The Big Picture on Our Fundrise Review:

-

- Fundrise is an online real estate crowdfunding platform that allows users to invest in commercial and private real estate without needing to purchase property directly. Investments can start as low as $10, and the platform offers many ways to invest in real estate.

- Fundrise offers a range of investment plans catering to different investor goals, including Income, Balanced, and Growth plans, with the added flexibility of choosing individual REITs for Pro members. However, these investments come with associated fees.

- People interested in investing in Fundrise need to do their due diligence, especially with related fees. While the platform presents an attractive platform for diversifying into real estate, investors must be mindful of the liquidity constraints. The platform emphasizes long-term investment, with penalties for early share redemption within five years.

Despite being a real estate investor and landlord, I love crowdfunding platforms. You can take $10 and invest it in dozens of different properties rather than investing $100,000 in one property.

It comes with a cost, of course. You don’t have the same control over your investments and must pay someone else fees to buy and manage the deals.

However, Fundrise remains one of my favorite real estate crowdfunding investments. Here’s why I invest my personal money with them, along with a clear-eyed review of Fundrise’s pros and cons.

Fundrise Review at a Glance

Let’s kick this Fundrise review with a quick summary, with further details discussed below.

| Category | Details |

| Minimum Investment | $10 |

| Prospective Returns | 2-5% annual dividends, 0-22% annual appreciation |

| Fees |

Annual Advisory Fee: 0.15% of assets Annual Asset Management Fee: 0.85% of assets |

| My Take | Fundrise offers an easy way to diversify your real estate portfolio. With as little as $10, you can buy shares in commercial real estate, apartment buildings, single-family rental properties, and property-secured debts all over the US. Just don’t invest money you might need back within the next five years. |

How Fundrise Works

At the simplest level, Fundrise offers a series of private REITs. A real estate investment trust (REIT) is a pooled fund that owns many different commercial and private real estate assets and loans secured against real estate.

When you invest with Fundrise, you choose between their Income, Balanced, and Growth investment plans. Previously, you had to invest at least $5,000 to pick a plan, but now, investors can invest with Fundrise with as little as $10.

The Income plan provides more consistent dividends, usually in the 4-5% range. The Growth plan aims to maximize your long-term returns, with less dividend income now but investment for greater appreciation. As you can guess, the Balanced plan mixes both investment strategies.

For $10/month or $99/year, you can upgrade to a Fundrise Pro membership and pick and choose individual REITs within Fundrise’s portfolio. You can set your custom asset allocation, deciding how much of your portfolio you want and which funds and properties you want.

Finally, accredited investors get access to private investment options such as fractional property ownership in specific buildings.

Selling Your Fundrise Shares

Real estate is an inherently long-term investment, at least when you invest for income and growth (buy-and-hold) rather than flipping.

There’s no organized secondary market to buy and sell Fundrise shares to other investors. You can transfer your shares to another Fundrise investor if you find one willing to buy them. More commonly, you can redeem your shares by selling them back to Fundrise, but if you do so within five years, they hit you with a penalty.

Well, sort of. Every quarter, Fundrise offers to buy back shares of their Interval Fund (also called Fundrise Flagship Real Estate Fund) with no penalty. However, they do charge a 1% penalty for early buyback of other fund shares, such as Fundrise eREITs.

What’s the difference between their Interval Fund and their eREITs? Good question. The Interval Fund is a large, baseline real estate fund that has the discretion to move around as needed. Other eREIT funds own specific sets of properties.

Your account will likely own shares of the Interval flagship fund and some in other eREITs.

The bottom line is that you can sell shares back to Fundrise in any quarter, but you might pay a small redemption penalty if you do so within five years of buying.

