The Neighborhood Assistance Corporation of America (NACA) is a nonprofit organization aimed at making homeownership affordable to underserved borrowers in lower-income communities. Its programs provide great perks like no down payments, closing costs, private mortgage insurance (PMI), and no credit score check—practically a perfect brew for house hackers everywhere.

However, the program doesn’t fit everyone—and comes with strings attached.

In this article, you’ll learn how:

-

- To house hack with no down payment, using a NACA mortgage loan.

- NACA’s Home Purchase Program (often referred to as the “Best In America” Mortgage Program) is a loan program designed to help low- to moderate-income individuals and families buy a home.

- The NACA Home Purchase Program has several advantages, like no down payments, no closing costs, and no PMI.

- Despite its inherent advantages, NACA loans have long process times, restrictive qualifications, and real estate ownership limits.

What Is NACA?

Certified by the Department of Housing and Urban Development (HUD), NACA’s mission is to make the dream of homeownership a reality for working Americans by counseling and enabling even those with poor credit to purchase a home or modify a predatory loan with better terms.

Participants in the NACA program work with housing counselors and real estate agents to guide them through the mortgage application process and offer them initiatives like the NACA Home Purchase Program and One-Dollar Homeownership.

Qualified members then get paired with partner banks, including Bank of America, which provides the loans. Borrowers who qualify as members of the NACA organization must maintain membership requirements, including $25 annual dues and participation in NACA events and activities.

NACA’s Best In America Mortgage Program

NACA’s Best In America Mortgage Program provides affordable mortgage payment options and allows borrowers to obtain one mortgage with either a 15- or 30-year term. NACA mortgages require no down payment, no closing costs or fees, and no PMI. NACA doesn’t check your credit score, but it does check your payment history.

On top of that, NACA’s Membership Assistance Program (MAP) supports its home mortgage and loan programs. Through the MAP, members can get in touch with NACA counselors for help with managing their financial situation and to get mortgage payment assistance.

As of 2024, the fixed interest rates for different terms compared to NACA’s are as follows:

| Mortgage Terms | NACA | Conventional US Rates |

| 15 Years | 5.5% | 5.927% |

| 20 Years | 5.375% | 6.502% |

| 30 Years | 5.875% | 6.697% |

Options To Lower Your Interest Rates

Even better, borrowers can decrease their interest rates for the entire mortgage by adding to the downpayment amount.

Adding 1.5% of the mortgage amount to the down payment decreases your interest rate by 0.25% for 30 and 20-year loans. For 15-year loans, 1% decreases the interest rate by 0.25%. That’s tough to beat.

House Hacking & Investing with a NACA Loan

If the NACA loan program is only open to homebuyers, how does it apply to real estate investing?

You can use a NACA mortgage when buying a home to house hack. There are many ways to house hack, from buying a multifamily property (allowed by the NACA program) to renting to housemates to buying a property with an accessory dwelling unit and more.

If you buy a fourplex with a NACA loan, you can not only score free housing, but you kick off your real estate investment portfolio with several doors at a low interest rate.

NACA Mortgage Requirements

Although there’s no down payment requirement for a NACA home loan, the program requires you to have cash available in savings. These “Minimum Required Funds” include earnest money returned at closing, prepayment for property taxes and insurance, and up to six months of reserves for utility deposits and other expenses, depending on the property and your financial situation.

NACA also requires you to pay for a home inspection and may require you to set aside additional cash to pay for fixing any health, safety, code, or structural issues identified.

Finally, you must maintain a NACA membership in good standing, which requires a nominal $25 annual fee and mandatory participation in at least five NACA events or activities each year, including one before qualification and another before closing. These events include advocacy campaigns and volunteering activities that support NACA’s mission.

NACA places a $25,000 junior lien on the property to ensure you play by the program’s rules and that you repay NACA any payment assistance you may receive after closing.

Who Qualifies for NACA Loans?

