The Big Picture on Foreclosure.com:

-

- Foreclosure.com provides a large database of foreclosed properties across the US to help buyers find discounted homes.

- Foreclosure.com helps investors quickly find potential property deals, but remember there are risks in buying foreclosures.

- The downsides of Forecloser.com are that it has no tenant info access, has potential missed listings, and is not free like some other sites.

- Foreclosure.com provides a large database of foreclosed properties across the US to help buyers find discounted homes.

Are you interested in buying homes in foreclosure?

According to real estate data provider ATTOM, there were over 33,270 homes in the U.S. with foreclosure filings this January 2024.

This is where Foreclosure.com could come in handy.

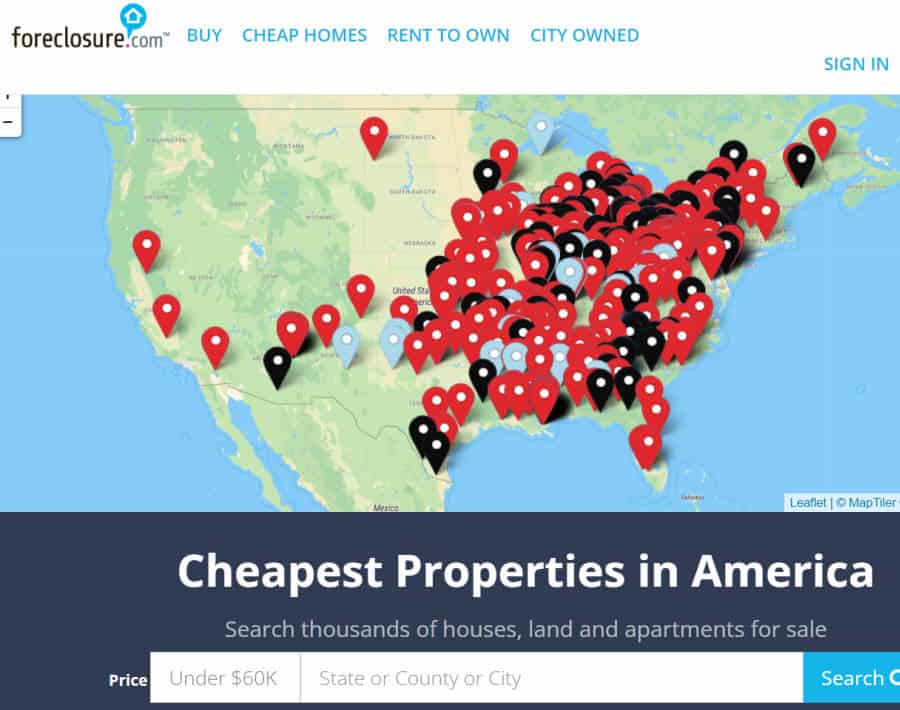

Foreclosure.com is an online platform that has made it easier than ever to search, identify, and purchase foreclosed properties. With an expansive and up-to-date database of foreclosure listings, Foreclosure.com allows investors and homebuyers to find affordable properties.

Strap in for our formal Foreclosure.com review, from how it works to its advantages and disadvantages.

Foreclosure.com Review at a Glance

Let’s kick things off with a quick glance at our Foreclosure.com review:

-

- Property Types Available: Bank-owned homes, government foreclosures, pre-foreclosure listings, real estate-owned properties (REO), and foreclosure auctions.

- Minimum Investment Required: The earnest money deposit with a submitted offer, plus any down payment and closing costs. According to Foreclosure.com, you could pay up to $5,000 or more, depending on the property’s price.

- Fees: $39.80/month after a free seven-day trial period.

- My Take: Foreclosure.com has everything you need to browse and buy foreclosed and distressed homes.

What Is Foreclosure.com?

Foreclosure.com is a real estate website that provides an extensive database of distressed properties to search for, with detailed listings on over 1.8 million foreclosures, pre-foreclosures, bankruptcy listings, auction properties, bank-owned homes across the country, and short-sale properties.

As you browse, you’ll notice it’s not just about aesthetics – the focus is on comprehensive real estate information to empower you in your research. While you do need to create a free account to unlock full property details, registration takes seconds.

Foreclosure.com gives investors and homebuyers an advantage, with more property search filters, neighborhood data, and transparency on deal conditions than what limited MLS property listings offer.

Common Types of Listings Found In Foreclosure.com

A March 2023 survey found that fifteen percent of distressed property buyers were owner-occupants, while 85% were likely investors. Which one are you?

