One of the most common critiques of the FIRE movement (financial independence, retire early) goes as follows:

“Sure, you can live off your investments when times are good, but what happens when the market crashes?”

A valid question, and one that every prospective early retiree should answer for themselves. But you don’t have to answer it alone.

I decided to look at the mother of all crashes, the Great Depression, and explore what would happen to FIRE practitioners if the worst moment in economic history repeated itself now.

How Far Assets Dropped in the Great Depression

There’s no sugarcoating it: the Great Depression was an investor’s nightmare.

For that matter, it was everyone’s nightmare.

See for yourself just how badly major asset classes fared during the Great Depression.

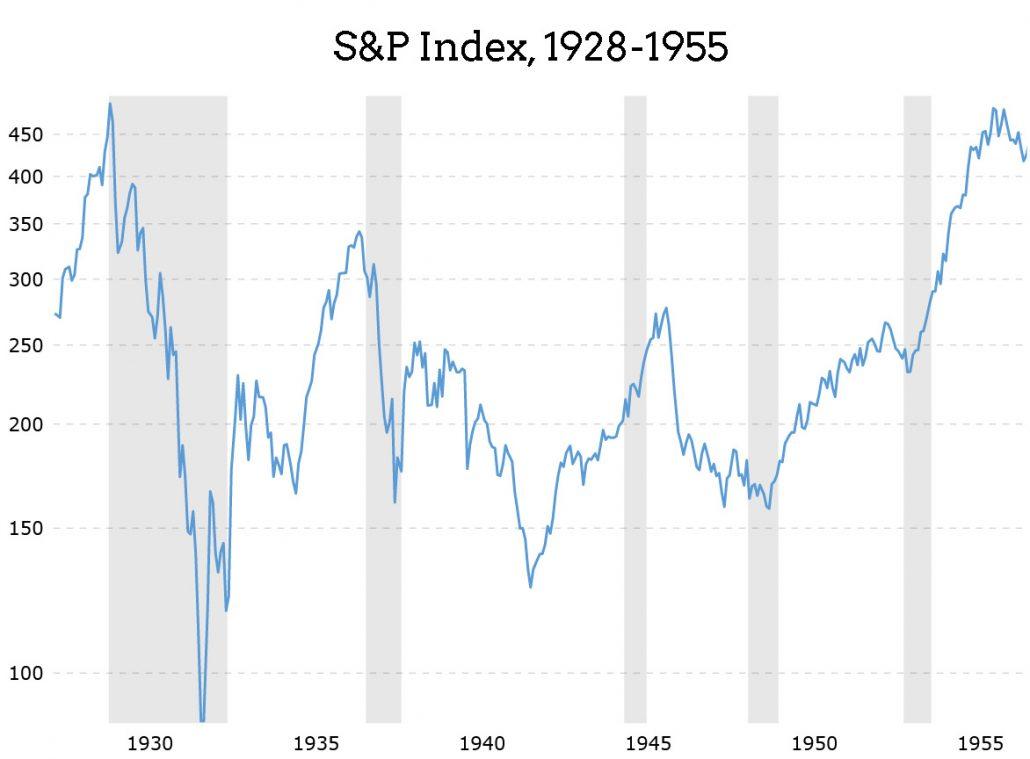

Stocks

The S&P (it wasn’t yet the S&P 500 then) reached its peak on Sep 16, 1929, and then proceeded to collapse by a gut-wrenching 86% over the next three years. It hit its low point on July 8, 1932, then began a painstakingly long recovery.

A recovery that took over two decades. It didn’t claw its way back to its 1929 peak again until Sept. 22, 1954: 25 years later, almost to the day.

Woof.

Housing

Real estate prices prove a little trickier to analyze.

Nominal home prices fell dramatically — 67% between their 1929 high and their 1932 low, according to one Harvard analysis. But the US dollar shifted in value so much during the Great Depression that nominal housing prices actually misrepresent the story.

If you apply the Case-Shiller Index (which hadn’t been invented yet) backward to estimate the inflation-adjusted change in home values, they only fell by 7% during that period.

Other economists put the figure somewhere in the middle. According to Encyclopedia.com, real home prices fell an average of 35% nationwide. The same report estimates that 40-50% of American homeowners defaulted on their mortgages at one point or another during the early years of the Depression. New home construction fell 95% over that three-year period, further exacerbating unemployment (which peaked at nearly 25%).

Home prices did recover, and much faster than stocks did. Backward analysis using the Case-Shiller Index puts it at 74 in 1929 before dropping to 69 in 1932, and then rebounding to 82 by 1940.

