Never Introduce Yourself as the Landlord

Manage your own properties? Great! We encourage it, especially for newer landlords.

We even teach a course all about automating, delegating, and eliminating the work of property management, to double your returns as a landlord and cut your labor in half.

And one lesson we stress: never introduce yourself as the landlord. You are “the manager.” The tenants don’t need to know who the landlord is. It’s not their concern. You’re their point of contact – that’s all they need to know.

Granted, the name of the owner will be on the online public records. Which is a great reason to own your properties under an entity name.

Collect the Rent Electronically

Sure, you could give them your P.O. box address to send rent checks to… and go physically pick them up… and then physically deposit them… and then wait for them to clear…

But that all sounds like a lot of work. And a lot of delay.

Alternatively, you could

collect rent electronically, and require in your lease agreement that rent is paid that way. They never know your banking details, all they know is your email address. There are free options available, and the rent deposits straight into your bank account.

You can even have the rent deducted directly from the tenant’s paycheck.

Own Your Properties Under a Legal Entity

This is one of those old questions that people have argued about since time immemorial, like “Is Spam actual meat?” and “Why was Wham so popular in the ‘80s?”

This is fodder for several nerdy legal debates, but the gist is that some landlords create limited liability companies (LLCs) to hold title to their rental properties, with the hope that if a rental-related lawsuit comes along, the worst that can happen is the plaintiff takes the property and not attack all of the landlord’s personal assets.

The other benefit is some degree of landlord anonymity, as covered above. In your

lease agreement, you can list the LLC as the landlord, and yourself as the “manager.”

Granted, in most states, the principal’s name is still a matter of public record along with the LLC. So, when an ambulance-chasing attorney looks up the LLC, they see your name right there, and just list you as a defendant in the lawsuit along with the LLC itself.

With that said, it takes an extra step to look up. And LLCs are ideal for folding into investment property trusts.

LLCs by themselves are not enough to protect you, which is why it’s important to sit down with an attorney to discuss how best to protect your assets. Which is why we’re partnered with one of the country’s leading authorities on asset protection for landlords, and investment property trusts.

But it’s also critical that you not Friend your tenants on your personal social media accounts (if you have a business account, that’s different). Do you really want your tenants seeing photos of you and your family relaxing on the beach?

People already think of landlords as living large like the 1%-ers. The last thing you want to do is encourage your tenants to think of you that way by letting them see pictures from your latest vacation (or that fancy dinner party with the cheese course).

Your personal life is none of your tenants’ business. If you must interact with your renters on social media, do so only from your official business page.

Ideally though, you don’t want your tenants to even know you’re the landlord.

But it’s also critical that you not Friend your tenants on your personal social media accounts (if you have a business account, that’s different). Do you really want your tenants seeing photos of you and your family relaxing on the beach?

People already think of landlords as living large like the 1%-ers. The last thing you want to do is encourage your tenants to think of you that way by letting them see pictures from your latest vacation (or that fancy dinner party with the cheese course).

Your personal life is none of your tenants’ business. If you must interact with your renters on social media, do so only from your official business page.

Ideally though, you don’t want your tenants to even know you’re the landlord.

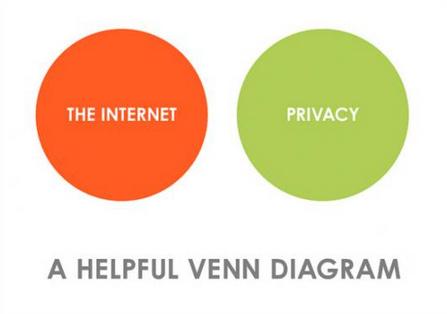

It really bothers me that people are not only quick to dismiss their own privacy, but they condemn other people who want privacy as “nutjobs” and “criminals.” They say things like “Well if you have nothing to hide, you have nothing to worry about!” But that’s ridiculous. You look deeply enough at anyone’s private life and you’ll find something that you could use to embarrass or criminalize them. Privacy matters, and I’m so glad you wrote this article about how landlords can keep their privacy better.

I agree William, I don’t need the world knowing every time I eat a muffin or make a change in my lease policies. Privacy matters, and I don’t like that anyone interested in privacy is so often marginalized as a “shady character with something to hide.”

Everyone throws a fit when there’s a data breach at a big website, or when they find out advertisers are targeting them personally on Facebook, but what do people do to protect their privacy?

When you read spy thrillers from 20 years ago, everyone is up in arms about the level of privacy invasion being proposed by the government. Now it’s just assumed as normal. We as Americans have basically just shrugged our shoulders and said “We don’t really need privacy, I guess.”

If anyone needs anonymity and privacy though, it’s landlords. Landlord privacy = critical.