Build Passive Income with Real Estate

Who says you need to work until you’re 65?

A Passive Income Blog for the Obsessed

Want to work forever?

Want to work forever?

We certainly don’t. Which is why we’re so obsessed with passive income. And while we love stocks, our true passion is passive real estate investing.

My name is Brian Davis, and I’m a passive real estate investor, personal finance writer, co-founder of SparkRental, and world traveler. I get to spend most of the year living abroad hiking, scuba diving, wine tasting, and breaking toes trying to learn how to surf.

Deni (my partner) and I have a simple goal: to help 5,000 people reach $5,000/month in passive real estate income. Want to be one of them? To start stacking up streams of passive income? To reach financial independence and retire early with rental properties or real estate syndications?

We created this real estate investing blog to help you stop relying so heavily on your 9-5 salary and start living more intentionally. Welcome!

The Latest from Our Real Estate Investing Blog

More Cities Upping Legal Liability for Landlords: 5 Tips to Protect Yourself

Years ago, I had a tenant who violated a zoning ordinance. Local laws prohibited placing barbecue grills on the rental property patios or porches. Mind you, this was not about use; it was about storage on the outside of the residential property. Well, guess who...

Tenant Damage to Property: How to Prevent & React to Rental Property Damage

Have you ever had a tenant damage your property? If not, count yourself lucky. As a landlord, the more important question is “How can I prevent tenant property damage?” And, if the worst happens, how do I handle tenant damage to property? How to Prevent Tenant...

How to Buy Your First Rental Property with No Money Down

TL;DR On Buying Your First Rental Property: Rental properties require more upfront investment and expertise than equities, like index funds, making them less accessible but potentially offering higher returns with lower volatility due to these entry barriers. Various...

Rent Stabilization in NYC: What Landlords Need to Know

New Yorkers love to complain about rents. Which is precisely why New York City has more rent-controlled and rent-stabilized units than any other city in the country. With rising home prices and rental rates rising again after falling in the Covid-19 pandemic, here’s...

New Laws Criminalizing Landlords: Is Orange the New Landlord Uniform?

Image Credit: Officer Bimblebury under the Creative Commons Attribution-Share Alike 4.0 International licenseWhen did we as a society start criminalizing landlords? Like so many other creeping, insidious changes in our society, it didn’t happen overnight. An early...

Free Prorated Rent Calculator

The Big Picture on Our Prorated Rent Calculator: Prorated rent refers to charging a tenant for a partial month's rent when the lease starts or ends mid-month. For instance, if a lease begins on September 25, the tenant would owe rent for the remaining days of...

How to Compete with Cash Real Estate Offers

Beaten by a cash offer on your last real estate offer to purchase? You’re not alone. The percentage of cash offers in real estate markets across the country have surged to 25% per the National Association of Realtors, up from just 15% a year ago. Still, you don't need...

How to Find Good Deals on Investment Properties – Even in a Hot Market

It’s been hard to find good deals on investment properties over the last few years. Fueled by low inventory, especially among starter homes, the last five years have seen home values skyrocket. Look no further than Zillow’s Home Value Index, which leapt from $163,000...

What Would Happen to Early Retirees If the Great Depression Happened Again?

One of the most common critiques of the FIRE movement (financial independence, retire early) goes as follows: “Sure, you can live off your investments when times are good, but what happens when the market crashes?” A valid question, and one that every prospective...

Cap Rates in Real Estate Investing: A Non-Nerd’s Guide

Not a big ol’ nerd for personal finance and real estate like I am? No sweat. We’ll keep the math simple. After all, math is a lot more fun when you’re calculating your future riches, right? Break out a cocktail napkin (and a cocktail to match), because calculating cap...

Can Money Buy Happiness? Exploring 11 Ways to Lasting Joy

Average people love to say “money can’t buy happiness.” They’re not only wrong, they’re deluding themselves — and probably not very happy. Many of the same blowhards lob around cliches like “money is the root of all evil.” Guess what? Lack of money is the true root of...

