The average cost of tuition for the 2023-2024 school year was $42,162 for private colleges. Ouch.

Public tuition in-state universities clocked in at $10,662, and out-of-state at $23,630. Multiply that by four years (or five, if your kid’s on the “super senior” track). And then multiply that again for each of your children.

That adds up to over half a million dollars ($505,944) if you send three kids to private colleges. And that’s just tuition — add many thousands more for books, housing, meal plans, and other ancillary costs.

So how do you pay for it?

Key Takeaways:

-

- College tuition has skyrocketed in the last few decades, which means you need to get increasingly creative to pay for it.

- Real estate investments can help you pay for college with less of your own cash invested — especially if you start early.

- Combine real estate investments with more traditional ways to minimize college costs to reduce the pain even further.

8 Ideas to Pay for College with Real Estate Investments

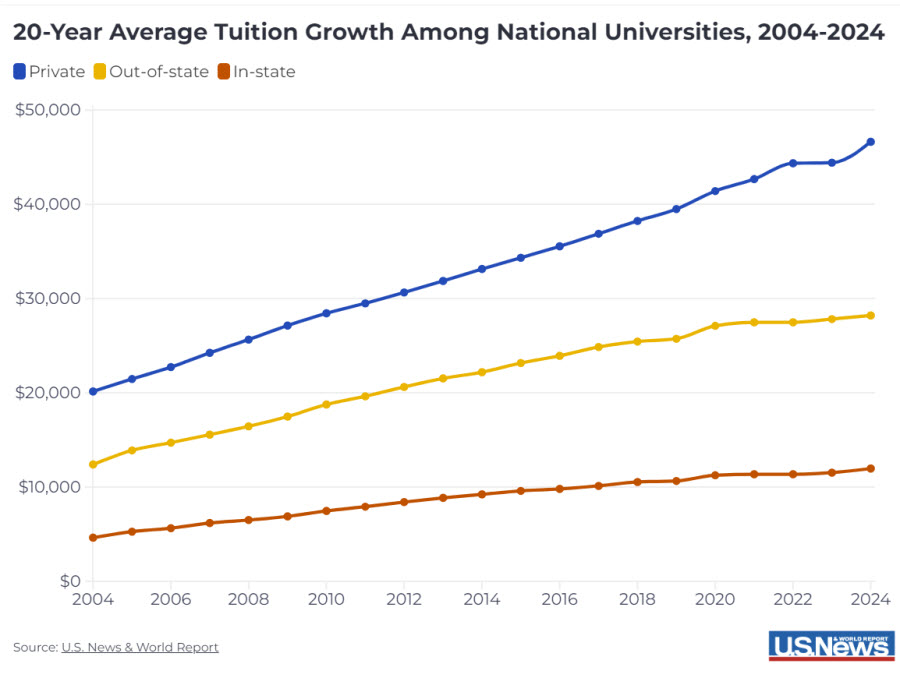

For a quick dose of depression, check out this graph from U.S. News and World Report, mapping tuition costs over the last two decades:

Tuition at private colleges has risen 132% in 20 years. And no, that’s not all inflation: adjusting for inflation, they’ve risen 40%.

It’s risen even faster at public universities: 158% in nominal dollars, 56% in inflation-adjusted dollars.

To take some of the sting out of tuition, try these real estate-related “tuition hacks.” Some require investing years in advance, others are on-the-fly discounts and programs you or your kids can apply for. All will help you reach the finish line, watching your children walk the stage with the world’s most expensive piece of paper.

1. Rental Income

Say you put down $35,000 on a rental property that cashflows $300/month. That’s $3,600/year toward your tuition. You buy a few of those properties and you can cover in-state university tuition in full.

To illustrate the point further, family finance guru Greg Johnson of ClubThrifty.com explains his own family’s plan:

“One way we’re planning to pay for our children’s college education is through the money we earn from our two rental properties. Although we also contribute to their 529 college savings accounts, our plan has always been to use part of the rental income to help pay for their college.

“Even though our kids are still a decade away from going to college, we’ll have both our rental properties paid off within the next 24 months.”

