Mortgage brokers love to tell you they can lower your mortgage payment by refinancing your rental property.

Sometimes they actually can. But is it worth refinancing, even then?

Before rushing into a rental property refinance, make sure you understand the true costs.

Why Investors Refinance Rental Properties

A lower monthly payment means stronger cash flow on your rental property. All investors love passive income — it’s why people become a landlord in the first place.

Perhaps the mortgage lender offers to refinance you at a lower interest rate. Or perhaps you want to switch from a 30-year mortgage to a 15-year loan, or vice versa.

And, of course, some lenders tempt you with cash out. You start drooling over all the uses you could put that money toward, from new rental property down payments to renovations to personal uses like home remodeling.

Some investing strategies revolve around refinancing. It’s a crucial step in the BRRRR method of real estate investing, for example. Refinancing creates the possibility of infinite returns on real estate investments.

Not all investors have a choice in the matter either. If you borrowed a balloon mortgage, you have to pay it off before the term expires. That means either selling, refinancing, or finding creative financing.

The Downsides to Refinancing

Take refinancing lightly at your peril. Keep a close eye on these drawbacks to refinancing an investment property before signing on any dotted lines.

High Closing Costs

To begin with, refinancing is expensive. The average mortgage refinance costs $4,345 according to LendingTree, and that’s for homeowners borrowing cheaper mortgages. Can you think of a few things you’d rather do with that money? I can, and they don’t involve handing it to a bunch of 25-year-old mortgage bankers to blow on a wild weekend in Vegas.

Your loan officer will be quick to assure that they’ll roll all closing costs into the loan. That doesn’t make the costs disappear, it just means you get the privilege of paying interest on their fees.

So your first question must be “How many years will it take me to recover the closing costs of the refinance, in monthly savings?” The answer probably won’t make you happy.

But that’s just the tip of the iceberg.

Restarting Your Amortization Schedule

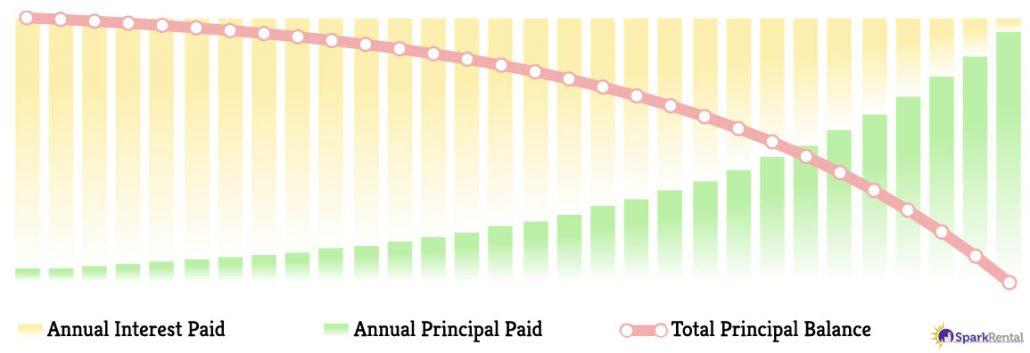

Each month that goes by in your current loan, a higher portion of your monthly payment goes toward paying down your principal balance. The principal paydown schedule is based on what mortgage bankers call “simple interest amortization.”

And there’s nothing simple about it.

The first payment of any mortgage is always the worst: most of the payment goes to interest for the bank, and a tiny fraction goes toward paying down your principal balance. The next month, slightly less goes to interest, and a little more goes toward principal. This change is gradual at first, then starts picking up speed in the second half of your loan.

Banks never, ever want to see borrowers get to this point in their mortgage payments. They want you to keep refinancing, so that they can charge you more up-front fees, but also to keep your monthly payment mostly interest.

It’s in the bank’s best interest (pun intended) to keep refinancing you, so that you never get far enough into your loan to really start paying down your balance.

So, the further you get in your loan, the more aggressively they’ll push refinance offers on you.

Use our free loan amortization calculator to view the full amortization schedule for any loan before signing on the dotted line.

Longer Debt Horizon

I know: 15 or 30 years from now feels like an eternity. But mortgage lenders count on you thinking that way, so that refinancing just feels like moving from one eternity of debt to another.

But if you don’t refinance, you will actually pay down your mortgage debt over time. And eventually you’ll pay it off entirely, owning your investment property free and clear. At that point, your cash flow explodes.

Don’t just keep punting your debt payoff date deeper and deeper into the future. Aim to actually pay off all your investment property loans, and sooner rather than later.

When Should Investors Refinance?

As outlined above, some investment strategies bake in refinancing from the start. While the BRRRR strategy isn’t for everyone, it’s a perfect example of how refinancing can make sense for investors.

If interest rates plummet and you can drop from a 9% interest rate to a 4% mortgage rate, that also makes sense. Likewise, you may need to pay off a balloon loan coming due soon.

The earlier you are in your amortization schedule, the less you sacrifice by restarting back at Square 1. But the further along you are, the closer you are to real progress in paying down your principal balance with each payment. If your original mortgage was a good one, it almost never makes sense to refinance.

Alternatives to Refinancing Investment Properties

“But what if I want to borrow more money?”

I’ll spare you the lecture on borrowing money for non-essential things like vacations or a new bathroom. If you really want to borrow money, consider some alternatives with potentially lower costs and stakes.

For flexible financing, consider home equity lines of credit (HELOCs). Or in this case, rental property equity lines of credit.

