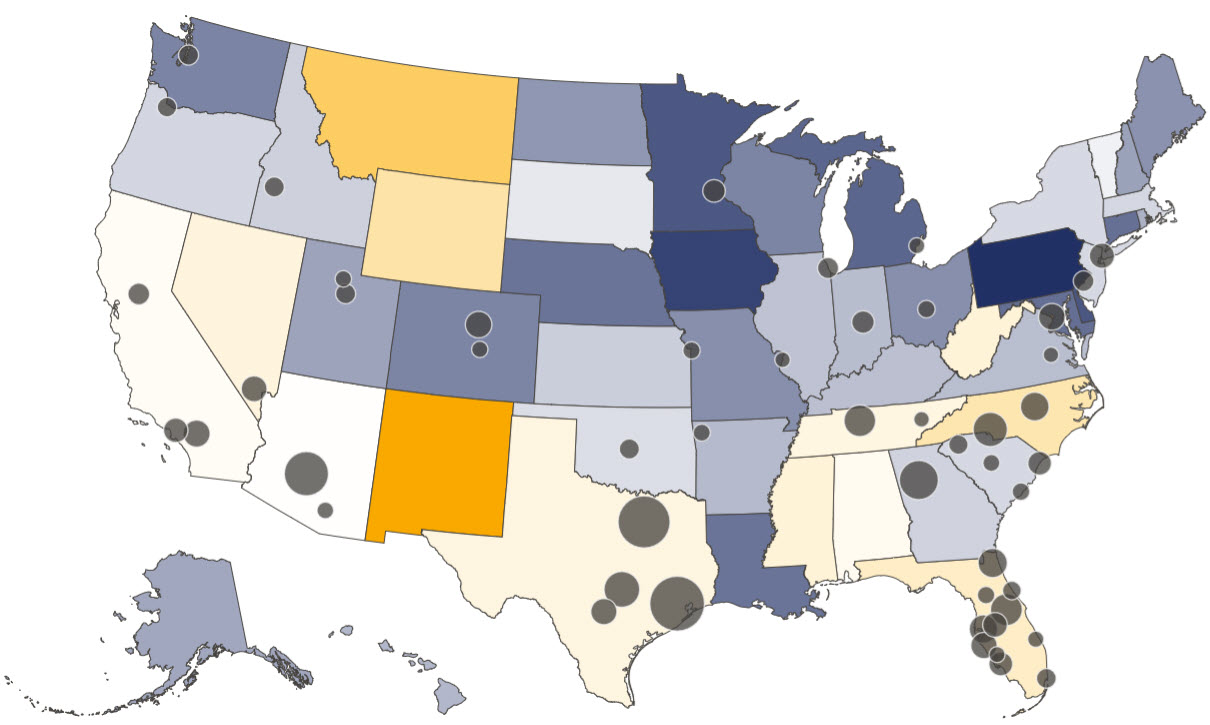

Brian: Well, yeah, yeah. So where are mortgage interest rates headed? Realtor.com forecasts that they will peak at 7.4% in early to mid 2023. The Federal Reserve is definitely not finished raising rates yet. They have talked about potentially slowing the pace of rate hikes, but they’re still hiking rates. So interest rates still have a little ways to climb. And then Realtor.com forecasts that they will by the end of next year will drop to an average of 7.1%. We’ll see. So mortgage interest rates, that’s one number to watch as we enter 2023. Home price growth, you know, people talk about nationwide averages, but really all real estate is inherently local. So you really want to look at home price changes in your city or the city where you are investing in properties, wherever that may be. So we’re going to put a couple links in the comments here. One is to where it’s an interactive map of cities where home prices are currently dropping.

Deni: Minus one.

Brian: Yeah.

Deni: Oh, I’m telling you. I do real estate in my whole life, but I sell.

Brian: As a realtor.

Deni: Right. And there’s been like bidding wars. It was crazy.

Brian: Over the last couple of years.

Deni: Yeah. And now, things are sitting. I’m seeing price drops. It’s. Completely. Different.

Brian: Yeah, Yeah. I mean, it’s really the first half of this year and the second half of this year have been starkly different in housing markets across the country, some more than others, though. So we put two links in the comments here, a couple of interactive maps to check out. One is a map of cities where home prices are dropping around the country. The other is a real estate heat map by county across the entire country. So county by county across the nation, how much home prices changed in the last year and and by quarter as well. So if you look back 12 months ago, home prices are still higher today than they were a year ago. So that’s worth keeping in mind here as context. So if you listen to the pundits in the press, it’s all doom and gloom, right? You know, the sky is falling, but home prices are still higher today than they were a year ago. Now, we have different forecasts from different economists here on where home prices are headed in 2023. So let’s start with a kind of middle of the road forecast. So Zillow points to a 13 and a half percent year over year change for the last 12 months, or at least the 12 months ending at the end of October.

