Leverage. It’s one of the great advantages of real estate over other types of investments.

You can finance 80%, 90%, even 100% of your investment. Ever tried doing that with stocks? Good luck finding a lender. The best you can do is buy stocks on margin, and that’s a risky proposition.

I surveyed professional real estate investors about how they approach rental property loans, and their tips for doing so with minimal fees, interest, and down payments. Here are eight rental property financing ideas, direct from the pros.

10 Ways of Financing Rental Properties

Not only can you finance rental properties much easier than most investments, but you have seemingly endless options to do so.

Research the following loan options as you build out your playbook for rental property financing.

1. Pool Money from Private Investors

Private funds from friends, family, and acquaintances are the ultimate rental property financing goal for many investors.

But it takes trust, and trust requires a track record of success. Don’t expect to finance your first property — or even your fourth — this way.

If you’ve been around the proverbial block a few times, and have established credibility with your friends and family, consider raising some private funds from them for your next real estate investment project.

One perk of this approach? You can often combine it with other forms of financing, such as a rental property mortgage from an online lender.

Here’s how Shawn Breyer of Breyer Home Buyers uses private funds:

“We use partners to put together small commercial multifamily deals and then we buy them out.

“I’m the one who sources the deals, performs due diligence, finds and manages contractors, and sets up and manages property managers. The partners that I bring in are other real estate investors and business owners that I’ve met through networking. We set up the terms on the deal and if they want in, we provide them with an annual rate of return over a specific payback period.

“Normally, we are able to rehab, rent, and refinance the properties within a year, so our velocity of money is high. We are able to keep their money working for them while we snowball our portfolio.”

2. Conventional Rental Property Mortgage Lenders

Conventional mortgage lenders were around 50 years ago, and they’ll be around 50 years from now.

While conventional mortgage lenders usually aren’t the best option for flips, they can be great for your first one, maybe two rental property loans. Why only one or two? Because conventional lenders operate within tight credit guidelines.

First, they always report to the credit bureaus. That means your conventional rental property mortgage will appear on your credit report.

Which is fine for one or two mortgages. But most conventional lenders won’t lend to you if you have more than a few mortgages appearing on your credit report. Typically they max out at four loans reporting on your credit, although a few loan programs allow as many as ten.

The good news about conventional rental property mortgages is that they tend to be (slightly) less expensive than other financing options. Lower interest rate, lower points and closing costs, the works. Check out Credible to compare conventional loan terms and score the best deal.

Still, traditional loans come with other headaches beyond credit reporting. “The amount of paperwork and documentation required can be intense and painful,” explains Nichole Stohler of Gateway Private Equity Group. “The tradeoff is that we’ve been able to lock in historically-low fixed interest rates for 30 years.”

Think of them as training wheel rental property loans. Great to get started, but then you’ll want to move on.

But move on to what?

3. Local & Regional Banks

Whether you’re looking for commercial or residential investment property loans, local community banks or credit unions can make great financing partners.

These banks typically hold the loans within their own portfolios rather than selling them off to major banks like Wells Fargo (like conventional mortgage lenders do). This type of loan, held indefinitely by the lender who originated the loan, is called a portfolio loan.

Nick Evans of CinchSell gets his long-term rental property financing from local banks. “Money can be easy to find if you’re bankable. Now, that also means paying taxes; you need to report your income, so you can provide tax returns to lenders.

“You can’t tell lenders you make X, and then have a tax return that says you make X minus all your ‘expenses’.”

By all means, take advantage of tax deductions for landlords. But don’t abuse them or misreport them to the IRS — even if they don’t catch you, it will make it that much harder to procure a rental property loan.

4. Online Portfolio Lenders

One of the most viable alternatives to conventional mortgage lenders is online lenders who offer rental property loans. The interest rates and lender fees tend to be similar or only slightly higher, but the lenders can often settle faster, and most don’t report to credit bureaus.

We’ve evaluated and compared several online investment property loans so you can look at their pricing and loan terms side by side in a chart. A few of our favorites include Lending One, Kiavi, and Visio — all tend to be fast, flexible, and affordable.

