Inherent in the name, a tiny home is exactly that — tiny (400 square feet or less). But the passive income opportunities that tiny homes offer are anything but.

So how much does a tiny home cost? What kind of returns can you earn on tiny homes as a real estate investment?

Average Cost of Tiny Homes

Whether you’re building or buying, tiny home costs are typically low but can vary widely.

Building your own tiny home could cost you anywhere from $8,000 to $40,000 or more. If you purchase a prefab home or hire a contractor your costs could climb up to $150,000. But the average cost of a tiny home is $30,000 – $60,000 according to Rocket Mortgage, regardless of whether you buy or build.

Beware that building permits alone cost an average of $1,350 in the US. That disproportionately raises costs for tiny homes, as a percentage of the total house cost.

The average cost of tiny homes per square foot is higher than traditional homes, at $300. Compare that to the $150 average cost per square foot for traditional homes: half as much. But remember, tiny homes must still contain the same mechanical systems, and often require components to serve multiple purposes. The bed might need to fold up against the wall or become a couch. The table might need to fold to become a bench sitting against the wall. And in these cases, the furniture is built directly into the house, rather than being bought separately.

While it is typically cheaper to go the DIY route and build your own tiny home, remember to weigh the cost of your time, especially if you don’t have the necessary construction skills to make such a large project worth it.

Additional costs include amenities and utilities, which can become particularly challenging to install for rural tiny homes. But you should also be mindful of specific zoning laws in your area that could incur further costs (more on them shortly).

Financing Tiny Homes

If you find that your costs have risen beyond what you originally anticipated, you may need to look into financing options.

Financing a tiny home can be difficult because rental property mortgage lenders don’t always classify tiny homes as residential real estate, unless they are on a permanent foundation. Foundations come with their own costs however, averaging between $5 – $7 per square foot. Expect the foundation to add $5,000 – $8,000 to the cost of a tiny home.

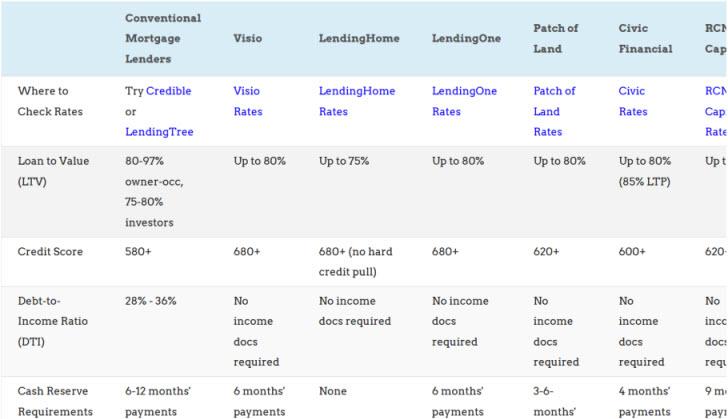

In addition, lenders typically won’t fund under a certain amount because they wouldn’t make enough from the arrangement. For example, many rental property lenders lend a minimum of $100,000 or $75,000, although a few like RCN Capital and Lendency go as low as $50,000.

While there are a variety of funding stipulations, there are some tiny home financing options that you can look into, such as RV loans, personal loans, home equity loans, and HELOCs. You can also use unsecured business credit lines and cards to finance tiny homes — check out Fund&Grow to open up to $250,000 in unsecured business credit lines as a real estate investor.

Tiny Home Returns & Profitability

As far as real estate investment opportunities go, tiny homes can be a much more affordable option with a high return on investment (ROI). Your upfront purchasing costs are much lower than a traditional single-family home, and you generally won’t have the added burden of a rental property mortgage.

Because your upfront costs are significantly reduced, you could more quickly begin making a profit on your tiny home investment.

The profitability of a tiny home will lie primarily in rental opportunities. The market for tiny homes is, well, tiny in comparison to the traditional housing market, thus your tiny home may not increase in value over time. So you need to make sure it produces strong real estate cash flow. Use our free rental income calculator to accurately forecast cash flow.

Tiny Home Rental Options

You can rent out tiny homes on their own land, as traditional rental properties of course. Or you can put one up on your own home property and rent it to long-term tenants, as a way to house hack.

