The Big Picture On Rental Applications In California

-

- Screen tenants thoroughly with rental applications that follow laws to avoid issues with problematic renters down the road.

- California law permits landlords to charge $62 max for a screening fee and pass other app charges directly to renter applicants.

- Check credit history, criminal records, eviction reports, ID, and housing verification when reviewing renter applications.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

If there’s one thing I’ve learned in my years as a landlord, it’s that good returns follow good tenants.

So, what do California landlords need to know about collecting rental applications and screening applicants to lease only to high-ROI tenants?

Too many landlords feel they don’t have time to screen tenants thoroughly and lose money every day the rental sits vacant. However, screening tenants is the landlords’ most important task. With a good tenant, you can sleep easy at night as a landlord, knowing the rent will get paid and the rental unit will be well cared for. With a bad tenant, on the other hand, you’re left to wonder about the state of your investment while fielding calls from angry neighbors.

One of the first things to remember is to find renters who will make your life easier as a landlord, not harder. Any prospective tenant can act like the best tenant in the world during the initial walk-through. But if you want to ensure you’re getting the best renter, it’s important to thoroughly screen every prospective tenant before signing a lease agreement, starting with the rental application process.

Why Do Landlords Need to Collect Rental Applications?

Successful property management begins with good documentation – if for no other reason than to avoid discrimination lawsuits.

When you decline one applicant and accept a lease agreement with another, the rejected applicant can sue you. Being a landlord is an occupational hazard. However, keeping your tenant screening reports and rental application forms gives you documentation to show the judge that you rented to a more qualified applicant.

The rental application in California requires applicants to legally declare, on penalty of perjury, that the information is correct. If they claim they have no pets or that only one adult will live on the property, then sneak in pets or extra occupants, they perjure themselves into the rental application.

Rental applications also contain asset information that’s useful later if you have to pursue a deficiency judgment. For example, California rental applications include vehicle information, so you can attach a lien to tenants’ vehicles if they fail to pay.

The rental application in California, together with a reliable real estate lease, reduces your liability risk and helps protect your invalids with a strong foundation for the ongoing relationship between you and your tenant; you will both be able to proceed with confidence in your mutual respect and trust and start the rental off on the right foot.

Here’s where you can access our free rental application for California.

Requirements For California Rental Application

California landlords should know the law requirements for rental applications. Below are some of the basic ones needed for rental applications in California.

| Requirement | Description |

| Applicant Contact Info | Include full name, SSN (if secure), license number, phone, and email. |

| Current & Prior Residence Info | Collect previous landlords’ contact info for insight into renter reliability. |

| Employment History & Proof of Income | Gather job history and pay stubs to assess ability to pay rent; include cosigners if applicable. |

| Authorization Signature | Obtain signed permission to contact references and run background checks. |

California Rental Application Fee Regulations

California Civil Code 1950.6(a) states, in the relevant part, “When a landlord or their agent receives a request to rent a residential property from an applicant, the landlord or their agent may charge that applicant an application screening fee to cover the costs of obtaining information about the applicant.”

In California, landlords can charge a maximum application fee of $62.02, effective December 2023. California regulates this annual adjustment based on the Consumer Price Index increase. Landlords can also have the applicant pay any tenant screening fees directly (which is how our tenant screening service works—you can select that the applicants be charged directly).

4 Tenant Screening Reports Landlords Must Include On A California Rental Application

Tenant screening reports are essential, especially for a California rental application. Below are the ones landlords must include.

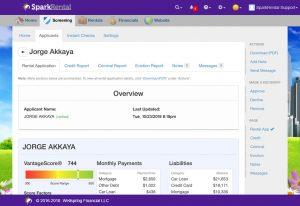

1. Check Credit Information

The applicant’s income tells you whether they can pay. An applicant’s credit report tells you whether they will pay.

Since you can’t always judge a book by its cover, tenant credit reports allow you to dig deeper into the prospective tenant’s financial habits. If they have a good credit history and pay their bills on time, they will pay their rent on time.

To give you a better picture, rental applicants with 650 credit scores, on average, got approved, while those below 538 were rejected.

We provide complete credit reports on all applicants that you can optionally include with your California rental application.