Raise Your Children as Good Entrepreneurs, Not Good Employees

Pause for a moment and consider what makes a good employee. Obedience? Check. Willingness to work long hours creating wealth for someone else? Check. Accepting a job and income controlled by others? Check. Now think about what makes a good entrepreneur....

The “Live Off Rents” Podcast

Prefer to watch or listen to your real estate investing and FIRE tips & tricks? No sweat.

Deni and Brian have been broadcasting live every week to the SparkRental-sponsored Facebook groups since 2017, and started releasing the content via podcast in 2020. Each episode is quick, 15-20 minutes, but jam-packed with actionable content.

No fluff, just advice you can put to work immediately to build passive income from real estate.

If you enjoy the episodes, share them, and please rate and review on iTunes or wherever else you listen!

Recent Episodes

Beyond Education: Group Real Estate Investment Club

Beyond Education: Group Real Estate Investment Club

Learning is wonderful, and we offer nearly endless free education content for real estate investors. But nothing beats getting in the trenches and actually investing to earn real returns.

At your request, we created a real estate investment club that lets you “earn while you learn” with a club of other investors. Every month, we meet on a video call to vet a new passive real estate investment. These group real estate investments range from private parnetships to private notes to real estate syndications and funds for fractional ownership in an apartment complex, self-storage facility, retail or other large property. You get all the benefits of real estate investing, from cash flow to appreciation to tax benefits, without the headaches of buying properties yourself.

Best of all, you can invest with a lot less money. Rather than the $50,000 – $100,000 needed for a typical private equity real estate investment or rental property down payment, you can invest with $5,000 per deal.

Oh, and non-accredited investors are welcome on all deals. We intentionally propose inclusive deals open to all investors.

Who Is this Real Estate Investing Blog For?

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

Well, sure, it’s for aspiring and active investors and landlords. We write about the nuts and bolts of investing passively in real estate syndications or actively in rental properties. We cover topics ranging from real estate crowdfunding to tax benefits, tenant screening to collecting rents, single-family to multifamily to self-storage and beyond.

But while the “how-tos” and “avoid these mistakes” are important, they’re only part of the picture.

The bigger picture? How real estate investing fits into your larger strategy for building wealth and passive income.

Specifically: reaching financial independence to give you the freedom to retire early, if you so choose. Or to supplement your current lifestyle so you can live better or switch to your dream work.

So who is this “real estate investing blog” for? It’s not just for passive real estate investors or active landlords — it’s for anyone looking for creative ways to reach FIRE through real estate investing.

Real Estate Investing & Landlord Education

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

Our real estate investing blog includes hundreds of articles personal finance articles, property management tips, and detailed real estate investing advice. Browse it, search it, use it as a free resource.

But our landlord education doesn’t end with the blog.

We offer a range of free webinars and online masterclasses for real estate investors. We offer a premium course called FIRE from Real Estate, to help you reach financial independence and retire early in years rather than decades. Our weekly newsletter keeps you abreast of rental industry trends, landlord tips, and the best of real estate investing blogs from around the web. And every week, Deni & Brian hop on live video on Facebook for a 15-minute live vlog and answer questions.

What for? Why do real estate investors and landlords need continuing education, anyway?

Because investing in rental properties is not like throwing money in an index fund.

Buying real estate investment properties takes skill (at least if you want to make money). Managing rental properties takes skill.

Your returns on rental investment properties are directly proportionate to your knowledge and skill, both as an investor and as a landlord. If you want to reach financial independence from real estate, you’re going to need to know what you’re doing.

That’s why we’re obsessed with ongoing real estate education at SparkRental. We want you to make as much passive income as possible, as fast as possible, on the fewest real estate investments possible.

More Resources for Investors

Had enough of us going on about the importance of real estate investing education?

“Cut to the goods already Brian! Gimme some free stuff!”

All right, all right. Here are some free real estate investing resources, to help you on your quest for financial independence from real estate:

Real Estate Investing Calculators

Real estate investing involves math. But it doesn’t have to be hard math. Use our free rental income calculator, house hacking calculator, property depreciation calculator and more to get ahead in the game of life.