Most don’t even look at your personal income or debt-to-income ratio. Instead, they evaluate the rental income from the property compared to the monthly mortgage payment. Known as DSCR loans, they work especially well for self-employed investors who can’t easily document their income.

Nichole Stohler has had good experiences with Quicken Loans: “For single-family rental properties, Quicken has been fantastic. They have amazing technology that makes the loan process less cumbersome and I’d finance all homes with them if I could.”

Why can’t she use them for all of her investment property loans?

“I’ve found that if you are buying a lot of homes in a short period of time (I bought eight in less than a year), rotating lenders is required because the underwriters at any single lender get nervous about the buying speed.”

5. Crowdfunding Websites

You can raise money for anything through crowdfunding websites. Including real estate investments.

In fact, some hard money lenders use crowdfunding to, well, fund the loans they issue. My favorite example is Groundfloor, and I invest in many of their loans myself as a passive investor. (Read more about investing in real estate crowdfunding platforms if you’re interested.)

It’s less common to find affordable long-term rental property loans from crowdfunding websites. Use crowdfunding for short-term bridge financing, and stick with online landlord lenders like Visio or New Silver for long-term rental property financing.

6. Hard Money Loans

No list of rental property financing options is complete without touching on hard money loans.

Hard money lenders issue short-term loans to real estate investors to buy and renovate a fixer-upper. Sometimes referred to as “fix and flip loans,” they also work well for investors using the BRRRR strategy. You may also hear these loans referred to as “private money loans,” since hard money lenders often lend their own cash or other private sources of money. Just don’t confuse them with private money lenders like friends and family.

While these lenders still look at your credit report and may require a minimum credit score, they tend to focus more on the deal itself. Hard money lenders want to make sure you’re buying a good deal, and the numbers make sense.

Andrey Sokurec, co-founder, and CEO of the real estate investment company Homestead Road explains why he likes hard money lenders for initial property purchases, despite their high cost: “A lot of times it’s much easier and faster to get funding from hard money lender than banks. Most hard money lenders don’t require financial information from the borrower and lend money based on the value of real estate.

“However, they charge higher rates. It’s common practice for hard money lenders to charge 1-4% upfront in points and 8-14% annual interest rate.”

If you need to settle quickly, with less red tape to wade through, sometimes hard money loans are the perfect tool for the job.

For flips, you can simply pay off the loan upon selling the property. If you want to keep the property as a long-term rental, you can refinance after the renovations are complete, for a cheaper 30-year rental property mortgage.

7. Lines of Credit Against Other Properties

Have equity in your home, or in your other rental properties?

You can take advantage of flexible, relatively affordable financing for new investment properties.

If your equity is in your home, you can borrow a HELOC (home equity line of credit) from traditional banks, although some online lenders can close faster and at a lower interest rate.

But the equity doesn’t need to be in your home. You can also tap equity in your existing rental properties: “One of my favorite ways to finance a rental property is by tapping a HELOC against other investment properties to provide the funds for a large down payment or payment in full,” explains investor Lucas Hall.

“Once the new rental property has been renovated or has some decent equity, I will refinance it and pay back the original HELOC, thereby keeping all the debt on each respective property. Doing so is just one easy way to keep my portfolio organized.”

Not a bad source of financing for rental properties, eh?

8. Unsecured Business Lines of Credit

Don’t have any equity in your home or another rental property? Don’t sweat it.

As a real estate investor, you qualify for unsecured business credit cards and lines of credit. That means you can open huge credit lines with no collateral.

Check out Fund&Grow as a business credit concierge service. For a one-time fee, they’ll help you open $100,000 – $250,000 in unsecured business credit lines.

Which, of course, you can tap for down payments, renovation costs, closing costs, or marketing expenses (such as direct mail campaigns). Or you can just hold them at the ready as an alternative to cash reserves.

9. Gap Funding

Mortgage loans and private lenders are all well and good, but sometimes you still have trouble meeting the down payment requirement.

If you get truly desperate for rental property financing, consider gap funding. In exchange for creative solutions — like you giving up partial ownership in the property — a gap lender will cover your down payment for you. It comes with high risk for the lender, so they don’t usually issue these loans without taking a stake in the rental property.