Either way, some of the most common listings investors or occupants can find on foreclosure.com are below:

| Listing Type | Description |

| Pre-Foreclosures | Properties that are behind on mortgage payments and are at risk of going into foreclosure in the future. Owners are given a chance to sell and pay off their loan before the bank forecloses. |

| Sheriff Sale Listings | Homes that proceed to a public foreclosure auction led by the local sheriff’s office or sheriff’s sales officer. Investors can bid on the properties. |

| Short Sale Listings | Homes being sold for below the amount owed on the mortgage with permission from the lender. This allows owners to avoid foreclosure and lenders to recoup some money owed. This is usually when the owner can no longer afford mortgage payments. |

| Bankruptcy Listings | Homes being sold to pay off debts as part of federal bankruptcy proceedings. Can provide opportunities for discounts. |

| City-Owned Listings | Tax-delinquent or vacant properties being auctioned off by municipal governments. Often sold as-is. |

| As-Is, Fixer-Upper, and Rent-to-Own Listings | Distressed properties sold below market value that may require repairs before being livable. Some can be gradually paid off over time through lease agreements. |

Best Features of Foreclosure.com

As you review Foreclosure.com, scope out these features designed to simplify buying a foreclosed home.

Search Home Foreclosures

Foreclosure.com focuses on “distressed deals” at every stage of the foreclosure process, including:

-

- Preforeclosure listings

- Foreclosure auctions

- Bank-owned homes (real estate-owned or REO properties)

- Government foreclosures

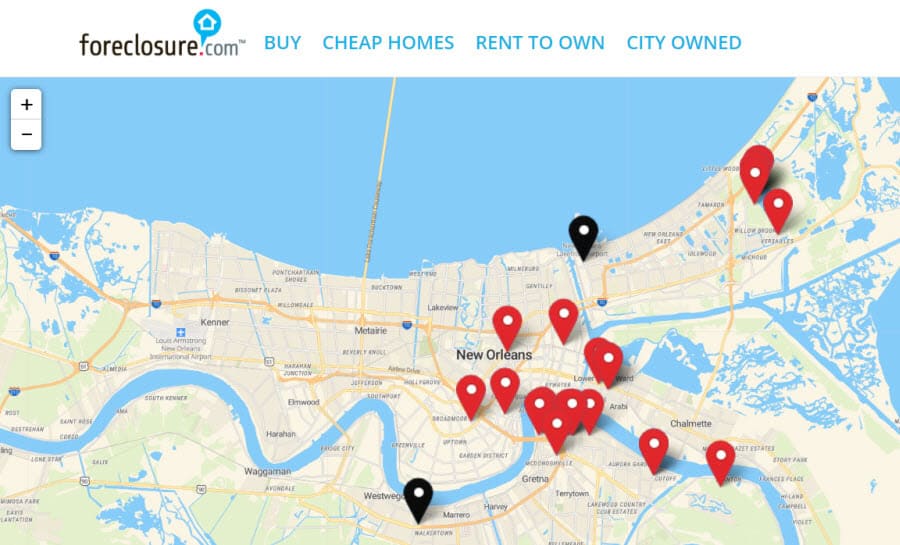

You can search home foreclosures in all 50 states. Filter your search by county or city, or even enter an exact address if you already have a home in mind.

