The Big Picture on Finding Pre-Foreclosure Homes:

-

- There are several ways to find pre-foreclosure homes. However, there’s a window between when a borrower defaults and when the property goes to foreclosure auction, during which you can potentially score a great deal.

- You have a range of options to find pre-foreclosure homes, some free. The fastest and easiest ways to find pre-foreclosure leads cost money.

- Speed matters: it helps to reach owners before everyone else because competition is fierce.

Everybody loves a bargain—especially on something as expensive as real estate.

Distressed property owners entering foreclosure often don’t have the luxury of time to wait for a full-price offer. They must sell yesterday to avoid the auction block, so they’re often open to a low-price but fast-closing offer.

But these off-market properties aren’t listed for sale on the MLS. So, how do you find pre-foreclosure homes?

What is Pre-Foreclosure?

A pre-foreclosure is the period after a borrower defaults on their mortgage and before the lender completes the foreclosure process.

Typically, you’ll have at least 90 days as a homeowner before receiving a notice of sale or an official notice of default, then another 30 days before the lender can file foreclosure proceedings.

This is something you should know if you’re into buying foreclosure homes.

The property gets listed for a public foreclosure auction, but most auctions receive no bids given the lack of access inside, so most lenders have to buy the property back. Then, after more legal work, they can evict any remaining residents before selling it as an REO property on the market.

Purchasing a property in preforeclosure, before the messy auction stage, is often an opportunity to get a good price with motivated sellers keen to avoid foreclosure. Just understand that timing here is complex across many stages–but the chance to negotiate directly with distressed sellers also allows for creative win-win solutions.

Top 10 States With The Highest Foreclosure Rates In 2023

Since we’re all at it, here’s the list of states and their average foreclosure rates.

|

State |

Foreclosure Rate (per housing unit) |

Average Home Price |

Compared to Typical U.S Price |

Real Median Household Income |

|

New Jersey |

1 in every 794 |

$507,923 |

145% more |

$92,340 |

|

Maryland |

1 in every 816 |

$418,269 |

119% more |

$108,200 |

|

Nevada |

1 in every 818 |

$432,527 |

124% more |

$72,330 |

|

South Carolina |

1 in every 832 |

$287,956 |

82% more |

$61,770 |

|

Delaware |

1 in every 843 |

$370,761 |

106% more |

$80,750 |

|

Illinois |

1 in every 873 |

$255,659 |

73% more |

$78,020 |

|

Florida |

1 in every 932 |

$407,218 |

116% more |

$65,370 |

|

Ohio |

1 in every 955 |

$220,031 |

63% more |

$67,520 |

|

Connecticut |

1 in every 1,025 |

$405,050 |

116% more |

$90,730 |

|

Indiana |

1 in every 1,144 |

$233,554 |

67% more |

$70,030 |

Now, let’s get into the ways of finding pre-foreclosure homes.

Ways to Find Pre-Foreclosure Home Listing

You’ve decided you want to try and buy pre-foreclosure properties before they go to auction. Great — now, how do you actually find them?

Try these options to find pre-foreclosure homes before the gavel drops.

1. Check Public Records For Pre-Foreclosure Listing

In the days of yore, people went to the courthouse to check public foreclose motions. I’ve done that myself, if you can believe it.

Today, some jurisdictions post pre-foreclosure filings on their websites. But don’t expect a uniform system for these across the country—these are all handled on the local level.

If you’re looking for the most cost-effective way to find pre-foreclosure listings, this is it. Just beware that it’s often clunky and time-consuming.

Once you find pre-foreclosure properties, you can reach out to the owner via direct mail campaigns or even text messages or email if you have access to a service that provides these.

2. Use a Subscription Service

Several excellent platforms provide you with up-to-the-minute foreclosure information in a user-friendly format. You can search geographically and look at pre-foreclosure filings on a map, filter search results, and view other types of distressed sellers, such as divorce filings and tax liens.

The catch, of course, is that you get what you pay for. None of these services are free.

Our favorite two distressed property services are Propstream and Foreclosure.com. Both let you view many distressed properties and come with all the bells and whistles outlined above.