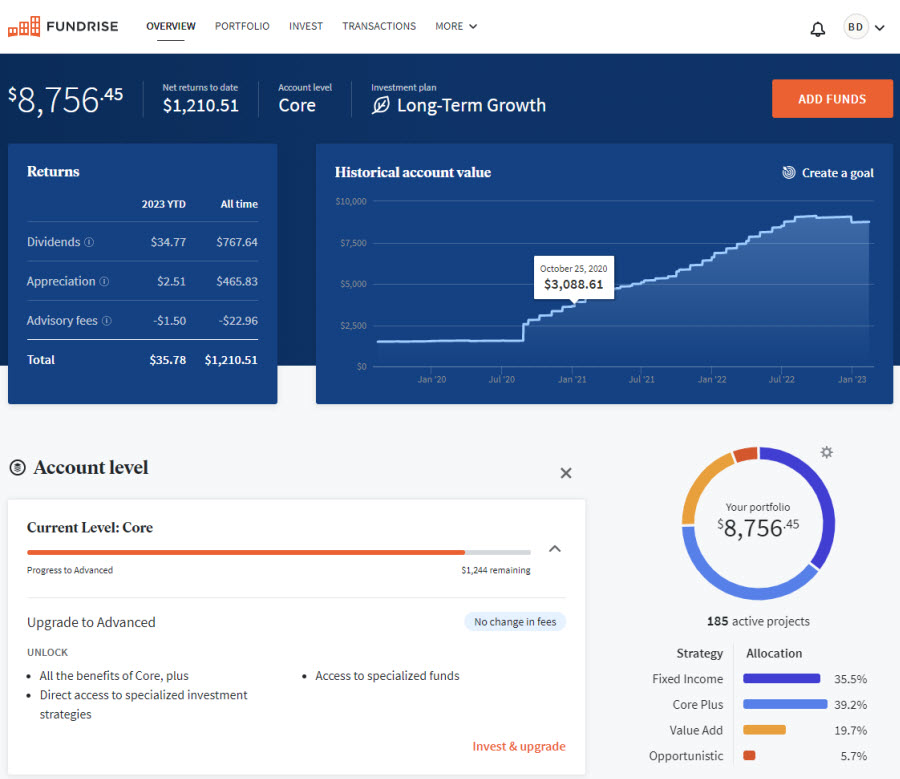

Fundrise Demo Video

Want to peek under the hood of my Fundrise account?

No review of Fundrise would be complete without seeing what it looks and feels like. Here’s how it works to invest through the Fundrise website dashboard:

Fundrise Returns

Fundrise had a rough 2023, delivering an average return of -7.45% across all accounts. However, Fundrise prices its shares based on current values, while stocks and publicly traded REITs are priced where investors believe values will go in 12-18 months.

In 2022, Fundrise delivered an average return across all portfolio types of 1.50%, beating the S&P 500 (-18.11%), public REITs (-25.10%), and bond markets (-11.99%) by double-digit returns.

In 2021, Fundrise averaged a 22.99% return across all its funds and investments. Across the three main investing plans, that breaks down to a 17.98% return for the Income plan, a 23.18% return for the Balanced plan, and a 25.12% return for the Growth plan.

And before that? Going back seven years, here’s how Fundrise’s average returns have compared to publicly-traded REITs and the S&P 500:

| Year | Fundrise | U.S. REITs | S&P 500 | Difference (Fundrise vs. U.S. REITs) | Difference (Fundrise vs. S&P 500) |

| 2023 | -7.45% | 11.48% | 26.29% | -18.93% | -33.74% |

| 2022 | 1.50% | -25.10% | -18.11% | 26.60% | 19.61% |

| 2021 | 22.99% | 39.88% | 28.71% | -16.89% | -5.72% |

| 2020 | 7.31% | -5.86% | 18.40% | 13.17% | -11.09% |

| 2019 | 9.16% | 28.07% | 31.49% | -18.91% | -22.33% |

| 2018 | 8.81% | -4.10% | -4.38% | 12.91% | 13.19% |

| 2017 | 10.63% | 9.27% | 21.83% | 1.36% | -11.20% |

Over that time span, Fundrise has paid an average income yield of 4.81%, compared to 4.21% by U.S. REITs.

Fundrise also provides more stable returns than publicly traded REITs. Investors don’t see the same wild volatility — look no further than 2022’s collapse in REIT values.

Also, public market REITs share an uncomfortably close correlation with stocks. For true diversification away from stocks, you need to get off the public stock exchanges.

Fundrise Fees & Expenses

Before jumping into Fundrise, we need to review their charges.

As outlined above, Fundrise charges a 0.15% annual advisory fee and a 0.85% annual asset management fee (1% total annual fee on assets under management).

That does not include their expenses in buying or managing their properties, such as property management fees.

Fundrise offers to waive your 0.15% advisory fee when you refer new clients to them. At each investment level, the fee waiver period gets longer. For example, at the $1,000 Basic level, they waive your fee for 90 days for each referral, while at the $5,000 Core level, they double that to 180 days.

If you sell shares in under five years, you also pay a 1% penalty on shares of eREITs, but not shares of the Interval Fund.

If you want to invest through an IRA, you can do so with their partner self-directed IRA custodian. That costs an additional $125 per year. However, you can waive that fee in one of two ways:

-

- Invest $3,000 to waive the fee this year, or

- Maintain a balance of $25,000 or more to waive the fee permanently.

Lastly, it’s worth noting that you can never fully know what hidden charges take place behind the curtain. If you own an apartment building, for example, and you handle repairs in-house, you could record a $15,000 roof repair bill that only costs you $5,000.

This means you should focus more on net-of-fee returns rather than getting too bogged down in the stated fees. Look at the annual returns Fundrise has generated over the last five years, and decide for yourself if they’re attractive enough for your money.

Review of Fundrise Advantages

Fundrise comes with plenty of pros, and a few cons as well. Below is a quick review of Fundrise’s upsides.