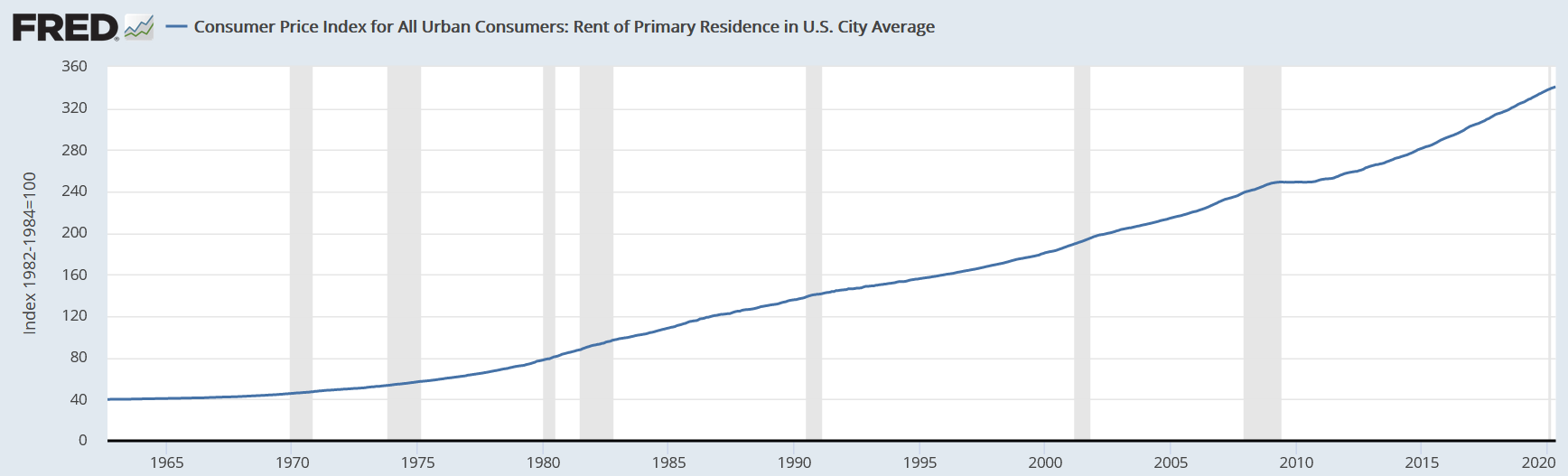

While there’s no readily available data on rents during the Great Depression, we can look at the more recent Great Recession of 2007-2009 as a guide. Home values plummeted similarly during both recessions, but rents remained more resilient in the Great Recession. In fact, they merely flattened, rather than dropping.

Which doesn’t mean landlords were popping Champagne and riding around on unicorns. Default rates, turnover rates, and evictions all rose, which all sent rental returns tumbling. Many landlords lost their properties to foreclosure during the Great Recession, when their tenants stopped paying the rent.

Bonds

Bond prices tend to move in the opposite direction as stocks. As bond yields drop, previously-owned bond prices (which pay higher yields) go up in price.

Which is exactly what happened in the Great Depression. The prime corporate bond yield average dropped from 4.59% in September 1929 to 3.99% in May of 1931. Helped by loose monetary policy, the average corporate bond yield continued falling and reached a new low of 2.94% in June 1938. A similar pattern played out among Treasury bonds.

Overall, bonds returned 6.04% during the 1930s. Which means investors could retreat to the relative safety of bonds and earn a modest but real positive return. They’d have done particularly well with bonds if they bought them early in the crisis rather than waiting. But hindsight is, of course, 20/20.

What If the Great Depression Repeated Itself Today?

First of all, policy-setting economists and the Federal Reserve have come a long way since the 1930s. We collectively have far more data and policy responses than our great-grandparents did.

So I don’t believe we will experience Great Depression-level market crashes any time in the foreseeable future. But that’s precisely the point of this thought experiment: to explore the worst-case scenario.

In particular, the impact on early retirees.

Example Depression Scenario for an Early Retiree

Let’s imagine you retire today with $1.5 million invested. Of that, you have 40% in stocks, 40% in real estate, and 20% in bonds.

You use a 3.5% withdrawal rate on your stocks and bonds, based on Michael Kitces’ analysis of the last 140 years of stock market returns. At no time during that period — including the Great Depression — would you have run out of money with a 3.5% withdrawal rate. Even if you retired in 1929, your portfolio would have survived the Great Depression and would have eventually recovered and taken off to grow higher in perpetuity. Even after 45 years of retirement.

