Free Version of the Service

The software, available through a monthly subscription service, is designed to facilitate the search, identification, analysis, and acquisition of residential real estate for individuals and small organizations. Individuals can access the limited features of the software – REI Property Pro Lite – for no cost.Deal Analyzer

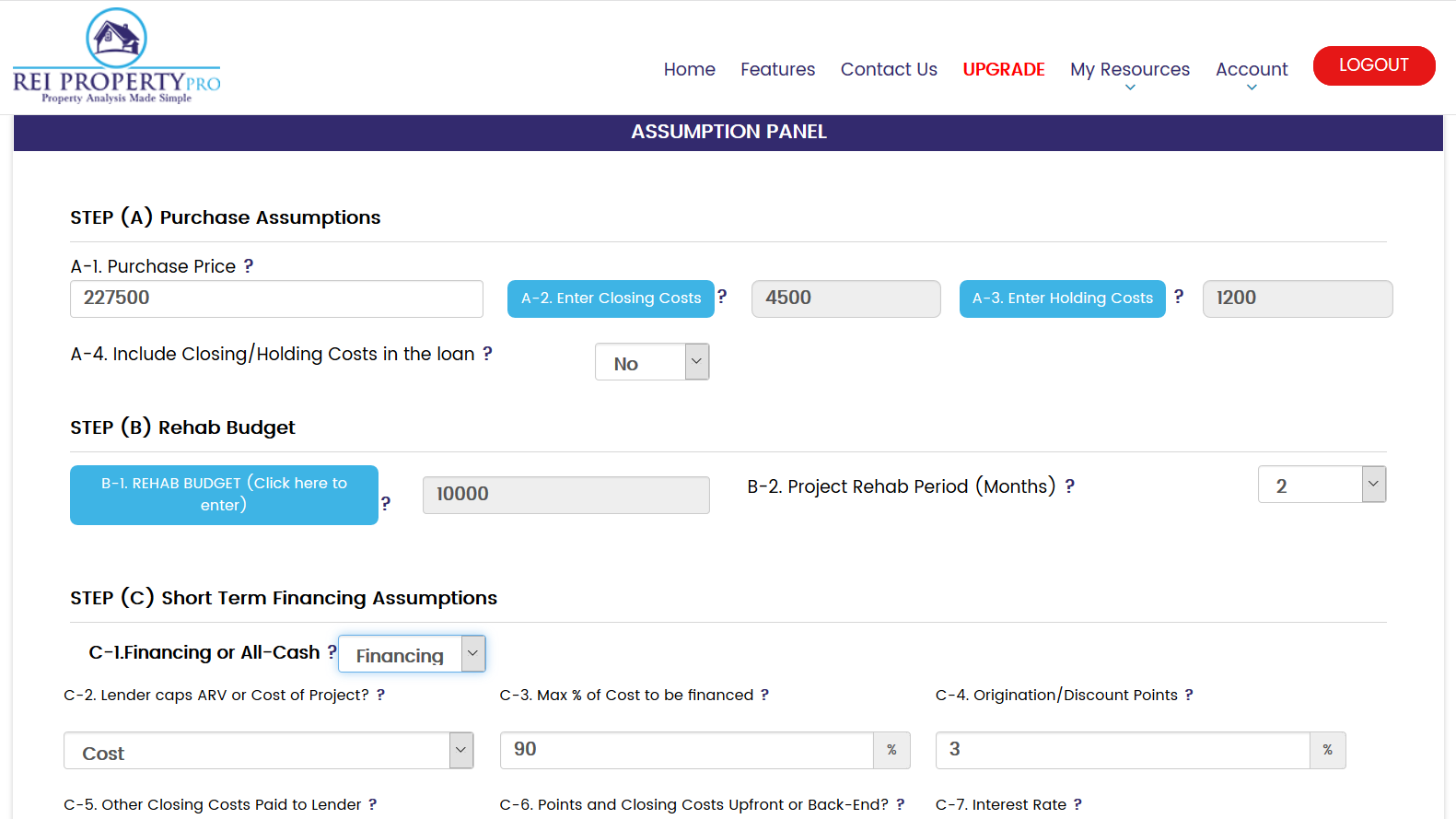

The features allow a simple financial analysis of proposed offering values and rental rates of return for up to three different acquisitions side by side based on user inputs of acquisition costs, rehabilitation costs and other costs, projected rents and expenses, and estimated future market value.Video Tutorials

The website provides several educational and client testimonial videos about aspects of residential real estate investing. The free library is organized into three categories:- Evaluating Property. Subjects range from how-to topics such as searching a property profile or estimate to explanations of profit strategies (flipping or buy-and-rent).

- Case Studies and Resources. Subjects include How to Estimate Rehab Costs to public sources of construction loans.

- Email Marketing. This section of email marketing tips focuses on the use of the email feature included in a paid membership. Instructions range from an explanation of email marketing to using the campaign editor.