Brian: The most recent data they have available. So that’s how much home prices have changed as a nationwide average over the last year. They forecast a 1.2% increase over the next 12 months. Now, some economists and analysts see a drop in 2023. So Morgan Stanley and Moody’s Analytics both forecast a 10% drop from peak to trough. Now, that does not mean a 10% drop in 2023 because based on their data, home prices already peaked in mid to late 2022 this year and have already been dropping. So, for example, Morgan Stanley’s analysis, they are showing a 5% drop in home prices in 2022 from the peak, not from the beginning of 2022, but from the peak that that home prices reached in mid 2022. So 5% drop from that peak by the end of 2022 and then a 4% drop in 2023 before hitting a trough in 2024 and then turning around and rising again. So Moody’s Analytics also has a similar forecast, 10% drop on average from peak to trough. But again, nationwide averages just don’t mean that much in real estate. Some cities might see a 20 to 25% drop. And we’re really looking at those pandemic darling cities.

Brian: That just way overshot the mark with their appreciation during the pandemic. Places like Salt Lake City in Utah or Boise, Idaho, like places where everybody moved in 2020 and 2021. And home prices just way overshot the the local fundamentals of how many people live there, what people can actually afford locally. So some markets are going to drop by a lot because they overshot the fundamentals. So now they have to correct back to what those economic fundamentals can support. Other cities aren’t going to drop in value at all. They’re going to keep increasing in value and some will just kind of flatline. So, again, you have to look at this case by case, city by city. All real estate is local. Can’t emphasize that enough. Now, on the other end of the spectrum here, so Realtor.com for a little context, they put the nationwide appreciation in 2021 last year at 17% at 2022. They put it at 10.2% and in 2023 they forecast 5.4% growth in home prices. So again, depending on which economists and which analytics company you look at. Estimates are kind of across the board from around 4% decline in value in 2023 up to five and a half percent increase in value as a nation.

Deni: I mean, there’s no surefire way anyway to figure any of this out. So, I mean, you just keep an eye on your location or and everything, you know, just out of curiosity, where everybody who’s joining in in your area, what are you seeing?

Brian: Yeah. Yeah. We love to hear that boots on the ground analysis from people because like we said, it’s all local, right? So what are you seeing in your local market? And like Deni said, none of us has a perfect crystal ball, so anything could happen. Some of this depends on if we have a recession or not. And if we do have a recession, how deep is it? Do we see a wide swath of foreclosures like we saw from 2009 through 2011? All of that is at play here. All right. We spend a lot of time at home price growth. But let’s talk about some other numbers here that are relevant to real estate markets. And as you consider whether to invest in the coming months and year, where to invest. So existing home sales trends, they have been declining over the last couple of years. So in 2021, there were 6.12 million home sales in the US. In 2022, that number dropped to 5.2 million and in 2023, Realtor.com forecasts that that will drop to 4.53 million. Again, like Denny, you pointed out a few minutes ago, there’s just a lot less buyer demand and a lot of that has to do with what we started out talking about, and that’s the mortgage interest rates being so much higher than they were at the start of this year.

Brian: On a related note to that is another number inventory available for sale. So the amount of inventory for sale dropped by over 19% in 2021. It has increased by 4% in 2020 to Realtor.com forecasts that it will jump by 22.8% in 2023. So more inventory on the market, lower home prices theoretically. And we’re just seeing some of that reshuffling of supply and demand and hopefully returning to a more normal economy, a more normal housing market. So the markets have been skewed by the pandemic. And it’s you know, we’re still kind of wobbling back and forth and trying to find that equilibrium. So. All right. A fifth number to look at as we enter 2023 is rent growth. So in 2021, depending on which set of statistics you look at, Realtor.com put it at 10% rent growth as an average nationwide in 2021, Zillow puts it at 13.9% for last year. For 2022, that rent growth has slowed, but it’s still very high compared to historical standards, 7.7%. And in 2023, Realtor.com forecasts 6.3% rent growth, again slower than this year, but still high by historical standards. Rents typically rise in that 3 to 5% range per year, really more like three or 4% or even 2 to 4%. A little bit faster than inflation.