You earn 8% cash flow on your rental properties currently. But to account for higher rent defaults and turnovers, and possibly even lower rents, let’s say that drops to 4% in Great Depression 2.0. You’ve also diversified into real estate crowdfunded investments such as Streitwise and Fundrise, which we’ll say similarly drop in returns from around 8% to around 4%.

So your annual passive income looks like this:

Stocks & Bonds: 3.5% of $900,000 = $31,500

Real Estate: 4% of $600,000 = $24,000 (down from $48,000 or 8% annual returns)

In other words, your passive income drops from $79,500 to $55,500, due to the lower returns on your real estate investments. The notion of safe withdrawal rates don’t apply to your real estate investments, because you aren’t selling any of them, you’re simply collecting the yield, the ongoing income.

How to Protect Against a Market Crash

If the doomsday scenario of another Great Depression reared up tomorrow, how could you protect yourself as someone pursuing FIRE?

In most cases, you simply keep following financial best practices. Here’s a lightning tour of what you can do to protect yourself from an enormous market crash.

Decide on a Risk Strategy Early

It’s one thing to live off dividends and rents and occasionally sell a stock or two while the market is up. It’s quite another when a recession causes your assets to plummet in value, companies go under or stop paying dividends, and tenants lose their jobs and stop paying their rents.

A working 25-year-old can ride out market crashes and barely notice them. They don’t depend on their investments for income, so they can leave them untouched. In fact, market crashes benefit them, because they can buy assets at a discount.

But retirees — young or old — do depend on their investments for income. They have several options to ride out the storm.

First, they can go back to work and start earning active income again, to avoid selling off any assets during the downturn. More on this momentarily.

Second, they can continue living off their investments unfazed, and simply trust that the market will recover. It always has in the past, albeit over vastly varying timeframes.

Third, they can move money to safer, defensive investments early in the crash. For example, they can move money out of sexy, high-growth tech stocks into safe, steady defensive stocks like utilities and consumer staples. However, this strategy comes with an inherent problem: how do you know a market crash is coming? You don’t, of course, which means you need to accept that you may well sell off assets when they pull back 5-10% only to have them turn around and rise again.

Whatever your strategy, set it now so you have a firm game plan before the market plunges.

Protect Your Earning Potential

As long as you can keep earning a living, you don’t need to sell off any assets at bargain basement prices during the crash. You can ride out the down market.

That poses a challenge for retirees who live on their investments, of course. But early retirees have an advantage over traditional older retirees: they can easily return to work.

When a crash hits, aim to avoid selling off any assets if you can help it. For workers, that means ensuring they have an up-to-date skill set in high demand. Their company might go under, but if their skills are valuable, they can find new work easily.

Older workers beware: don’t get complacent and assume you can work your current job as long as you want. A study by ProPublica and the Urban Institute found that 65% of workers over 50 have been forced from a job: 56% have been fired or pushed out of a position, and another 9% have been forced to leave a job due to personal reasons (such as health or caregiving responsibilities). Many never worked again, or ended up taking a deep cut in pay in their next job.

For retirees, that means having a viable plan to start earning again if a recession hits. Though I plan to reach financial independence by age 42, I never plan to “retire.” Work can and should be meaningful, and I plan to keep working in a fulfilling way forever.

Maintain Low or Flexible Living Expenses

The lower your living expenses, the easier they are to cover with active income — even if you take a pay cut.

Low living expenses also mean less reliance on your investments. You may be able to continue living on rents and dividends and bond interest alone, rather than selling off assets.

Plus, low living expenses help you maintain a high savings rate, to build greater wealth faster.

In particular, aim to keep your structural living expenses low, such as your housing payment and car payment. Other costs, such as food, clothing, entertainment, and even insurance you can adjust easily. Find a way to house hack to reduce or eliminate your housing payment entirely!

Keep an Emergency Fund

An emergency fund can sustain you temporarily during a job loss or market crash.

As for how much emergency funds you should have, it depends on how stable your income and expenses are. People with extremely stable jobs and incomes need less cash in an emergency fund than those with variable incomes or less secure jobs. Likewise, people with low, steady living expenses need less in an emergency fund than those with highly variable expenses.

For a general rule of thumb, aim for between two and six months’ living expenses in your emergency fund. I structure my emergency fund with several tiers of defense: cash savings, unused low-APR credit cards, and some money held in extremely stable bond funds (a TIPS fund to protect against inflation). That way, I don’t have to leave a massive amount of cash sitting around losing value to inflation.

If the market crashes, tap your emergency fund rather than selling off your assets at a loss.

Pay Off Your Mortgage(s)

The lowest risk “investment” you can make is paying off your mortgages.

Start with your rental property mortgages, if any. These charge higher interest rates than home mortgages. If you’re on the fence, read these pros and cons of paying off your mortgages versus investing in new rental properties.

