Heard of DSCR loan programs as a real estate investor, but not sure how they work (or what DSCR even means)?

Many private portfolio lenders use DSCR (debt service coverage ratio) rather than borrower income to qualify loans. That keeps the underwriting about the quality of the deal itself, not your W-2 income.

Most real estate investors quickly graduate from conventional mortgage loans to portfolio loans. But as you make the switch to these faster, more flexible rental property loans, you need to understand exactly how they differ from conventional mortgage loans.

What Is a DSCR Loan?

An acronym for debt service coverage ratio, DSCR is a formula that portfolio lenders use to measure a rental property’s income versus the proposed loan costs. Note that portfolio lenders keep loans within their own portfolios rather than bundling and selling them off (like conventional lenders do).

These types of loans measure the property’s income via DSCR rather than looking at the borrower’s personal income. For example, when you borrow from Visio or Lending One, they don’t ask you for your pay stubs or calculate your debt-to-income ratio. Instead, they scrutinize the property you plan to buy or refinance, to see how market rents compare to your proposed loan payments.

In other words, lenders use DSCR to ensure the property will have positive cash flow. They typically use DSCR to evaluate long-term rental property mortgages, not short-term interest-only loans such as hard money loans. Think 30-year fixed mortgages, 5/1 ARMs, or other “permanent financing” loan terms.

Lenders vary on how they underwrite loans for short-term rental properties, but often they run the numbers based on the long-term lease agreement rent, in case you need to switch leasing models for more stable income.

So, how do lenders calculate DSCR?

How to Calculate DSCR for Residential Rental Properties

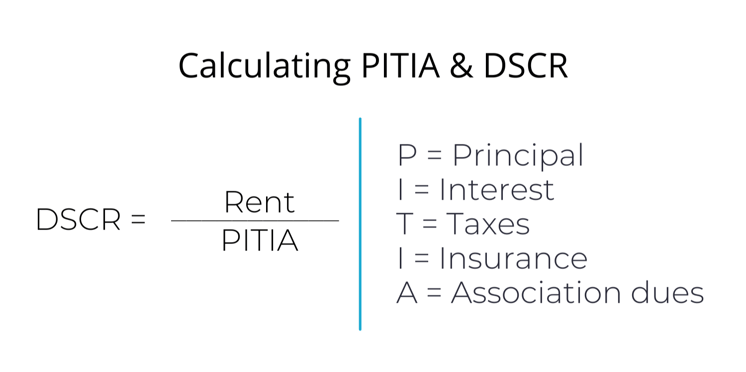

For residential rental properties with 1-4 units, lenders typically calculate the DSCR by simply dividing the monthly rent by the monthly mortgage payment. The latter includes principal, interest, property taxes, insurance, and any homeowners or condo association fees (abbreviated to PITIA).

The DSCR formula looks like this:

Image courtesy of Visio

It’s not exactly “rocket surgery,” as my ex-girlfriend used to say. Consider a quick example: you want to buy a property that rents for $1,000, and the total monthly mortgage payment including PITIA is $750. Punch that into your nerdy calculator watch as $1,000 / $750 = 1.33 DSCR.

The PITIA might break down to $500 for principal and interest, $200 for property taxes, and $50 for landlord insurance. I’m just making up numbers, but you get the idea.

If the rent is higher than the loan monthly payments, the DSCR ratio drops below 1 to show negative cash flow.

Don’t blow any neurons here. This is as simple as it gets.

How to Calculate DSCR for Commercial Properties

Lenders calculate DSCR slightly differently for commercial real estate.

Rather than the monthly rental income divided by the monthly loan payment, they use net operating income (NOI) divided by annual debt obligations.

The commercial DSCR formula looks like this:

Commercial DSCR = NOI / Annual Debt Service

Aside from the obvious difference that they use annual numbers instead of monthly, the real difference is that lenders use net income rather than gross rents. Lenders require you to subtract operating expenses such as property management fees, vacancy rate, repairs, and maintenance.