Unlike bonds or note investing, rentals are the gift that keeps on giving. I asked Greg about his plans for the properties after Junior walks across the stage with that expensive piece of paper. “Then, we’ll use that rental income to help fund our retirement!”

2. Loans Against Rental Properties

Now imagine that you buy a few rental properties when your child is three years old. You take out 15-year rental property mortgages against them. Over the next 15 years, your tenants pay down your mortgage balances, and you enjoy some steadily increasing cash flow in the meantime.

By the time your son or daughter graduates high school, you own these investment properties free-and-clear. Just in time for you to take out a new mortgage loan or two and cover their tuition in full.

“Wait a minute, what’s the difference between borrowing against rental properties versus borrowing student loans?”

First, the interest rates on rental property loans are lower. But more importantly, rental properties generate positive cash flow. Your renters effectively pay off your mortgages for you.

Put another way, your tenants pay for your kids’ college tuition.

3. Invest in Real Estate in a Self-Directed Roth IRA

A self-directed IRA lets you invest in virtually anything you want. That includes real estate syndications, private equity real estate funds, and real estate crowdfunding investments.

You can even buy rental properties with a self-directed IRA, although it comes with more challenges.

And when you invest in a Roth IRA, the investments compound tax-free.

As long as you’ve owned the account for at least five years, you can withdraw the earnings tax- and penalty-free. And, of course, the underlying investments remain intact to help fund your retirement. That leaves Roth IRAs a flexible and tax-free way to invest for your kids’ college education.

4. Pursue Infinite Returns on Real Estate

The use of leverage in real estate lets you pull your initial investment back out, leaving $0 of your own money tied up. That frees you to keep reinvesting the same capital over and over again.

And each investment can start generating more cash flow, appreciation, and tax benefits for you.

Active real estate investors can do this with the BRRRR strategy. The acronym stands for buy, renovate, rent, refinance, repeat — you buy a fixer-upper, and instead of selling it as a flip after forcing equity, you refinance and keep it as a rental. When you refinance, you can potentially pull all of your original investment back out.

What fewer people know is that you can do this with passive real estate investments too. When you invest in a real estate syndication, often the sponsor refinances after completing renovations. They return some or all of your investment capital, but you keep your fractional ownership in the property. You keep earning cash flow distributions, and the property keeps appreciating. When it eventually sells, you get another big payday.

This is known as infinite returns on real estate investments, since you can keep reinvesting the same capital in more and more investments. And over the course of the first decade or two of your child’s life, a relatively small initial investment can stack up a lot of cash flow and profit returns. Perhaps enough to cover college tuition.

5. House Hack to Ditch Your Housing Payment

We talk all the time about ways to house hack, so I won’t belabor the point here. But if you don’t have a housing payment, you can funnel tens of thousands more each year into investments to help you pay for college, early retirement, and more.

You could house hack with a multifamily of course, moving into one unit and renting out the other(s). Or you could house hack with an accessory dwelling unit (ADU), or renting some or all of your home on Airbnb, or any number of other creative ideas. Read up on ways to house hack for massive savings every month.

6. Consider “Kiddie Condo” House Hacking

Housing college students is expensive. So what if you took that expense away, while earning appreciation?

You can buy an investment property with your adult child on the deed with you. Your child meets the occupancy requirement so you don’t have to, and you get a conventional owner-occupied mortgage with a low interest rate and low down payment.

They move into one bedroom, and rent out the other rooms to housemates. The rents from housemates cover the mortgage payment and then some, so you collect a little cash flow rather than shelling out for your kid’s housing.

The property appreciates over the next few years while your child finishes school. When they graduate, you can either keep it as a student housing rental property or sell it to cash out and put the proceeds toward covering their education costs. Win, win, win.

Read more about kiddie condo house hacking for full details, but you get the broad concept.

7. Pay Off Your Mortgage

Remember how we talked about tenants paying off your rental property mortgages for you? The same logic applies to your own home if you house hack.

