Famed for its simplicity and historical resilience, this approach has guided generations of investors in balancing growth and risk. But while a simple 60/40 allocation fared well during the years 2010-2021, this period in financial history may be closer to the exception than the norm.

Recent shifts in the global financial markets are challenging the efficacy of this traditional strategy. Institutional investors have long since broadened their horizons. For decades now, they’ve relied on the precepts of modern portfolio theory, with its greater diversification among private-market alternatives.

Which all begs the question: where does real estate fit into modern portfolio theory? How does diversifying into real estate help you reduce risk in your portfolio while still earning high returns?

Key Takeaways:

-

- The classic 60/40 portfolio is based on 20th Century stock and bond market performance. It doesn’t reflect today’s markets.

- The correlation between stocks and bonds has risen in the 21st Century, so bonds no longer offer the protection from stock market crashes that they once did.

- Private real estate investments add true diversification in today’s market — without sacrificing on returns.

Evolution & Challenges of the 60/40 Portfolio Strategy

An investment mainstay for decades, the 60/40 portfolio allocates 60% to stocks for growth and 40% to bonds for income and risk mitigation.

Historically this allocation provided a balanced approach, leveraging the growth potential of equities and the stability of fixed-income assets. However, the current economic landscape marked by prolonged low interest rates, inflationary pressures, and geopolitical uncertainties is diminishing the strategy’s effectiveness.

Key factors contributing to these challenges include:

-

- Prolonged Low Interest Rates: The extended period of low interest rates has compressed bond yields, reducing the income-generating capability of the fixed-income portion of portfolios.

- Inflationary Pressures: Rising inflation rates have eroded the real returns of both stocks and bonds, challenging the traditional hedge that bonds provide against stock market volatility.

- Potential stock market volatility: while the S&P 500 has bounced back in 2023 following an abysmal 2022, a large percentage of the gains are attributable to seven large tech stocks. Given how buoyed tech stocks have been by AI enthusiasm, performance of the stock market as a whole may be tenuous.

- Geopolitical Uncertainties: Global geopolitical tensions, including trade wars and regional conflicts, have increased market volatility, impacting both equities and fixed income markets.

- Increased Correlation Between Stocks and Bonds: Historically, stocks and bonds have exhibited a negative correlation, providing a diversification benefit. However, recent trends show an increasing correlation between these asset classes, reducing the risk mitigation offered by bonds in a portfolio.

These factors collectively suggest that investors need to rethink the traditional 60/40 split.

Modern Portfolio Theory in Today’s Market

Modern Portfolio Theory (MPT), formulated by Harry Markowitz in the 1950s, emphasizes diversification to optimize risk-adjusted returns. The core principle of MPT is that an investor can achieve maximum returns for a given level of risk by diversifying across various asset classes. The point of diversification, in Dr. Markowitz’ formulation, was to reduce cross-asset allocation.

In a prior decade, you might have thought of achieving this through investing in different sectors of the economy, or in investing in domestic as well as global securities, or in holding a meaningful portion of your portfolio in bonds.

Changing market dynamics call into question what constitutes effective diversification. In the current market, the traditional negative correlation between stocks and bonds is waning. That creates a need for alternative assets if you want true diversification.

Not coincidentally, institutional investors (most famously Dave Swenson of the Yale Endowment) have been taking modern portfolio theory to the next level for decades by investing in a basket of illiquid “alternatives.” The Yale portfolio has beaten general market indices by a wide margin for decades by allocating over 20% to alternatives like private equity real estate, infrastructure, commodities, and private-market properties.