Deni: It’s really crazy too, because there are landlords out there who don’t do rent increases and because everything else is going up. Yeah. And then all of a sudden they’re there, you know, given if they’re allowed, some locations won’t let you, but they’re raising rents. Unbelievable. And I hear people who are renting that. I know and just from just from other people that they were just hiked up by like 200 some more. And if you go out, you’re not going to find anything either, because rents have really, really haven’t increased.

Brian: Yeah. And, you know, landlords, landlords try to be nice or they or they’re timid and they don’t raise their rents. Then they wake up one day and they realize that they’re charging like 20% below market value for their rents and then they try to hike the rents by 20%. That’s not fair to tenants. No, it’s sticker shock.

Deni: So which is a good point. You’re you’re actually doing your tenants a service by doing incremental increases and then they expect it.

Brian: Yeah. And Danny, that’s something that you and I have talked about a lot over the years is setting expectations for your that rents will go up every year, but they will go up by a fair and incremental amount, you know, 3%, 5%, maybe 7%. But but usually no more than that because otherwise, yeah, you give your tenants sticker shock. A lot of times they non renew and that leaves you with a vacancy. So. All right, we’re getting on a tangent, but that is something that Danny and I have talked a lot about over the years and feel strongly about. Raise your rents every year, but do it incrementally and do it fairly. All right. A sixth number to keep an eye on entering 2023. Here is rental vacancy rates. And you know, they’ve been very low for the last couple of years. This is something that in particular you want to watch out for if we do end up having a recession. So in recessions, rents don’t drop. Historically, they flatline. So you don’t as a landlord or as a real estate investor, you don’t have to worry about rents dropping in a recession, but you do have to worry about higher vacancy rates. Higher turnover is higher evictions. So that is going to add to your expenses, even though you’re so you’re your rents won’t drop, but your expenses will increase in a recession typically as a landlord or rental investor. So something to keep an eye on. We still don’t foresee rental vacancy rates shooting up into the double digits or really taking off. But it is something to watch, especially if it looks like a recession is is looming on the horizon. All right. Number seven, unemployment rates right now, they are crazy low. They’re actually too low. The labor market is too tight at the moment.

Brian: Current unemployment rate nationwide is 3.7%. The long term average is 5.74%. And really in that 5 to 6% range is a healthy labor market. It shows a balance between employees and employers. So right now, until that unemployment rate ticks up a little bit and until the labor market loosens a little bit, you know, we’re probably going to continue to see very high inflation. So something to keep an eye on. Number eight, the homeownership rate, that is, it’s currently 65.8% in 2022. Realtor.com forecast that to dip slightly in 2023 to 65.7%. If if we were to have a huge recession, then what you typically see in a recession is the homeownership dropping a little bit as some homeowners lose their homes or sell their homes in order to cash out and they become renters. And that is precisely why you don’t see rents drop during recessions, is that the demand for rental housing actually increases, some with that homeownership rate dropping a little bit so homeowners become renters. So something to keep an eye on. And last of all, housing starts. Keep an eye on that. You probably have heard this every which way from Sunday. There is a huge housing shortage in the US. Depending on who you ask, which economists you talk to, we are short between one and one half million and 5 million housing units in the US. You know all these pundits playing Chicken Little and saying that the sky is falling. What they are ignoring, in my humble opinion, is the fact that at the end of the day, we are still short millions of housing units in the US. We don’t have enough housing supply and housing starts have been declining for, let’s see here since April of this year, they’ve been declining in April.

Deni: There was a big issue, you know, when COVID hit with that as well, that really impacted it. Yeah.

Brian: Yeah. A lot of home builders, it’s slowed them down. Not not just the lockdowns and the you know, the people pulling out of the labor force were that had an impact on home construction. But also we had. A huge shortage of home building supplies such as lumber during the pandemic because everybody and their brother were stuck at home. And so they decided to renovate their homes. So. And so that put a big cramp on Home builders shot up construction costs. Labor costs have been much, much higher over the last couple of years because we’ve had such a tight labor market. So, yeah, the bottom line being housing starts have been declining since April. There’s every reason to believe they will continue declining into 2023. So we’re going to we’re going to continue to have a housing shortage. So, yes, home prices overshot some during the the pandemic. They rose too high too fast compared to incomes and local fundamentals. They are going to correct a little bit. That doesn’t mean we’re going to see a 2008 style housing crash when we had because then we had an oversupply of housing. Right. And a foreclosure wave because of loose lending standards.