2. Criminal Background Check

Besides pulling credit reports, you need to screen renters’ backgrounds. You should check state and federal criminal records to determine whether the prospective tenant has a criminal history. Look out for recent fraud and violent offenders and avoid them as high-risk tenants.

Sex offender registries and terrorist watchlists are typically included in criminal background checks and are important to consider. Landlords can visit the Dru Sjodin National Sex Offender Public Website to check.

3. Eviction History Report

This gets to the crux of the matter: has the applicant violated other landlords’ lease agreements and had to be evicted?

Avoid signing a lease with applicants who have been evicted in the last five or ten years.

4. Housing History & Identity Verification

A fourth report to consider is verifying the applicant’s identity and housing history. If it doesn’t align with their California rental application information, landlords, beware!

Nearly 90% of landlords reported checking previous evictions, income, job and rental history, credit scores, and criminal backgrounds when making tenant decisions—so you should, too. Start the process with a free tenant background check, and you can use our landlord app to run any or all of the tenant screening reports above.

Why Landlords Should Interview Prospects Before Collecting a Rental Application in California?

The rental application, including tenant screening, takes around 24 to 72 hours (1 to 3 days). It surely is a lot of work, but if you use pre-screening to your advantage, you can save time by not proceeding with tenants who are not a good match.

Pre-screening helps you eliminate any candidate who doesn’t fit your surface-level criteria. These criteria can be easily determined during an initial conversation. For example, you should determine if a prospective tenant has a pet or smokes.

You will waste your time if you don’t ask the right questions during pre-screening. The later stages of tenant screening, including the rental application, reaching out to references, and analyzing a credit and background check, should be reserved for tenant leads with a high chance of being qualified.

Questions You Can Ask To Potential Tenants

Pre-screening enhances your overall screening process. It’s your opportunity to set expectations for your rental process, which will help you attract quality tenants. Here are some potential questions to ask.

- Why are you moving?

- What is your current living situation?

- When are you looking to move in?

- What is your monthly income?

- Can I ask for references from your former landlords and employer?

- Will you submit a California rental application and authorize a background check?

- The security deposit is $X. Are you comfortable with that deposit amount? (most landlords require 1 to 2 month’s rent)

- Do you have pets?

- Do you smoke?

- Will you have roommates?

This can be a lot of questions to ask all up front, but it will give you the best sense of how qualified a tenant lead is from the start.

Which Occupants Need to Fill Out a California Rental Application Form?

The question of who needs to fill out a rental application in California often arises when more than one person will live in the rental property or co-signers will be part of the deal.

Here’s what you need to remember:

- Anyone over 18 years old who will live in the property for any time should complete a rental application.

- Anyone not living in the home but co-signing the lease should complete a rental application.

- Anyone who moves in or comes later should complete a rental application in California.

All those groups need to fill out a rental application to let you know who will live in your property. You need to have contact information if problems should arise with the property. After all, one of the requirements for renting a house in California is a completed application form per adult.

If interested renters walk away because of your policy, you’re probably better off. About 25% of rental applications are rejected because they don’t meet the landlord’s criteria. Those are usually the applicants who don’t want to fill out an application, aren’t ready to commit, or don’t think they would pass your screening requirements.

Standard Housing Laws on Tenant Screening

The Federal Fair Housing Act prohibits discrimination in the rental, sale, or financing of housing based on race, color, national origin, religion, familial status, and disability. Tenant screening is an aspect of rental housing where every fair housing legislation will apply.

Requiring different information from different protected classes of applicants violates landlord Fair Housing laws. For instance, you cannot require a white applicant to provide a copy of a tax return and a Hispanic applicant a copy of his employer-provided W-2 form. You cannot inquire about religion or national origin. Also, in California, you cannot ask about immigration status or citizenship.

70% of renters in California have pets, but only 30% of rentals accept them. You can prohibit pets generally and state this on an application. However, suppose a prospective tenant has a letter from a doctor saying he requires a companion dog due to a mental health condition. In that case, you cannot deny tenancy or prohibit the dog.

In summary, you cannot base any action or decision in the screening process on any aspect of an applicant’s membership in one of the protected classes.