NACA loans are designed to help people who often become victims of predatory lending or borrowers otherwise shut out of the home financing marketplace. As such, the NACA Home Purchase program focuses on low- to moderate-income borrowers (Priority Members) and low- to moderate-income areas (Priority Areas). NACA defines its Priority Members as homebuyers whose income is less than the median income for their Metropolitan Statistical Area (MSA). Buyers under these income limits can buy their property anywhere. Borrowers with higher income, however, must purchase property in a Priority Area, defined as a U.S. Census Tract where the median income is below the median income for that MSA. Even if you have a poor credit history and have missed some payments, the program offers leniency around circumstances beyond your control, like unaffordable medical bills, predatory loans, or hardship caused by natural disasters.Types Of Properties Eligible For The NACA Mortgage

NACA loans cover these types of properties:-

- Primary Residence

- Single-Family Homes

- Condominiums and Co-ops

- Multi-Unit Properties (up to four units)

- New Construction

- Mixed-Use Properties (primary residential use)

- Properties in Need of Repair

- NACA Modular Home

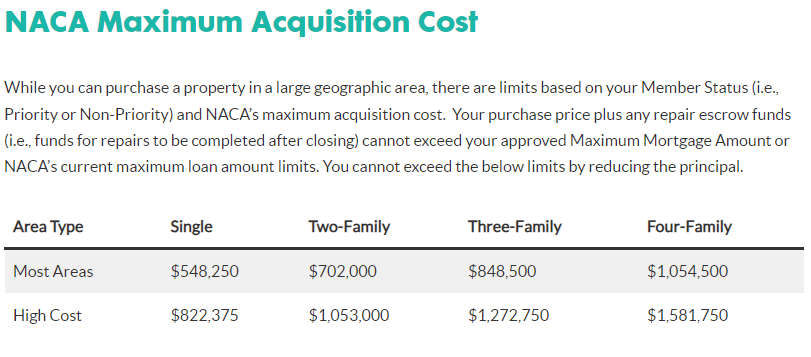

How Much Can I Loan From NACA?

The maximum mortgage amount depends on your membership, property area, and family size. Here are the most updated limits from the NACA website: Source: NACA Loan Limits

NACA caps monthly loan payments at 31% of your gross income or 33% of your documented affordability. This can be raised to a maximum of 35% for the 15-year mortgage.

Source: NACA Loan Limits

NACA caps monthly loan payments at 31% of your gross income or 33% of your documented affordability. This can be raised to a maximum of 35% for the 15-year mortgage.

Is NACA’s Purchase Program Available In My State?

NACA provides services and is available across all 50 states in the US. However, that doesn’t mean that every area is covered. As mentioned earlier, the NACA purchase program focuses on priority locations like low-to-moderate-income and underserved areas in both rural and urban regions.What Is The Process For The NACA Home Buying Program?

The process for obtaining a NACA loan is notoriously clunky, often taking between three to six months to complete. The first step to becoming NACA qualified is to attend a NACA homebuyer workshop and complete a face-to-face membership intake session in one of NACA’s local offices (or remotely via video counseling). They are also required to submit the following:-

- Pay stubs from the last 30 days

- Tax returns from the last two years

- W-2s from the last two years

- Bank statements from all accounts over the last three months

- Bank statements from the last 12 months if self-employed

Advantages of NACA Loans

Why do prospective homebuyers go through all that red tape?-

- No down payment: Enough said

- Low interest rates, no PMI: It’s hard to beat a NACA home loan in terms of raw numbers. NACA loans offer better than market rates with no PMI, for exceptionally low monthly mortgage payments. If you qualify, you will not likely find a mortgage that costs you any less.

- No closing costs or fees: When you work through the NACA mortgage program, the lender pays the closing costs, including appraisal, title, origination fees, and various other fees that easily add up to thousands of dollars.

- No credit score check: Borrowers with poor FICO scores can still qualify for a NACA mortgage as long as they haven’t habitually neglected to pay their bills in the past.

- Works for almost all property types: Most property types are eligible for a NACA mortgage, including condos, single-family, multifamily (up to four units), and mixed-use properties.

Disadvantages of the NACA Program

Despite being called “The Best Mortgage In America,” the NACA loan program does have its disadvantages.-

- Eligibility limits: NACA prioritizes lower-income borrowers and lower-income locations. It also limits the price of the property you can buy. You’ll need to check with the local NACA office to ask what income level and property areas meet their criteria.