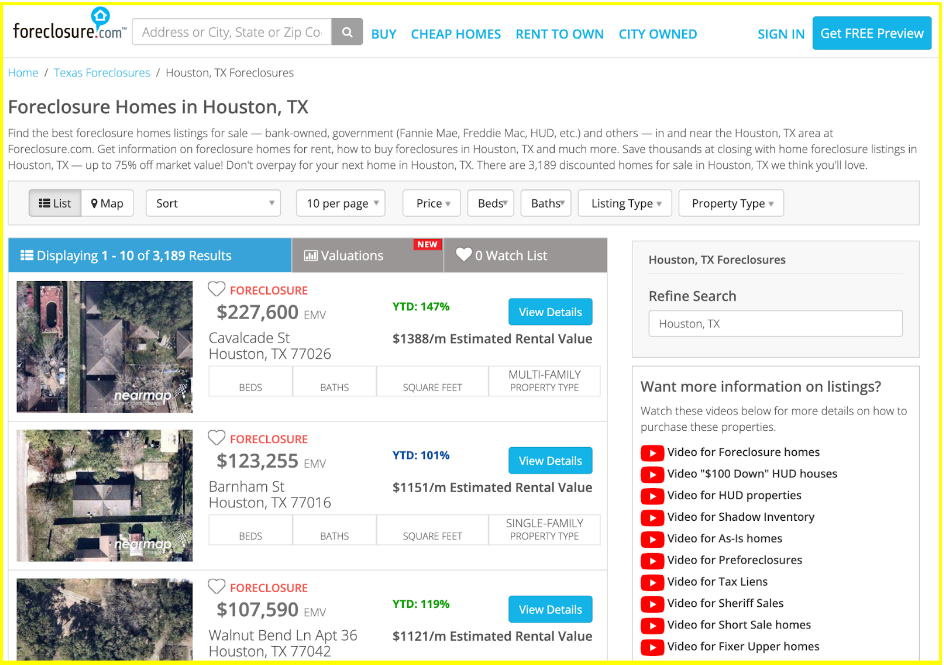

By way of example, here’s a teaser showing current foreclosures in Houston, TX

Detailed Listings

While you must sign in to view every piece of info, the listings on Foreclosure.com are robust. I’ll use an example from my hometown, Portland, Maine, to give you a sense of what a listing looks like.

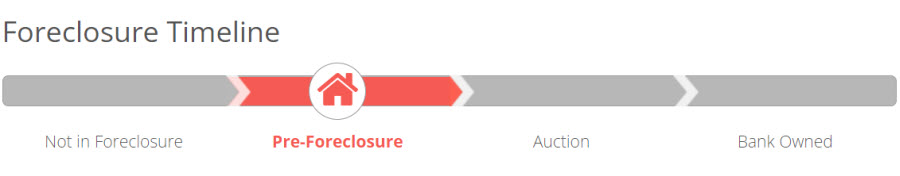

You’ll start with photos (which you can only access after you’ve created an account), and next, you’ll see the foreclosure timeline:

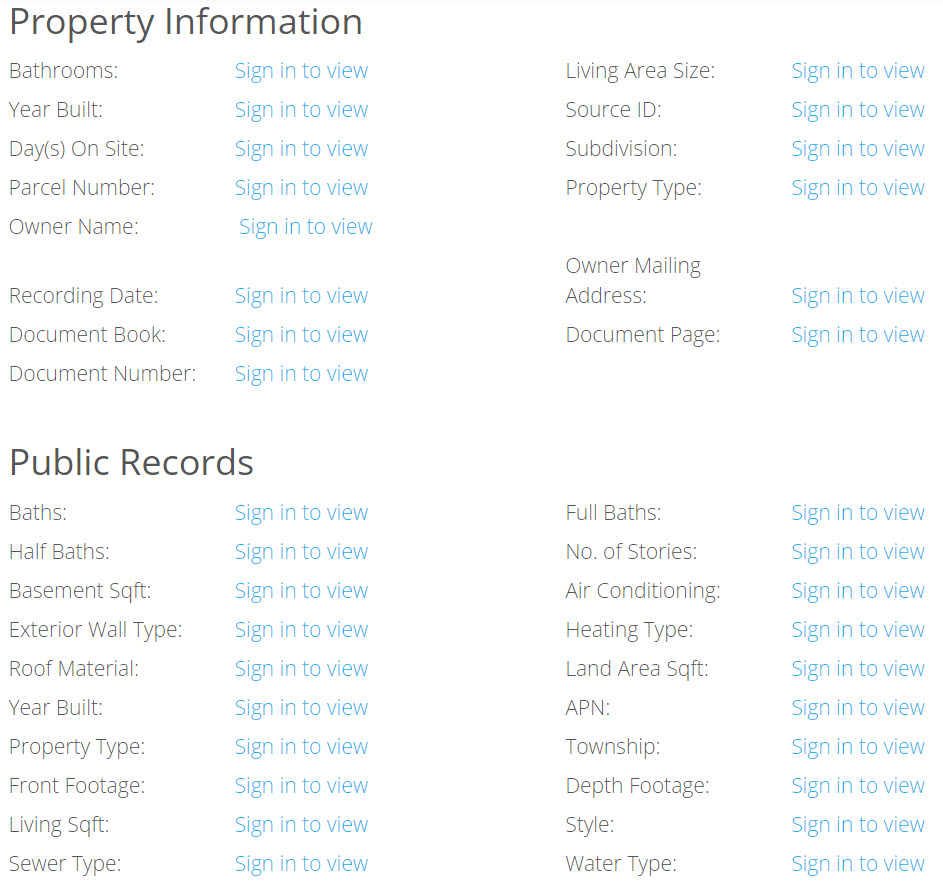

This particular listing has passed the pre-foreclosure phase and is nearing auction. Beyond this, you’ll get to the nitty-gritty: the property information.

