The Big Picture On Exit Strategies For Real Estate Investors:

-

- Despite attractive yields and relatively low risks, real estate investment don’t always pan out the way you want to. That’s why it’s important to have an exit strategy in place.

- Common real estate exit strategies include straight selling, refinancing, and seller financing. However, these strategies cannot be used in all situations.

- Lesser-known real estate exit strategies include allowing rent-to-own options, bundling real estate properties into one deal, donating to charity, passing it to your offspring, and more. As alluded to before, each strategy should be applied depending on your specific situation.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

How often in life does everything go exactly to plan?

Real estate investing is no different, except the stakes are much higher. You need contingency plans for your contingency plans, a depth chart that would make an NFL team proud.

In other words, you need multiple exit strategies. You can’t always sell properties conventionally, and you can’t always hold them as rentals, either. What do you do if your flip turns into a flop, and you only have short-term financing? Or if you can’t keep your rentals after all, because your spouse walked out and hired a pit bull of an attorney to requisition your assets?

Our plans don’t always work out, but when we’re working with assets worth hundreds of thousands of dollars, failure isn’t an option. Consider the following unconventional real estate exit strategies, that all investors should keep warm on the back burner in case their main dish gets burnt.

Common Real Estate Exit Strategies

Before we dive into the less popular strategies, let’s brush up the the more common exit strats.

| Strategy | Description |

|---|---|

| Selling | Direct sale of the property to another party. |

| Wholesaling | Agreeing to sell a property, then finding an end buyer to purchase it at a higher price. |

| Refinancing | Replacing the original mortgage with a new one, often to obtain better terms or to access equity. |

| Lease Option | Allowing a tenant to rent the property with the option to buy it later. |

| Seller Financing | Selling the property by becoming |

1. Lease Option/Rent-to-Own

While most investors understand the concept, most have never actually used a lease option agreement. The idea is simple: if you’re not in a rush to sell, you can sign a lease with Spencer Renter that gives him the option to buy the property within a year or two, for a preset price.

The tight time frame protects the seller in several ways. First, it provides urgency for the buyer, and pushes them to act quickly. Second, it protects against the seller committing to an outdated price, if the property appreciates quickly.

Lease options can be especially effective in slower markets, where there isn’t enormous demand at the present moment. In red-hot markets, it’s just not necessary, and is likely to leave the seller burned by losing out on the appreciation over the course of the option term.

To help the renters purchase, you can opt to provide seller financing. This creates both work and risks for you as the seller though: you have to service the loan, and if the buyers default on their payments… well, the foreclosure process is a lot more expensive and time-consuming than the eviction process.

Then there’s the question of your existing mortgage – are you paying it off? With what money? Are you doing a wraparound mortgage and leaving your original mortgage loan in place? That could violate your loan terms, which nearly always require payoff in the event of a change of ownership.

Still, seller financing can combine well with a lease option, to sell a property for top dollar without paying a real estate agent commission. It just takes more patience than, say, auctioning the property off.

Tip: Make sure your lease agreement includes a “no-equitable interest” clause. Double check that your state permits them, as they protect your property – and your ownership of it – until the tenant-buyer actually settles.

2. Convert Your Property to a Short-Term Rental

Signing a long-term lease agreement doesn’t always deliver the highest real estate cash flow. In your market, the property could generate better rental cash flow as a vacation rental on Airbnb.

Use our free rental cash flow calculator to run the numbers as a long-term rental, and then try Mashvisor’s short-term rental calculator to run the numbers as a vacation rental. Every market is unique, and becoming an Airbnb landlord may or may not make financial sense for your particular property.

| Type | Income Potential | Occupancy Variability | Management Intensity | Regulatory Considerations |

|---|---|---|---|---|

| Short-Term Rental | Higher, due to the ability to charge more per night but may have more vacant days. | High, with potential for more vacancies between bookings. | High, requires more frequent cleaning, guest communication, and booking management. | Potentially significant, with local laws possibly restricting short-term rentals. |

| Long-Term Rental | Steadier, as it typically involves a fixed monthly payment. | Low, often with continuous occupancy for the term of the lease. | Lower, with less frequent tenant turnover and maintenance requests. | Generally fewer restrictions, but landlord-tenant laws apply. |

Granted, there’s more to the decision that cash flow. Managing a vacation rental takes far more work than managing a long-term rental. You can hire a property manager of course, but expect them to take a heftier cut than your typical long-term rental manager.

