Passive Income & Personal Finance

Hint: trading hours for dollars is not a winning long-term strategy

Ready to up your finances’ game?

We aren’t just a “real estate investing website” or a “landlord site.” We’re passionate about helping everyday people build passive income from rental properties, and create their ideal life.

After all, what good are rental properties or extra income if it doesn’t actually result in a better life for you?

So we take personal finance, passive income, and financial independence very, very seriously.

It starts with a commitment to spend less and earn more. To shove a lever in that gap between your spending and your income, and HEAVE HO!

The more of your income goes toward investments, the faster you can accumulate passive income. The faster you accumulate passive income, the sooner you’ll reach financial independence.

If all that sounds loosey-goosey and short on details, well, that’s why we drill down to the details in the articles below.

Reaffirm your commitment to a richer life, buckle up, and start digging in!

“Required Reading” – Start Here First:

Free Video Series: Building Passive Income from Rental Properties

Super excited about what’s possible with passive income from rental properties? Getting pumped about financial independence? We don’t blame you – we love this stuff too!

Check out our free video series on this very topic, at our sister site SnapLandlord:

Full Library of Passive Income & Personal Finance Articles:

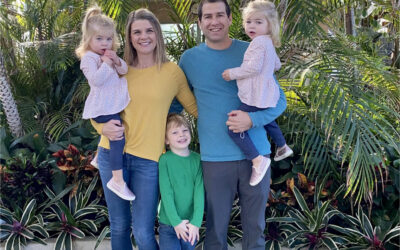

How Greg & His Family Retired Young with Rental Properties

“I wanted to get money out of the way so I could spend my time with kids and a wife (I didn't yet have.)” Greg Wilson retired recently at 42. But he started planning for financial independence and early retirement when he was a teenager: “I am the son of a business...

What Is a Good Credit Score?

Generally, the credit bureaus consider anything over 670 a good credit score. If your score is 671 or higher, you’re doing fairly well. The best credit score and the highest credit score possible is 850 for both FICO® and VantageScore models. FICO considers a score...

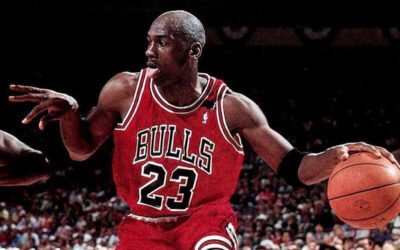

How to Build Unshakable Confidence as a Real Estate Investor

As a kid, I used to watch Michael Jordan lead his team to professional basketball championships year after year. Before every game winning shot, momentum-shifting defensive play, or pass to the right person at the right time, you could see the unshakable confidence in...

Do Real Estate Investors Owe Self-Employment Taxes?

No one likes paying taxes. And that goes doubly for bootstrapping entrepreneurs trying to build income without the safety net of a W2 job. But Uncle Sam sees it differently. The IRS expects self-employed people to pay double FICA taxes, covering both the employee’s...

How to Buy Your First Rental Property with No Money Down

TL;DR On Buying Your First Rental Property: Rental properties require more upfront investment and expertise than equities, like index funds, making them less accessible but potentially offering higher returns with lower volatility due to these entry barriers. Various...

What Would Happen to Early Retirees If the Great Depression Happened Again?

One of the most common critiques of the FIRE movement (financial independence, retire early) goes as follows: “Sure, you can live off your investments when times are good, but what happens when the market crashes?” A valid question, and one that every prospective...