- Visitors should not be dismayed at the “home-made” quality of the videos. Though the presentations lack visual polish, the content is simple, relevant to the subject, and easily understood.

Premium (Paid) Version

The premium service with additional features sells for $29 monthly or $299 annually. Full access for up to ten (10) users costs $79 monthly ($799 annually) or up to twenty (20) users for $119 monthly ($1,299 annually).Additional Features

The service offers a full slate of tools in four categories intended to ease the administrative and analytical tasks associated with residential real estate ownership:- Property identification and market value. Using a previously identified street address, paid users can access a Property Profile search for owners, physical, financial, and property tax details. Estimates of future market values based on comparable sales in the surrounding community are a separate module in the same category.

- Strategy comparisons. Whether a property might be flipped for a suitable profit or kept and rented should be a required exercise before making any real estate residential investment. REI Property Pro Service includes worksheets to compare each strategy and an easy-to-use form for rehabilitation costs.

- Customizable legal forms and documents. Residential real estate investors necessarily employ a variety of legal documents during the acquisition, maintenance, and disposition of their investments. Potential users of the service should note that the individual states have different real estate laws. REI Property Pro Service also provides pre-designed, customizable templates for website landing pages and email solicitations. Before using any legal document, a wise investor should always confirm the applicable real estate and investor solicitation laws in the state of the proposed transaction. The cost of an attorney consult is usually much less than the cost of defending a lawsuit.

- Marketing and solicitation. Mothers often warn their daughters that “you have to kiss many frogs before you find a prince.” Contrary to many sales pitches, success in real estate investing is the result of hard work and time. Finding good deals with motivated sellers usually requires hours of effort, followed by complete analyses. Premium users have access to multiple email campaign tools and templates designed especially for residential real estate investment. The module also offers a variety of formatted phone scripts easily integrated into an email campaign.

What I Like About the Service

Newcomers to residential real estate investing will appreciate the soup-to-nuts, one-stop-shopping approach of the REI Property Pro Service, especially the explanatory videos. The analyses, templates, and models are easily understood and used. However, the results can be misleading if an investor fails to apply realistic figures in the calculations. I particularly like the model analysis comparing flip and buy-to-rent strategies and the multiple cost factors included in the calculations. Hard-nosed investors interested in quick, down-and-dirty results will find the model useful. The spreadsheet included a link to an affiliated private money lender that some users may explore, possibly at the expense of above-market interest rates for investment property loans. Completed worksheets and past details of previously considered real estate properties become more valuable as time goes by, and the number of potential deals increases. While documentation remains in the cloud, serious investors should download copies of their analyses to home computers to ensure the data is always available. The price of the service for a single user is more than competitive at $29 monthly. A similar, though more robust service (REI PRO) costs $97 per month. What many consider to be the Cadillac of residential real estate investing tools – PropStream – costs the same or more than 300% of the fee of REI Property Pro. (See our full Propstream review here.)(article continues below)

What I Don’t Love About the Service

Since the service appeals primarily to beginning real estate investors, I would like to see more educational materials as well as explanations of the various calculations used in the models.

A serious investor should be able to make revenue and cost projections, understand the relationships between time and money, as well as the risks associated with any investment. If it were just a matter of plugging a few numbers into a formula, everyone would be rich!

Financial details about the provider of the cloud service are not available, raising the possibility that the service may not survive long-term. For this reason, users should be careful to download and retain copies of their analysis, mailing lists, and other data that may have future value.

Read llc mortgage loan requirements.

Ownership and Background

Synergy Investments & Consulting, based in Atlanta, developed the crowd-based real estate analysis service. Its owner, Rolanda Andrews, began as a real estate agent, buying her first investment property in 2000. She subsequently opened a commercial mortgage business and an independent insurance agency.

Rolanda continues to work in the latter in addition to her real estate investing and ownership of several companies.

My Recommendation

None of the information, reports, or models presented by the REI Property Pro Service is proprietary, revolutionary, or unique. Nevertheless, their models and templates are easy to complete and convenient, especially when compared to a loose-leaf folder of scribbled calculations and miscellaneous detail. Neophyte investors will benefit from the formulaic approach, potentially avoiding total financial disasters while they gain experience and expertise.

More sophisticated investors will appreciate the comparison models, the subsequent documentation, and the multiple templates for websites, physical and email mailings, and prospect lists for the low price of $29 monthly, about the cost of a digital daily newspaper.

Sophisticated, experienced investors participating annually in dozens of real estate transactions would probably prefer the more robust offerings of REI PRO or PropStream.

Have you used any of REI Property Pro’s tools? How about REI PRO or Propstream? What were your experiences?

Related Article Read : how to get down payment for investment property?

Related Article Read : how to buy rental property with no money?

The More You Learn, the More You Earn as a Landlord:

About the Author

I like REI Property pro, especially combined with Propstream. If you are new to this industry I suggest you do your research properly. Anyways Michael, I liked your honest review!

Great point S., and we really like Propstream too. Thanks for the comment!