And consider how top-heavy rents are on that list above. Even on the top-ten list, the most expensive city (San Francisco) costs twice as much as the tenth most expensive city (Honolulu or San Diego, depending on which list you’re looking at).

Meanwhile, Honolulu and San Diego are twice as expensive as the 25th most expensive city (Madison)!

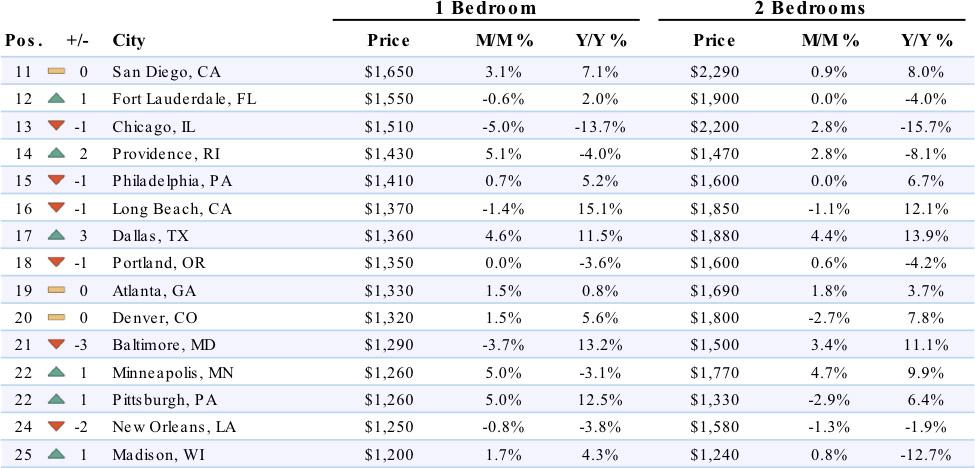

Who wants to spend $4,560/month on a two-bedroom apartment, when they could live in another major city for $1,500/month? No, really: a two-bedroom in Atlanta averages $1,690; in Baltimore, $1,500; in Philadelphia, $1,600; in Pittsburgh, $1,330. None of those are backwaters; they each have an NFL team for Pete’s sake! (Whoever the eff Pete is.)

Millennials, who for a decade drove the

re-urbanization trend, have been

fleeing these most expensive cities in favor of mid-tier cities.

And they’re not just moving to less expensive cities – they’re also moving out to the suburbs.

The Second Wave of Suburbanization

Millennials are the

largest generation in America, make up the

largest cohort of homebuyers, and the largest cohort of urban renters.

But last year, nearly half of millennial homebuyers bought in the suburbs. Another 20% or so bought in rural areas, leaving roughly a third who bought in cities.

“Okay, but what about urban renters? They’re not running off to buy suburban colonials with white picket fences, right?”

Actually, the majority of them want to. No really –

surveys among millennials have found that even urban renters plan to move out to the ‘burbs.

“Why? I thought all they cared about were overpriced coffee shops and craft beer?”

It turns out that, shocker, millennials care about the exact same things that other young parents do, when they get married and have kids. Taxes. Cost of living. Crime rates. School quality.

Which is exactly why they’re moving to the suburbs. On average,

it costs $9,000 more to raise a child in the city than it does in the suburbs. And that’s just cost of living.

With the sudden spike in

violent crime rates in major cities over the last two years, it’s no wonder so many millennials are packing up for smaller cities and suburban America.

Case Study: Chicago

Case Study: Chicago

The nation’s third-largest city watched as its population fell by 9,000 people last year. Meanwhile, developers built over 26,000 new multifamily rental units last year.

Which doesn’t include single-family homes. Or dilapidated buildings renovated and put back on the rental market. Or homes and condos built to be sold, rather than rented.

And crime? It has not been a proud year for Chi-town, with

homicides up 11.4%.

Read: supply is way up, even while demand disappears.

Is it any wonder rents for one-bedroom apartments are down 26%?

Like so many other large cities, Chicago has been hard at work digging its own fiscal grave for decades. Pension debt alone is an

unpayable $33.8 billion. That doesn’t help their bond ratings any, which are

rated as junk status by Moody’s.

What does Chicago do? They go on a taxing spree,

raising every tax they can think of to try to boost revenues. No, really – the average Chicago family is now paying

$1,692 more per year in taxes than they did just five short years ago.