3. Bundle Multiple Properties

3. Bundle Multiple Properties

Have several properties you need to sell? Consider selling them as a bundle as your real estate exit strategy.

The properties could be bundled to offer a “package discount,” or they could be fully renovated, turnkey properties selling for a pretty penny. Matt Andrews of REFreedom.com uses this tactic all the time: “After we find, fix, and rent the properties, we package and sell them (sometimes 5, 10, 20 at a time) to large funds, buying groups, and international investors.”

Sure, there are fewer buyers in the market for property bundles, but they are serious buyers with deep pockets. They can move fast and settle quickly.

Consider also that rented properties are self-sufficient, on a monthly cost basis. It costs a lot of money to carry vacant properties while trying to sell them, but sellers have the luxury to wait for the perfect institutional buyer to come along if they’re rented and earning money while on the market as a performing bundle.

There’s also an economy of scale at play here. It’s no picnic marketing seven vacant properties separately, but selling as a bundle means only one “product” to market and sell. This helps investors and marketing agents focus their efforts, and frees up more time and resources to market that bundle more aggressively.

(article continues below)

4. Guerilla FSBO Tactics

4. Guerilla FSBO Tactics

Real estate agents are expensive for exit strategies, and aren’t always necessary. Sure, unique and upscale properties probably need a realtor to do some serious sales maneuvers, but an average middle-class house? The primary marketing is a simple MLS listing.

Today’s real estate investors can list their properties on the MLS using flat-fee listing services such as Clever and Houzeo that cater to For-Sale-By-Owner customers, at a fraction of the cost of a traditional realtor. But MLS listings are just the beginning.

There are entire Facebook groups dedicated to local real estate available for sale. If you’re targeting investors, there are also Facebook groups for local real estate investors, not to mention local real estate investing clubs. For that matter, you can take advantage of our nationwide Facebook group for real estate investors, with roughly 32,000 members!

It doesn’t take a realtor to put a “For Sale” sign in the window, or host an open house. Or, for that matter, to post flyers in the local grocery stores, fitness clubs, coffee shops, etc.

In some ways, this technique is the opposite of hiring an auction house. You’ll do all the work yourself instead of handing it off, but you’ll maintain much more control over the process, and you can wait for the right price. You’ll also be in an excellent position to offer seller-financing as part of the package, to help encourage buyers along (more on this later).

5. Auctions

Auctioning off properties works great when you need a quick sale.

Don’t expect top dollar – auctioning real estate prioritizes sale date over sale price. But when you absolutely, positively need to sell a property by a certain date, auctions are a reliable way to sell.

As anyone who has auctioned anything can tell you, who you choose as the auctioneer matters. A lot. Reputable auction companies attract serious, reputable bidders, who trust that the auctioneer is not deceiving them. It takes time for auctioneers to build trust – just ask Sotheby’s, who has been around since 1744.

Established auctioneers also have powerful marketing machinery in place, to reach the maximum possible audience. They cultivate extensive mailing lists, standing ad slots with local publishers, familiarity with the best ways to reach the right prospects in the local market.

But even when you use a reputable, experienced auctioneer, the outcome remains a gamble. Your final price will come down to who turns out that day, which can be affected by random variables like the weather, or seemingly unrelated events like a conference taking place across town. Maybe the traffic is just exceptionally bad that day, and prospective bidders decide not to make the drive.

Auctions aren’t quite an act of desperation, but they certainly won’t attract top dollar, either.

6. Dodge Taxes by Rolling Your Profits into a Larger Property

Taxes suck, even lower capital gains taxes on real estate. They siphon off money you could otherwise put toward building passive income and reaching financial independence.