As a general rule, it only makes sense if you find an absolutely phenomenal deal that you just can’t get done any other way. But tuck it away as another creative financing idea for real estate investments.

10. Owner Financing

Been waiting patiently for owner financing to appear on the list?

Seller financing is one of those funding techniques that works great… when you can negotiate it. But you certainly can’t count on it.

Remember Nakeisha Turner, the single mom real estate investor who lives and invests in urban Baltimore? She finances many of her deals with seller financing. A specialty niche of hers is to speak with people in her target neighborhoods who inherit their parents’ properties free and clear, and who don’t have the money to renovate them.

(Wondering how she finds those deals? Try out off-market deal finder PropStream.)

Her offer goes something like this: “The property you inherited is sitting there collecting tax liens and vacancy fines from the City. I’m interested in turning it into a rental, and I can send you monthly payments, so the property becomes a source of income for you. What are your thoughts?”

When you’re negotiating with a seller, it doesn’t hurt to raise the question of owner financing. Broach the topic with the seller directly, rather than through an intermediary real estate agent. You’ll need to be able to explain exactly how owner financing works and what’s in it for them. Plus you’ll want to read the seller’s reaction to see if they could be open to it, or whether it’s a hard no.

Final Tips for How to Finance a Rental Property

Here are some recurring themes that came up again and again, as I interviewed professional real estate investors about their favorite financing for investment properties:

Create Long-Term Relationships with Lenders

Create Long-Term Relationships with Lenders

Homeowners don’t need relationships with lenders, because they only work with one every few years at most. Investors do need strong relationships; their ability to buy new properties (and, you know, earn a living) depends on their ability to get financing.

With relationships come trust and speed – with a single phone call to the right investment property lender, a real estate investor can line up financing for a rental property or flip.

Alex Terauds, Partner and Director of Finance at the Connor Real Estate Group, recommends you “work with a mortgage broker that has significant experience doing deals similar to yours. It is important to get to know your lender first before committing. Choose your lender thinking about the long-term and not just the first deal.”

Have Several Lenders for Every Type of Real Estate Deal

Flip houses or use the BRRRR method? Build relationships with not one, but several fix-and-flip lenders.

The same is true for long-term rental property financing, for HELOCs, and so on.

You never know when one lender will say “No” to a deal, or why. Maybe they’re a local bank thin on capital that month. Maybe they don’t like the market where your next property is located.

Sometimes, an investment property lender just won’t like your deal for whatever reason, even if you think it’s a home run. (Although if a lender doesn’t like your deal, make sure you double check all your numbers and projections!)

Matthew Miller, owner of Stockpile Property Ventures, likes to keep several local lenders close. “Get approved with at least two local direct lenders. A good lender is a necessity for new investors when they are starting out.”

No Documented Income? Use DSCR Loans

Portfolio lenders don’t generally have income requirements or ask you to provide proof of income such as tax returns or bank statements. They don’t calculate debt-to-income ratios, unlike traditional financing and bank loans.

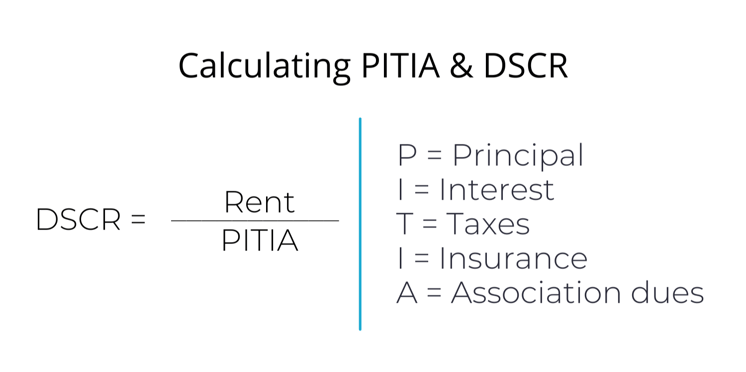

Instead, they calculate debt service coverage ratio (DSCR) to assess the property’s monthly cash flow. The formula looks like this:

Image courtesy of Visio

It’s a simple ratio of the monthly rent income to loan costs including principal, interest, property taxes, insurance, and any association fees. In other words, they want to make sure you’ll generate positive cash flow.