But this strategy extends even further. By paying off your mortgage before your kids go to college, it knocks that expense off of your monthly budget. Freeing up room for a new expense: college tuition.

If your mortgage costs you $1,500 per month, and you pay it off early, that frees an extra $18,000 per year. Which you can put toward your kid’s college costs.

8. Flip Houses with Your Kids

Flipping houses is more of a real estate side hustle than an investment, but it can be a fun way for your kid to contribute to their own college education costs.

As a teenager, they can help you find good deals on properties and renovate them. You can teach them valuable skills such as negotiating with sellers and contractors, home renovation skills, estimating property values, and of course evaluating real estate investments.

If you flipped a property for a $45,000 profit every summer, each flip would cover either four years of public school tuition or one year of private tuition.

And you get to spend time working and bonding with your child, which is priceless (as Mastercard would say).

Other Ways to Cover College Costs

Real estate investments offer some great ways to pay for university tuition. But real estate isn’t the only way to pay for college.

Consider these ideas as well, to come at the problem from several angles.

Lesser-Known Benefits of 529 Plans

You’ve probably heard of 529 plans: tax-advantaged accounts where you can save for college. They’re a bit like an IRA for college savings, rather than retirement savings.

“You get a small state income tax deduction, the appreciation is tax-free when used on education,” explains Jim Wang of WalletHacks.com. Some states even offer a tax credit, rather than a tax deduction.

A few of the lesser-known benefits of a 529 plan include:

-

- You can own 529 accounts in multiple states. You don’t have to stick with one state — you can own multiple accounts across a range of states, and never combine them if you prefer.

- Your friends and family can contribute, too. While they may or may not see tax benefits depending on their state, friends and family members can contribute toward your 529 plan. For many practically-minded folks, or people who don’t want to be bothered to follow the latest toy fad, it makes a great gift option.

- You can change beneficiaries. Did your first child get a full ride at Stanford, based on their brilliant bassoon tooting? No problem. You can change the beneficiary to your second child, or your grandchild, or niece or nephew. Or you can cancel the account entirely (although you may owe some taxes on the money).

- You can contribute even if you don’t have kids yet. Jim Wang explains further: “Even if you don’t have kids, you can make yourself the beneficiary, contribute, and then change the beneficiary if/when you have kids (or when you need to use the money for your kids).”

Some 529 plans let you invest in real estate investment trusts (REITs). But unfortunately you can’t invest in real estate crowdfunding or private equity real estate investments in 529 plans.

The $2,500 AOTC Tax Credit

Unlike tax deductions (which come off your taxable income), tax credits subtract directly from your final tax bill.

Parents paying for their kids’ college education can utilize the American Opportunity Tax Credit, which entitles them to knock up to $2,500 of their tax bill — for each student.

There is an income limit however. At a modified adjusted gross income above $80,000 ($160,000 for married couples), the credit starts to phase out. It disappears entirely for single people earning a MAGI above $90,000 ($180,000 for couples filing jointly).

Make Your Kids Work & Contribute

“When I was your age, I worked five jobs, volunteered at the homeless gerbil shelter, walked to school uphill both ways, and still managed to graduate in three years!”

Or something like that.

But your kids should have some skin in the game, for their college costs. If they have to work on the side to chip in, they’ll be far more likely to actually go to class and do their homework.

If they get straight As, you can always reimburse them for their portion of the semester. A little extra incentive never hurts, right?

Negotiate for More Financial Aid

If the college didn’t offer you much (or anything) for financial aid, that’s not the end of it.

It’s the beginning.

First, have your child write a formal appeal letter. Lather on some extra “why I’m such a good fit for this school.” Don’t be afraid to use the classic comparison shopper line “My second-choice school offered me $_______, but I’d rather go to your school.”

Keep in mind the FAFSA application doesn’t necessarily include all of your expenses, and it’s often a year out of date, since it’s based on the prior year. For example, medical bills aren’t taken into account on FAFSA, but they’re very real for you. (They’re the other expense that’s skyrocketing as fast as college tuition!)

Apply for Private Scholarships

Sure, colleges offer scholarships. But they’re not the only ones.