Then you can tackle your home mortgage, as another way to lower your living expenses. Try these strategies to pay down your mortgage faster.

(article continues below)

Diversify Your Investments Now

Your parents always told you not to put all your eggs in one basket. Nowhere does that principle apply more than in your investments.

Real estate investors ask me all the time:

“If I can reliably earn a 15% cash-on-cash return on rental properties, with all the tax benefits for landlords, why would I invest in anything else?”

The answer is simple: because there’s safety in diversification.

Investing in many different asset classes, in many sectors, across many countries protects you from a collapse in any one of them.

I invest in all of the following asset types:

ETFs: Exchange-traded funds own a wide range of stocks. It makes it cheap and easy to own shares in US and international stocks, large cap and small cap stocks, across every industry. Open a free robo-advisor account with Schwab or SoFi Invest to let them manage your stock investments for you.

Private REITs: I own shares in Streitwise and Fundrise for ongoing dividend income and growth.

Private Notes & Crowdfunded Loans: I lend money privately to other real estate investors at a 10% return, and lend money to other investors’ crowdfunded loans on GroundFloor for an 8-12% return.

Direct Real Estate Ownership: I invest in rental properties and land.

Invest for Income, Not Just Growth

Some investments generate ongoing passive income. These include rental properties of course, but also bonds, private notes, and dividend-paying stocks, funds, and private REITs. Plus some others that are less applicable to most people, such as royalties.

Income-oriented investments don’t require you to sell off assets in order to generate income to live on. When you don’t have to sell off any assets, you don’t have to worry about sequence of returns risk: the risk of a market crash early in your retirement. The timing of market crashes matters, because if your portfolio has many years of strong growth after you retire, it reaches “escape velocity” by having grown so high that you’ll never spend it down no matter how long you live.

And income-oriented investments tend to be more stable, even during market corrections and crashes.

If You Get Truly Spooked…

If you’ve recently retired and can’t return to work to start earning active income again, and you start panicking about a looming market crash, you do have some options.

As mentioned above, you can move your higher-risk stocks into lower-risk defensive stocks like consumer staples and utilities. People will always buy toilet paper regardless of the economy, as we learned in 2020.

You can also move money away from stocks and into precious metals. Consider them the original safe haven during recessions.

If you like, you can also move money out of high-risk stocks or high-risk bonds into lower-risk bonds, such as government and municipal bonds. While they don’t pay high returns, they do sometimes offer tax perks.

Cryptocurrencies may help you protect against inflation, but they won’t protect against a market crash. Probably. They haven’t been around long enough for much historical data. But consider them a high-risk investment and among the first to drop in an economic downturn.

Just don’t break the rules of good investing in your panic. Think long-term, and err on the side of leaving your existing investments in place.

Final Thoughts

Take heart: even investors who retired in 1929 wouldn’t have run out of money — ever — if they followed a 3.5% withdrawal rate.

And diversifying your investments to include rental properties and other real estate investments will help you weather stock market crashes even better.

Remember, markets are cyclical. Stock market crashes and housing market corrections are inevitable. When they come along, buy up assets if you can afford it. Avoid selling if you can help it.

Most of all, avoid making emotional decisions like panic selling and stick with the fundamentals. As you near retirement, shift your portfolio to include more income-producing investments and fewer growth-oriented ones.

Do that, and even if another Great Depression hits tomorrow, early retirees (and their portfolios!) will survive it intact.♦

Do you worry about an upcoming market crash? Why? What are you doing to prepare, as someone pursuing financial independence or early retirement?

Learn more about financial independence & retiring early (FIRE):

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I’ll definitely recommend this article to my colleague. At least we have an idea before we let go of our day job!

Keep us posted on your progress toward financial independence/retiring early Sally!

This article is superb. So many solutions for early retirees.

Glad you enjoyed it Deana!

Fascinating thought experiment. Thanks for going through this exercise!

Glad you found it as interesting as I did Cally!

God forbid this happens. But if it happens for any reason, people should read this blog. It’s amazing.

Thanks Harry, glad to hear it resonated with you!

Early retirements may come with a price but as long as we can mitigate the possibilities everything would be fine. I’m planning on retiring early but didn’t think of this type of scenario. Thanks for letting me know! Now I know what to do in case doomsday happen. (But I hope it wont! lol)

Definitely a worthwhile thought experiment 🙂

It is better to be prepared than never. We should learn something from this global pandemic.

Amen Adam!

Complacency is my number one enemy. I’ll bookmark this article – feasible and sensible!

Glad to hear it was helpful Aaron!