You can also open unsecured business lines of credit as a real estate investor. Check out this explainer video from Fund&Grow to learn how to open $100-250K in unsecured credit.

I’ve used credit cards to fund renovations for investment properties. They’re an option as well, both personal and business credit cards. You can use Plastiq to avoid cash advance fees and limits, you don’t have any closing costs, and you get reward points.

More experienced real estate investors often borrow all the money they need from friends and family. These private money loans may not even come with fees at all.

How to Refinance a Rental Property

Decided that refinancing your investment makes the most sense for your specific situation?

Start by exploring both portfolio and conventional lenders. Portfolio lenders come with plenty of advantages, most notably that they don’t limit the number of mortgages that can appear on your credit history. They also don’t appear on your credit report, can close faster than traditional mortgage lenders, and offer far more flexibility.

Portfolio lenders also make it much easier to borrow a mortgage for an LLC-owned property.

In some cases traditional lenders charge slightly lower interest rates however. Compare actual prequalified interest rates at Credible*, or compare portfolio lenders on our rental property mortgages page.

Borrowers with excellent credit scores can borrow up to 80-90 loan-to-value ratio (LTV). Weaker borrowers can expect to borrow 60-70% LTV, and they’ll pay higher mortgage rates.

As you establish relationships with specific portfolio lenders, you can often secure discounted interest rates and fees. The better your relationship with a lender, the more likely they are to offer flexible loan requirements as well.

You can also try calling around local and regional banks, to ask if they offer investment property mortgages. It takes more work, but you could find a hidden gem of a lender offering flexible loan terms and affordable loan rates.

Here’s a quick overview of today’s mortgage interest rates:

| Owner-Occupied Mortgages for House Hacking | Conventional Mortgages for Investment Properties | Long-Term Portfolio Mortgages | Short-Term Fix & Flip Loans | Private Lenders & Seller Financing | |

|---|---|---|---|---|---|

| Where to Check Rates | Try Credible | Try Credible | Try Kiavi, Visio, or Forman Loans | Try Kiavi, Forman Loans, Civic, or New Silver | Ask people you know! |

| Loan to Value (LTV) | 80-97% | 80-97% owner-occ, 75-80% investors | Up to 80% | Up to 90% + 100% of renovation costs | Negotiable |

| Credit Score | 500+ | 620+ | 600+ | 575+ | No minimum |

| Debt-to-Income Ratio (DTI) | 28% - 36% | 28% - 36% | No income docs required | No income docs required | No income docs required |

| Cash Reserve Requirements | 6-12 mos.' payments | 6-12 mos.' payments | 0-6 mos.' payments | 0-6 mos.' payments | None |

| Interest Rates | 15-Year: 6.50% - 7.99%; 30-Year: 7.25% - 8.13% | 15-Year: 7.13% - 8.49%; 30-Year: 7.99% - 9.49% | 7.375% - 9.99% (ARMs) / 7.49% – 10.99% (fixed) | 8.49% – 13.99% | Negotiable |

| Repayment Term | 15 or 30 Years | 15 or 30 Years | 3/1 ARM, 5/1 ARM, 7/1 ARM, or 30-year fixed | 6-18 Months | Negotiable (usually a balloon) |

| Time to Funding | 30-60 Days | 30-60 Days | 10-30 Days | 7-30 Days | Negotiable |

| Loan Limits | $50,000 - $1,867,274 (multifamily) | $50,000 - $1,867,274 (multifamily) | $75,000 - $2M | $75,000 - $2M | Negotiable |

| Report to Credit Bureaus? | Yes | Yes | No | No | No |

| Where to Apply | Try Credible | Try Credible | Try Kiavi, Visio, or Forman Loans | Try Kiavi, Forman Loans, Civic, or New Silver | N/A |

Final Thoughts on Refinancing Rentals

A good loan is a low-interest, fixed-rate mortgage, for a term (15-30 years) that makes sense for your financial goals.

But what if you bought an investment property with a bad loan? A high-interest loan, or an adjustable rate mortgage that just spiked?

Then, and only then, it might make sense to refinance. Still, you’ll need to look closely at how long it will take your monthly savings to justify the cost, and at how much longer you’re extending your debt.

Remember that loan officers are salespeople. They are trying to sell you something — in this case, more debt. Like nuclear reactors, debt can be a useful tool, but it’s also extremely dangerous. Always aim to get the right mortgage when you first purchase, because refinancing later is very, very expensive.♦

What factors are influencing whether you refinance a rental property or take a different route?

Leaders Are Readers, So Keep Reading!

*Credible Disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

What about the Brrrr method? When is a good time to refi then?

Hey Marie, with the BRRRR method you want to refinance for a permanent mortgage as soon as the renovations are complete. Here’s a detailed breakdown of the BRRRR strategy: https://sparkrental.com/brrrr-method-real-estate-leverage/.

Keep us posted on how we can help!

Remember that loan officers are salespeople trying to sell you something. That should put you in the right skeptical state of mind when they start making you offers.

Agreed Joe!

Great timing to read your article. I’ve started getting letters from my mortgage lender asking if I’m interested in a cash-out refi, and I confess I’ve thought about it. Thanks for sharing!

Glad to hear the article was helpful Fara!

Loan amortization is something every real estate investor needs to understand. Look at a full amortization table for any loan before moving forward with it.

Absolutely Pete!

Added some much-needed perspective on this. Thanks!

Glad to hear it was helpful Anya!