Do you blame millennials for taking their young children and moving somewhere cheaper and safer, that offers better public schools?

I don’t.

What Does All This Mean for Rental Investors?

None of this means the sky is falling, or that rental properties are suddenly bad investments. It just means you should be paying attention.

Is the population in your area rising or falling? What are the demographics of the people moving in? Younger adults tend to drive the most economic gain, since they’re more likely to start businesses, they spend more money on consumption, and they have children (who come with all kinds of expenses to boost the local economy).

Are local crime rates going up or down? What about taxes – are they rising or falling? Are the local public schools performing better or worse than they did five years ago?

It’s possible to make money in declining markets, but it’s a lot easier to make money in improving markets.

Fortunately, nearly all markets in the U.S.

are improving. If you live in one of the few top-tier cities where rents are declining, now is a good time to consider expanding your radius.

No one says you have to invest a mile from home. You have plenty of appreciating markets to choose from, so start thinking analytically, and exploring new markets is as good a reason as any to take a family vacation!

What to Do Next

- First, answer the questions above about your own market!

- If you enjoyed this article, sign up for our Passive Income Newsletter. Every week we’ll help you earn more while working less.

- And hey, if you liked this, your friends probably will, too! Share it on Facebook or Twitter. You can also follow us on Facebook and or Twitter for awesome daily doses of, well, real estate awesomeness ?

What to Read Next

As a real estate investor, you’ve probably wondered “What happens if housing markets collapse?”

It’s one of the biggest fears and questions we hear from our passive income students. One answer is that it’s uncommon for real estate values to go down – it happens in bubbles, or major recessions, or when a local economy collapses (e.g. a steel town after the steel mill closes).

But it doesn’t happen often.

It’s even rarer for rents to go down. Even during the Great Recession, as housing values plummeted by 30% here, 25% there, rents actually increased.

So, what’s happening now, in America’s largest cities?

As a real estate investor, you’ve probably wondered “What happens if housing markets collapse?”

It’s one of the biggest fears and questions we hear from our passive income students. One answer is that it’s uncommon for real estate values to go down – it happens in bubbles, or major recessions, or when a local economy collapses (e.g. a steel town after the steel mill closes).

But it doesn’t happen often.

It’s even rarer for rents to go down. Even during the Great Recession, as housing values plummeted by 30% here, 25% there, rents actually increased.

So, what’s happening now, in America’s largest cities?

In New York City, rent for a two-bedroom apartment is down nearly 20% from its peak. In Honolulu, rents are down by 23%!

And Chicago’s rents have fallen so far that America’s third largest city is no longer on the top ten list (more on Chicago later).

Yet home prices have continued to rise in these cities. New York City home values are up 9.3% year-over-year. Honolulu values are up 4.8%.

This divergence of rents and home prices spells B-A-D N-E-W-S for rental investors. But what about elsewhere in the country, outside these pricey mega-cities?

In New York City, rent for a two-bedroom apartment is down nearly 20% from its peak. In Honolulu, rents are down by 23%!

And Chicago’s rents have fallen so far that America’s third largest city is no longer on the top ten list (more on Chicago later).

Yet home prices have continued to rise in these cities. New York City home values are up 9.3% year-over-year. Honolulu values are up 4.8%.

This divergence of rents and home prices spells B-A-D N-E-W-S for rental investors. But what about elsewhere in the country, outside these pricey mega-cities?

Among the 26th-50th ranked cities by rent, almost all have seen rents continue to rise.

Among the 26th-50th ranked cities by rent, almost all have seen rents continue to rise.

Rents nationwide are up 3.2% year-over-year, and home values are up 6.8%. Hardly the kinds of numbers to give economists nightmares.

Rents nationwide are up 3.2% year-over-year, and home values are up 6.8%. Hardly the kinds of numbers to give economists nightmares.

Case Study: Chicago

Case Study: Chicago

Killer article Brian! Love the data. Making me think twice about investing in my home town (although I’ve been meaning to diversify for a while anyway)

Rents are going up nowadays. I’m just wondering if it will continue to go up and then burst down in the future. Thoughts?

I don’t see rents dropping unless a recession hits. But that’s a real possibility.