Imagine gross rents for the year equal $100,000, and your total operating expenses (from property taxes to property management to maintenance and beyond) come to $50,000, so your NOI equals $50,000. The annual principal and interest on your proposed loan come to $35,000. The DSCR would be $50,000 / $35,000 = 1.43.

DSCR Calculator

Want us to calculate DSCR for a rental property for you?

Here’s a quick and easy DSCR calculator that you can bookmark and come back to any time:

We’re thoughtful like that.

DSCR Loan Requirements

As mentioned above, lenders who offer a DSCR loan program don’t typically require personal income documentation, such as tax returns and pay stubs. But they still require plenty of other documentation.

All lenders run your credit history to see how well you’ve paid your debt obligations in the past. For rental property loans, many lenders have a minimum credit score of 660, although some go as low as 620 or set the minimum credit requirement at 700.

Lenders send their own appraiser out to perform an appraisal, which includes the market rent (used to calculate DSCR).

If you apply for a mortgage as an LLC, the lender of courses needs your articles of organization, EIN, and operating agreement.

Lenders may also require bank statements to show proof that you have the cash reserves needed to meet DSCR loan requirements.

And, of course, you need to come up with the down payment.

DSCR Loan Down Payment

Like conventional mortgage lenders, DSCR lenders typically require a down payment of at least 20% on rental property mortgages.

In some cases, they may accept as little as 15% down, or they may require 25%, 30%, or even more down depending on your creditworthiness.

However, most DSCR lenders allow you to borrow the down payment from elsewhere, unlike most conventional lenders. That means you can open unsecured business credit lines through a service like Fund&Grow, and tap them to cover some or all of the down payment or closing costs.

Try these other creative ideas to cover the down payment on a rental property if you’re strapped for cash.

DSCR Loan Rates

Like all loan types, DSCR loan rates fluctuate based on benchmarks like the 10-Year Treasury rate or the LIBOR.

Lenders price their loans with a margin over the benchmark. For example, lenders might aim for roughly 300 basis points (3%) higher than the 10-Year Treasury rate. If the 10-Year Treasury sits at 3.5%, they would aim to price their loans around 6.5% in that example.

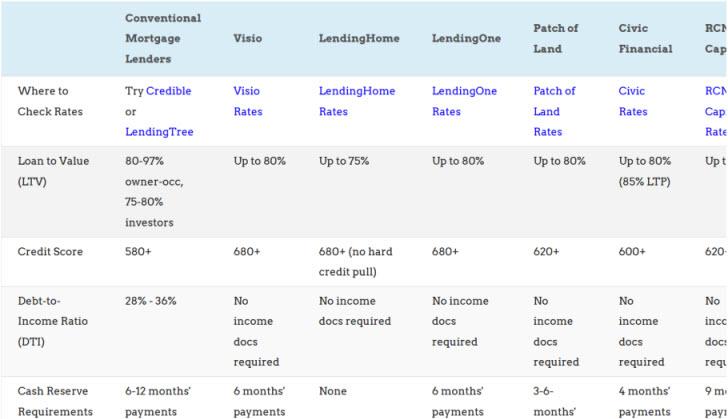

Here’s an overview of current DSCR loan rates for rental properties:

| Conventional Mortgage Lenders | Forman Loan Services | Kiavi (formerly LendingHome) | LendingOne | Visio | RCN Capital | New Silver | Lendency | Conventus | |

|---|---|---|---|---|---|---|---|---|---|

| Where to Check Rates | Try Credible | Instant Rate Quote | Kiavi Rates | LendingOne Rates | Visio Rates | RCN Capital Rates | New Silver Rates | Lendency Rates | Conventus |

| Loan to Value (LTV) | 80-97% owner-occ, 75-80% rentals | Up to 80% | Up to 80% | Up to 80% | Up to 80% | Up to 80% | Up to 80% | Up to 80% | Up to 80% |

| Credit Score | 580+ | 660+ | 660+ (no hard credit pull) | 680+ | 680+ | 660+ | 680+ (no hard credit pull) | 660+ | 620+ |

| Debt-to-Income Ratio (DTI) | 28% - 36% | No income docs required | No income docs required | No income docs required | No income docs required | No income docs required | No income docs required | No income docs required | No income docs required |