Low Investment Minimum

Unlike a $50,000 down payment for a rental property, anybody can scrape together $10. Fundrise makes it easy to get started and dip your toe in the waters of real estate crowdfunding.

Take $10 and open an account with Fundrise, if only to see how it works.

Easy Diversification

You can spread your $10 across dozens or even hundreds of properties across the US.

That includes apartment complexes, single-family homes, office buildings, shopping centers, and other commercial properties, making it extremely easy to diversify into real estate.

Available to Non-Accredited Investors

You don’t need to be an accredited investor (a millionaire or high earner over $200,000) to invest with Fundrise.

That’s not the case with many other real estate crowdfunding investments, which only serve accredited investors, as the regulation is easier.

Low Volatility

Stock markets go through double-digit corrections all the time and usually take publicly traded REITs with them, even if the underlying real estate market is healthy.

As outlined above, Fundrise isn’t immune to market corrections and dips. However, the platform doesn’t often see the same double-digit swings that public REITs do.

Passive Investment in Real Estate

Just how passive is rental income from properties you own?

Passive enough while you have a paying tenant. Not passive when you have to advertise vacant units, screen tenants, negotiate lease agreements, make repairs, collect rents, and go through the eviction process. (Although our landlord software can help make all of them easier, cough cough.)

However, investing in real estate crowdfunding platforms like Fundrise makes for truly passive income. You invest once, then let the returns flow in. You can set up automated recurring investments each month if you like and automatic dividend reinvestment.

High Dividends Available

The Supplemental Income investing plan comes with a high dividend yield, often 4-5% per year. You earn relatively stable quarterly dividends, all while your shares appreciate. The downside to higher dividends is that you give up capital appreciation in exchange for it.

Most stocks and mutual funds can’t compete on both yield and appreciation potential.

Invest in Real Estate in an IRA

Fundrise partnered with a self-directed IRA custodian, Millennium Trust Company, to make buying Fundrise shares in your IRA simple. They even offer several options to waive the annual custodian fee, as outlined above.

You can use the same self-directed IRA to invest in real estate of other types, such as rental properties.

Depending on your financial goals, the option to invest in real estate through an SDIRA, especially with the fee waived, can be a huge perk.

Expert Dealfinding & Management

On a related note, you don’t have to worry about learning the skills required to find good deals on real estate, how to finance them with investment property loans, or how to manage properties effectively.

You do not have to do the labor after learning the necessary skills. Fundrise handles all of it for you.

No Liability

Everyone loves to hate and sue landlords. That adds a huge risk to your personal assets, not just your rental properties.

However, with more states and cities imposing criminal penalties on landlords, the risk goes even deeper. You can serve jail time if you run afoul of anti-landlord laws.

It gets uglier out there for landlords every year. That’s precisely why I’ve increasingly started investing in land and through real estate crowdfunding platforms rather than putting so much money into residential real estate investments.

Review of Fundrise Disadvantages

A Fundrise review wouldn’t ring true without a clear-eyed look at its risks and downsides.

Make sure you understand the following disadvantages before investing through Fundrise.

Limited Liquidity

When you buy a stock or a share of a publicly traded REIT, you can sleep easy knowing that you can sell it at a moment’s notice with no transaction cost.

You can’t sell your shares instantly on a crowdfunding platform like Fundrise. You have to submit a redemption request to sell your shares, which Fundrise can opt to honor when it chooses.

They do let you redeem your shares of their Interval Fund penalty-free once a quarter. But you still pay a penalty for selling shares of their eREITs within five years of buying.

Unpredictable Returns

When you buy a rental property, you can predict the annual cash flow with a rental property calculator.

Fundrise used to publish average expected returns for its various investment plans but no longer does so. To be fair, all markets are unpredictable, and no one can predict the future. But it still felt reassuring nonetheless.

Still, you can confidently expect 2-5% per year in dividends, depending on your plan, and anywhere from no appreciation up to double-digit growth.

Historical Returns Trail Stocks

The S&P 500 has generated a higher ROI than Fundrise over the last seven years.

That said, stocks have exceeded their long-term S&P 500 average return of around 10%. Since 2017, Fundrise has delivered a long-term average return of 7.56%.

People always ask me about real estate versus stocks, and which they should invest in. The simple fact is that you should invest in both. Stocks offer strong long-term growth, liquidity, and diversification across industries and countries. Real estate offers higher income yields, more stable returns, and diversification away from volatile stock markets.

I personally aim for around 50-60% of my asset allocation in stocks and 40-50% in real estate. You choose what makes the most sense for your personal finances and long-term goals.

How Fundrise Compares

First, not many real estate crowdfunding platforms let you invest with just $10. The only others that I know of are Concreit and Groundfloor (which allow $10 investments but require a $1,000 opening transfer). Other real estate crowdfunding websites that let you invest relatively small amounts include Ark7 ($20) and Arrived ($100).