There are tens of thousands of private scholarships available, for every conceivable reason. Many revolve around financial need of course, and there are merit scholarships… but what about all the arcane scholarships out there you’ve never heard about? If your daughter’s into singing glee-club-style while performing horseback gymnastics, there’s probably a scholarship for that.

The challenge, of course, is finding them. Scope out Scholly for some help.

Every little bit helps, and if you add up enough $500 and $1,000 private scholarships, you’ll suddenly find college far more affordable.

Education Grants

Along similar lines, you can apply for grants. Grants are similar to scholarships, but are usually provided by the state or federal government, and/or by the college itself.

Typically grants are given based on financial need. One option are Federal Pell Grants, but they cap family income at $30,000. States vary however; see this list of state standards for financial aid grants.

The Earlier You Start, the Less You Pay

Just like retirement investing, the earlier you start saving and investing for your children’s college education, the less of your own money you need to invest. Compound interest can handle more of the heavy lifting for you.

If you start when your child is born and invest $190 each month at 10% returns, you’d have over $100,000 by the time they go to college. Wait until they’re ten years old, and you’d have to invest $720 a month to reach the same figure.

But by getting creative with the real estate strategies above, you may not need anywhere near the amount that other parents do. Think outside the box, and come at the problem from as many directions as you can.♦

How do you plan to pay for your own or your child’s college education? Do real estate investments play a role?

More Reads to Make You Rich:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

Awesome article. My kids are still young, but my wife and I were just talking about how we need to start putting together a plan for college. I do think they should have some skin in the game, but my parents paid for my college (back in the stone age when it was “affordable”), and I want to help our kids too.

Thanks Greg! And I hear ya about your kids having skin in the game, that’s how I intend to handle it as well.

Our kids are in their teenage years, so this is definitely looming over us! Thanks for covering this, it’s a big part of why we’re investing in rentals, and it’s great to see some more creative ideas.

Glad you found it useful Cara!

A key caveat with the 529 plans — the money you spend from the 529 can’t count toward the $2,500 American Opportunity Tax Credit. That would be double-dipping.

To max out your tax credits:

First, plan to pay $4,000 out of pocket for tuition each year. That will get you the full $2,500 AOTC. Then you can pay the remainder from the 529.

Another quirk: Housing costs don’t apply to the AOTC, so if they’re staying in a dorm or off-campus housing, that doesn’t help get you the $2,500 tax break. BUT, housing expenses ARE valid educational expenses to pay from a 529 account, up to a point.

Make sure you plan accordingly, otherwise you’ll find out in April that you screwed up your tax breaks back in September when fall semester started and you can’t go back and fix it!

Great tips! Thanks for sharing some of these quirks, very helpful.

Excellent article. This is something we’ve been thinking about more and more. Glad you covered this, ties in with the main reason people invest in real estate: to have more opportunities for their family.

Great article Brian!

One other idea to consider is Running Start programs. Basically the federal government pays for high school students to take college courses, and the credits are usually transferable to whatever college they end up in.

Some excellent ideas in here that I’d never thought of! Great article, and I’m particularly going to try using income from rental properties to help cover some of my daughter’s tuition expenses.

Thanks Kiera, glad you found some of the ideas useful!

With college so expensive nowadays, you HAVE to get creative. Some great tips on here, going to try buying a rental with my daughter as a collaborative project to help cover costs!

I hear you Mayce – it’s gotten outrageously expensive. Definitely need to get creative, and use multiple tactics to make it affordable!

I love these! Not enough people think outside the box for ways to pay for college tuition. And real estate is a great avenue to help cover the costs.

Thanks Mellissa, appreciate the comment, and I (of course) agree!

It’s gonna be tough to pay for college tuition so I am starting to build my passive income through rental as you mention & I’m gonna take the other suggestions too!

Yeah college tuition has gotten crazy expensive. Raging inflation certainly isn’t helping either…

Some creative ideas here. Going to explore some of these investments chasing infinite returns, great concept if you start early enough.

Glad to hear it was helpful Derek!