The Big Picture on Our Lofty Review:

-

- Lofty lets you buy $50 shares in rental properties for steady cash flow, with a liquid secondary market to sell your shares at any time without penalties.

- According to Lofty’s estimates, returns are paid daily in USD, with estimated annual returns ranging from 0-12% cash flow and 0-15% appreciation.

- Buying and selling shares on Lofty’s marketplace incurs a 2.5% transaction fee, which is waived for new property listings during their initial offering.

The U.S. real estate and infrastructure market is valued at $95.71 trillion in 2023 and is expected to reach $124.82 trillion by 2032. That means there’s a lot of room for growth on the table. Unfortunately, the price of entry is one of the biggest hurdles to real estate investing. Does that mean that people who don’t have thousands of dollars in their bank accounts don’t get to invest? Well, no. Not if crowdfunding platforms like Lofty have a say in it.

There’s a lot to like about the Lofty real estate crowdfunding platform. You can buy fractional shares in investment properties for just $50 apiece, collect daily rental income, and sell those shares whenever you want, similar to stock brokerages.

Now, their secondary market for buying and selling shares relies on some high-tech tools, including blockchain and cryptocurrencies. Not everyone is comfortable in that space, to put it mildly, but a lot of money is moving in these places.

Intrigued? Here’s how Lofty.ai works.

Lofty Review At A Glance

Here’s a quick summary of my Lofty review. (There are plenty more details afterward, so don’t switch off just yet.)

|

Category |

Details |

|

Minimum Investment |

$50 |

|

Prospective Returns (Annual Cash Flow) |

0-12% |

|

Prospective Returns (Annual Appreciation) |

0-15% |

|

Buy Shares Fee |

2.5% (waived for new property listings) |

|

Sell Shares Fee |

2.5% |

|

My Take |

An affordable way to buy fractional shares of rental properties, with full liquidity to sell at any time. However, receiving returns via cryptocurrency adds friction and turns off some would-be investors. |

What Is Lofty.ai?

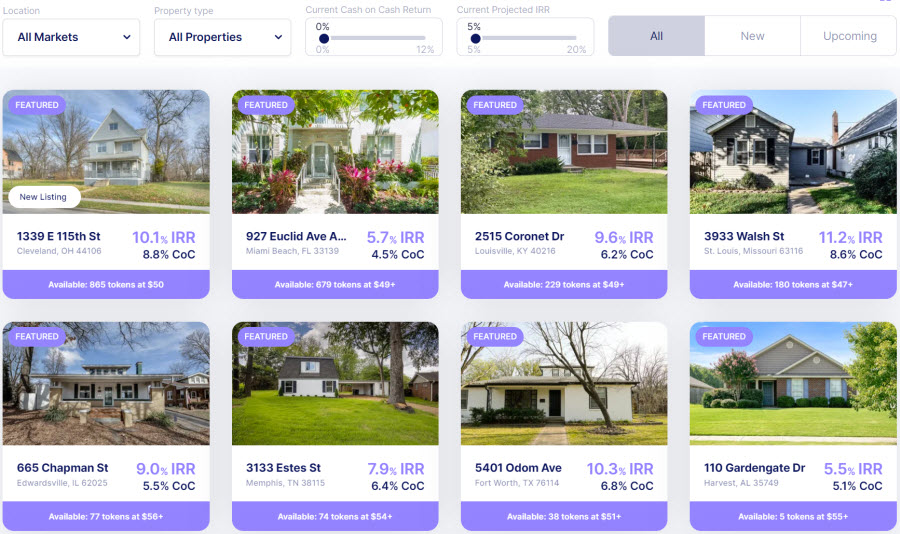

Lofty.ai provides an online marketplace to invest in real estate with the help of blockchain technology. As an investor, you can browse listings for vetted single-family, multi-family, and mixed-use rental properties.

After purchasing tokenized real estate shares in a property, you earn rental income paid out daily. You can also sell your shares at any time through the liquid marketplace. So Lofty.ai opens up real estate investing to more people by providing easy access, fractional ownership, portfolio diversification, and instant liquidity.

However, how do buying and selling shares work on Lofty.ai, and what’s with the connection to cryptocurrencies?

How Lofty.ai Works

When a property gets listed on Lofty.ai, ownership transfers to an LLC with shares priced at $50 each documented on the blockchain. Real estate investors can invest by purchasing these tokens representing fractional ownership.

After the initial shares sell out—pretty much like IPO—the lofty tokens trade on Lofty’s secondary market, where prices fluctuate based on supply and demand. You can fund your account through ACH (0.8% fee, $5 max), wire (free, $50k minimum), card (2.9% plus $0.30 per transaction), or cryptocurrencies like ALGO, USDCa, and STBL.

