Rental properties are a great way to fund some or all of your retirement. They produce steady, predictable income without eating into your principal. And they have many tax advantages and other benefits for retirement.

But before you embark on a multi-year real estate investing journey, you should first figure out how many rental properties you actually need to retire.

Once you know how many rental properties you need, you can more easily pick an investing strategy and find the right real estate niche. You’ll also have a clear milestone to measure your progress against. And you might even realize that you’re closer to retirement (aka financial independence) than you think!

In the rest of this article, I will share the math behind real estate retirement planning and examples of how to retire with rental properties. Then I will also show you 5 steps to help you personally calculate the number of rental properties you will need to retire.

No Real Estate Retirement Calculator Needed

Traditionally, people who plan for retirement use tools like a retirement calculator. For example, SparkRental offers an Early Retirement Calculator that includes many different sources of income.

Retirement calculators are helpful, especially when investing in typical assets like mutual funds and stocks. But as you’ll see below, the retirement math is much simpler when using rental income.

Of course, it helps if you accurately calculate cash flow. Use a rental income calculator to forecast cash flow for any property.

Real Estate Retirement Math

The real estate retirement math has 3 variables:

- Your expenses in retirement (E)

- Your wealth invested in real estate (W)

- The conservative income yield or cash-on-cash return on that wealth (r)The basic formula is this:

W x r = E

or

E ÷ r = W

For example, let’s assume your expenses in retirement will be $70,000 per year. Let’s also assume you can find properties with a 10% cash-on-cash return.

This means you need to invest wealth (aka equity) of $700,000 into rental properties.

E ÷ r = W

$70,000 ÷ 10% = W

$700,000 = W

If that math doesn’t work for your situation, you can change each of those three variables as needed.

For example, if your expenses will be $100,000 per year, you may need to invest $1 million instead of $700,000

$100,000 ÷ 10% = W

$1,000,000 = W

Or, you could also be more conservative with your cash-on-cash return. Let’s say you could only get a 6% return. How much wealth would you need in order to still cover $100,000 in expenses? Let’s look.

$100,000 ÷ 6% = W

$1,666,667 = W

Next Steps

So, the math begins with your retirement expenses (E). You decide what that number is. But if you’re unsure how to estimate your expenses, I’ll get into how to calculate those needs in more detail later in the article.

Next, you plug in (r), your cash-on-cash return assumption (like 10%). This is the cash yield you can expect from your rental properties.

The result of that math equation is the amount of wealth (W) you need to either invest (if you already have the capital) or accumulate (if you’re still growing your portfolio).

Simple math, right? But of course actually doing that math in the real world is a little trickier.

So, let’s look at an example.

What a Retirement Rental Property Looks Like

Examples are always the easiest way for me to understand concepts. I bet you feel the same way. That’s why I want to give you some real numbers here.

But examples are only helpful when you understand the assumptions. You may need to adjust these assumptions to make them relevant to your situation.

So, in my examples assume that all of the rental properties will have the following characteristics:

| Rental Property Assumptions | |

| Property Type: | Single Family Houses |

| Market Location: |

|

| Total Cost of Each Property (Purchase, Closing Costs, Repairs) |

$120,000 |

| Cash Investment Per Property | $30,000 |

| Mortgage Details | $90,000 principal (4.4% interest, 30 years, $450/month principal & interest payment) |

| Total Rental Income | $1,200 / month |

| Operating Expenses | -$500 / month |

| Net Operating Income | $700 / month |

In an ideal world, each house would also be built for low maintenance renting with a large crawl space, masonry or brick exterior siding, hardwood and tile floors inside for inexpensive tenant turnovers, and wonderful neighbors. But getting 100% of that may be asking for too much!

Now let’s look at two different examples of rental properties to produce retirement income.

The Leveraged Rental Retirement Portfolio

There is an endless debate about how much debt you should use in real estate investing. Some even question whether you should use leverage in real estate at all. I’ll be happy to jump into the nuances of that debate in future articles, but for now, I’m just going to give you two examples – one with debt leverage and one with no debt.

The goal in both examples will be $84,000 per year in rental income (pre-tax).

Here’s example #1 with leverage:

-

- 28 rental properties

- Total cost = $3,360,000 ($120,000 per property)

- $840,000 equity capital invested ($30,000 per property)

- $2,520,000 debt financing ($90,000 per property)

- Total rental income/month = $33,600 ($1,200 per property)

- Operating Expenses/month = -$14,000 (-$500 per property)

- Net operating income/month = $19,600 ($700 per property)

- Mortgage payments/month = -$12,600 (-$450 per property)

- Total net positive cash flow/month = $7,000 ($250 per property)

- Total net positive cash flow/year = $84,000

Using the math formula from earlier, we can calculate our cash on cash yield as follows:

$840,000 x r = $84,000

r = 10%

There are positives and negatives to every investing and life decision you make. This portfolio is no different.

Positives/Negatives to The Leveraged Rental Retirement Portfolio

Positives:

-

- You locked in low-interest, long-term debt secured by quality rental properties. This is a great inflation hedge.