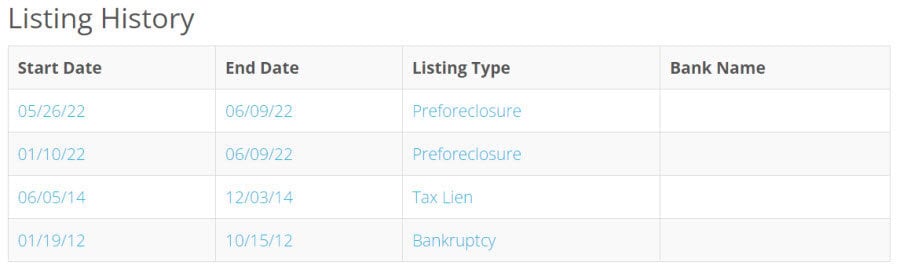

Again, you’ll notice that you must sign in to view this information. However, once logged in, Foreclosure.com provides all the information you need to get a feel for the home and the surrounding area. That includes legal records about the foreclosed home’s history:

As you scroll down through the listing, you’ll see a section that explains the rental potential of the home:

While this is an estimate, it’s pulled from local data and past rental history associated with the property or other similar properties in the area, which is critical in real estate investing.

In general, as long as you have an account, you can see a wealth of details on all properties, and you’ll be provided with the next steps, including information about the public auction, seller, and so forth.

Cheap Home Options

Foreclosed homes usually sell lower than non-foreclosed homes. In fact, foreclosed homes sell for 36.4% less than non-distressed properties. This means buyers can often get steep discounts when purchasing foreclosures.

Even so, Foreclosure.com has an option specifically catering to those looking for really cheap offers, like homes under $60,000. You’ll search just like you would through the homepage, but the search focuses on cheaper homes in your area.

Lower-end investors sometimes have difficulty finding real estate professionals and other support personnel that cater to their niche, making it a useful feature for these investors.

Rent-to-Own Options

Foreclosure.com offers a rent-to-own search feature for aspiring homeowners on a budget that spans nationwide listings, when you select a state and county, a page displays available properties with details like bedrooms and bathrooms.

Sign in to your free account to unlock contact information and initiate the next steps. Helpful tidbits on the process provide context on how these arrangements work.

You’ll notice they also mix in commercial rent-to-own opportunities alongside residential options. While niche, this tool allows you to filter for specific property types that meet your current financial reality and future homeowner dreams.

Fees

Gaining access to Foreclosure.com isn’t free. They offer a free seven-day trial that provides all of the features of a paid account. To continue to use Foreclosure.com, you’ll pay $39.80 per month. While this may not be worth it for beginner investors just looking to browse, for investors who regularly purchase properties, this is a small price to pay, especially compared to competitors.

Foreclosure Knowledge Center

Investors can take advantage of Foreclosure.com’s articles that generally explain the details of the foreclosure process. This is perfect for beginners interested in potentially purchasing a foreclosed home but don’t know much about lenders or aren’t quite ready to do so yet.

Foreclosure Email Alerts

You can also sign up for free foreclosure email alerts. These alerts are sent directly to your email and consist of a list of foreclosed homes for whichever zip code you desire. Additionally, Foreclosure.com offers a list of foreclosure laws and timelines for all 50 states.

Advantages of Foreclosure.com Subscription

Foreclosure.com talks a big game, claiming the title of the largest marketplace of foreclosed homes. And they mostly live up to their boasts. Advantages to Foreclosure.com include:

-

- Comprehensive Database: One of the top features that scores well in our Foreclosure.com review is it provides an extensive and up-to-date database of foreclosed properties, including mortgage records, price range, type of properties, and more, making it easy to find the bargain house of your dreams.

- Easy to Use: The site’s intuitive design ensures that searching for foreclosure is simple, quick, and user-friendly. This also makes it easier for landlords to sell the property.

- Low Cost: Foreclosure.com offers a low-cost subscription model with access to the latest foreclosure listings and invaluable resources such as foreclosure statutes and related news.

- Reliable Resources: Foreclosure.com provides users with reliable resources and support to help them through foreclosure.