Tiny homes also make great short-term vacation rentals, for another passive income option. If your tiny home is located on another property that you own, or even on your own property, you could list it as a vacation rental property on either Airbnb or Vrbo.

The profitability of a vacation rental property is directly tied to location, and could make or break your chances of being a successful Airbnb host. Adding a tiny home could make a particularly lucrative option if you own land in or near a popular travel destination or tourist attraction, for example. Or if your tiny home is located in a unique, rural location, this could also be a draw for vacationers looking for a unique “off-the-grid” holiday destination.

However, before you build or park your tiny home on your beach front piece of land and book hundreds of guests throughout the summer months, you’ll need to check your local zoning laws.

(article continues below)

Tiny Home Zoning Laws

When you buy or build a tiny home, location is key. But there are specific zoning laws in place for tiny houses, or sometimes no zoning laws at all because zoning boards don’t know how to classify tiny homes. These laws vary by state and county, so you’ll need to do some research.

In most cases, zoning ordinances don’t include tiny homes. Therefore, you can’t just build or park a tiny home on your property, or a friend or family member’s property, for free. Even if you own your property and want to add a tiny home as a rental space, you will likely run into red tape with your local zoning board.

Zoning laws are even muddier for tiny homes on wheels because zoning boards typically classify them as recreational vehicles (RVs), which must be parked in specific areas or RV campgrounds to be considered habitable spaces. So, for real estate investment and passive income purposes, consider building a tiny home on a solid foundation on a property, similar to an accessory dwelling unit (ADU), which zoning boards appear to be less wary of.

Tiny Home Companies

If you want to build your own tiny home, you’ll need to first check your local zoning regulations and likely get a building permit, which will typically cost you a couple hundred dollars.

However, if you’d prefer to purchase a prefab tiny home, there are a variety of options available to you. Some of the larger, more well-known tiny home companies, such as Tumbleweed or the Mint Tiny House Company specialize in tiny homes on wheels. Companies typically offer a variety of model options, allowing you to more carefully choose and tailor your tiny home.

Purchasing from a tiny home company will have a higher price tag, but in many cases, companies can also install amenities and utilities for an additional cost, saving you from the stress of trying to install all fixtures yourself. Companies can also assure the quality of the homes, especially where weather-proofing and durability are concerned.

New Tumbleweed tiny homes start around $85,000, although they also offer some used tiny houses. New tiny homes from Mint start around $115,000.

Final Thoughts

Tiny homes can make a profitable real estate investment option, particularly as a vacation rental. However, you need to be mindful of location and zoning laws to make it worth your while.

To attract guests to your short-term or vacation rental tiny home, location is key. Vacationers, in particular, want to be near sights and activities, or they might be looking for a unique experience.

However, you can’t just build or park your tiny home wherever you want, or for free, even if you own the land. Zoning laws for tiny homes are particularly gray, with laws varying by state and county. You may have difficulty acquiring specific permits or permissions before renting it out to tenants or listing it on a vacation rental site like Airbnb or Vrbo.

Do your research before making any commitments, and as with any real estate investment, calculate your returns using conservative numbers.♦

How are you considering using tiny homes as a real estate investor?

More Real Estate Investing Reads:

About the Author

Kalicia Bateman is a personal finance editor at BestCompany.com, specializing in mortgages, personal loans, credit cards, and a variety of other finance topics. She is passionate about simplifying finance for a wide consumer base, and strives to combine complex information with authenticity, and even humor when possible.

Yes, tiny homes are a cinderella story for short term rentals!

Never thought of it that way but I suppose that’s true Nica!

Location matters a lot. Many landlords are doing wonders while investing in tiny homes!

Amen Ted!

Thanks for sharing. I’m considering buying a tiny home near our neighborhood. It’s quite unique and it’s like love at first sight!

Let us know how it goes Ely!

I think having multiple tiny homes is far better than having a huge Bangalow.

I hear you Kerry!

I want to give it a try. I never considered tiny homes because of the small income. However, when I ran the math I can see the potential. Thanks for sharing!

Glad to hear it got you thinking Kyle!