When you own shares, you receive daily rental income. Selling involves exchanging into USDCa stablecoin, converting to ALGO (algorand) on either the MyAlgoWallet or Pero Wallet, transferring to a crypto exchange like Coinbase, and finally withdrawing into dollars.

So, not exactly a smooth conversion, which doesn’t look too good for the Lofty review. Thankfully, Lofty knows it is, and they’re working on a way to sell your property shares to receive actual cash.

Advantages of Lofty in Real Estate Investment

Lofty offers plenty to like as a real estate crowdfunding platform. Consider the following upsides as you review Lofty as a marketplace to invest in fractional ownership in real estate.

Liquidity & Secondary Market

The huge difference that sets Lofty apart from most real estate crowdfunding websites is its secondary market, letting you buy and sell shares at any time. That addresses one of the greatest drawbacks when you invest in rental properties: the lack of liquidity.

Many real estate crowdfunding platforms require you to leave your money locked up for years. If they do let you cash out early, they slap you with penalties. So, the ability to buy and sell shares of rental properties at any time takes away some of the fear of investing.

Low Minimum Investment

Removing another major obstacle to real estate investing, Lofty sets share prices (token prices) at $50 apiece for new offerings. I can only think of a few other real estate crowdfunding platforms that let you invest with that little (Fundrise, Groundfloor, and Concreit).

After the initial sale, share prices float on the market. You can buy shares for as little as $40 on the Lofty marketplace.

Non-Accredited Investors Allowed

You don’t have to be a wealthy accredited investor to buy shares on Lofty. Anyone with $50 in their bank account can invest.

International Investors Allowed

For that matter, you don’t have to be a U.S. citizen or permanent resident, either. Foreign investors can invest on Lofty’s crowdfunding platform as well.

Daily Rental Income

Lofty provides passive income, and few investments pay out daily. Beyond being fun to watch the money come in daily, it also means more rapid compound returns on your investments based on your holding period.

Just don’t expect it to rain in your account. You’re usually still looking at 5-12% annualized returns.

As a final thought here, you receive rental income in U.S. dollars, not cryptocurrency.

Diverse Property Options

At the time of this writing, the Lofty.ai marketplace features 148 properties in real estate markets across 11 states. And at $50 per token, you could spread a relatively small amount of money over many properties in over a dozen cities.

Detailed Information for Each Property

Property listings on the Lofty marketplace feature a wealth of information. Beyond the basic financials of the property value, current rent, property taxes, insurance, and other operating expenses, you can also view home inspection reports, property valuation reports from HouseCanary, renovation details, closing statements, purchase contracts, and more.

You can also view the current occupancy status, recent property updates, and information about the neighborhood, along with other information. This way, you’d see whether it’s a good investment opportunity.

Polished Online Platform

As a high-tech real estate company, Lofty’s online marketplace and platform are polished and professional. From interactive visuals to a clean interface, expect a slick user interface.

One particularly nice touch is their visual returns calculator. For any property, you can use sliding scales to select the appreciation, cash-on-cash return, and number of tokens purchased, and it graphs your projected compound returns over time.

Vote on Property Decisions

Owning even a single share of a rental property entitles you to vote on decisions regarding property management and selling the property. Even fractional real estate owners are still owners; you get a say in all decisions.

$25 Signup Bonus

When you click our referral link to Lofty.ai, you receive a $25 bonus to kick off your investments. (We get a similar bonus for full transparency in our Lofty review!)

That means you instantly earn a 100% return on your first $25 invested on Lofty’s platform.

Downsides of Lofty.ai in Real Estate Investing

For all those impressive upsides, Lofty comes with its share of drawbacks. Remember the following as part of your Lofty review and due diligence.

No Cash Option When Selling Shares

When you sell your property ownership tokens, you get paid in USDCa, a stablecoin cryptocurrency. Sure, it’s tied to the U.S. dollar, but that doesn’t satisfy every investor’s concerns.

Additionally, the jumps between different crypto networks mean that you need to contend with multiple fees. The Algorand Blockchain Network charges a fixed 0.001 ALGO for every transaction (the conversion changes, but it is roughly $0.0002 today).

Then, you need to sell or convert your assets on Coinbase, which also charges a fee. A quick look at Coinbase’s site indicates that “These fees are calculated at the time you place your order and can be influenced by factors such as your chosen payment method, order size, market conditions, and jurisdictional location.”

So, not only do you have plenty of hoops to jump through, but you also have to pay for the privilege of doing so.

Lofty promises it’s working on a way to get paid out in actual cash when you sell your shares, and that can’t come soon enough for some investors. But as long as that doesn’t materialize, this will be a negative point for our Lofty review.

Fees for Buying & Selling Shares

Anyone interested in trying Lofty needs to review their fees, as the platform actually charges significant fees for both buying and selling shares. When you buy or sell shares on their secondary market, you pay 2.5% on each transaction.