- In addition to rental cash flow, you will also receive growth from amortization of loans ($41,356 just in year #1 of the loans)

- You have the potential for price and rent appreciation since you bought these in a solid location, which could send your returns off the chart in the future.

Negatives:

-

- 28 properties to care for as an asset manager and/or property manager. Without strong systems, this could be a hassle.

- Financing for 28 properties at those attractive terms could be challenging (probably the weakest link of this portfolio).

- The next Great Depression could expose the entire portfolio to a risk of loss. Would you have cash reserves to survive if rents crater by 25% or even 50%? Few investors could survive that, which is something to think about even if the chances are very small.

This example, like all case studies, has more details we could discuss and debate. But I hope it illustrates one possible type of retirement rental portfolio.

Now let’s look at one without debt.

The Free and Clear Rental Retirement Portfolio

In this example, you have the same goal of $84,000 per year in net, pre-tax rental income. But the portfolio looks very different.

- 10 rental properties

- Total cost = $1,200,000 ($120,000 per property)

- $1,200,000 equity capital invested ($120,000 per property)

- $0 debt financing

- Total rental income/month = $12,000 ($1,200 per property)

- Operating expenses/month = -$5,000 (-$500 per property)

- Net operating income/month = $7,000 ($700 per property)

- Mortgage payments/month = $0

- Total net positive cash flow/month = $7,000 ($700 per property)

- Total net positive cash flow/year = $84,000

Using the math formula from earlier, we can calculate our cash on cash yield as follows:

$1,200,000 x r = $84,000

r = 7%

Just like the last portfolio, there are positives and negatives to this example.

Positives/Negatives to the Free and Clear Rental Retirement Portfolio

Positives:

- Asset and property management is relatively simple. I could easily manage this number and type of properties part-time while traveling and enjoying life. A third-party property manager could make it even more passive.

- Low deflation risk. Even in the next Great Depression, rents could be lowered or even bartered for goods and services, if needed.

- Benefit from price and rent appreciation if and when it comes.

Negatives:

- Higher equity capital requirement ($1,200,000) means it could take longer to reach retirement goal.

- Less attractive inflation hedge compared with a leveraged portfolio (although growth is less of a concern in a mature portfolio as long as it generally keeps up with inflation).

I have used two extremes in these examples to demonstrate the positives and negatives. In real life though, it may make more sense to mix the two (which is more like what my business partner and I have done). You can and should adjust the basic principles to the reality of your situation and to your comfort level.

Now that I’ve shared some general examples, let’s move on to your situation. I’d like to share five steps to calculate the number of rental properties you will need to retire.

(article continues below)

Step #1 – Calculate Your Current Personal Expenses

Financial blogger JD Roth says your current expenses (and not your income) are the best starting point to figure out how much money you need to save for retirement. Once you know your current expenses, you can then make adjustments (like for inflation) to figure out your future needs.

This makes sense, of course, because financial independence means owning investments that pay your living expenses. Free from the need to work for money, you can then do what matters.

The problem is that many of us don’t really know our personal expenses. Sure, you spend less than you earn. And you probably save a lot of money too.

But if you want to gain extreme confidence in your plan and possibly retire earlier than you thought, you need to know your expenses with more certainty.

Tools to Help You Calculate Your Expenses

If you’re a financial nerd like me, you will probably already know your current expenses and even have a detailed spreadsheet! But if you’re not a nerd yet, here are a few tools to help you get started calculating your personal expenses:

-

- Spreadsheets – Always a very simple, effective, and flexible tool to track your expenses. You can download a free budget template here.

- Mint.com – This is a free online tool from Intuit that automatically tracks your personal expenses by pulling data from your bank accounts and credit cards.

- YNAB (You Need a Budget) – This is a paid software app that has more bells and whistles than Mint.

If you have not calculated your expenses before, just know that it won’t be a quick 60-second exercise. But it’s not overwhelming either. I recommend scheduling a few hours on a weekend to really dig into the numbers.

But for now, just make an educated guess and let’s move on to the next step.

Step #2 – Adjust Expenses For Retirement (if needed)

Will you spend more, less, or the same in retirement? Of course, that depends on your situation. But don’t be surprised if the total expenses are less than you spend during your working years.

Why would this be so?

What if you own your residence free and clear? Won’t that save you money?

What if you earn most of your income from rentals sheltered by depreciation? That’s the point of this article, right? You’ll pay a lot less in taxes with sheltered rental income compared with the high salary years at work.

Other Examples of Savings

In addition, what if the free time and flexibility you have as a retiree allows you to negotiate much more than before? When you’re working a job 50 weeks per year, that 2-week vacation in the summer will be expensive. However, when you have many months of free time, you can choose to travel during the times of year and to the places where you find good deals. There are many more examples of savings just like this.

But in the end, you’ll want to make an estimate you’re comfortable with. For some real numbers and perspective, you might enjoy “How Much Will It Cost You to Live in Retirement” by Darrow Kirkpatrick at CanIRetireYet.com.

Step #3 – Estimate Other Sources of Income

Will you have other sources of income when you retire? Or will rental properties be your only source?