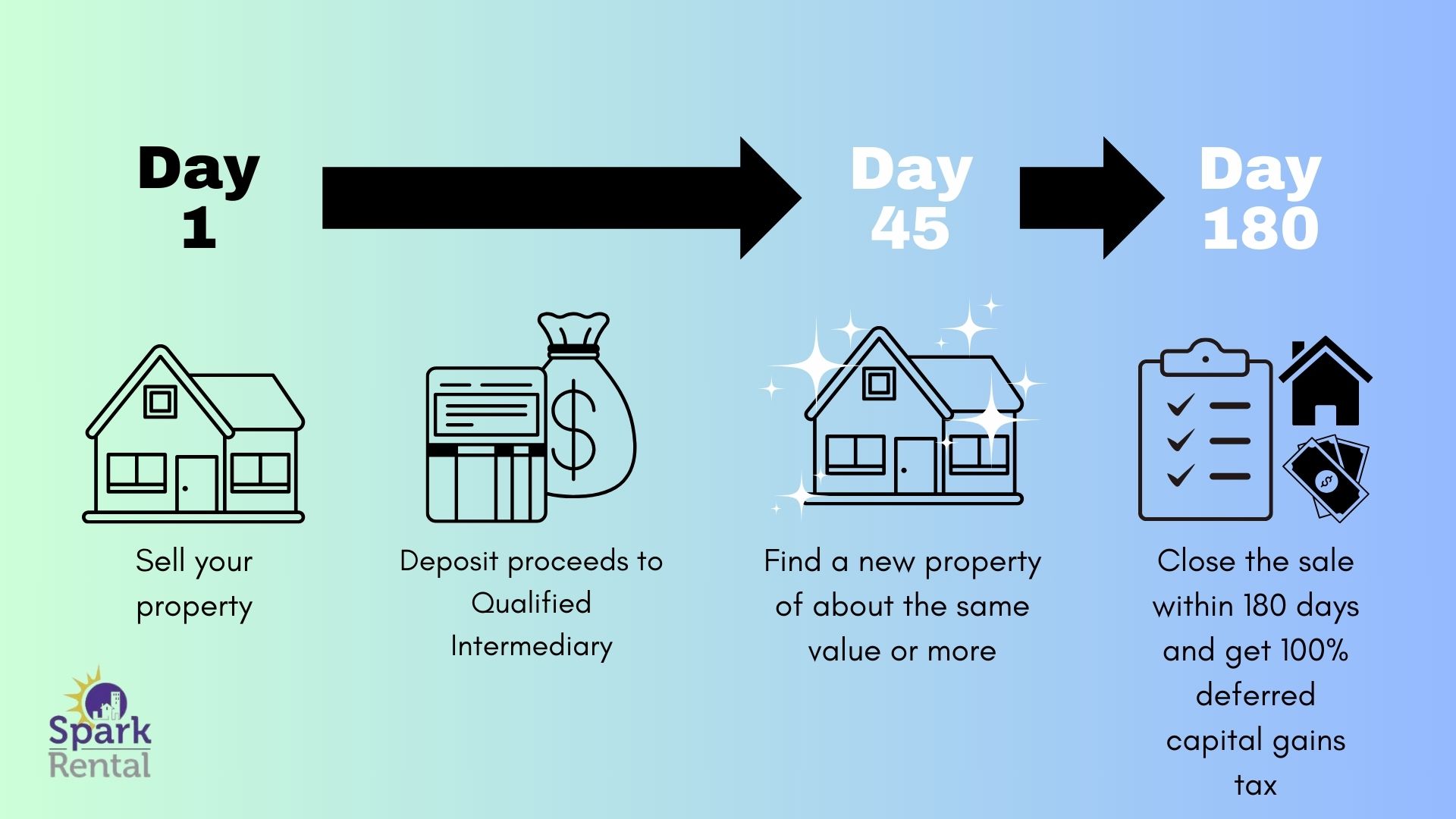

Fortunately, you don’t have to pay taxes on your profits from selling real estate. Not if you use them to buy another property, using a 1031 exchange.

Within 45 days of selling your old rental property, you identify a replacement property you plan to purchase. You must then settle on the new property within 180 days of selling the old one.

The new property must cost at least as much as the property you sold — it’s a tool for scaling your real estate portfolio, after all.

Read up on how 1031 exchanges work before pulling the trigger, and keep rolling your real estate profits into ever larger rental properties with greater cash flow!

7. Pull Out Equity with Loans (Which Your Tenants Pay Back)

One of the most common real estate exit strategies is to sell the property to cash out the equity. But then you lose the asset, and no longer benefit from ongoing cash flow or appreciation. Where’s the fun in that?

Alternatively, you could keep the property and still pull out the equity through a rental property loan. It clips your cash flow, but you get to keep the property, which continues appreciating, and you can keep raising the rent each year. You get paid out for your equity, but you don’t have to pay taxes on it. Quite the opposite: you get to deduct the interest as a landlord tax deduction!

In other words, you can have your cake and eat it too. And your tenants can pay the mortgage back down again, just like they did the first time around.

Win, win, win.