Check out our full Propstream review and Foreclosure.com review for full details about each, and you can preview Foreclosure.com below:

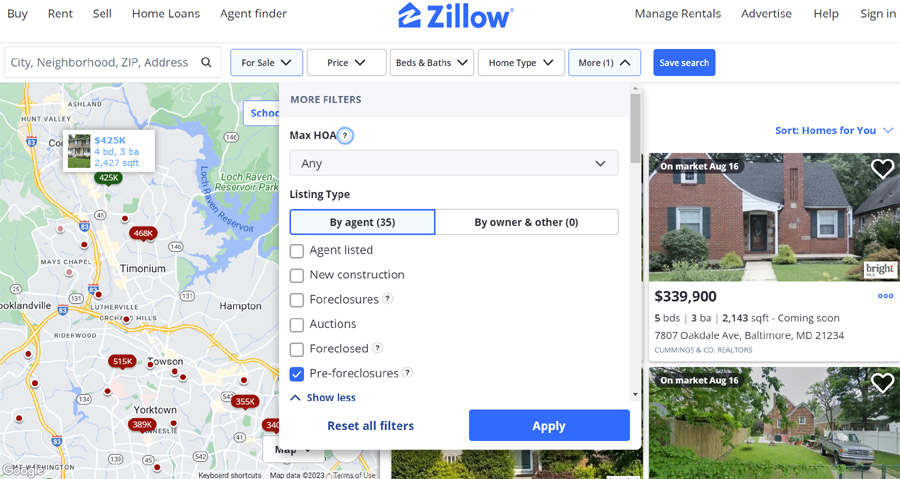

3. Use Zillow

Everybody knows Zillow, for better or worse. You can also view pre-foreclosure properties on Zillow. When you do a search on Zillow, go under “More Filters” to “Listing Type” and select “Pre-foreclosures.” It really is that simple.

You can even set up email alerts for when new pre-foreclosures meeting your criteria hit Zillow’s system. Zillow’s data isn’t as up-to-date or as extensive as Propstream or Foreclosure.com. But Zillow offers a great place to get started for free as you learn how to buy foreclosure properties.

4. Local Legal Announcement Journals

State laws require lenders to advertise foreclosure auctions publicly to ensure everyone in the public has equal access to show up and bid. So, local legal announcement journals carry ads for upcoming foreclosures.

On the plus side, checking these journals is free or cheap. But you’ll be the last to know about upcoming foreclosures, compared to paying subscriptions to platforms like Foreclosure.com, Mashvisor, and Propstream.

92,896 properties faced foreclosure filings in the fourth quarter of 2023 in the US, so it’s not exactly slim pickings out there.

However, you want to reach prospective sellers before everyone else. Their inboxes get flooded with hundreds of letters from people like you, all offering a solution to their property problem.

5. Build a Network of Bird Dogs to Find Homes For Sale

In real estate lingo, a bird dog keeps an ear out for would-be sellers. If they catch wind of someone in financial trouble, they tip you off — for a generous fee if the property closes, of course.

Once you’ve chosen a target market, start networking with in-the-know people who live or work there. Bartenders, baristas, barbers, hair stylists, postal workers, and local gossip make great bird dogs. Reach out to them often to stay front-of-mind.

The huge advantage of bird dogs is that they often alert you to distressed property owners before the lender files for foreclosure. That puts you in touch with these potential sellers before all those hundreds of other buyers, bankruptcy attorneys, and other solicitors.

6. Network with Real Estate Attorneys For Investment Property

Most homeowners in foreclosure often speak with real estate attorneys about their options before even talking to real estate agents. These attorneys can list you among those options as a fast buyer.

However, that requires a strong relationship with them. For attorneys to reliably refer distressed property owners to you, they need to know and trust you. That requires you to invest a lot of time and often money in taking them out for meals or drinks, getting to know their spouses, and similar wining and dining.

Like most industries, real estate revolves around who you know. So, make this your real estate investment strategy and get comfortable with networking if you want to make the big bucks.

7. Network with Wholesalers

If all of the above sounds like a lot of work, you could skip it and just pay wholesalers their fee to connect with quasi-bargains on properties.

Real estate wholesalers find discounted properties and then turn around and flip the contracts to investors like you. For a markup, of course. You (hopefully) pay less than you’d pay for the market value or the property listed on multiple listing services, but don’t expect the same kinds of home run deals you can create for yourself by reaching out to owners in pre-foreclosure.