Other sources could include:

- Stock dividends

- Interest from bonds

- Interest from real estate crowdfunding sites like Groundfloor and Concreit

- Dividends from real estate crowdfunding investments like Fundrise and Streitwise

- Annuities

- Social security pension (for those of us old enough to receive it)

- Employer pensions (more rare today than ever)

I tend to heavily concentrate in one sector (real estate). I do like Warren Buffett says and “put my eggs in one basket and watch them very closely!” But I plan to continue diversifying over time. So, an estimate of other income sources makes sense.

And if real estate investing is only a small part of your overall retirement plan, this is where you incorporate the other passive income streams from your portfolio. Mixing and balancing those will take some thinking and perhaps some professional advice. But real estate can be the solid and steady source of income at the core of your plan.

Step #4 – Create a Profile of Your Retirement Rental Property

Earlier in this article, I described what a retirement rental property looked like for my example. I included characteristics like:

-

- The property type

- The general location within the country

- The specific location within a region

- The price range

- The cost and debt structure

- The rental income, net operating income, and cash-on-cash return

At a minimum in this step, estimate the cost, debt structure, and cash-on-cash return for your rental properties. The cost and debt structure can be figured out with your real estate agent and with your mortgage lenders, respectively.

Cash-on-Cash Return

For the cash-on-cash return, I don’t recommend going below 6%, even on a free and clear property in a quality location. On the other hand, I also don’t recommend assuming you will get larger returns like 15-20%. Although those yields are possible and I have achieved them, it is better to build a retirement plan on a more conservative foundation.

This upfront work is really the blessing and the curse of real estate investing. Few people will choose to do it, but that leaves you with less competition because you will!

Step #5 – Calculate Rental Properties Needed to Retire

Now we’re back to the simple math and three variables from the beginning of the article.

- Your estimated expenses in retirement (E)

- Your wealth (aka equity) invested in real estate (W)

- The yield or cash-on-cash return on that equity (r)

In this case, you already have #1 and #3 from prior steps, so you need to figure out #2 – the wealth to invest.

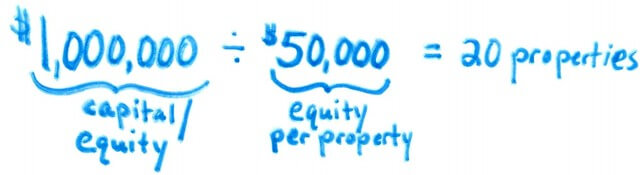

For example, if you want $80,000 income at retirement and expect to get an 8% cash on cash return, you need to invest equity of $1 million.

W x 8% = $80,000

W = $1,000,000

With that number in hand, your final calculation depends upon the property values and the debt structure you’ll choose.

For example, if the properties in your market will cost $100,000 and if you plan to own them free and clear, you’ll need 10 rental properties.

But if you plan to have 50% leverage and the properties cost $100,000, you’ll need to own 20 rentals.

The point of this step-by-step process was to focus your financial goals down to a certain number of rental properties. Your goals may vary, of course, but I highly recommend you try the process for yourself.

How Many Rental Properties Do YOU Need to Retire?

So far I’ve shared the simple math of real estate retirement, two examples of rental retirement portfolios, and 5 steps to calculate the number of rental properties you need to retire.

Will this be a perfect prediction of your retirement rental income? Of course not. But it doesn’t need to be perfect in order to move you towards your goals. A solid, approximate goal will do the job.

But most importantly I hope this information will give you confidence and a solid framework. You can then build upon those to create a retirement income from rental properties for yourself.

I wish you a successful journey towards rental retirement income!♦

How many rental properties do you need to retire? Were these examples and steps helpful for you? What do you think about using rental income to fund some or all of your retirement?

More Early Retirement Reads:

About the Author

Chad Carson is a real estate investor, world traveler, father of two beautiful children, husband, and founder of CoachCarson.com. His mission: to help you do more of what matters to you personally. And he walks his own talk, too — he spent nearly two years with his family in Ecuador, running his business and real estate portfolio from abroad while adventuring with his family.

This article originally appeared on CoachCarson.com and is republished here with the author’s permission.

Interesting read. I’m revisiting my early retirement formula to include more alternative assets like rentals.

Glad to hear you got something out of it Allison!

This formula is more realistic than my computation. I’m impressed!

Thanks Andy!

Glad it was helpful Andy!

Great stuff. I am selling and buying properties right now, looking for higher yield, and working on with my early retirement.

Keep us posted on your progress Matthew!

I’ve turned over properties like that, too. Kind of like culling your herd. Best of luck with your next steps and early retirement plans!

I’m glad to drop by here to reassess my early retirement journey. I’m far from getting there but I’m all out working on it!

All about making progress and staying the course Gian!

Having a partner makes financial independence more acheiveable. Like the saying goes, “Two people are better than one, because they get more done by working together. If one falls down, the other can help him up.”

That’s true, at least if both partners are completely on board and in sync. In many marriages though, one partner likes the spend while the other likes to save and invest. That can make it even harder to reach financial independence than if you were single.