Downsides of Foreclosure.com

No Foreclosure.com review is complete without talking about cons. While the platform can be vital for real estate investors looking for low-cost homes, it’s not perfect. A few downsides to Foreclosure.com include:

-

- Lack of Access to Detailed Tenant Information: Foreclosure.com does not provide access to detailed tenant information. Granted, lease agreements between property owners and renters are not on public record.

- Potential for Missed Properties: Foreclosure.com assimilates data from many sources, but that doesn’t mean they catch every distressed property in a given market.

- It Costs Money: Free services allow you to look through foreclosed listings for free, and Foreclosure.com isn’t one of them, at least not in the long term. Still, Foreclosure.com offers more bang for your buck. It provides extensive foreclosure sale information and updates the entire database twice daily.

How Foreclosure.com Compares

Wondering how Foreclosure.com compares to other foreclosure website competitors?

|

Websites |

||||

|

Min. Investment |

Earnest money: varies based on property cost |

Varies by property cost |

Varies by property cost |

None, you cannot purchase foreclosed homes through Zillow, only browse. |

|

Fees |

$39.80/month |

$49.60/month |

Free to sign up |

Free |

|

Property Types |

Bank-owned homes, government foreclosures, pre-foreclosure listings, foreclosure auctions, and more. |

Foreclosures, pre-foreclosures, bank-owned homes, auctions |

Short-sales, foreclosures, regular properties on the open market |

Pre-foreclosures, foreclosure auctions, and bank-owned properties |

|

Year Founded |

1999 |

1996 |

2003 |

2006 |

FAQs

Is Foreclosure.com Legit?

Yes, Foreclosure.com is a legitimate platform for investing in discounted real estate, though access to full listings requires a paid membership after the 7-day free trial.

For both first-time investors and seasoned experts, they provide comprehensive, real-time data to identify promising investment properties. You can filter large inventory spanning pre-foreclosure, repossess, auction and auction dates, and bank-owned homes to pinpoint options matching your buying criteria.

While risks exist when purchasing distressed assets sight unseen, their robust tools can promote informed decisions, like estimating repairs or reading market trends. Investors or real estate agents can gain an edge by seeing deals earlier than on MLS and leveraging educational resources to evaluate real estate deals.

Still, conduct due diligence like touring homes and consulting professionals to maximize investment returns.

Do Banks Hate Foreclosure?

Yes. Banks lose money when foreclosing. They usually sell foreclosed homes at a loss compared to the original mortgage loan amount.

What Is The Best Alternative To Foreclosure?

Forbearance agreements. They temporarily pause mortgage payments, buying you time to get your finances in order. If you meet the terms, the lender cannot foreclose.

What Exactly Is a Short Sale?

A short sale is when a lender accepts less than what is owed on a mortgage to let a financially struggling homeowner sell their property. The lender writes off the remaining loan balance.

Who Has The Most Foreclosures?

Among large metro areas, those with the highest foreclosure rates in January 2024 were Spartanburg, SC, Columbia, SC and Cleveland, OH.

Foreclosure.com Review: Is It Worth It?

So that’s it for our Foreclosure.com review! If you’re looking for a simple, get-to-the-point site to help you find distressed sellers in your area, you’ve found it with Foreclosure.com. While the monthly fee adds up over a year, those planning to purchase multiple investment or rental properties in the year may find the price well worth it, thanks to the robust database of homes.

Overall, Foreclosure.com is an excellent resource for those seeking to purchase a foreclosed property. Every time I had a question about a process or a listing, I was able to find the answer in minutes on the site. The wealth of educational material and helpful customer support to assist users throughout the process. While the platform’s look feels a little outdated, everything you actually need to know still exists within the listings.♦

Have you ever bought a home in foreclosure? Did you use Foreclosure.com? What kind of experience did you have?

I’ve been interested in buying foreclosures for a while now. Will check these guys out.

Keep us posted Martha!

Foreclosure.com’s analytics are superior. It’s pretty impressive

Glad to hear that feedback Jacob!

My first property was from foreclosure.com. Bought it really cheap, then flipped it. Been a good resource for me, and worth the cost.

Glad to hear it Oscar!

Emotions got in the way when I first thought about buying a property in foreclosure. But the simple fact is that foreclosed houses don’t just disappear. Somebody buys them, and if I can be that person, I can make a dilapidated house into a nice home for someone else.

Absolutely Sarah!