Granted, Lofty waives that fee for new properties during their initial offering. But even the 2.5% fee for selling shares is higher than Fundrise’s early withdrawal penalty of 1% on its eREITs and eFunds, and the Lofty transaction fee never expires.

Bear in mind that Lofty also charges a 0.8% fee on inbound ACH transfers. It’s capped at $5 per transfer, and you can avoid it by transferring funds into your Lofty account by cryptocurrency, but that comes with its own headaches.

Inaccurate Cash Flow Estimates

I particularly don’t like how misleading Lofty’s returns forecasts are.

When they showcase a property’s expenses, they ignore vacancy rates, repairs, and maintenance. These expenses often add up to 20% of the gross rent, so ignoring them means woefully overestimating returns.

That means you must calculate the real estate cash flow for prospective properties yourself. Use an independent rental cash flow calculator to forecast returns more accurately.

How Lofty Compares

So, how does Lofty compare to other competing real estate crowdfunding platforms?

First, only two other crowdfunding platforms offer anywhere near the same liquidity: Concreit and Stairs by Groundfloor.

Both pay in the 4-6% range for return on investment, and both are investments in pooled funds of loans secured by real property (not equity investments such as fractional ownership). Concreit dings your returns by 20% (but not your principal investment) if you sell within the first year, and it takes 30-60 days from initiating a withdrawal until you receive cash in hand.

However, the most similar investment model is Arrived (formerly Arrived Homes, full Arrived review here). They, too, offer fractional interest in rental properties, with a minimum investment of $100. However, there’s no secondary market for selling shares, so with Arrived, you’re stuck with your shares until the property sells in 5-7 years or thereabouts.

Fundrise and Streitwise let you buy shares in funds that own multiple investment properties. But they hit you with a penalty if you sell shares within five years, and it can take months to sell and liquidate your shares. That said, the Fundrise early redemption fee of 1% is still lower than the standard fee of 2.5% to sell shares on Lofty. (For more details, read our full Fundrise review.)

In short, no one but Stairs by Groundfloor offers the same liquidity as Lofty, and they offer debt investments that pay 4-6% returns rather than ownership interests in properties. But Lofty’s fees for both buying and selling discourage casual trading and incentivize long-term investing.

FAQs

Is Lofty Legit?

Lofty is a legit real estate investment platform. The startup uses innovative structures like DAO LLCs to enable fractional real estate investments while remaining compliant. The platform also has an average of 7,000 active users every month, which tells us that many people trust Lofty. With prominent backers and five years without regulatory issues, Lofty seems to have found an effective model.

How Does Lofty Make Money?

Lofty makes money by charging a 2.5% fee on buy and sell orders for properties traded on its marketplace. This might be a deal-breaker to people reviewing Lofty for potential investments.

Is Fractional Real Estate a Good Investment?

Fractional real estate can be a good investment, allowing investors to access the asset class with less capital. However, success depends on your investment strategy, such as choosing properties wisely based on location, type, market conditions, interest rates, and other factors – the same key considerations as traditional real estate investing.

Should You Invest Through Lofty.ai?

If you don’t have $50,000 for a down payment on a rental property, Lofty offers an easy way to invest just $50 for fractional ownership in one. Sweetening the deal further, you can sell anytime, removing the long-term commitment that usually comes with real estate.

Just don’t plan on day trading shares in rental properties. The 2.5% fee for buying and selling shares means you should still consider them long-term investments, albeit ones with an instant exit strategy if needed.

Finally, get comfortable with the notion of receiving payouts from selling shares in cryptocurrency. Yes, USDCa is a stablecoin tied to the U.S. dollar, and that removes some risk and volatility. But it still leaves you with a tortuous process to convert rental property tokens into cold hard cash.

That’s it for our Lofty review.!♦

Have you invested with Lofty.ai? What have your experiences been?

Love that you can buy and sell tokens at any time. Too rare in real estate crowdfunding.

Agreed Samuel!

A unique style of investing. Kinda fun to see platforms getting creative to solve traditional problems like lack of liquidity in real estate investing.

Absolutely Laura!

Diversifying real estate investments is just getting easier and easier. Love it

Amen Ora!

Great concept. Not big on getting paid out in crypto, but I’m glad to see they’re actively working on paying investors in US dollars. Might buy a share or two to test it out, and hopefully by the time I want to sell they can pay me in greenbacks.

I hear you Charles! That’s one nice thing about this and some other real estate crowdfunding platforms: you can dip your toe in the water with less than $100.

Interesting use of blockchain technology. Goes to show that blockchain is good for more than just crypto. But I’d really like to see them offer payouts in U.S. dollars, adds a lot of friction to mess around with crypto, even if it’s a stablecoin.

Agreed Jermaine!