Deni: Crazy foreclosure wave.

Brian: Right. All of which, you know, caused home prices to plummet. That’s not the situation today. Lending standards have been appropriate over the last five years or so. So we don’t have a whole bunch of homeowners out there who have no business being homeowners like we had in 2008. There is not an oversupply of housing. There’s the opposite of housing shortage. So don’t worry that the that the real estate markets across the country are going to totally collapse like we saw in 2008 through 2011, 2012. It’s not going to happen. We might we will see a correction. But as as we’ve pointed out, how deep that correction is, if and in which markets it even happens. That’s all open for debate. And some of some analysts foresee home prices increasing in 2023. Zillow foresees that happening. Com foresees that happening. Other analysts like Morgan Stanley and Moody’s Analytics see a continuation of a decline slightly nationwide again. They expect a 4% drop in home prices in 2023, hardly a a catastrophic crash even at the low end of that estimate spectrum. So.

Deni: Then all in all, you just got to keep watching. There’s no crystal ball and everything else. And my personal thing is there’s always going to be a need for rentals.

Brian: So no question. And and, you know, that’s why Denny and I continue investing in real estate syndications and in particular multifamily vacations, although we’re also especially excited about self storage facilities, mobile home parks, both of which do really well during recessions historically, and multifamily properties do well historically as well. Like you said, Denny, people need a roof over their heads. They need a place to live. During recessions, some homeowners become renters, which add to the demand for rental housing. There is a housing supply shortage in this country, especially in markets, cities that have seen a lot of population growth. So we invested in a deal, a multifamily property in Phenix, for example, a few months back in our co investing club. We are in the process of investing in two cities in Texas right now, both of which continue to see strong population growth. So yeah, this is why we feel confident continuing, continuing to invest and dollar cost averaging, continuing to invest every single month, small amounts of money in different multifamily properties around the country, especially in high growth markets. Tim Dooley says everything dropped off as you got to number eight. So talk about your cliffhangers. Oh Denny, did my audio drop out?

Deni: No, there was a problem actually on Facebook. I got a warning that came up, so. Oh no, unfortunately. But we’re going to have the recording available on the podcast, so it’ll all be there.

Brian: Well, I got love technology. Yeah, well, I’ll do a quick recap of those nine numbers to watch that we listed. Number one, mortgage interest rates. Keep an eye on those. They are expected to continue rising into 2023 and then expected to peak in 2023 and decline some by the end of the year. Home price growth. Keep an eye on that, obviously. But but look by Citi, because all real estate is local, like we said, number three, existing home sales volume and trends that those trends are expected to continue declining. Number four, inventory available for sale. That should rise in 2023 and it should rise by a lot, actually. Number five, rent growth. Keep an eye on that. You know, exploded in 2021. It has still been high. In 2022, it’s expected to be 6.3% in 2023, still higher than average. Number six, rental vacancy rates. Keep an eye on that, especially if it looks like we’re entering a recession. Number seven, unemployment rate’s currently very, very low by historical standards. Number eight on homeownership rate. And number nine, housing starts, which continue to decline and continue to contribute to the housing shortage that we see nationwide. Deni, is there anything you want to add before we call this episode complete?

Deni: No, I think you did it. I think you covered it all.

Brian: All right. Well, stay in touch. You guys. Let us know what you want to hear about in the coming weeks. I I’m going to be in Argentina for the next few weeks, so.

Deni: Total bragging.

Brian: Yeah, I know, Right? I will still be joining you guys for the Facebook lives, or at least for most of them over the next few weeks. But my wife and daughter and I are going to go do some hiking and Patagonia and some wine tasting in Mendoza, which I’m particularly excited about.

Deni: Hopefully not your daughter.

Brian: No, not her. Although the last time we took her wine tasting, the winery gave her this little plastic wine glass with grape juice in it. It was the cutest thing I’ve ever seen in my life.

Deni: That is cute. Oh, that’s awesome. Well, that is it for today. Please. Anytime. If you have any subjects that you want us to talk about, let us know. Contact us. [email protected] or Deni or Brian. And yeah, we’ll see you next Tuesday.

Brian: And if you like, if you like the podcast, please give us a five star rating on iTunes or Stitcher or wherever you listen to podcasts. It helps us get the word out. All right, guys, have a great week. We’ll see you soon.

Deni: Bye bye.