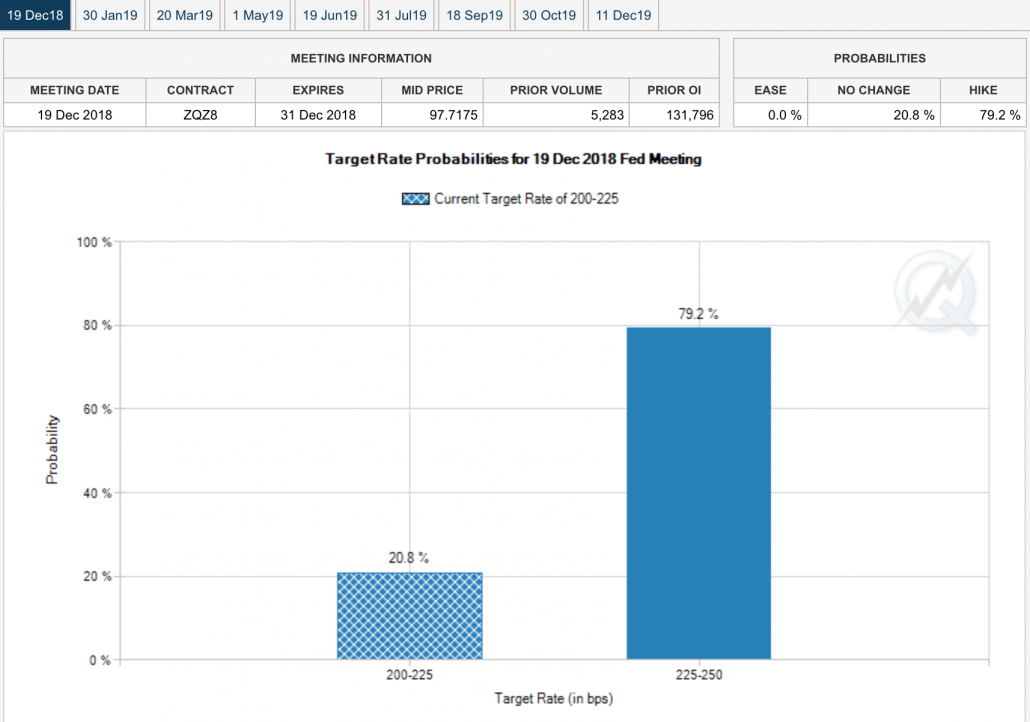

Introduction to US interest rates: The US economy has entered a stage of quantitative tightening. This is characterized by a consistent increase in interest rates. According to the CME Group FedWatch Tool, the current interest rate is 200 – 225 basis points, and it is likely (20.8%) to remain that way when the next highly anticipated Fed meeting takes place on December 19, 2018. There is a 79.2% likelihood of interest rates rising, in the region of 225 – 250 basis points on the aforesaid date.

Extrapolating Fed interest rates for January 30, 2019, figures remain largely unchanged with a 19.4% probability of rates remaining in the 200 – 225 basis point range, 75.5% probability of rates in need 225 – 250 basis point range, and a 5.1% probability of rates rising beyond that in the 250 – 275 basis point range.

Related Article Read: Ways to find pre foreclosure homes.

Related Article Read: Guide to Driving For Dollars.

The Correlation Between Interest Rates and Real Estate

On the face of it, it appears that higher interest rates may serve only to cool demand for real estate purchases. As an example, consider the ‘price’ of a $300,000 property when the interest rate is 1% and the equivalent ‘price’ of that same $300,000 property when the interest rate is 10%.

Clearly, higher interest rates serve to temper demand by making property much more expensive to potential homeowners. If this sentiment is pervasive, it adds downward pressure onto property prices, making them less desirable and driving up the rental market. There are many reasons why interest rates steadily increase or decrease over time. The recession in 2008 was brought about by rampant lending and culminated with the sub-prime mortgage crisis which precipitated the collapse of the property market and a mass sell-off in global assets.

To remedy this crisis, widespread tightening took place in credit markets. The Obama administration enacted massive and unprecedented quantitative easing. This facilitated an era of interest-rate declines, making the cost of borrowed money cheap. This meant that banks, credit card companies, mortgage brokers and other lenders were pumping credit money into the economy to fast-track investment spending, property purchases, and to prop up a collapsing real estate market.

By the end of the quantitative easing spell towards 2013, the US economy was humming. The Fed under Janet Yellen decided to tighten the screws to prevent the US economy from overheating. This occurs when too much economic activity is taking place with cheap money and can lead to inflationary pressures. To rein in the rampant expenditure, interest rates started to rise. This serves as a disincentive to borrow as the cost of borrowed money is more expensive. Inflationary pressures (this is when general prices are rising) is typically associated with rising interest rates to protect consumers from decreased personal disposable incomes.

(article continues below)

What About Real Estate Markets?

The real estate market is not homogeneous across the US. Certain markets were impacted far more than others during the global financial crisis. For example, Florida was hit particularly hard as were many other states. Arizona’s real estate market, for instance, is characterized by 64% homeownership of at least 1 home, and the other 36% rentals. With regards to home warranty protection, Arizona’s real estate market surprisingly, some 80% of homeowners do not have home warranty protection while 20% of homeowners do.

How long are homebuyers staying in their home? It appears that 51% of homebuyers plan on staying in their home for at least a year while 49% of homeowners plan on staying for less than a year. These types of trends and patterns are due to the economic realities post-financial crisis. While home values typically tend to retain their value during inflationary periods, there are other ways to ‘stabilize’ property prices by adding value for potential buyers. Things like prepaid HOA fees, prepaid home warranties, and properly maintained systems and appliances can add value during uncertain times.

Bond Markets, Inflation Rates, Interest Rates, and Real Estate

If bond demand increases, interest rates typically rise. The Fed manipulates interest rates by buying and selling bonds, thereby increasing or decreasing the money supply. There is a clear, albeit non-linear relationship, between interest rates and real estate values. When all other factors are excluded, rising interest rates have a negative effect on future cash flow. This means that the value of the asset – in this case, real estate – decreases. There are several ways that interest rates impact real estate purchases (real estate demand). For example, the opportunity cost of investing in real estate when interest rates are high increases dramatically given that there is typically a fixed return on real estate. If money is better spent elsewhere, demand for real estate will decrease.

The complex relationship between inflation-linked effects and interest-rate effects on real estate is worth pointing out. If inflation is rising rapidly, this generally bodes well for hard assets like real estate. If the property value increases significantly, the inflation-linked higher valuation may outweigh the interest rate pressure on the asset. In this instance, the effect on real estate can be positive. Generally, it is accepted that real estate tends to hold its value well during inflationary times, even as interest rates are rising. Provided that banks play ball and are eager to facilitate lending to customers, this economic model can work.

Related Article Read: What Is the Due Diligence Period in Real Estate?

Related Article Read: How to transfer property from a person to an LLC.

Final Word: Real estate has one added advantage over other financial assets: it generally holds its value well during inflationary times. This makes it an attractive asset.

What are your thoughts on where inflation and interest rates are headed in 2019?