| Cash Reserve Requirements | 6-12 mos.' payments | 9 mos.' payments | None | 6 mos.' payments | 6 mos.' payments | 9 mos.' payments | 6 mos.' payments | 6-12 mos.' payments | 3-6 mos.' payments |

| Min. Interest Rate | 6.50-8.625%+ owner-occ, 7.49-9.49%+ rentals | 6.90%+ | 7.9%+ | 6.25%+ | 7.97%+ | 7.99%+ | 7.95%+ | 6.375%+ | 7.375%+ |

| Repayment Term | 15 or 30 Years | 5/1 ARM, 7/1 ARM, or 30-year fixed. Non-recourse loans available. | 3/1 ARM, 5/1 ARM, 7/1 ARM, 30-year fixed, or interest-only | 5/1 ARM, 7/1 ARM, or 30-year fixed | 5/1 ARM, 7/1 ARM, or 30-year fixed | 3/1 ARM, 5/1 ARM, 7/1 ARM, 30-year fixed, or 5- or 10-year interest-only | 30-year fixed | 5/1 ARM, 7/1 ARM, 10/1 ARM, or 30-year fixed | 30-year fixed |

| Time to Funding | 30-60 Days | 14-21 Days | 10-30 Days | 10-30 Days | 21-30 Days | 14-21 Days | 5 Business Days | 20-30 Days | 30-45 Days |

| Loan Limits | $50,000 - $726,200 (higher in some markets) | $55,000+ (no limit) | $75,000 - $2M | $75,000 - $2M | $75,000 - $2M | $55,000 - $2M | $100,000 - $2M | $55,000 - $2M | $150,000 - $9 million |

| Prepayment Penalties | Varies by lender; as high as 5% within 1 year | 0-5 years available | 3% first year, 2% second year, 1% third year, none after 3 years | 80% of 6 months' interest within first 3 years | 3, 5, or 7-year options, including a 3-year step-down pre-payment penalty option | 0-5 year prepayment options | 3 or 5 year options | 2, 3 or 5 year options | 3 Year Stepdown (3-2-1%) |

| States Serviced | Credible is licensed in all except: HI, MO, NV | All except: AZ, CA, MN, NV, ND, SD | AL, AR, AZ, CA, CO, CT, DC, FL, GA, IL, IN, KS, KY, MA, MD, MI, MN, MO, NC, NJ, NV, NY, OH, OK, OR, PA, SC, TN, TX, VA, WA, WI & WV | All Except: AK, NV, ND, SD & UT | All Except: AK, DE, ID, MN, ND, NE, NV, OR, RI, SD, UT, VT | All Except: AK, HI, NV, ND, SD & VT | All Except: AK, AZ, CA, CO, DC, ID, MN, NV, ND, OR, SD, UT & VT | All Except: AK, AZ, CA, ID, MN, NC, ND, NV, OR, RI, SD, TN, UT, VA,VT | All except: AZ, DC, MN, MT, ND, NV, SD, VT & UT |

| Report to Credit Bureaus? | Yes | No | No | No | No | No | No | No | No |

| Where to Apply | Try Credible | Forman Loans | Kiavi (no hard credit pull) | LendingOne | Visio Lending | RCN Capital | New Silver | Lendency | Conventus |

How to Get a DSCR Loan

Borrowing money is like anything else in life: it helps to have relationships.

Aim to start building relationships with portfolio lenders such as Kiavi, Visio, New Silver, LendingOne, and Conventus. The more deals you do with them, the more flexibility they’ll give you on pricing and underwriting.

Lenders price and underwrite their loans based on perceived risk. Your goal as a borrower applying for a loan is to reduce that perceived risk as much as possible.

(article continues below)

DSCR Loan Pros and Cons

Portfolio DSCR loans come with their share of pros and cons, like any financing. Make sure you understand both before borrowing.

Pros of DSCR Loans

Real estate investors love DSCR loans for the following reasons:

-

- Lenders Don’t Check Personal Income: If you’re self-employed or invest in real estate full-time, DSCR lenders won’t hold that against you.