Approaching Homeowners in Foreclosure

Owners facing foreclosure are overwhelmed with stress. As a real estate professional, approach them with empathy and tact if you want them to consider working with you. They get inundated with letters from investors wanting to buy their homes. Make your outreach unique and creative so you stand out (I can’t tell you how; otherwise, it won’t be unique).

Remember that most homeowners don’t want to sell; they want to stay. Some investors have successfully offered distressed owners a lease-buyback—letting them stay as renters, rebuild credit, and then repurchase the home. The challenge is how they will afford potentially higher rent if they can’t afford their mortgage. In most cases, they can’t, which raises thorny ethical questions about setting them up for failure

The flip side of that argument is that they’re consenting, competent adults who understand the legal contract they’re entering. But hey, I can’t pretend to have all the answers from a moral standpoint. So, follow your own moral compass as you negotiate arrangements with distressed sellers.

Pros & Cons of Buying Properties In Pre-Foreclosure

There’s one giant, glaring upside to buying pre-foreclosure properties: you can potentially score a great bargain on an off-market distressed property.

However, pre-foreclosure homes come with their share of downsides. First, the sellers are stressed and emotional, making them unpredictable and unreliable. They often change their minds half a dozen times in as many days, sometimes breaking their contact with you.

That’s assuming you can connect with them in the first place. As outlined above, homeowners in foreclosure get hundreds of letters, each promising the moon. It’s hard to stand out amid all that noise.

And it stands out that you must if your marketing campaigns are to yield profits rather than losses. Direct mail campaigns aren’t cheap, so you must close a certain percentage of leads or eat the losses.

Finally, you need to contend with an unforgiving deadline. All too often, homeowners in foreclosure bury their heads in the sand until the last possible moment. They’ll call you a few days before the foreclosure auction, asking how quickly you can close.

Most buyers can’t close within a few days. If you can, you’ll score deals that your competitors miss. That requires an unbelievably streamlined title review and funding process. Your typical investment property lender requires 14–21 days to close a loan, minimum.

FAQs

How many late payments before foreclosure?

Typically, an owner must miss four consecutive mortgage payments before foreclosure proceedings begin, though timing varies by lender and market conditions.

How long does a house stay in pre-foreclosure in California?

In California, the non-judicial foreclosure process typically takes 120 days, though it can take 200 or more.

How long is pre-foreclosure in Texas?

In Texas, a mortgage must be over 120 days delinquent before foreclosure action can begin.

How long is pre-foreclosure in NY?

In New York, lenders must send a pre-foreclosure notice at least 90 days before starting foreclosure proceedings.

Final Thoughts on Pre-Foreclosure Properties

Make no mistake: buying pre-foreclosure homes is a competitive field. When most people talk about purchasing distressed properties, they mean pre-foreclosures.

Plenty of money can be made if you can overcome the competition. But you need a compelling offer, empathy, and the ability to close lightning fast. Most of all, it helps to get to owners before your competition.

Consider learning under a mentor or senior partner specializing in buying pre-foreclosure properties. It’s both an art and a science; the best way to learn the nuances is from a seasoned veteran.♦

Still, have questions about how to buy pre-foreclosure homes? What’s your strategy to find pre-foreclosure properties?

I suspect AI powered apps will get pretty good at finding pre-foreclosure homes in the near future.

Could be Zell! Depends on how much sensitive credit and financial data they can get their hands on, I imagine.

Good overview. I personally use Propstream, great platform. If you don’t use the most up-to-date methods for finding leads, you put yourself at a huge competitive disadvantage.

Agreed SSM!

My team’s strategy to find pre-foreclosure properties includes checking public records, using subscription services, exploring Zillow, monitoring local legal announcement journals, building a network of bird dogs, connecting with real estate attorneys, and networking with wholesalers. These methods help me discover potential opportunities before properties go through the full foreclosure process.

Wow, you run the full gamut! Definitely helps to have a team in place.

Found success in bank-owned listings, not pre-foreclosure. I found homeowners in foreclosure too difficult to work with. Strange as it sounds, banks are easier.

Thanks for sharing your firsthand experiences Olivia!

I use a subscription service as my secret weapon for discovering lucrative pre-foreclosure opportunities. You gotta pay to play

I hear you LP!

Thanks for sharing!

Glad it was helpful Josh!