Fundrise owns a mix of properties and debts secured by properties. In contrast, Groundfloor only owns property-secured loans, and Concreit mostly owns secured loans (although they also own a fractional share in a real estate syndication). As such, Groundfloor and Concreit pay more moderate but stable returns. Groundfloor averages around 10% per year for the last decade or so and Concreit pays a steady 6.5% dividend yield.

Arrived, Ark7, and Lofty each let you buy fractional ownership in properties. Specifically, you can buy shares in individual properties, including single-family rentals, multifamily properties, and mixed-use properties. You earn rental income proportional to your ownership share and get paid out once it sells after a few years. The business model lets you pick and choose properties to invest in for a pleasant feeling of control. Ark7 and Lofty also provide a secondary market for selling shares after the initial one-year holding period.

However, Fundrise gives you instant diversification across dozens of properties and hundreds of secured loans. And the more you invest with them, the better you can fine-tune your investments. Accredited investors get even more access to specific property deals.

Overall, Fundrise compares well to all its competitors, regardless of your investment goals.

Fundrise Review FAQ

Still have questions about Fundraise that our review didn’t mention? We’ve got you covered.

Is Fundrise Legit?

Yes, Fundrise is a legitimate real estate investment platform. It’s one of the oldest and most established real estate crowdfunding websites. I have thousands of dollars invested with them in a balanced portfolio, including equity and debt secured by real estate properties.

Is Fundrise Safe?

In many ways, Fundrise’s real estate platform is safer than buying REITs — look no further than the volatility in REIT returns compared to the range in Fundrise returns above.

However, every investment comes with risk, and Fundrise is no different. They suffered losses for the first time ever in 2023, as housing markets cooled quickly. Any investment can cause a loss of money, but I like Fundrise’s track record and prospects for long-term returns.

Does Fundrise Actually Make Me Money?

Yes, you can make money with Fundrise. It had an unbroken stream of positive annual returns from 2017 to 2022. However, each investment experience is different, and profitability depends on what real estate projects or Fundrise investments you pick.

Can You Lose Money on Fundrise?

Yes, although they’ve only delivered negative returns as a real estate investing platform in 2023 (see the answer above).

Does Fundrise Pay Dividends?

Yes, even their Starter Plan and Long-Term Growth investment plan pay dividends. You can receive them as cash deposited in your bank account or reinvest them automatically.

How Are Fundrise Returns Taxed?

You receive a 1099-DIV for dividend income from each Fundrise eREIT and their Interval Fund. When you sell shares in these non-traded REITs, you get a form 1099-B documenting your profits (or losses).

If you own shares in the Fundrise eFund, you get a form K-1 each year.

Is Fundrise Registered With The SEC?

Fundrise is a legitimate and SEC-recognized investment platform. You can check the Security And Exchange Commission website for more information.

Fundrise Review: Is It A Good Investment?

I invest using the Fundrise platform myself, so I clearly believe that it is an income-producing real estate platform—but it’s not necessarily the best crowdfunding real estate platform out there.

You should only invest money with Fundrise that you’re comfortable leaving invested for at least five years. Which, by the way, is true for almost every real estate investment. If you’re looking for short-term real estate investment opportunities, try Groundfloor or Concreit.

I recommend starting with a small initial investment to get comfortable with it as a real estate investment platform. That’s how I started, and I have gradually invested more and more money with them over the last few years. So far, I’ve been pleased with the returns, the diversification, and the ease of use.

Consider diversifying further with Lofty, Streitwise, and Arrived (see our full Arrived review for details). Each brings its unique pros and cons. Or try Groundfloor if you’re looking for a real estate crowdfunding platform for short-term investments. If you still don’t feel comfortable with these platforms, you can ask a financial advisor to review Fundrise and any other investment platform you’re interested in. ♦

What do you like and dislike about Fundrise? Let us know about your thoughts or experiences with them below!

Full Disclosure: In addition to being investors in Fundrise, we are also partners with them and receive a commission when we refer other investors to them. Transparency = important!

I like the idea of investing in real estate with $10. Going to try it out with a little money and see how I like the platform! Thanks for sharing.

Let us know what you think about them Jennifer!

A great investment platform!

Agreed Senia!

Thanks for sharing this! I am going to start investing in Fundrise. Wish me luck!

Good luck Lisa! Not that you need it 🙂

Great platform to diversify investment. I have some money in Fundrise and some in traditional REITs, and wish I had more in Fundrise and less in REITs at this point.

I hear you Jake!

Fundrise is a good option for diversifying your portfolio. Still a long-term investment, but their early redemption policy is pretty investor-friendly, at most charging a 1% fee on a portion of your portfolio.

Agreed Orla!