FAQs

What is the average income-to-rent ratio required by California landlords?

California landlords generally require an income-to-rent ratio of 30% or more, though some may accept a lower ratio for otherwise qualified tenants.

How do I become a tenant in California?

Guests become tenants in California by staying 14 days within six months or seven nights consecutively.

Do you need a permit to rent a house in California?

No permit is required to rent a house in California, though local regulations may vary.

The Bottom Line

A rental application is an important part of tenant screening. In a perfect world, a landlord would be able to trust all people who wish to rent from them. However, the world is imperfect, and not all tenants are equal.

Collect a California rental application from all interested parties, run thorough tenant screening reports, and remember that your returns are directly tied to the quality of your tenants.

Can I ask pre-screening questions before showing the property? I have had responses to view the property only to find out, by google they are either under 18 or they have been evicted in the past. I am a first time landlord in CA.

Hi Jan, yes you can ask pre-screening questions so you don’t waste your time by showing the property to someone who’s not qualified anyway. Just make sure you keep your pre-tenant screening questions far away from relating to the “protected classes” under Fair Housing laws.

I am doing a group showing given the large number of inquiries I’ve received (60+). I have not done any pre-screening aside from putting my minimum credit score, income requirements and “no evictions” in the listing. My desire is to pre-screen people at the open houses by asking some of the questions above on paper (# people, pets, income, credit score. move-in date) and in-person…. and then to invite the top prospects to officially apply. (Since it costs $40 I don’t want people to waste their money on application if not a top prospect). BUT I want to make sure I stay legal, of course — does this plan work, and/or anything I need to keep in mind? Or do I just need to let everyone apply that’s interested?

Just make sure you have some kind of uniformly applied system that you can defend if pressed. For example, all applicants with monthly income at least four times the rent, or all applicants with a self-declared credit score over 700, you then run full tenant screening reports on.

If a potential tenant fills out a rental application and it doesn’t indicate info contained therein is under penalty of perjury, is it actually under penalty of perjury? I ask because as a new landlord I have seen applications [on line] which don’t say anything at all about under penalty of perjury.

Is there California law that covers this, if so, what it is?

Thanks.

I think you’d have a hard time pressing charges for perjury regardless; California courts don’t tend to be very landlord-friendly. But if a tenant submits false information about themselves in a rental application and signs it, I’d think that meets the legal definition of perjury.

Just for the record, UNLESS the rental application actually says, “under penalty of perjury” anything written on the application isn’t actually under said law…

Speaking of which, there’s NO law in California barring a potential tenant from “lying” on a rental application.

Can my leasing agent legally ask my partner and I to each fill out an application that costs $40? From what I understand in the state of California is it illegal to charge over $50 (2019).

Yes, the $50 limit is for each adult. They legally cannot give you and your partner a discount because that would discriminate against unrelated adult roommates.

We have a single unit on the our property. After accepting application and screening fee, what feedback am I required to perform? I see application refusal forms which provides a reason.. is that needed/ required? Is another type of communication required back to the applicants which were not as qualified?

Just for the record, UNLESS the rental application actually says, “under penalty of perjury” anything written on the application isn’t actually under said law…

Speaking of which, there’s NO law in California barring a potential tenant from “lying” on a rental application.

If I have multiple applications submitted in a short period of time and multiple applicants who meet my minimum requirements, do I have to take the very first application submitted or can I evaluate across the qualified applicants to see whose application is the strongest overall based upon consistently applied criteria?

Hi Mr. Davis,

I have a property manager who just rerented my apartment. The last tenant caused a lot of damage. The manager said he found an acceptable tenant, signed a lease and gave her possesion on October 1. (Property in Santa Rosa, Ca.)

I have requested a copy of the application form and credit report. He states that he cannot provide these as that is a ‘breach of tenant privacy’. I have never heard that a landlord is not entitled to these documents. Any advice?

Dan Brady

Hi Dan, that’s odd, I’ve never heard that either. The property manager is your agent, working on your behalf, so you’re entitled to see the information he collects on your behalf. And ultimately, leasing decisions are up to you, based on this kind of information that he collects for you.