- Speed: When lenders don’t have to put you through a personal income verification and job history verification, it simplifies the underwriting process and saves everyone time. These lenders can typically close loans in around three weeks.

- No Ceiling on Total Loans: Most DSCR lenders allow you to hold many mortgage loans simultaneously. Conventional lenders put a cap on the number of loans you can have reporting on your credit before they stop lending to you.

- No Credit Reporting: In most cases, DSCR loans don’t appear on your credit report.

- Legal Entities Allowed: Portfolio lenders let you buy investment properties under your LLC or other legal entity name, lending to the entity rather than you personally. You may still have to sign a personal guarantee on the loan, however.

- Higher Maximum Loan: Conforming loan programs through Fannie Mae and Freddie Mac set maximum loan amounts. While DSCR lenders do too, they’re often significantly higher.

- More Property Types: Portfolio lenders often allow types of properties beyond just single-family homes and 2-4 unit multifamily properties. Loan options could cover mixed-use properties, apartment buildings with five or more units, and other property types that are harder to finance than single-family rentals.

Cons of DSCR Loans

For all those advantages, DSCR loans come with their share of drawbacks compared to conventional loans.

-

- Higher DSCR Loan Interest Rates: Often DSCR loans come with slightly higher interest rates than conventional mortgage loans.

- Higher DSCR Loan Fees: Lenders sometimes charge higher fees on this type of loan, compared to traditional mortgage loans.

- Potentially Higher Credit Score Requirements: Some DSCR lenders require a minimum credit score of 680 or 700.

- Tighter Underwriting for Novice Investors: For your first investment property or two, DSCR lenders will underwrite you more strictly. They value experience when reviewing loan applications from real estate investors.

FAQs About DSCR Mortgage Loans

If you still have questions about debt service coverage ratio loans, here are a few common ones we hear all the time.

What is a good DSCR loan ratio?

As a general rule, many portfolio lenders require a minimum DSCR of 1.25. They want to write loans against rental properties that cash flow well, not properties with negative or breakeven cash flow.

Who should use DSCR loans?

Landlords and rental property investors are an ideal fit for DSCR loan programs. In particular, those looking to buy more than one or two investment properties — those who want to scale their real estate portfolios — make great borrowers for DSCR loans.

Is it hard to borrow a DSCR loan?

In many ways, it’s easier to borrow a DSCR loan than a conforming or FHA loan. Lenders require less paperwork and underwrite the real estate cash flow of the deal as much as they underwrite you as a borrower. You won’t have to provide income documentation, but plan on explaining your experience in real estate investment. Seasoned investors have a leg up over first-time investors.

Are DSCR loans expensive?

These loans tend to come with comparable interest rates as conforming mortgages for investment properties. At most, DSCR loan rates might cost 25-50 basis points more, but they won’t cost several percentage points more than conforming mortgage rates for investment properties.

Is a DSCR Loan Program Right for You?

These loans offer a great way to scale your rental property portfolio beyond your first property or two.

Lenders reward you for experience in real estate investing, rather than penalize you for having too many mortgage loans appearing on your credit report. They don’t require income verification, ideal for self-employed borrowers such as full-time investors.

But that doesn’t make them better than private loans, such as owner financing or borrowing private money from friends and family. Consider DSCR loans to be one more option in your financing toolkit as a real estate investor.♦

Still have questions about DSCR loan requirements or DSCR loan programs? Fire away in the comments below!

Once you make the switch to DSCR loans you never go back to conventional mortgage lenders. DSCR lenders are just so much easier to work with, and charge similar mortgage rates and points.

I agree Thelma!

I’m looking for loan options that are newbie friendly. Any recommendations?

Hi Sasha, any of the options on the chart above are worth contacting to get quotes on interest rates, points, and loan terms. Keep us posted on your experience with them!

Most investors need greater flexibility than traditional mortgage lenders offer, which make the DSCR loan business such a great option.

Agreed Dara!

Scaling is way easier using DSCR loans than conventional mortgage loans.

Absolutely Clint!

This is one of those real estate terms I’d heard thrown around but never really knew what it meant. *The more you know 😉

Haha, I hear you Albert!