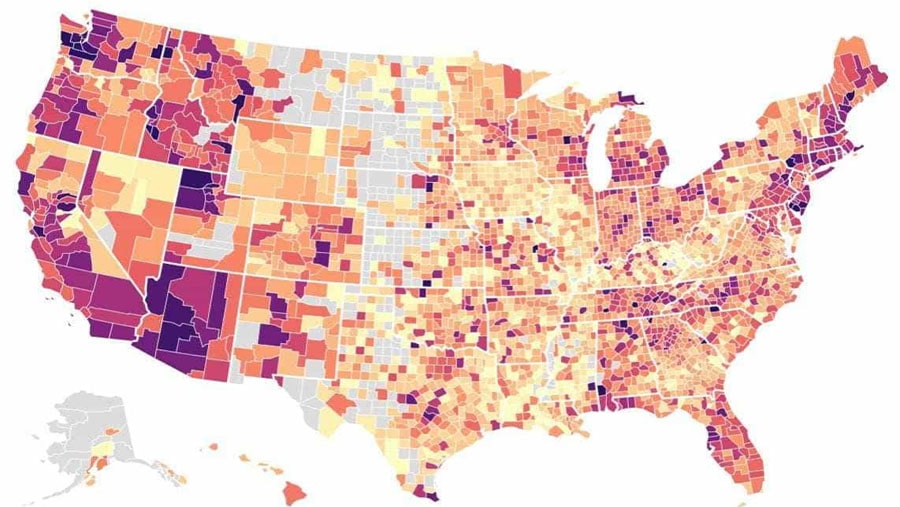

Interactive Real Estate Maps

It’s a big country, with thousands of towns you could invest in. Where should you invest? Why? Check out our interactive maps of the hottest housing markets, cooling real estate markets, best cities for real estate investing by price/rent ratio, and more.

Real Estate Crowdfunding Comparison

Wondered whether real estate crowdfunding investments are worth considering? The answer: some are, others aren’t. But which are worth it? Check out our comparison of real estate crowdfunding platforms — and which we invest in ourselves.

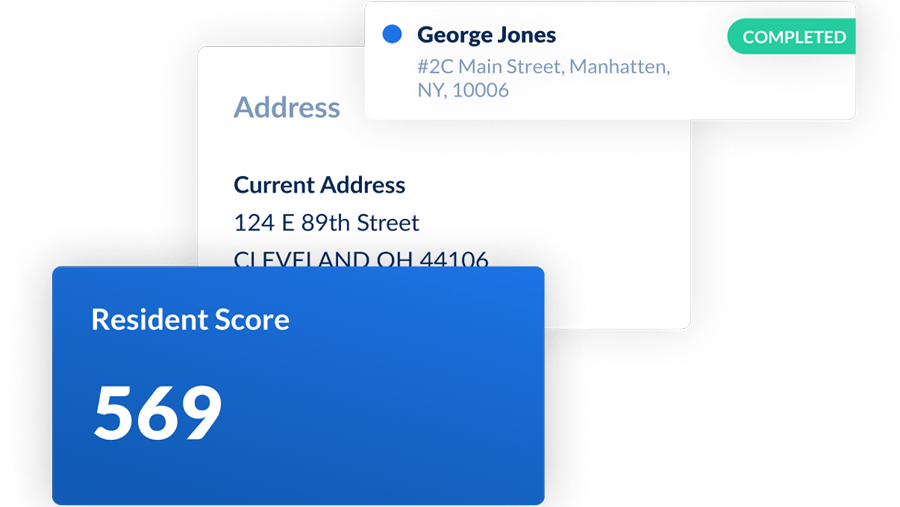

Landlord Software & Mobile App

Use our free landlord software to screen tenants, collect rent online, and automate your rental accounting. Sync your bank account, automatically label income and expenses, and use one-click Schedule E tax statements.

Want more free landlord resources? Check out our list of Free Real Estate Investing Tools.