8. Pass the Property to Your Children

No one says you have sell the real estate property at all, as one of your exit strategies. The property can exit at the same time you do, becoming part of your estate.

In tax year 2024, the first $13,610,000 in assets that you leave to your children is exempt from federal estate taxes. You can leave your investment properties to your children, for them to keep as passive income sources or sell as they see fit.

Between now and then, you can keep taking out rental property loans, letting your tenants pay them down for you, and then doing it all over again to keep cashing out even as you earn cash flow and the property appreciates.

9. Donate the Property to Charity

When you donate an investment property to charity, you pay no real estate capital gains tax on it. As a registered nonprofit, they don’t pay any taxes on it either.

You do get to write off the equity in the property as a charitable donation deduction however. Which means you can avoid the hassles of hiring a real estate agent, marketing the property for sale, and carrying it vacant while you list it.

Plus you get to sleep easy at night knowing that you helped make the world a better place.

10. Use a Niche Realtor Specializing in Investors

The best realtors have a deep niche; they may not do everything, they do one or two things extraordinarily well.

That niche of course includes your property’s location – your realtor should be an absolute expert on that market. But if you’re trying to sell to another investor, and you want to use a realtor, you need to find the local realtor who knows every investor in the market worth their salt.

In this case, you’re not paying for their MLS access, or their ability to bake muffins while hosting a hunky dory open house. You’re paying for their network. You’re paying them to get on the phone and call every investor they know until they find one who bites.

The right investor specialist realtor can find you a buyer in a day. They have a (virtual) rolodex overflowing with hungry investors, and they’ll know exactly who to call for your specific property type. “Two-story brick rowhouse in Federal Hill, rented for $1,900? Yep, Wendy loves those. I’ll give her a call right now.” Done. Fini. Past tense.

The Importance Of PropTech In Real Estate Investing

PropTech, or property technology, are software, platforms, and other services that leverage current technology to improve real estate investing. These benefits may cover buying, selling, property management, market and location research, and every other task.

It can also help you with choosing or implementing your preferred exit strategy. Common proptech include:

-

- Smart home devices

- Property management software

- Online real estate marketplaces

- Virtual and augmented reality for property tours

- Blockchain for real estate transactions

- IoT (Internet of Things) for building management

- AI and machine learning for property valuation and prediction

- Crowdfunding platforms for real estate investment

- Drones for aerial property photography

- Big data analytics for market research and trends

Final Thoughts

As real estate investors grow their portfolios and tackle larger projects, they need to understand all the options at their disposal for, well, disposing of their properties. Life is not predictable, and the higher the stakes, the stronger the need for contingency plans.

Scaling your real estate business means both risk management and creating a strategy for exiting your real estate investment with a profit. “What made these strategies successful was our ability to systemize then scale up the process,” explains Matt Andrews. Once a system is refined so that it’s easy for any employee to handle it, the sky’s the limit for real estate investing businesses.♦

What unconventional real estate exit strategies have you used? How’d they work out for you?

These are fun! I’d like to try a guerrilla FSBO tactics, and use social media. Save 3-4% on real estate agent fees, when I can do everything my old realtor does.

Yeah for run-of-the-mill properties, nothing too unique, often you can do just as well selling on your own. Keep us posted about how it goes!

I’ve bought properties at auction but never sold there, just too unpredictable for my taste. I’m intrigued by the bundling idea though, like the scalability of it. And I feel like the hard part would be identifying potential buyers and building relationships with them, but that’s up-front work that will pay off forever.

I’ve auctioned properties off before, and it is definitely a crap shoot. I’ve seen properties go for full market value (sometimes even higher), and I’ve seen them sell for half what they should. Don’t be a stranger, stay in touch about your bundling progress!

Some cool ideas, will check some of these out

Glad it was useful for you Patrick!

Short term rental is the deal, really. It’s been working for me for a while, specially if you have a house at the country side or at the beach. And just a tip if you’re in this position, it’s really good to work with influencers to promote your place.

There are definitely a lot of people out there who have done well with short-term rentals and Airbnb! Glad to hear it’s been working out for you Rachel!

I am sure you must have a lot of experience in real estate. These ideas can only be given by pros. Much appreciated!

Glad you found them useful Ray!

I’ve learned a lot that real estate investing is no different, except that the risks are much bigger. Our ideas don’t always pan out, but failure isn’t an option when we’re dealing with assets worth hundreds of thousands of dollars.

True Jewel!

Thanks for the good read!

Thanks for the comment Santi!