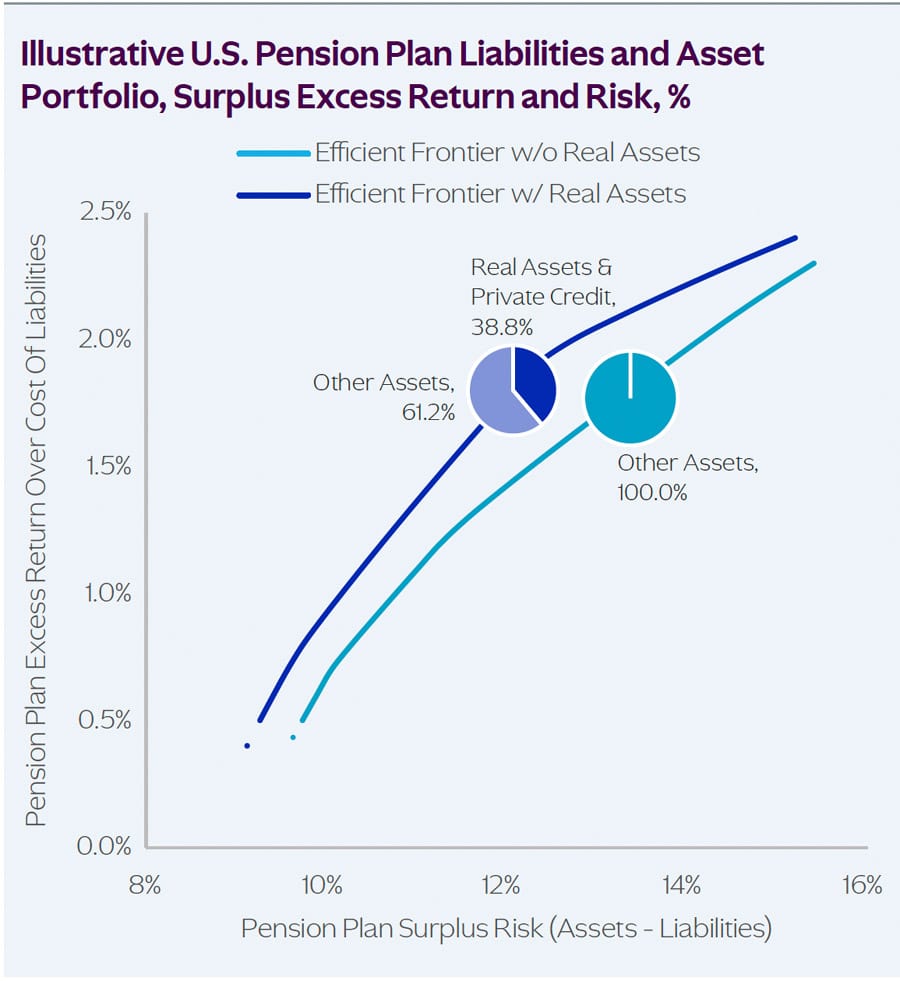

In graphical terms, an asset allocation that follows modern portfolio theory would bear out a higher “efficient frontier” — the relationship between returns and volatility (risk) of the portfolio. For any given level of target return, a diversified portfolio (per MPT) would reflect a lower level of portfolio-level risk with higher returns. Check out this paper by investment firm KKR breaking down historical risk versus returns.

Diversification in Today’s Markets

So how are today’s leading asset allocation strategists applying modern portfolio theory?

Global investment firm KKR’s analysis of the current macroeconomic climate points to a structural shift in the market. KKR suggests that in the face of ongoing fiscal stimulus, labor shortages, a global energy transition, and heightened geopolitics, there is a “higher resting heart rate” for inflation in many developed markets.

This change implies a more correlated relationship between stocks and bonds, reducing the role of bonds as effective “shock absorbers” in portfolios. Consequently, KKR advocates for Real Assets, including private real estate investments and real estate credit, as viable alternatives to traditional fixed income. These assets offer resilience against inflation and can serve as substitutes for bonds in diversified portfolios.

The increasing interest in private markets, including real estate debt, aligns with the need for more robust and varied investment strategies in today’s complex financial landscape.

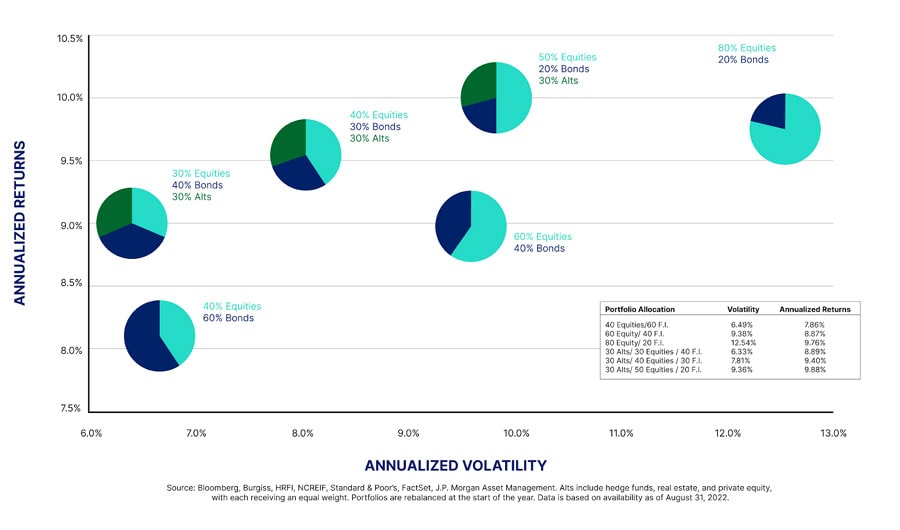

Recent work from JP Morgan highlighted how portfolios with 30% allocated to private-market alternatives (like private real estate syndications) could move investors up the efficient frontier, looking at recent asset performance data.

In this empirical study, a portfolio allocation of 40% stocks, 30% bonds, and 30% alts delivered 27% better risk-adjusted returns than a traditional 60/40 portfolio over the period studied. It’s why SparkRental’s Brian Davis replaces bonds with real estate in his own portfolio.

The Growing Importance of Private Real Estate Credit

Private real estate credit includes secured real estate loans issued by non-bank lenders. These include hard money loans, construction loans, bridge loans, private rental property mortgages, and other loans for investment properties.

The appeal of private real estate credit lies in its ability to offer steady income, predictable returns, and lower volatility compared to traditional fixed-income assets. Notably, real estate debt has demonstrated resilience in down markets including 2022 and 2023. Historical data shows lower maximum drawdowns and quicker recoveries compared to traditional bonds. For a simple example, look no further than Groundfloor, which continued paying between 9.5-10% average annualized returns throughout this period.