Don’t Spread Yourself Too Thin Financially

Don’t Spread Yourself Too Thin Financially

Real estate investors need to stay capitalized because they never know when a project will go over budget, or take three months longer than expected, or when a furnace will need replacing in a rental property.

“Don’t get into a project you are uncomfortable with or one that will spread you too thin financially,” recommends Matthew Miller. “Just because someone will give you a loan on a property doesn’t necessarily mean it’s a good deal! Have liquidity available to invest with or start wholesaling to build up your liquidity before doing a rehab project.”

Include Financing Costs in Your Profit & Expense Forecasts

It may sound obvious, but far too many new real estate investors underestimate the costs of financing investment properties. Not only do investment property loans usually come with points, but they’ll also charge “junk fees” and other closing costs, and may force you to use their (more expensive!) title company.

Which says nothing of the carrying costs, which investors should budget for at least three months longer than they plan. Renovation projects blow their timetables all… the… time.

Does your bridge lender charge an inspection fee to release draws? Include them in your budget!

“Make sure you take financing and processing costs into account when underwriting potential investment properties,” explains Scott Pollard of Houndstooth Capital Real Estate. “Also, be conservative on the time it takes to sell. It may be a hot market but baking in some extra time if anything unexpected happens is always a safe practice.”

What are your favorite ways to finance investment properties? Have a favorite lender or financing tip? Share them below!

More Real Estate Investing Reads:

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-30% on Fractional Real Estate Investments.

Very comprehensive overview of rental property financing options. I myself like online landlord lenders. After a few deals you settle into a rhythm with them, like you said. Build a relationship.

Makes investing a lot easier when you have no worries about financing!

Thanks Sandra! And I’m with you, the online rental property lenders are a great way to go, much more scaleable than conventional lenders.

I used to like local community banks. Now I prefer online rental property financing/lenders, as their standards are more uniform. Every time I went to the community bank with a deal, it seemed like their lending standards were different.

Great summary!

Thanks Chelsea, and great point about local banks. They’re often less predictable and reliable than nationwide lenders.

Thanks for the great tips on rental property financing ideas in this post!

Excellent post! Thank you for sharing very useful ideas for real estate financing. Keep sharing these types of articles, far too many investors struggle with how to finance rental properties.

Thanks Rueth, much appreciated!

I really enjoyed reading your article! Thank you for sharing very useful ideas for financing real estate rental properties.

All the best,

Russell

Thanks for the kind words Russell!

Holy smokes!!!

To be honest, I usually don’t leave comments on articles that I have read but I got to say that I found this article inspiring and informative.

Especially, since I am considering buying my first investment condo in Destin, FL to eventually turn into an Airbnb rental next year.

Cheers!

Thanks Eddie, and keep us posted about your first rental property purchase!

Thank you for sharing a lot of actionable steps and ideas about how to find good real estate financing.

Definitely an area that gives a lot of investors anxiety, although I’ve actually found that rental property financing is one of the easier parts of investing!

I agree Ronald – rental property financing makes a lot of new investors nervous, but it’s actually easier than ever in today’s world of online portfolio lenders!

I was really wondering how to get started in this current housing market but your rental property financing ideas open my mind to think outside the box.

Thanks a lot!

Glad to hear it was useful Paul!

I’ve to say that this was a really good read, considering that I am about to tackle my 1st rent this year. I have a much better understanding of where I can find the funds to finance the purchase provided I buy it right.

Thank you!!!

I don’t know why closers would charge a “Junk Fee”. What defines a “junk fee?”

A “junk fee” is just any flat fee charged by the lender to boost their bottom line. It has no relation to actual junk.

I am not interested in funding for investment property purchase. Purchase require 25% down payment. Want to know what sources can assist with this payment. Please contact me 7862059299

Hi Odeline, if you’re struggling with coming up with a down payment, try these down payment ideas for investment properties.