Leasing & Onboarding New Renters

Everything you need to know about signing new lease agreements and onboarding new tenants.

Preparing to sign a lease agreement?

Don’t sign it lightly.

Have you collected rental applications from a large pool of candidates? Have you run credit, criminal and eviction reports on all applicants? Collected application fees or charged the screening reports to the renter, to verify they’re committed?

If you’ve done all that, and made all the phone calls to verify income, employment, housing history, etc., and you feel 100% rock solid about this tenant… now you need to make sure you have a defensive lease agreement.

Think of your lease agreement as your shield, your armor. Most state landlord-tenant laws are extremely tenant-friendly, and designed to protect the renter, not the landlord. That means you’re responsible for protecting yourself.

How do you do that? With a comprehensive, protective lease package. Read on for more details, and happy leasing!

“Required Reading” – Start Here First!

Want more? We have you covered! Here’s some further reading on lease agreements, security deposits, move-in and everything else you need to know about onboarding new renters.

Full Library of Leasing & New Tenancy Articles:

How to Buy Turnkey Properties Sight Unseen

The Big Picture on Buying Turnkey Properties Sight Unseen: Turnkey properties are real estate assets that are fully renovated, furnished, and ready for rental or already have a tenant at the time of purchase—but the definition doesn’t apply to everyone. “Sight unseen”...

Best Ways to Find Pre-Foreclosure Homes For Investors To Score Bargains

The Big Picture on Finding Pre-Foreclosure Homes: There are several ways to find pre-foreclosure homes. However, there’s a window between when a borrower defaults and when the property goes to foreclosure auction, during which you can potentially score a great deal....

23 Rental Property Income Tax Deductions For Landlords In 2024

The Big Picture on Rental Property Tax Deductions: Landlords have different rental property tax deductions that can help with keeping more of their income in their pocket. They can deduct virtually every real estate investing business-related expense, and they...

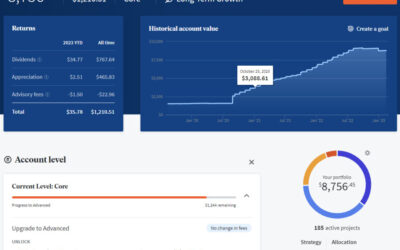

Fundrise Review 2024: An Easy Way to Diversify Your Portfolio?

The Big Picture on Our Fundrise Review: Fundrise is an online real estate crowdfunding platform that allows users to invest in commercial and private real estate without needing to purchase property directly. Investments can start as low as $10, and the platform...

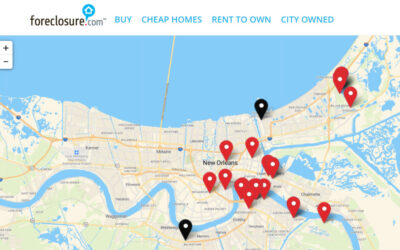

Foreclosure.com Review: Is It Any Good?

The Big Picture on Foreclosure.com: Foreclosure.com provides a large database of foreclosed properties across the US to help buyers find discounted homes. Foreclosure.com helps investors quickly find potential property deals, but remember there are risks in buying...

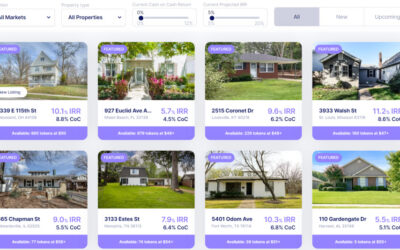

Lofty Review: Fractional Real Estate Investing with Full Liquidity

The Big Picture on Our Lofty Review: Lofty lets you buy $50 shares in rental properties for steady cash flow, with a liquid secondary market to sell your shares at any time without penalties. According to Lofty's estimates, returns are paid daily in USD, with...