- Occupancy requirement: A NACA home loan requires you to occupy the property for the duration of the mortgage. No big deal for house hackers looking to live in one unit of multifamily property and rent the others, but NACA loans are a no-go for other investment properties.

- Restriction on owning other property: Because the NACA program is designed to help lower-income people in underserved areas become homeowners, the program excludes real estate investors by disqualifying anyone with an ownership interest in any other property.

- Cumbersome application process: The application process for the NACA mortgage program takes an average of three months, according to NACA’s website. Joining the program includes workshops and counseling intended to educate and prepare borrowers in underserved communities for homeownership. House hackers with substantial financial literacy may not find this necessary, but they must still spend the time completing these steps.

- Membership requirements: NACA member borrowers are required to attend at least five NACA events each year to maintain their membership. NACA credits its aggressive advocacy campaigns with keeping the program alive, so it takes participation in these events seriously.

Is Getting A NACA Mortgage The Best Option For Me?

If you are looking to become a homeowner and house hack by purchasing a multi-unit property that you’ll also live in, a NACA mortgage may be the best deal around. The deal gets sweeter if you’re a buyer of modest means and looking to buy property in a lower-income neighborhood.

If this doesn’t sound like you or your situation, or you’re skittish about the strings attached to a NACA home loan, you may find a better source of funding elsewhere.

Alternatives to NACA Loans

A NACA home loan won’t work for everyone. Even if you qualify, you might prefer a mortgage without the conditions NACA imposes. If the NACA mortgage program doesn’t seem like the best fit for you, consider these alternative mortgage products.

VA Loans

Current or former members of the U.S. Armed Forces enjoy access to VA loans backed by the U.S. Department of Veterans Affairs. A federal guarantee allows lenders to offer veterans better terms, including lower interest rates, no down payment, and no PMI requirement. It’s an all-around good deal if you qualify as a service member.

FHA Loans

The Federal Housing Administration (FHA) backs loans for homebuyers with limited cash to put down or impaired credit. FHA-insured mortgage loans come in many flavors but offer low down payments and lenient underwriting standards to give borrowers a better deal. In exchange, FHA borrowers must pay a premium for mortgage insurance and face a cap on the property price allowed. Like with NACA loans, FHA loans require the borrower to live in the property as an owner-occupant.

USDA Loans

The U.S. Department of Agriculture administers USDA loans for low- to middle-income homebuyers in rural areas with a population under 35,000. USDA loans require very low (often zero) down payments and lower credit scores than conventional home loans. They do require borrowers to carry mortgage insurance throughout the life of the loan. Only primary residences qualify for USDA loans, and, importantly, they restrict some income-producing properties like hobby farms.

Fannie Mae or Freddie Mac Loans

Fannie Mae and Freddie Mac offer special home loans intended for lower-income buyers. Fannie Mae’s HomeReady program offers low-down-payment loans for borrowers with a minimum credit score of 620 but requires PMI, higher down payments for multi-unit properties, and income limitations on borrowers in some areas.

Freddie Mac’s similar Home Possible loan program offers 3% and 5% down payment loan options and does not require PMI once the loan balance drops below 80% of the property value. Borrowers with good credit scores qualify for the best rates. You’ll pay the usual closing costs. Both require the borrower to occupy the property but permit multifamily homes.

Final Thoughts on Getting a NACA Loan

The NACA Home Purchase program offers generous terms with more than a few strings attached. For homebuyers who qualify for the program, it’s tough to beat a NACA mortgage from a raw numbers perspective.

If you don’t mind jumping through a fair number of hoops and living by the program’s rules and restrictions, a NACA mortgage may be one of the best deals around.♦

Ever participated in the NACA program? Are the 0% down payment and lower interest rates on NACA loans worth the headaches?

To succeed in the NACA loan process, it’s important to be organized, attend sessions on time, self-assess your financial situation, keep communication with NACA, and have all required documents ready.

Sounds like you speak from experience Mandy!

A unique and rare feature in the market! Minus the red tape.

I never knew this program existed. Going to look into this, thanks

Keep us posted Lionel!

Living in a low-income neighborhood and having the opportunity to benefit from the NACA program feels like a stroke of luck. However, navigating the treacherous red tape that accompanies it can be incredibly challenging. Pretty ironic!

It’s a great program if you can get through all the bureaucracy!