Private real estate credit not only offers stability, cash flow, downside protection, and less-correlated returns, it also benefits from “once-in-a-cycle” tailwinds in terms of return potential. Rates on real estate private credit are now elevated for three major reasons:

-

- The rates that private lenders can command have gone up in direct response to aggressive rate hikes by the Fed.

- The collapse of SIlicon Valley Bank and others prompted a mini-crisis in the midsize banking sector, where many real estate operators historically source debt financing. Balance sheet tightening by traditional lenders has truncated the supply of debt financing for real estate activity.

- Many market indicators and demographic trends remain favorable for real estate operators and developers, including positive jobs numbers, high rates of household formation, and low availability of single-family homes for purchase or rent.

These factors together mean that investors may be able to participate in real estate private credit and earn, as Howard Marks recently put it, “equity-like returns from debt.”

EquityMultiple makes real estate private credit opportunities available to individual self-directed investors via its Ascent Income Fund, as well as investments into distinct loans.

What About Private Equity Real Estate?

Commercial real estate valuations have dropped rapidly since rates began rising. But dropping valuations does not mean disappearing opportunities for investors.

If anything, lower prices mean the opposite. If property values drop when interest rates increase, the opposite is also true: values leap when rates drop. Over the next several years, investors in real estate private equity have the opportunity to benefit from “cap rate compression.” In other words, acquiring assets at suppressed valuations and exiting in a more favorable interest rate environment.

At the same time, we increasingly see distressed sellers emerging in real estate markets. Asset owners who took on floating rate or short-term debt in the former regime are now unable to refinance, and forced to liquidate or take on “rescue capital.”

Executing on this strategy requires solid financing options, knowhow, and access. While you may not be able to buy up properties by yourself, you may be able to tap into fractional real estate investments through platforms like EquityMultiple and group investment clubs like SparkRental’s Co-Investing Club.

Real Estate Primed to Win Either Way

Think about these group real estate investments in the context of modern portfolio theory and cross-asset allocation.

In early 2024, the economy could go in one of several directions. We could see a “higher for longer” phase of the cycle, where economic growth remains strong and rates stay high. In this case, diversifying into real estate private credit (for the reasons stated above) offers high returns with relatively low risk. While it would remain a bad time to sell properties, we’d continue to see plenty of opportunities to invest in real estate private equity at discounted prices.

If growth slows or a recession hits and rates drop, we can expect pain in the stock market. However, lower rates push up real estate asset valuations, creating a great market for selling existing investments.

In either case, returns from private real estate win. No matter what the coming years hold, we can expect that return dynamics will play out differently for private real estate than for stocks and bonds traded on public markets.

The “nightmare” scenario for a real estate investment made today would be inflation resurging and the Fed raising interest rates even further. But that scenario looks extremely unlikely at the close of 2023.

Invest for This Century, Not the Last

The 60/40 portfolio is a relic of the past.

Private-market real estate assets, particularly real estate debt, present a promising solution to the limitations of the traditional 60/40 allocation strategy. Real estate private equity may also provide a less correlated substitute for the growth potential of stocks.

By incorporating these assets into investment portfolios, investors can achieve a more resilient and adaptable investment strategy, better suited to navigate the complexities of today’s market dynamics. As the investment world continues to evolve, the inclusion of diversified real estate assets stands as a testament to the enduring importance of adaptability and strategic foresight in investment planning.♦

What role does real estate play in your broader investment portfolio and asset allocation?

More Reads to Make You Rich:

About the Author

Soren Godbersen is Chief Growth Officer at EquityMultiple, where he leads investor communication efforts. He oversees a host of initiatives to grow the firm’s real estate investing platform for self-directed investors. Mr. Godbersen holds a Bachelor of Arts in Economics from Whitman College.

Fascinating to see some of the data on the lower risk and higher returns of portfolios with private equity real estate. I wonder how portfolios with no bonds perform?

Yeah I don’t invest in bonds for the most part in my portfolio. Passive real estate investments fill that role for me.

A must-read for those adapting their investment approach.

Glad it resonated with you Donald!

Hi Soren! Great article, one key aspect that stands out is the focus on real estate debt, emphasizing the potential for stable returns and income generation. This approach aligns with the current economic landscape, where investors are often seeking reliable income streams amid market volatility. Real estate, known for its tangible nature and income-generating potential, could indeed play a pivotal role in diversifying portfolios and enhancing overall stability – Thanks for sharing!

Thanks Suzanne, and I agree!

When I first got into investing I tried to chase appreciation at the expense of cash flow. It didn’t go well for me. Today I only invest in properties with a clear path to positive cash flow yield.

I made similar mistakes Bridget!

Real estate is a big player in how I handle my money. I invest some of my money in rentals and make sure my money grows in a safe and steady way, not just relying on one type of investment.

Same here Xyrille! Although instead of rentals I invest in passive real estate syndications.

Some interesting data in here. Love that it challenges the conventional wisdom that higher returns always come with higher risk.

Agreed Eric!